Oct-Dec 2013, the NPI Showed No Change in Comparison to a 4 Per Cent Rise in the Jul-Sep 2013 Quarter

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Chennai Comprehensive Transportation Study (CCTS)

ACKNOWLEDGEMENT The consultants are grateful to Tmt. Susan Mathew, I.A.S., Addl. Chief Secretary to Govt. & Vice-Chairperson, CMDA and Thiru Dayanand Kataria, I.A.S., Member - Secretary, CMDA for the valuable support and encouragement extended to the Study. Our thanks are also due to the former Vice-Chairman, Thiru T.R. Srinivasan, I.A.S., (Retd.) and former Member-Secretary Thiru Md. Nasimuddin, I.A.S. for having given an opportunity to undertake the Chennai Comprehensive Transportation Study. The consultants also thank Thiru.Vikram Kapur, I.A.S. for the guidance and encouragement given in taking the Study forward. We place our record of sincere gratitude to the Project Management Unit of TNUDP-III in CMDA, comprising Thiru K. Kumar, Chief Planner, Thiru M. Sivashanmugam, Senior Planner, & Tmt. R. Meena, Assistant Planner for their unstinted and valuable contribution throughout the assignment. We thank Thiru C. Palanivelu, Member-Chief Planner for the guidance and support extended. The comments and suggestions of the World Bank on the stage reports are duly acknowledged. The consultants are thankful to the Steering Committee comprising the Secretaries to Govt., and Heads of Departments concerned with urban transport, chaired by Vice- Chairperson, CMDA and the Technical Committee chaired by the Chief Planner, CMDA and represented by Department of Highways, Southern Railways, Metropolitan Transport Corporation, Chennai Municipal Corporation, Chennai Port Trust, Chennai Traffic Police, Chennai Sub-urban Police, Commissionerate of Municipal Administration, IIT-Madras and the representatives of NGOs. The consultants place on record the support and cooperation extended by the officers and staff of CMDA and various project implementing organizations and the residents of Chennai, without whom the study would not have been successful. -

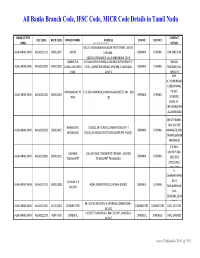

Banks Branch Code, IFSC Code, MICR Code Details in Tamil Nadu

All Banks Branch Code, IFSC Code, MICR Code Details in Tamil Nadu NAME OF THE CONTACT IFSC CODE MICR CODE BRANCH NAME ADDRESS CENTRE DISTRICT BANK www.Padasalai.Net DETAILS NO.19, PADMANABHA NAGAR FIRST STREET, ADYAR, ALLAHABAD BANK ALLA0211103 600010007 ADYAR CHENNAI - CHENNAI CHENNAI 044 24917036 600020,[email protected] AMBATTUR VIJAYALAKSHMIPURAM, 4A MURUGAPPA READY ST. BALRAJ, ALLAHABAD BANK ALLA0211909 600010012 VIJAYALAKSHMIPU EXTN., AMBATTUR VENKATAPURAM, TAMILNADU CHENNAI CHENNAI SHANKAR,044- RAM 600053 28546272 SHRI. N.CHANDRAMO ULEESWARAN, ANNANAGAR,CHE E-4, 3RD MAIN ROAD,ANNANAGAR (WEST),PIN - 600 PH NO : ALLAHABAD BANK ALLA0211042 600010004 CHENNAI CHENNAI NNAI 102 26263882, EMAIL ID : CHEANNA@CHE .ALLAHABADBA NK.CO.IN MR.ATHIRAMIL AKU K (CHIEF BANGALORE 1540/22,39 E-CROSS,22 MAIN ROAD,4TH T ALLAHABAD BANK ALLA0211819 560010005 CHENNAI CHENNAI MANAGER), MR. JAYANAGAR BLOCK,JAYANAGAR DIST-BANGLAORE,PIN- 560041 SWAINE(SENIOR MANAGER) C N RAVI, CHENNAI 144 GA ROAD,TONDIARPET CHENNAI - 600 081 MURTHY,044- ALLAHABAD BANK ALLA0211881 600010011 CHENNAI CHENNAI TONDIARPET TONDIARPET TAMILNADU 28522093 /28513081 / 28411083 S. SWAMINATHAN CHENNAI V P ,DR. K. ALLAHABAD BANK ALLA0211291 600010008 40/41,MOUNT ROAD,CHENNAI-600002 CHENNAI CHENNAI COLONY TAMINARASAN, 044- 28585641,2854 9262 98, MECRICAR ROAD, R.S.PURAM, COIMBATORE - ALLAHABAD BANK ALLA0210384 641010002 COIIMBATORE COIMBATORE COIMBOTORE 0422 2472333 641002 H1/H2 57 MAIN ROAD, RM COLONY , DINDIGUL- ALLAHABAD BANK ALLA0212319 NON MICR DINDIGUL DINDIGUL DINDIGUL -

SNO APP.No Name Contact Address Reason 1 AP-1 K

SNO APP.No Name Contact Address Reason 1 AP-1 K. Pandeeswaran No.2/545, Then Colony, Vilampatti Post, Intercaste Marriage certificate not enclosed Sivakasi, Virudhunagar – 626 124 2 AP-2 P. Karthigai Selvi No.2/545, Then Colony, Vilampatti Post, Only one ID proof attached. Sivakasi, Virudhunagar – 626 124 3 AP-8 N. Esakkiappan No.37/45E, Nandhagopalapuram, Above age Thoothukudi – 628 002. 4 AP-25 M. Dinesh No.4/133, Kothamalai Road,Vadaku Only one ID proof attached. Street,Vadugam Post,Rasipuram Taluk, Namakkal – 637 407. 5 AP-26 K. Venkatesh No.4/47, Kettupatti, Only one ID proof attached. Dokkupodhanahalli, Dharmapuri – 636 807. 6 AP-28 P. Manipandi 1stStreet, 24thWard, Self attestation not found in the enclosures Sivaji Nagar, and photo Theni – 625 531. 7 AP-49 K. Sobanbabu No.10/4, T.K.Garden, 3rdStreet, Korukkupet, Self attestation not found in the enclosures Chennai – 600 021. and photo 8 AP-58 S. Barkavi No.168, Sivaji Nagar, Veerampattinam, Community Certificate Wrongly enclosed Pondicherry – 605 007. 9 AP-60 V.A.Kishor Kumar No.19, Thilagar nagar, Ist st, Kaladipet, Only one ID proof attached. Thiruvottiyur, Chennai -600 019 10 AP-61 D.Anbalagan No.8/171, Church Street, Only one ID proof attached. Komathimuthupuram Post, Panaiyoor(via) Changarankovil Taluk, Tirunelveli, 627 761. 11 AP-64 S. Arun kannan No. 15D, Poonga Nagar, Kaladipet, Only one ID proof attached. Thiruvottiyur, Ch – 600 019 12 AP-69 K. Lavanya Priyadharshini No, 35, A Block, Nochi Nagar, Mylapore, Only one ID proof attached. Chennai – 600 004 13 AP-70 G. -

Puzhuthivakkam

ROUTE NO 1 (PUZHUTHIVAKKAM) BUS STOP TIMING PUZHUTHIVAKKAM BUS STAND 7.30 PREM CARE HOSPITAL 7.35 BRINDAVAN NAGAR BUS STOP 7.35 KAKKAN BRIDGE 7.35 NGO COLONY BUS STOP 7.40 ST THOMAS MOUNT RAILWAY STATION 7.45 JEYALAKSHMI THEATER 7.45 SURENDHRA NAGAR 7.50 SBI COLONY 8.00 EZHUR AMMAN KOIL 8.00 MOOVARASANPET 8.05 COLLEGE ROUTE NO 3 (VINAYAGAPURAM - RETTERY) BUS STOP TIMING NADHAMUNI THEATER(VILLIVAKKAM) 6.20 VRJ HOSPITAL 6.20 SENTHIL NAGAR 6.25 VINAYAGAPURAM BUS STOP 6.30 RETTERY SIGNAL 6.35 KOLATHUR MOOGAMBIGAI SHOP 6.35 WELDING SHOP BUS STOP 6.35 DON BOSCO SCHOOL 6.40 PERAVALLUR BUS STOP 6.40 GANAPATHY STORES (PERAVALLUR JUNCTION ) 6.40 AGARAM GANDHI STATUE 6.45 VENUS GANDHI STATUE 6.45 PERAMBUR BRIDGE PETROL BUNK 6.50 OTTERI BRIDGE BUS STOP (ESI CUT) 6.55 AYANAVARAM SIGNAL 7.00 AYANAVARAM ESI HOSPITAL 7.00 PURASAIWAKKAM WATER TANK(ICICI BANK)NEAR 7.05 PACHIYYAPAS COLLEGE 7.10 METHA NAGAR 7.10 CHOLAI MEDU BUS STOP 7.15 LOYOLA COLLEGE 7.15 LIBERTY NEAR STATE BANK 7.25 DURAISAMY SUBWAY JUNCTION 7.30 AYODHYAMANDAPAM BUS STOP 7.30 POSTAL COLONY - WEST MAMBALAM 7.30 SRINIVASA THEATRE BUS STOP 7.35 ARANGANATHAR SUBWAY BUS STOP 7.35 KAVERY NAGAR BUS STOP BUS STOP 7.35 C.I.T NAGAR 7.40 SAIDAPET 7.45 SAIDAPET ARCH BUS STOP 7.45 CHINNAMALAI COURT 7.45 VELACHERY 200 FEET ROAD (ERIKARAI) 7.50 VELACHERY 200 FEET ROAD WATER TANK 7.50 COLLEGE ROUTE NO 4 (THIRUVOTRIYUR) BUS STOP TIMING THIRUVOTRIYUR BUS STOP (AJAX) 6.30 THERADI BUS STOP 6.30 ELLAI AMMAN KOIL (JUNCTION) 6.30 RAJA SHOP BUS STOP 6.35 THANGAL BUS STOP 6.40 CROSS ROAD BUS STOP THONDAIRPET 6.40 -

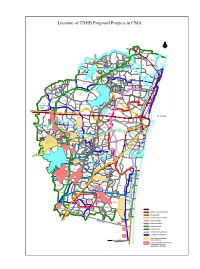

\\Gis\G\MP II Final Dec2007\CMA A0 Maps\CMA Urbanisation 1973 2006 Model

Location of TNHB Proposed Projects in CMA 49 Ariyanvoyal 47 Kollati 46 Nandiyambakkam 50 40 Minjur Madiyur 30 31 34 Sekkanjeri Nerkundram Nayar 39 Valuthigaimedu 41 43 25 29 Seemapuram Athipattu 26 Surapattu Athur Karanodai 35 27 Mahfushanpettai Sothuperambedu 32 38 43 Girudal apuram 37 Chinnamullavoyal Ennore N 42 H 28 36 Periamullavoyal 24 - Orakkadu 33 Pudupakkam Vallur 5 22 Pudur 18 Erumaivettipalayam Sholavaram Kandi gai 16 Kodipallam 17 15 PONNERI TALUK Arumandai Thirunilai 21 19 14 23 5 Ankadu Marambedu Vellivoyal Pal ayaerumai vettipalayam Sembilivaram 20 6 Kummanur Sholavaram Tank 4 Siruniyam 11 Nallur Perungayur 1 7 9 13 Kathivakkam Pannivakkam Sothupakkam 12 3 Vichoor Edayanchavadi Vijayanallur 10 10 Melsinglimedu 8 8 Palavoyal Sirugavoor Padiyanallur 2 11 7 Attanthangal Sendrambakkam Thiruthakiriyampattu 9 4 1 2 47 Alamadi Vilangadupakkam Kadapakkam 14 5 Ernavur 48 Arakkambakkam 13/2 Athivakkam 6 3 Pandeswaram Thiyambakkam Ariyalur 12 Layon 18 17/2 25 Sadayankuppam 43 Alinjivakkam 24 Elanthancheri Morai NaravariKuppam 19 23 27/2 Payasambakkam 22 Amulavoyal Vaikkadu 50 15 17/1 20 Kosapur Karlapakkam 46 39 Vadakarai Chettimedu Melpakkam Layongrant 13/1 49 Pammadukulam 40 16 MO 51 Tundakalani 21 R Roa Kadavur Redhills Vadapurambakkam d Keelakandaiyur 45 35 26 27/1 Tenambakkam Mathur Manali 42 Thiruvottiyur 53 44 Velacheri Pulikutti Vellanur 38 52 Puzhal Alathur 41 Pottur Redhills Lake 28 37 Sathangadu Vilakkupatti 29 56 l ChinnaSekkadu a 54 Mittanamalli n 27 Palavedu a 34 C Pakkam 62/1 63 Madhavaram 62/2 Surappattu Kathirvedu -

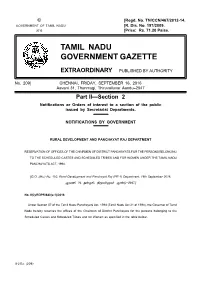

Reservations of Offices

© [Regd. No. TN/CCN/467/2012-14. GOVERNMENT OF TAMIL NADU [R. Dis. No. 197/2009. 2016 [Price: Rs. 71.20 Paise. TAMIL NADU GOVERNMENT GAZETTE EXTRAORDINARY PUBLISHED BY AUTHORITY No. 209] CHENNAI, FRIDAY, SEPTEMBER 16, 2016 Aavani 31, Thunmugi, Thiruvalluvar Aandu–2047 Part II—Section 2 Notifications or Orders of interest to a section of the public issued by Secretariat Departments. NOTIFICATIONS BY GOVERNMENT RURAL DEVELOPMENT AND PANCHAYAT RAJ DEPARTMENT RESERVATION OF OFFICES OF THE CHAIRMEN OF DISTRICT PANCHAYATS FOR THE PERSONS BELONGING TO THE SCHEDULED CASTES AND SCHEDULED TRIBES AND FOR WOMEN UNDER THE TAMIL NADU PANCHAYATS ACT, 1994. [G.O. (Ms.) No. 102, Rural Development and Panchayat Raj (PR-1) Department, 16th September 2016, ÝõE 31, ¶¡ºA, F¼õœÀõ˜ ݇´-2047.] No. II(2)/RDPR/640(a-1)/2016 Under Section 57 of the Tamil Nadu Panchayats Act, 1994 (Tamil Nadu Act 21 of 1994), the Governor of Tamil Nadu hereby reserves the offices of the Chairmen of District Panchayats for the persons belonging to the Scheduled Castes and Scheduled Tribes and for Women as specified in the table below:- II-2 Ex. (209) 2 TAMIL NADU GOVERNMENT GAZETTE EXTRAORDINARY THE TABLE RESERVATION OF OFFICES OF CHAIRMEN OF DISTRICT PANCHAYATS Sl. Category to which reservation is Name of the District No. made (1) (2) (3) 1 The Nilgiris ST General 2 Namakkal SC Women 3 Tiruppur SC Women 4 Virudhunagar SC Women 5 Tirunelveli SC Women 6 Thanjavur SC General 7 Ariyalur SC General 8 Dindigul SC General 9 Ramanathapuram SC General 10 Kancheepuram General Women 11 Tiruvannamalai -

Jul-Sep 2013 Quarter from Different Perspectives – from That of Capital Appreciation, from a Rental/Yield Realisation Perspective and from a Supply Standpoint

FOREWORD This has been one of the more interesting quarters in the residential real estate market. Data indicates that markets are looking for a sense of direction. Weak sentiment because of economic factors as well as the upcoming elections has dampened investor enthusiasm. However, this is the first time that the end user has shed inhibitions and got into the driver’s seat in the residential property market. Read this quarter’s PropIndex analysis along with the Housing Sentiment Index (HSI). The HSI has been jointly released by Magicbricks and Indian Institute of Management, Bangalore. The first of its kind in the market, the HSI tracks property buyer sentiment across the country by way of detailed questionnaires. It clearly indicates that while the consumer is willing to wait in anticipation of better prices, he is also quite willing to search for the best deals over the next six months. The number of enquiries indicate strong underlying demand. However, with investors shying away due to a slow market, the end user is using this window of six to eight months to explore the markets at length, search for a property of their choice and then negotiate to get a good deal. Both developers and landlords seem more willing to negotiate in an effort to keep up the sales velocity. In a market driven by end users, consumer preferences come into sharper focus. Apartments emerged as the winner with all cities showing robust demand. Smaller units of 1, 2 and 3BHK were preferred over premium, large apartments. However, demand for premium apartments was driven by a small group of buyers who showed that sentiments had nothing to do with this volume of demand. -

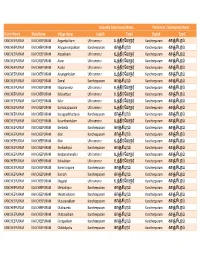

List of Ac with Vp.Pdf

Assembly Constituency Name Parliament Constituency Name District Name Block Name Village Name English Tamil English Tamil KANCHEEPURAM KANCHEEPURAM Angambakkam Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Ariyaperumpakkam Kancheepuram கா சிர Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Arpaakkam Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Asoor Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Avalur Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Ayyangarkulam Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Damal Kancheepuram கா சிர Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Elayanarvelur Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Kalakattoor Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Kalur Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Kambarajapuram Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Karuppadithattadai Kancheepuram கா சிர Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Kavanthandalam Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Keelambi Kancheepuram கா சிர Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Kilar Kancheepuram கா சிர Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Kilar Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Keelkadirpur Kancheepuram கா சிர Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Keelperamanallur Uthiramerur உதிரேம Kancheepuram கா சிர KANCHEEPURAM KANCHEEPURAM Kolivakkam Uthiramerur உதிரேம Kancheepuram -

Mint Building S.O Chennai TAMIL NADU

pincode officename districtname statename 600001 Flower Bazaar S.O Chennai TAMIL NADU 600001 Chennai G.P.O. Chennai TAMIL NADU 600001 Govt Stanley Hospital S.O Chennai TAMIL NADU 600001 Mannady S.O (Chennai) Chennai TAMIL NADU 600001 Mint Building S.O Chennai TAMIL NADU 600001 Sowcarpet S.O Chennai TAMIL NADU 600002 Anna Road H.O Chennai TAMIL NADU 600002 Chintadripet S.O Chennai TAMIL NADU 600002 Madras Electricity System S.O Chennai TAMIL NADU 600003 Park Town H.O Chennai TAMIL NADU 600003 Edapalayam S.O Chennai TAMIL NADU 600003 Madras Medical College S.O Chennai TAMIL NADU 600003 Ripon Buildings S.O Chennai TAMIL NADU 600004 Mandaveli S.O Chennai TAMIL NADU 600004 Vivekananda College Madras S.O Chennai TAMIL NADU 600004 Mylapore H.O Chennai TAMIL NADU 600005 Tiruvallikkeni S.O Chennai TAMIL NADU 600005 Chepauk S.O Chennai TAMIL NADU 600005 Madras University S.O Chennai TAMIL NADU 600005 Parthasarathy Koil S.O Chennai TAMIL NADU 600006 Greams Road S.O Chennai TAMIL NADU 600006 DPI S.O Chennai TAMIL NADU 600006 Shastri Bhavan S.O Chennai TAMIL NADU 600006 Teynampet West S.O Chennai TAMIL NADU 600007 Vepery S.O Chennai TAMIL NADU 600008 Ethiraj Salai S.O Chennai TAMIL NADU 600008 Egmore S.O Chennai TAMIL NADU 600008 Egmore ND S.O Chennai TAMIL NADU 600009 Fort St George S.O Chennai TAMIL NADU 600010 Kilpauk S.O Chennai TAMIL NADU 600010 Kilpauk Medical College S.O Chennai TAMIL NADU 600011 Perambur S.O Chennai TAMIL NADU 600011 Perambur North S.O Chennai TAMIL NADU 600011 Sembiam S.O Chennai TAMIL NADU 600012 Perambur Barracks S.O Chennai -

Jeppiaar Srr Engineering College Omr, Padur, Chennai – 603103

JEPPIAAR SRR ENGINEERING COLLEGE OMR, PADUR, CHENNAI – 603103. 33. BUSES ROUTE R Starting No Point Via 1 Vinayagapuram Retaieary Signal-6.00, Donbosco School-6.05, Periyar Nagar-6.10, Agaram- (5.55) 6.15, Venus Theater-6.18, Perambur-6.20, Jammaliya-6.23, Oattery-6.25, Pudupet-6.35, Thousand Light-6.40, JSRREC-7.40. 2 Ambattur Pudur Oragadam-6.00, Ambattur OT-6.03, Korattur-6.13, Lucas-6.15, Anna Nagar (5.55) Depot-6.18, Rountana-6.20, NSK Nagar-6.23, Metha Nagar-6.25, Choolai Medu-6.30, Valluvar Kottam-6.35. 3 Minjur Enoore-5.55, Eranaur-6.00, Lift Gate-6.05, Ajax-6.10, Thiruvotriyur-6.12, (5.45) Kasimedu-6.25, Kalmandabam-6.28, Rayapuram Signal-6.30. 4 MR Nagar Errukanchery-6.08, Vyasar Padi-6.12, Dowton-6.20, Veppery PS-6.30, (6.05) Central-6.30, Rayapet-6.42, Ajantha-6.43, Mylapoore-6.45, TVR Post Office- 7.00. 5 Mugappeir West Collector Nagar-6.03, Thirumangalam Signal-6.08, Chinmiya Nagar-6.15, (5.55) Avichi School-6.20, Vadapalani Depot-6.23, Kodambakkam-6.27, Sekar Emporium-6.30, Magalingapuram-6.35, Usman Road-6.37, T Nagar-6.40. 6 Veppampattu Thirunindraur-5.35, Pattabiram-5.40, Avadi BS-5.45, Chek Post-5.48, Market- (5.30) 5.50, Govardanagiri-5.55, Velappan Chavadi-6.10, Maduravoyal-6.15, Koyambedu-6.23, MMDA Colony-6.25, Vadapalani-6.30, Kasi Theater-6.35, Guindy-6.40. 7 Muthamizh Nagar KKD Nagar EB-6.15, MKB Nagar-6.17, Mullai Nagar-6.18, Basin Bridge- (6.10) 6.23, Mint-6.25, Stanly Hospital-6.27, Beach Station-6.30, Neppiar Bridge- 6.35, Avvayar Statue-6.40, Light House-6.42, Santhome-6.43, Four Sour Estate-6.45, Mandaiveli-6.47, Panaiyur-7.05, Muttukadu-7.10. -

(SZ) in the Matter of SP Surendranath Ka

1 BEFORE THE NATONAL GREEN TRIBUNAL SOUTHERN ZONE, CHENNAI Application No.179 of 2015 (SZ) In the matter of S. P. Surendranath Karthik No.9, Lake View Street, Iyappa Nagar, Madipakkam Chennai .. Applicant Vs. 1.President Medavakkam Panchayat Chennai 2. President Pallikaranai Town Panchayat Chennai 3. District Environmental Engineer Tamil Nadu Pollution Control Board M.M. Nagar, Kancheepuram Dist 4. Tahsildar Sholinganallur 5. Block Development Officer St. Thomas Mount Panchayat Union Chitlapakkam, Chennai 6. Chairman Tamil Nadu Pollution Control Board Chennai 7. Chairman Central Pollution Control Board Delhi 8. The District Collector Kancheepuram District 9. Principal Secretary to the Government Department of Environment and Forests 2 Chennai 10. Principal Secretary to the Government Department of Revenue, Chennai 11. Zonal Officer Corporation of Chennai Puzhuthivakkam, Chennai 12. Regional Deputy Commissioner (South) Corporation of Chennai Adyar, Chennai 13. Engineer – in – Chief Water Resources Organisation, Chepauk, Chennai 14. The President, Kovilambakkam Town Panchayat .. Respondents Counsel for the applicant M/s. Kaushik N. Sharma Umapathy Counsel for the respondents For respondent No.1 .. Mr.V. Meganathan For respondent Nos.3 & 6 .. Mrs. Yasmeen Ali For respondent Nos.4,8 & 9 .. Mr. M.K. Subramanian For respondents 5, 10 & 13 .. Mr. Abdul Saleem For respondent No.7 ,.. Mr. D.S. Ekambaram For respondents 11 & 12 .. Mr. Surya Prakash For respondent No.14 .. Mr.M Dhandapani O R D E R CORAM Hon’ble Shri Justice Dr. P. Jyothimani, Judicial Member Hon’ble Shri P.S. Rao, Expert Member ----- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - ---- 10th November, 2016 ---- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - --- Whether the judgment is allowed to be published on the internet .. Yes/No 3 Whether the judgment is to be published in the All India NGT Reporter.. -

ANALYSIS of TRAFFIC and MANAGEMENT at KOVILAMBAKKAM INTERSECTION 1R.Chitra,2M.P.Chockalingam 1Asst Professor, Department of Civi

International Journal of Pure and Applied Mathematics Volume 116 No. 19 2017, 593-599 ISSN: 1311-8080 (printed version); ISSN: 1314-3395 (on-line version) url: http://www.ijpam.eu Special Issue ijpam.eu ANALYSIS OF TRAFFIC AND MANAGEMENT AT KOVILAMBAKKAM INTERSECTION 1R.Chitra, 2M.P.Chockalingam 1Asst Professor, Department of Civil Engineering, BIST, BIHER, Bharath University, Chennai-73 2Adjunct Faculty, Department of Civil Engineering, BIST, BIHER, Bharath University, Chennai-73 [email protected], [email protected] Abstract: To study the traffic volume at a four legged may be offset from each when reaching an intersection, intersection and analyse the traffic characteristics of the even though both ends may be considered the same street intersection suggest alternatives for intersection [2] improvement To provide better management solution for traffic congestion and to suggest solutions focussed on 2. Problems at Intersection sustainability in the long run. As long as each vehicle moves in its own lane without 1. Selection of Study Area getting in the way of another vehicle, travelling is smooth. But travel is not all in the same direction. Our The Chennai Metropolitan Authority (CMA) consists of chosen line of traffic often must cross the paths of other the Municipal Corporation of Chennai and its adjoining vehicles, and that's when trouble comes—the intersection areas and 8 Municipalities. There are 244 settlements problem. [3] located within the CMA boundary of Chennai. Majority ➢ The intersection faces traffic congestions during peak of these developments occur within 5-6 km hours. distance from major road networks or rail networks.