Contactless Payments Travel Well in London

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Operator's Story Appendix

Railway and Transport Strategy Centre The Operator’s Story Appendix: London’s Story © World Bank / Imperial College London Property of the World Bank and the RTSC at Imperial College London Community of Metros CoMET The Operator’s Story: Notes from London Case Study Interviews February 2017 Purpose The purpose of this document is to provide a permanent record for the researchers of what was said by people interviewed for ‘The Operator’s Story’ in London. These notes are based upon 14 meetings between 6th-9th October 2015, plus one further meeting in January 2016. This document will ultimately form an appendix to the final report for ‘The Operator’s Story’ piece Although the findings have been arranged and structured by Imperial College London, they remain a collation of thoughts and statements from interviewees, and continue to be the opinions of those interviewed, rather than of Imperial College London. Prefacing the notes is a summary of Imperial College’s key findings based on comments made, which will be drawn out further in the final report for ‘The Operator’s Story’. Method This content is a collation in note form of views expressed in the interviews that were conducted for this study. Comments are not attributed to specific individuals, as agreed with the interviewees and TfL. However, in some cases it is noted that a comment was made by an individual external not employed by TfL (‘external commentator’), where it is appropriate to draw a distinction between views expressed by TfL themselves and those expressed about their organisation. -

Oyster Conditions of Use on National Rail Services

Conditions of Use on National Rail services 1 October 2015 until further notice 1. Introduction 1.1. These conditions of use (“Conditions of Use”) set out your rights and obligations when using an Oyster card to travel on National Rail services. They apply in addition to the conditions set out in the National Rail Conditions of Carriage, which you can view and download from the National Rail website nationalrail.co.uk/nrcoc. Where these Conditions of Use differ from the National Rail Conditions of Carriage, these Conditions of Use take precedence when you are using your Oyster card. 1.2 When travelling on National Rail services, you will also have to comply with the Railway Byelaws. You can a get free copy of these at most staffed National Rail stations, or download a copy from the Department for Transport website dft.gov.uk. 1.3 All Train Companies operating services into the London Fare Zones Area accept valid Travelcards issued on Oyster cards, except Heathrow Express and Southeastern High Speed services between London St Pancras International and Stratford International. In addition, the following Train Companies accept pay as you go on Oyster cards for travel on their services within the London National Rail Pay As You Go Area. Abellio Greater Anglia Limited (trading as Greater Anglia) The Chiltern Railway Company Limited (trading as Chiltern Railways) First Greater Western Limited (trading as Great Western Railway) (including Heathrow Connect services between London Paddington and Hayes & Harlington) GoVia Thameslink Railway Limited (trading as Great Northern, as Southern and as Thameslink) London & Birmingham Railway Limited (trading as London Midland) London & South Eastern Railway Company (trading as Southeastern) (Special fares apply on Southeaster highspeed services between London St Pancras International and Stratford International). -

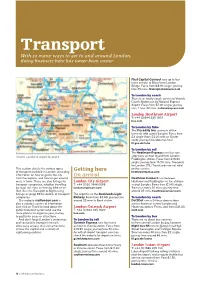

Transport with So Many Ways to Get to and Around London, Doing Business Here Has Never Been Easier

Transport With so many ways to get to and around London, doing business here has never been easier First Capital Connect runs up to four trains an hour to Blackfriars/London Bridge. Fares from £8.90 single; journey time 35 mins. firstcapitalconnect.co.uk To London by coach There is an hourly coach service to Victoria Coach Station run by National Express Airport. Fares from £7.30 single; journey time 1 hour 20 mins. nationalexpress.com London Heathrow Airport T: +44 (0)844 335 1801 baa.com To London by Tube The Piccadilly line connects all five terminals with central London. Fares from £4 single (from £2.20 with an Oyster card); journey time about an hour. tfl.gov.uk/tube To London by rail The Heathrow Express runs four non- Greater London & airport locations stop trains an hour to and from London Paddington station. Fares from £16.50 single; journey time 15-20 mins. Transport for London (TfL) Travelcards are not valid This section details the various types Getting here on this service. of transport available in London, providing heathrowexpress.com information on how to get to the city On arrival from the airports, and how to get around Heathrow Connect runs between once in town. There are also listings for London City Airport Heathrow and Paddington via five stations transport companies, whether travelling T: +44 (0)20 7646 0088 in west London. Fares from £7.40 single. by road, rail, river, or even by bike or on londoncityairport.com Trains run every 30 mins; journey time foot. See the Transport & Sightseeing around 25 mins. -

A Rail Manifesto for London

A Rail Manifesto for London The new covered walkway linking Hackney Central and Hackney Downs stations creates an interchange which provides a better connection and more journey opportunities March 2016 A Rail Manifesto for London Railfuture1 seeks to inform and influence the development of transport policies and practices nationally and locally. We offer candidates for the 2016 London Mayoral and Assembly elections this manifesto2, which represents a distillation of the electorate’s aspirations for a developing railway for London, for delivery during the next four years or to be prepared for delivery during the following period of office. Executive Summary Recognising the importance of all rail-based transport to the economy of London and to its residents, commuters and visitors alike, Railfuture wishes to see holistic and coherent rail services across all of London, integrated with all other public transport, with common fares and conditions. Achieving this is covered by the following 10 policy themes: 1. Services in London the Mayor should take over. The 2007 transfer of some National Rail services to TfL has been a huge success, transforming some of the worst services in London into some of the best performing. Railfuture believes it is right that the Mayor should take over responsibility for more rail services in London, either by transferring service operation to TfL or by TfL specifying service levels to the operator, and that this must benefit all of London. 2. Improved Services. Frequencies play an important role in the success of metro and suburban train services. We believe that the Mayor should set out the minimum standards of service levels across London seven days per week for all rail services. -

Standard-Tube-Map.Pdf

Tube map 123456789 Special fares apply Special fares Check before you travel 978868 7 57Cheshunt Epping apply § Custom House for ExCeL Chesham Watford Junction 9 Station closed until late December 2017. Chalfont & Enfield Town Theydon Bois Latimer Theobalds Grove --------------------------------------------------------------------------- Watford High Street Bush Hill Debden Shenfield § Watford Hounslow West Amersham Cockfosters Park Turkey Street High Barnet Loughton 6 Step-free access for manual wheelchairs only. A Chorleywood Bushey A --------------------------------------------------------------------------- Croxley Totteridge & Whetstone Oakwood Southbury Chingford Buckhurst Hill § Lancaster Gate Rickmansworth Brentwood Carpenders Park Woodside Park Southgate 5 Station closed until August 2017. Edmonton Green Moor Park Roding Grange Valley --------------------------------------------------------------------------- Hatch End Mill Hill East West Finchley Arnos Grove Hill Northwood Silver Street Highams Park § Victoria 4 Harold Wood Chigwell West Ruislip Headstone Lane Edgware Bounds Green Step-free access is via the Cardinal Place White Hart Lane Northwood Hills Stanmore Hainault Gidea Park Finchley Central Woodford entrance. Hillingdon Ruislip Harrow & Wood Green Pinner Wealdstone Burnt Oak Bruce Grove Ruislip Manor Harringay Wood Street Fairlop Romford --------------------------------------------------------------------------- Canons Park Green South Woodford East Finchley Uxbridge Ickenham North Harrow Colindale Turnpike Lane Lanes -

Family History Research at London Transport Museum

Family history research at London Transport Museum Introduction This factsheet is for family historians researching ancestors who have connections with public transport in London. Many thousands of people have been employed across the different modes of transport over the years, but unfortunately relatively few records survive because there is no business or statutory requirement to keep them beyond a few years. The guide to sources below is designed to help you identify surviving records that may be related to your research. It tells you where they are located and how you can access them. Questions at the end of this factsheet may also help you get started on your family history journey. Museum Library London Transport Museum Library, Albany House, 98 Petty France, London SW1H 9EA You may want to visit the Library as part of your research. Information about our collection and how to contact us or arrange a visit is on our Library page on the Museum website. Where to start To find relevant staff records, you first need to identify which company your ancestor might have worked for and the years when they may have been employed there. The London Passenger Transport Board (also known as London Transport) was formed in 1933. Before then, public transport in London was run by many different companies operating the buses, trams and underground railway lines. You might know your ancestor’s job from a certificate or photograph. If you know where they lived in London, you could use that as a starting point to identify their employer. Be aware though that in the past people often walked long distances to go to work. -

Mayor's Transport Strategy

Mayor’s Transport Strategy 1 What’s inside? Introduction ........................................................................................... 3 Transport and quality of life ................................................................. 6 London’s transport challenges ............................................................ 8 The Vision ........................................................................................... 12 The Healthy Streets Approach ........................................................... 17 Healthy Streets and healthy people ................................................... 23 A good public transport experience .................................................. 32 New homes and jobs .......................................................................... 41 Making it happen ................................................................................ 49 2 Introduction The Mayor’s Transport Strategy is the legal document that explains how the Mayor wants to make transport better in London over the next two decades. It is a plan with lots of big goals. It says that people’s health and quality of life are very important when we plan transport in London. The Mayor wants London to be a city that is home for more people and a better place for everyone to live in. 3 We spoke with lots of different people across London to help the Mayor get his plan right. This document sums up the Mayor’s Transport Strategy, which you can view at https://www.london.gov.uk/what-we- do/transport/our-vision-transport/mayors- transport-strategy-2018. Please note: There is not an Easy Read version of the long document. You can ask us for a paper copy of the full Mayor’s Transport Strategy, which is 300 pages long. 4 You can also call us on 0343 222 1155 if would like information in other formats such as large print. 5 Transport and quality of life To create a city for all Londoners we need transport that will help London grow in a way that is good for everyone. -

Tfl Corporate Archive Top 20 Records

LT000605/005 - Description of the New Administrative Offices of the Underground Group of Companies By the late 1920s, the Underground Electric Railways Companies of London Ltd was anxious to house all of its ‘head office’ staff in one new purpose-built office block on the site of the old Metropolitan District Railway offices above St James’s Park station. The plans developed by Adams, Holden and Pearson, the architects commissioned by the Group, were radical: • 55 Broadway would be the tallest office building in London; • there would be a cruciform design - in place of the customary hollow rectangle format – which would offer staff more natural daylight in wings projecting from a central core housing lifts, staircases and essential services; and • Contemporary artists would be invited to sculpt decorative features directly onto the stone facade. As detailed in this reprint of a 1929 brochure about the building, 55 Broadway was constructed between 1927 and 1929. 700 reinforced concrete piles sunk to an average depth of 40 feet below basement level support the building. Nineteen load-bearing steel girders span the railway, and special insulation was used to reduce vibration from the trains. Above ground, the building was constructed around a steel girder skeleton and faced with 78,000 cubic feet of high quality Portland stone. The building has a bold appearance, enhanced by progressive stepping back above the sixth, eighth and ninth floors – giving an uneven pyramid effect. The clock tower, 174 feet high, has a similar stepped back effect. Granite for the ground floor came from Norway whilst the Travertine marble used in the interior came from Italy. -

London and South Coast Rail Corridor Study: Terms of Reference

LONDON & SOUTH COAST RAIL CORRIDOR STUDY DEPARTMENT FOR TRANSPORT APRIL 2016 LONDON & SOUTH COAST RAIL CORRIDOR STUDY DEPARTMENT FOR TRANSPORT FINAL Project no: PPRO 4-92-157 / 3511970BN Date: April 2016 WSP | Parsons Brinckerhoff WSP House 70 Chancery Lane London WC2A 1AF Tel: +44 (0) 20 7314 5000 Fax: +44 (0) 20 7314 5111 www.wspgroup.com www.pbworld.com iii TABLE OF CONTENTS 1 EXECUTIVE SUMMARY ..............................................................1 2 INTRODUCTION ...........................................................................2 2.1 STUDY CONTEXT ............................................................................................. 2 2.2 TERMS OF REFERENCE .................................................................................. 2 3 PROBLEM DEFINITION ...............................................................5 3.1 ‘DO NOTHING’ DEMAND ASSESSMENT ........................................................ 5 3.2 ‘DO NOTHING’ CAPACITY ASSESSMENT ..................................................... 7 4 REVIEWING THE OPTIONS ...................................................... 13 4.1 STAKEHOLDER ENGAGEMENT.................................................................... 13 4.2 RAIL SCHEME PROPOSALS ......................................................................... 13 4.3 PACKAGE DEFINITION .................................................................................. 19 5 THE BML UPGRADE PACKAGE .............................................. 21 5.1 THE PROPOSALS .......................................................................................... -

Explore More and Pay Less with a Visitor Oyster Card

Transport for London Explore more and pay less with a Visitor Oyster card Enjoy discounts at leading restaurants, shops, theatres and galleries including: Visitor Oyster card – the smarter way to travel around London A Visitor Oyster card is a quick and easy way to pay for journeys on bus, Tube, tram, DLR, London Overground, TfL Rail and most National Rail services in London. Special money saving offers Simply show your Visitor Oyster card to benefit from fantastic offers and discounts in London. • Enjoy up to £150 worth of discounts on food, drinks, shopping, culture and entertainment in London • Complimentary champagne and cocktails at selected restaurants • 2-for-1 West End theatre tickets • Up to 25% discount on museum entrance tickets • 5% discount at London’s iconic bookstore and a world-famous chocolate shop! • Up to 26% discount on Emirates Air Line cable car tickets • 10% discount on single tickets on most Thames Clippers river buses Visitor Oyster card offers Food & drink 20% off food, Free hot fudge 25% discount on soft drinks and sundae with your food bill merchandise every entree Offer valid for up to 4 people Valid Monday to Friday 11.30 purchased per Visitor Oyster card shown am to midnight, Saturdays 11am to 3pm and Sundays Free gift with a 11.30am to 11pm. £25 spend at The Maximum 8 people per Rock Shop Visitor Oyster card shown. Open Monday to Saturday 9.30am to 11.30pm and Sunday Pre-booking recommended by 9.30am to 11pm. phone on +44 20 7287 1000 or online, quoting ‘Oyster20’. -

Student Travel Discounts

Advice & Guidance Money Mentors Student travel discounts Studying in London is a unique experience compared to other universities. Whilst the capital offers an unrivaled amount of things to see and do, it can at first be an overwhelming experience with its own trials and tribulations. Although there are two discount options available to help reduce costs, understanding which one is best is in itself a confusing process. Most students are aware of the 18+ Student Oyster Photocard, but lesser known is the discount offered on the tube using the 16-25 Railcard. So which one is the best? The simple answer is that it depends entirely on the student - how frequently you use the transport network, and during which times. Before forking out on either, it is useful to know the basic details. The 18+ Student Oyster Photocard The 18+ Oyster entitles you to 30% off travelcards and Bus and Tram season tickets. It is available to full- time King’s students living in the Greater London area applying online using the TFL website at a cost of £20. You’ll simply need your course dates, the student number on your ID card, as well as a photo and your email. Applying a discounted travelcard to an oyster gives peace of mind that you won’t spend any more than the amount you’ve already paid. It is important to stress though, there is no discount to pay-as-you-go fares with an 18+ Oyster. You could be overpaying for a travelcard if you aren’t using the tube or buses frequently so it is worth considering the other option before handing over £20 to Tfl. -

Rail Passenger Numbers and Crowding Statistics: Notes and Defnitions

Notes and defnitions Rail passenger numbers and crowding statistics: Notes and defnitions Last updated: September 2020 Contents This document provides a range of background information on the Department for Transport’s (DfT) rail passenger numbers and Background p1 crowding statistics. It also details some of the factors that may afect the accuracy of the statistics. The latest statistics can be found on Defnitions p2 the DfT rail statistics webpage. Methodology p3 Background Cities, stations and p8 train operators In line with arrangements specifed in the contracts between train included in statistics operators and DfT, the train operating companies carry out periodic counts of the number of passengers travelling on their services and Factors afecting p10 provide data on passenger numbers and capacity provision to DfT the statistics to permit the monitoring of train crowding levels. In the past DfT monitored crowding for London commuter services under a regime Why the statistics p13 known as ‘passengers in excess of capacity’ (PiXC) and, over time, may difer from the PiXC measure formed the basis of the crowding statistics that passenger are published. Until 2010, summary statistics on crowding were perceptions published by the Ofce of Rail and Road (ORR). Uses of these p14 In recent years, the amount of passenger count data being collected statistics has increased. In addition to the PiXC measure on London commut- er services, a wider range of information has been made available Confdentiality of p14 on passenger numbers and crowding for major stations in London passenger counts and for other major cities in England and Wales. The statistics show trends in passenger numbers throughout the Timeliness of the p15 statistics day and PiXC during the peaks for cities outside London, to allow crowding to be compared between cities on a consistent basis.