Tent Cash Flow Designs and Analysis for Gradient Cash Flow Lectures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Calculus and Differential Equations II

Calculus and Differential Equations II MATH 250 B Sequences and series Sequences and series Calculus and Differential Equations II Sequences A sequence is an infinite list of numbers, s1; s2;:::; sn;::: , indexed by integers. 1n Example 1: Find the first five terms of s = (−1)n , n 3 n ≥ 1. Example 2: Find a formula for sn, n ≥ 1, given that its first five terms are 0; 2; 6; 14; 30. Some sequences are defined recursively. For instance, sn = 2 sn−1 + 3, n > 1, with s1 = 1. If lim sn = L, where L is a number, we say that the sequence n!1 (sn) converges to L. If such a limit does not exist or if L = ±∞, one says that the sequence diverges. Sequences and series Calculus and Differential Equations II Sequences (continued) 2n Example 3: Does the sequence converge? 5n 1 Yes 2 No n 5 Example 4: Does the sequence + converge? 2 n 1 Yes 2 No sin(2n) Example 5: Does the sequence converge? n Remarks: 1 A convergent sequence is bounded, i.e. one can find two numbers M and N such that M < sn < N, for all n's. 2 If a sequence is bounded and monotone, then it converges. Sequences and series Calculus and Differential Equations II Series A series is a pair of sequences, (Sn) and (un) such that n X Sn = uk : k=1 A geometric series is of the form 2 3 n−1 k−1 Sn = a + ax + ax + ax + ··· + ax ; uk = ax 1 − xn One can show that if x 6= 1, S = a . -

Topic 7 Notes 7 Taylor and Laurent Series

Topic 7 Notes Jeremy Orloff 7 Taylor and Laurent series 7.1 Introduction We originally defined an analytic function as one where the derivative, defined as a limit of ratios, existed. We went on to prove Cauchy's theorem and Cauchy's integral formula. These revealed some deep properties of analytic functions, e.g. the existence of derivatives of all orders. Our goal in this topic is to express analytic functions as infinite power series. This will lead us to Taylor series. When a complex function has an isolated singularity at a point we will replace Taylor series by Laurent series. Not surprisingly we will derive these series from Cauchy's integral formula. Although we come to power series representations after exploring other properties of analytic functions, they will be one of our main tools in understanding and computing with analytic functions. 7.2 Geometric series Having a detailed understanding of geometric series will enable us to use Cauchy's integral formula to understand power series representations of analytic functions. We start with the definition: Definition. A finite geometric series has one of the following (all equivalent) forms. 2 3 n Sn = a(1 + r + r + r + ::: + r ) = a + ar + ar2 + ar3 + ::: + arn n X = arj j=0 n X = a rj j=0 The number r is called the ratio of the geometric series because it is the ratio of consecutive terms of the series. Theorem. The sum of a finite geometric series is given by a(1 − rn+1) S = a(1 + r + r2 + r3 + ::: + rn) = : (1) n 1 − r Proof. -

3.3 Convergence Tests for Infinite Series

3.3 Convergence Tests for Infinite Series 3.3.1 The integral test We may plot the sequence an in the Cartesian plane, with independent variable n and dependent variable a: n X The sum an can then be represented geometrically as the area of a collection of rectangles with n=1 height an and width 1. This geometric viewpoint suggests that we compare this sum to an integral. If an can be represented as a continuous function of n, for real numbers n, not just integers, and if the m X sequence an is decreasing, then an looks a bit like area under the curve a = a(n). n=1 In particular, m m+2 X Z m+1 X an > an dn > an n=1 n=1 n=2 For example, let us examine the first 10 terms of the harmonic series 10 X 1 1 1 1 1 1 1 1 1 1 = 1 + + + + + + + + + : n 2 3 4 5 6 7 8 9 10 1 1 1 If we draw the curve y = x (or a = n ) we see that 10 11 10 X 1 Z 11 dx X 1 X 1 1 > > = − 1 + : n x n n 11 1 1 2 1 (See Figure 1, copied from Wikipedia) Z 11 dx Now = ln(11) − ln(1) = ln(11) so 1 x 10 X 1 1 1 1 1 1 1 1 1 1 = 1 + + + + + + + + + > ln(11) n 2 3 4 5 6 7 8 9 10 1 and 1 1 1 1 1 1 1 1 1 1 1 + + + + + + + + + < ln(11) + (1 − ): 2 3 4 5 6 7 8 9 10 11 Z dx So we may bound our series, above and below, with some version of the integral : x If we allow the sum to turn into an infinite series, we turn the integral into an improper integral. -

1 Approximating Integrals Using Taylor Polynomials 1 1.1 Definitions

Seunghee Ye Ma 8: Week 7 Nov 10 Week 7 Summary This week, we will learn how we can approximate integrals using Taylor series and numerical methods. Topics Page 1 Approximating Integrals using Taylor Polynomials 1 1.1 Definitions . .1 1.2 Examples . .2 1.3 Approximating Integrals . .3 2 Numerical Integration 5 1 Approximating Integrals using Taylor Polynomials 1.1 Definitions When we first defined the derivative, recall that it was supposed to be the \instantaneous rate of change" of a function f(x) at a given point c. In other words, f 0 gives us a linear approximation of f(x) near c: for small values of " 2 R, we have f(c + ") ≈ f(c) + "f 0(c) But if f(x) has higher order derivatives, why stop with a linear approximation? Taylor series take this idea of linear approximation and extends it to higher order derivatives, giving us a better approximation of f(x) near c. Definition (Taylor Polynomial and Taylor Series) Let f(x) be a Cn function i.e. f is n-times continuously differentiable. Then, the n-th order Taylor polynomial of f(x) about c is: n X f (k)(c) T (f)(x) = (x − c)k n k! k=0 The n-th order remainder of f(x) is: Rn(f)(x) = f(x) − Tn(f)(x) If f(x) is C1, then the Taylor series of f(x) about c is: 1 X f (k)(c) T (f)(x) = (x − c)k 1 k! k=0 Note that the first order Taylor polynomial of f(x) is precisely the linear approximation we wrote down in the beginning. -

Sequences and Series

From patterns to generalizations: sequences and series Concepts ■ Patterns You do not have to look far and wide to fi nd 1 ■ Generalization visual patterns—they are everywhere! Microconcepts ■ Arithmetic and geometric sequences ■ Arithmetic and geometric series ■ Common diff erence ■ Sigma notation ■ Common ratio ■ Sum of sequences ■ Binomial theorem ■ Proof ■ Sum to infi nity Can these patterns be explained mathematically? Can patterns be useful in real-life situations? What information would you require in order to choose the best loan off er? What other Draftscenarios could this be applied to? If you take out a loan to buy a car how can you determine the actual amount it will cost? 2 The diagrams shown here are the first four iterations of a fractal called the Koch snowflake. What do you notice about: • how each pattern is created from the previous one? • the perimeter as you move from the first iteration through the fourth iteration? How is it changing? • the area enclosed as you move from the first iteration to the fourth iteration? How is it changing? What changes would you expect in the fifth iteration? How would you measure the perimeter at the fifth iteration if the original triangle had sides of 1 m in length? If this process continues forever, how can an infinite perimeter enclose a finite area? Developing inquiry skills Does mathematics always reflect reality? Are fractals such as the Koch snowflake invented or discovered? Think about the questions in this opening problem and answer any you can. As you work through the chapter, you will gain mathematical knowledge and skills that will help you to answer them all. -

A Quotient Rule Integration by Parts Formula Jennifer Switkes ([email protected]), California State Polytechnic Univer- Sity, Pomona, CA 91768

A Quotient Rule Integration by Parts Formula Jennifer Switkes ([email protected]), California State Polytechnic Univer- sity, Pomona, CA 91768 In a recent calculus course, I introduced the technique of Integration by Parts as an integration rule corresponding to the Product Rule for differentiation. I showed my students the standard derivation of the Integration by Parts formula as presented in [1]: By the Product Rule, if f (x) and g(x) are differentiable functions, then d f (x)g(x) = f (x)g(x) + g(x) f (x). dx Integrating on both sides of this equation, f (x)g(x) + g(x) f (x) dx = f (x)g(x), which may be rearranged to obtain f (x)g(x) dx = f (x)g(x) − g(x) f (x) dx. Letting U = f (x) and V = g(x) and observing that dU = f (x) dx and dV = g(x) dx, we obtain the familiar Integration by Parts formula UdV= UV − VdU. (1) My student Victor asked if we could do a similar thing with the Quotient Rule. While the other students thought this was a crazy idea, I was intrigued. Below, I derive a Quotient Rule Integration by Parts formula, apply the resulting integration formula to an example, and discuss reasons why this formula does not appear in calculus texts. By the Quotient Rule, if f (x) and g(x) are differentiable functions, then ( ) ( ) ( ) − ( ) ( ) d f x = g x f x f x g x . dx g(x) [g(x)]2 Integrating both sides of this equation, we get f (x) g(x) f (x) − f (x)g(x) = dx. -

Operations on Power Series Related to Taylor Series

Operations on Power Series Related to Taylor Series In this problem, we perform elementary operations on Taylor series – term by term differen tiation and integration – to obtain new examples of power series for which we know their sum. Suppose that a function f has a power series representation of the form: 1 2 X n f(x) = a0 + a1(x − c) + a2(x − c) + · · · = an(x − c) n=0 convergent on the interval (c − R; c + R) for some R. The results we use in this example are: • (Differentiation) Given f as above, f 0(x) has a power series expansion obtained by by differ entiating each term in the expansion of f(x): 1 0 X n−1 f (x) = a1 + a2(x − c) + 2a3(x − c) + · · · = nan(x − c) n=1 • (Integration) Given f as above, R f(x) dx has a power series expansion obtained by by inte grating each term in the expansion of f(x): 1 Z a1 a2 X an f(x) dx = C + a (x − c) + (x − c)2 + (x − c)3 + · · · = C + (x − c)n+1 0 2 3 n + 1 n=0 for some constant C depending on the choice of antiderivative of f. Questions: 1. Find a power series representation for the function f(x) = arctan(5x): (Note: arctan x is the inverse function to tan x.) 2. Use power series to approximate Z 1 2 sin(x ) dx 0 (Note: sin(x2) is a function whose antiderivative is not an elementary function.) Solution: 1 For question (1), we know that arctan x has a simple derivative: , which then has a power 1 + x2 1 2 series representation similar to that of , where we subsitute −x for x. -

Derivative of Power Series and Complex Exponential

LECTURE 4: DERIVATIVE OF POWER SERIES AND COMPLEX EXPONENTIAL The reason of dealing with power series is that they provide examples of analytic functions. P1 n Theorem 1. If n=0 anz has radius of convergence R > 0; then the function P1 n F (z) = n=0 anz is di®erentiable on S = fz 2 C : jzj < Rg; and the derivative is P1 n¡1 f(z) = n=0 nanz : Proof. (¤) We will show that j F (z+h)¡F (z) ¡ f(z)j ! 0 as h ! 0 (in C), whenever h ¡ ¢ n Pn n k n¡k jzj < R: Using the binomial theorem (z + h) = k=0 k h z we get F (z + h) ¡ F (z) X1 (z + h)n ¡ zn ¡ hnzn¡1 ¡ f(z) = a h n h n=0 µ ¶ X1 a Xn n = n ( hkzn¡k) h k n=0 k=2 µ ¶ X1 Xn n = a h( hk¡2zn¡k) n k n=0 k=2 µ ¶ X1 Xn¡2 n = a h( hjzn¡2¡j) (by putting j = k ¡ 2): n j + 2 n=0 j=0 ¡ n ¢ ¡n¡2¢ By using the easily veri¯able fact that j+2 · n(n ¡ 1) j ; we obtain µ ¶ F (z + h) ¡ F (z) X1 Xn¡2 n ¡ 2 j ¡ f(z)j · jhj n(n ¡ 1)ja j( jhjjjzjn¡2¡j) h n j n=0 j=0 X1 n¡2 = jhj n(n ¡ 1)janj(jzj + jhj) : n=0 P1 n¡2 We already know that the series n=0 n(n ¡ 1)janjjzj converges for jzj < R: Now, for jzj < R and h ! 0 we have jzj + jhj < R eventually. -

Six Ways to Sum a Series Dan Kalman

Six Ways to Sum a Series Dan Kalman The College Mathematics Journal, November 1993, Volume 24, Number 5, pp. 402–421. Dan Kalman This fall I have joined the mathematics faculty at American University, Washington D. C. Prior to that I spent 8 years at the Aerospace Corporation in Los Angeles, where I worked on simulations of space systems and kept in touch with mathematics through the programs and publications of the MAA. At a national meeting I heard the presentation by Zagier referred to in the article. Convinced that this ingenious proof should be more widely known, I presented it at a meeting of the Southern California MAA section. Some enthusiastic members of the audience then shared their favorite proofs and references with me. These led to more articles and proofs, and brought me into contact with a realm of mathematics I never guessed existed. This paper is the result. he concept of an infinite sum is mysterious and intriguing. How can you add up an infinite number of terms? Yet, in some contexts, we are led to the Tcontemplation of an infinite sum quite naturally. For example, consider the calculation of a decimal expansion for 1y3. The long division algorithm generates an endlessly repeating sequence of steps, each of which adds one more 3 to the decimal expansion. We imagine the answer therefore to be an endless string of 3’s, which we write 0.333. .. In essence we are defining the decimal expansion of 1y3 as an infinite sum 1y3 5 0.3 1 0.03 1 0.003 1 0.0003 1 . -

Calculus Terminology

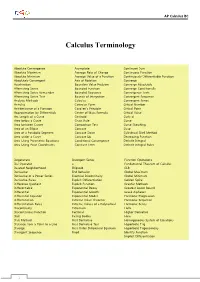

AP Calculus BC Calculus Terminology Absolute Convergence Asymptote Continued Sum Absolute Maximum Average Rate of Change Continuous Function Absolute Minimum Average Value of a Function Continuously Differentiable Function Absolutely Convergent Axis of Rotation Converge Acceleration Boundary Value Problem Converge Absolutely Alternating Series Bounded Function Converge Conditionally Alternating Series Remainder Bounded Sequence Convergence Tests Alternating Series Test Bounds of Integration Convergent Sequence Analytic Methods Calculus Convergent Series Annulus Cartesian Form Critical Number Antiderivative of a Function Cavalieri’s Principle Critical Point Approximation by Differentials Center of Mass Formula Critical Value Arc Length of a Curve Centroid Curly d Area below a Curve Chain Rule Curve Area between Curves Comparison Test Curve Sketching Area of an Ellipse Concave Cusp Area of a Parabolic Segment Concave Down Cylindrical Shell Method Area under a Curve Concave Up Decreasing Function Area Using Parametric Equations Conditional Convergence Definite Integral Area Using Polar Coordinates Constant Term Definite Integral Rules Degenerate Divergent Series Function Operations Del Operator e Fundamental Theorem of Calculus Deleted Neighborhood Ellipsoid GLB Derivative End Behavior Global Maximum Derivative of a Power Series Essential Discontinuity Global Minimum Derivative Rules Explicit Differentiation Golden Spiral Difference Quotient Explicit Function Graphic Methods Differentiable Exponential Decay Greatest Lower Bound Differential -

20-Finding Taylor Coefficients

Taylor Coefficients Learning goal: Let’s generalize the process of finding the coefficients of a Taylor polynomial. Let’s find a general formula for the coefficients of a Taylor polynomial. (Students complete worksheet series03 (Taylor coefficients).) 2 What we have discovered is that if we have a polynomial C0 + C1x + C2x + ! that we are trying to match values and derivatives to a function, then when we differentiate it a bunch of times, we 0 get Cnn!x + Cn+1(n+1)!x + !. Plugging in x = 0 and everything except Cnn! goes away. So to (n) match the nth derivative, we must have Cn = f (0)/n!. If we want to match the values and derivatives at some point other than zero, we will use the 2 polynomial C0 + C1(x – a) + C2(x – a) + !. Then when we differentiate, we get Cnn! + Cn+1(n+1)!(x – a) + !. Now, plugging in x = a makes everything go away, and we get (n) Cn = f (a)/n!. So we can generate a polynomial of any degree (well, as long as the function has enough derivatives!) that will match the function and its derivatives to that degree at a particular point a. We can also extend to create a power series called the Taylor series (or Maclaurin series if a is specifically 0). We have natural questions: • For what x does the series converge? • What does the series converge to? Is it, hopefully, f(x)? • If the series converges to the function, we can use parts of the series—Taylor polynomials—to approximate the function, at least nearby a. -

3.2 Introduction to Infinite Series

3.2 Introduction to Infinite Series Many of our infinite sequences, for the remainder of the course, will be defined by sums. For example, the sequence m X 1 S := : (1) m 2n n=1 is defined by a sum. Its terms (partial sums) are 1 ; 2 1 1 3 + = ; 2 4 4 1 1 1 7 + + = ; 2 4 8 8 1 1 1 1 15 + + + = ; 2 4 8 16 16 ::: These infinite sequences defined by sums are called infinite series. Review of sigma notation The Greek letter Σ used in this notation indicates that we are adding (\summing") elements of a certain pattern. (We used this notation back in Calculus 1, when we first looked at integrals.) Here our sums may be “infinite”; when this occurs, we are really looking at a limit. Resources An introduction to sequences a standard part of single variable calculus. It is covered in every calculus textbook. For example, one might look at * section 11.3 (Integral test), 11.4, (Comparison tests) , 11.5 (Ratio & Root tests), 11.6 (Alternating, abs. conv & cond. conv) in Calculus, Early Transcendentals (11th ed., 2006) by Thomas, Weir, Hass, Giordano (Pearson) * section 11.3 (Integral test), 11.4, (comparison tests), 11.5 (alternating series), 11.6, (Absolute conv, ratio and root), 11.7 (summary) in Calculus, Early Transcendentals (6th ed., 2008) by Stewart (Cengage) * sections 8.3 (Integral), 8.4 (Comparison), 8.5 (alternating), 8.6, Absolute conv, ratio and root, in Calculus, Early Transcendentals (1st ed., 2011) by Tan (Cengage) Integral tests, comparison tests, ratio & root tests.