Union Territory Tax

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Systems and Accommodation of Distinct Groups: a Comparative Survey of Institutional Arrangements for Aboriginal Peoples

1 arrangements within other federations will focus FEDERAL SYSTEMS AND on provisions for constitutional recognition of ACCOMMODATION OF DISTINCT Aboriginal Peoples, arrangements for Aboriginal GROUPS: A COMPARATIVE SURVEY self-government (including whether these take OF INSTITUTIONAL the form of a constitutional order of government ARRANGEMENTS FOR ABORIGINAL or embody other institutionalized arrangements), the responsibilities assigned to federal and state PEOPLES1 or provincial governments for Aboriginal peoples, and special arrangements for Ronald L. Watts representation of Aboriginal peoples in federal Institute of Intergovernmental Relations and state or provincial institutions if any. Queen's University Kingston, Ontario The paper is therefore divided into five parts: (1) the introduction setting out the scope of the paper, the value of comparative analysis, and the 1. INTRODUCTION basic concepts that will be used; (2) an examination of the utility of the federal concept (1) Purpose, relevance and scope of this for accommodating distinct groups and hence the study particular interests and concerns of Aboriginal peoples; (3) the range of variations among federal The objective of this study is to survey the systems which may facilitate the accommodation applicability of federal theory and practice for of distinct groups and hence Aboriginal peoples; accommodating the interests and concerns of (4) an overview of the actual arrangements for distinct groups within a political system, and Aboriginal populations existing in federations -

India Creates Three New States

India creates three new states BY HARIHAR BHATTACHARYYA The Indian federation took a very of the linguistic characteristics of the States Reorganization Commission significant turn in November 2000 country. This pledge led to an awakening in 1953, and on the basis of its with the creation of three new states. of interest in self-rule among various recommendations, to pass the nationalities and ethnic groups prior to States Reorganization Act in 1956. Although infrequent, the creation of new independence. Many of the post- states is not unusual here. India has a As a result of this Act in 1956, India independence movements for statehood long history of what is called “states undertook the first major reorganization had their origins in this reorganization”. of states, and the reasons were strongly pre-independence phase. linguistic: the new federal units were created so that the states’ boundaries Language: the original basis A dynamic period of change would better correspond with linguistic for statehood boundaries. When the Indian republic was The formation of states on the established in 1950, there were 27 Since 1956, there has been a more- basis of language was a pledge states of different status and powers. or-less continuous process of states and a demand of the anti-colonial reorganization. For most of this period, nationalist movements in India. During the first major territorial the creation of new states was based The federal idea in India began reorganization in 1956, the number on both ethno-regional and linguistic to take shape on this vision. of states was reduced to 14, largely characteristics. -

India Country Name India

TOPONYMIC FACT FILE India Country name India State title in English Republic of India State title in official languages (Bhārat Gaṇarājya) (romanized in brackets) भारत गणरा煍य Name of citizen Indian Official languages Hindi, written in Devanagari script, and English1 Country name in official languages (Bhārat) (romanized in brackets) भारत Script Devanagari ISO-3166 code (alpha-2/alpha-3) IN/IND Capital New Delhi Population 1,210 million2 Introduction India occupies the greater part of South Asia. It was part of the British Empire from 1858 until 1947 when India was split along religious lines into two nations at independence: the Hindu-majority India and the Muslim-majority Pakistan. Its highly diverse population consists of thousands of ethnic groups and hundreds of languages. Northeast India comprises the states of Arunāchal Pradesh, Assam, Manipur, Meghālaya, Mizoram, Nāgāland, Sikkim and Tripura. It is connected to the rest of India through a narrow corridor of the state of West Bengal. It shares borders with the countries of Nepal, China, Bhutan, Myanmar (Burma) and Bangladesh. The mostly hilly and mountainous region is home to many hill tribes, with their own distinct languages and culture. Geographical names policy PCGN policy for India is to use the Roman-script geographical names found on official India-produced sources. Official maps are produced by the Survey of India primarily in Hindi and English (versions are also made in Odiya for Odisha state, Tamil for Tamil Nādu state and there is a Sanskrit version of the political map of the whole of India). The Survey of India is also responsible for the standardization of geographical names in India. -

States Reorganization and Accommodation of Ethno-Territorial Cleavages in India Occasional Paper Number 29

Occasional Paper Series Number 29 States Reorganization and Accommodation of Ethno-Territorial Cleavages in India Harihar Bhattacharyya States Reorganization and Accommodation of Ethno-Territorial Cleavages in India Harihar Bhattacharyya © Forum of Federations, 2019 ISSN: 1922-558X (online ISSN 1922-5598) Occasional Paper Series Number 29 States Reorganization and Accommodation of Ethno-Territorial Cleavages in India By Harihar Bhattacharyya For more information about the Forum of Federations and its publications, please visit our website: www.forumfed.org. Forum of Federations 75 Albert Street, Suite 411 Ottawa, Ontario (Canada) K1P 5E7 Tel: (613) 244-3360 Fax: (613) 244-3372 [email protected] 3 States Reorganization and Accommodation of Ethno-Territorial Cleavages in India Overview What holds India, a vast multi-ethnic country, together in the midst of so many odds? The question is particularly significant because India’s unity and integrity has been possible despite democracy. The key to the above success lies in a mode of federation building that sought to continuously ‘right-size’ the territory of India. The method followed in doing so is called ‘states reorganization’ in India as a result of which ethno-territorial cleavages have been accommodated and regulated. The result has been durable ethnic peace and political stability. At independence (15 August 1947), India inherited nine provinces and over 560 princely states from the old colonial arrangements. An interim state structure was put in place, but it was recognized that a fundamental restructuring would be required in due course. The process was complex and painstaking but managed to create sub-national units called ‘states’, mostly on the basis of language; subsequently non-linguistic ethnic factors were also taken into consideration. -

Industrial Profile

INDUSTRIAL PROFILE OF UNION TERRITORY OF PUDUCHERRY 2014-15 Complied by MSME - Development Institute, Ministry of MSME, Govt. of India, 65/1. G S T Road, Guindy, Chennai - 600032 Ph: 044 – 22501011, 12 & 13. Fax 044- 22501014 Website:www.msmedi-chennai.gov.in, e-mail: [email protected] C O N T E N T S.No TOPIC PAGE NO. 1. General Characteristics 1 1.1 Location & Geographical Area 1 1.2 Topography 2 1.3 Availability of Minerals. 2 1.4 Forest 2 1.5 Administrative set up 2 2. U.T of Puducherry - at a Glance 3 2.1 Existing Status of Industrial Areas in UT of Puducherry 6 3 Industrial Scenario of UT of Puducherry 7 3.1 Industries at a Glance at Puducherry 7 3.2 Industries at a Glance at Karaikal 7 3.3 Year Wise Trend of Units Registered at Puducherry 8 3.4 Year Wise Trend of Units Registered at Karaikal 8 3.5 Details Of Existing MSEs & Artisan Units (2013-14) 9 3.6 Details Of Existing MSEs & Artisan Units (2014-15) 10 3.7 Large Scale Industries/Public Sector undertaking 11 3.8 Major Exportable Items 10 3.9 Growth Trend in UT of Puducherry 14 3.10 Vendorisation / Ancillarisation of the Industry 14 3.11 Medium Scale Enterprises 15 4. Service Enterprises 17 4.1 Potential for New MSMEs 18 5 Existing Clusters of Micro & Small Enterprises 18 6. General issues raised by Industrial Associations 19 7 Steps to Set up MSMEs 19 Addresses of various Licensing Agencies and 8. -

20 Year Perspective Plan for Tourism in Union Territory Of

20 YEAR PERSPECTIVE PLAN FOR TOURISM IN UNION TERRITORY OF PONDICHERR Y ¹ FINAL REPORT¹ MARCH 2003 TATA ECONOMIC CONSULTANCY SERVICES 20 YEAR PERSPECTIVE PLAN FOR TOURISM IN UNION TERRITORY OF PONDICHERRY ¹ FINAL REPORT ¹ Prepared for DEPARTMENT OF TOURISM GOVERNMENT OF INDIA NEW DELHI MARCH 2003 TATA ECONOMIC CONSULTANCY SERVICES VI-A, ELDORADO, 112, NUNGAMBAKKAM HIGH ROAD CHENNAI - 600 034 CONTENTS CHAPTER TITLE PAGE NO. EXECUTIVE SUMMARY 1-15 I UNION TERRITORY OF PONDICHERRY – 1-45 AN OVERVIEW II PONDICHERRY REGION – A PROFILE 1-16 III KARAIKAL REGION – A PROFILE 1-17 IV MAHE REGION – A PROFILE 1-16 V YANAM REGION – A PROFILE 1-22 VI RECOMMENDED PROJECTS AND THEIR 1-23 ECONOMIC BENEFITS VII FINANCING THE TOURISM PROMOTION 1-9 PROJECTS VIII INFRASTRUCTURE DEVELOPMENT 1-2 IX PRIVATISATION OF TOURISM ASSETS 1 X ENVIRONMENTAL IMPACT ASSESSMENT 1-27 i.exe EXHIBITS EXHIBIT TITLE PAGE NO. A LIST OF RECOMMENDED TOURISM PROJECTS FOR 13-14 UNION TERRITORY OF PONDICHERRY B RECOMMENDATIONS FOR TOURISM PROMOTION 15 POLICY MEASURES 1.1 PROJECTIONS OF LIKELY FUTURE POPULATION 34 IN PONDICHERRY UT 1.2 UNION TERRITORY OF PONDICHERRY – 35-38 A COMPOSITE STATE PROFILE 1.3 TRENDS IN TOURIST INFLOW INTO PONDICHERRY 39 UT 1.4 PLAN SCHEMES FOR DEVELOPMENT OF TOURISM 40-43 PROJECTS 1.5 ESTIMATES OF TOURIST INFLOW – PONDICHERRY 44 AND KARAIKAL 1.6 ESTIMATES OF TOURIST INFLOW – MAHE AND 45 YANAM 2.1 TOURIST INFLOW INTO PONDICHERRY REGION 16 3.1 TOURIST INFLOW INTO KARAIKAL REGION 17 6.1 SALIENT FEATURES OF RECOMMENDED 20-21 PROJECTS 6.2 PROPOSED INVESTMENT SCHEDULE FOR 22-23 RECOMMENDED PROJECTS MATRICES IN CHAPTER X 12-27 i.exe M A P S NO. -

1 the UNION TERRITORY GOODS and SERVICES TAX ACT, 2017 Commentary

THE UNION TERRITORY GOODS AND SERVICES TAX ACT, 2017 Commentary : A separate Act is implemented for Union Territory states to impose and administer Goods and Service Tax (GST) in India in the name of The Union Territory Goods and Service Tax Act, 2017 (UTGST). The Constitution (One Hundred and first Amendment) Act, 2016 inserted a new clause, Clause 26B in Article 366 of the Constitution. As per this clause, ―State‖ with reference to Articles 246A, 268, 269, 269A, and 279A includes a Union territory with Legislature. Even ‗State‘ for the purposes of GST, includes a Union territory with Legislature. Delhi and Puducherry are Union Territories with legislature and are considered as ―States‖. Technically SGST cannot be levied in a Union Territory without legislature. This applies to following Union Territories of India: Andaman and Nicobar Islands, Lakshadweep, Dadra and Nagar Haveli, Daman and Diu and Chandigarh. To plug this loophole, GST Council has decided to have Union Territory GST Law (UTGST) – which would be at par with State Goods and Service Tax (SGST). As per Article 246(4) of Constitution, the Parliament has powers to make laws with respect to any matter for any part of the territory of India, which is not included in the State, including the matters enumerated in State List. Therefore, with the approval from the GST Council, the Central Government passed the UTGST Law in the Parliament. Thus following combination of taxes will be applicable for any transaction:- 1. For Supply of goods and/or services within a state (Intra-State): CGST + SGST; 2. For Supply of goods and/or services within Union Territories (Intra-UT): CGST + UTGST; 3. -

Press Information Bureau Government of India ***** Maps of Newly Formed Union Territories of Jammu Kashmir and Ladakh, with the Map of India

Press Information Bureau Government of India ***** Maps of newly formed Union Territories of Jammu Kashmir and Ladakh, with the map of India New Delhi, November 2, 2019 On the recommendation of Parliament, the President effectively dismantled Article 370 of the Indian Constitution and gave assent to the Jammu and Kashmir Reorganization Act, 2019. Under the leadership of Prime Minister Shri Narendra Modi and supervision of Union Home Minister Shri Amit Shah, the former state of Jammu & Kashmir has been reorganized as the new Union Territory of Jammu and Kashmir and the new Union Territory of Ladakh on 31st October 2019. The new Union Territory of Ladakh consists of two districts of Kargil and Leh. The rest of the former State of Jammu and Kashmir is in the new Union Territory of Jammu and Kashmir. In 1947, the former State of Jammu and Kashmir had the following 14 districts - Kathua, Jammu, Udhampur, Reasi, Anantnag, Baramulla, Poonch, Mirpur, Muzaffarabad, Leh and Ladakh, Gilgit, Gilgit Wazarat, Chilhas and Tribal Territory. By 2019, the state government of former Jammu and Kashmir had reorganized the areas of these 14 districts into 28 districts. The names of the new districts are as follows - Kupwara, Bandipur, Ganderbal, Srinagar, Budgam, Pulwama, Shupian, Kulgam, Rajouri, Ramban, Doda, Kishtivar, Samba and Kargil. Out of these, Kargil district was carved out from the area of Leh and Ladakh district. The Leh district of the new Union Territory of Ladakh has been defined in the Jammu and Kashmir Reorganization (Removal of Difficulties) Second Order, 2019, issued by the President of India, to include the areas of the districts of Gilgit, Gilgit Wazarat, Chilhas and Tribal Territory of 1947, in addition to the remaining areas of Leh and Ladakh districts of 1947, after carving out the Kargil District. -

![1The Constitution (Scheduled Castes) 2[(Union Territories)] Order 1951 C.O](https://docslib.b-cdn.net/cover/3780/1the-constitution-scheduled-castes-2-union-territories-order-1951-c-o-2153780.webp)

1The Constitution (Scheduled Castes) 2[(Union Territories)] Order 1951 C.O

166 1THE CONSTITUTION (SCHEDULED CASTES) 2[(UNION TERRITORIES)] ORDER 1951 C.O. 32 In exercise of the powers conferred by clause (1) of article 341 of the Constitution of India, as amended by the Constitution (First Amendment) Act, 1951, the President is pleased to make the following Order, namely:— 1. This Order may be called the Constitution (Scheduled Castes) 2[(Union Territories)] Order, 1951. 2. Subject to the provisions of this Order, the castes, races or tribes or parts of, or groups within, castes or tribes, specified in 3[Parts I to III] of the Schedule to this Order shall, in relation to the 2[Union territories] to which those parts respectively relate, be deemed to be Scheduled Castes so far as regards members thereof resident in the localities specified in relation to them respectively in those Parts of that Schedule. 4[3. Notwithstanding anything contained in paragraph 2, no person who professes a religion different from the Hindu, 5[the Sikh or the Buddhist] religion shall be deemed to be a member of a Scheduled Caste.] 6[4. Any reference in this Order to a Union territory in Part I of the Schedule shall be construed as a reference to the territory constituted as a Union territory, as from the first day of November, 1956, any reference to a Union territory in Part II of the Schedule shall be construed as a reference to the territory constituted as a Union territory as from the first day of November, 1966 and any reference to a Union territory in Part III of the Schedule shall be construed as a reference to the territory constituted as a Union territory as from the day appointed under clause (b) of section 2 of the Goa, Daman and Diu Reorganisation Act, 1987.] 2[THE SCHEDULE PART I.—Delhi Throughout the Union territory: — 1. -

ALL INDIA FOOTBALL FEDERATION CONSTITUTION Definitions: the Terms Given Below Denote the Following: 1

ALL INDIA FOOTBALL FEDERATION CONSTITUTION Definitions: The terms given below denote the following: 1. Federation or AIFF means the All India Football Federation 2. FIFA means Federation Internationale de Football Association. 3. IFAB means the International Football Association Board. 4. AFC means the Asian Football Confederation. 5. IOA means the Indian Olympic Association. 6. National Association means an Association, which is in membership with FIFA. 7. Member Association means a Permanent Member, Associate Member or Provisional Member. 8. Permanent Member means a football Association of a State or Union Territory which has been granted permanent affiliation to the AIFF. 9. Associate Member, means the Services Sports Control Board (SSCB), the Railways Sports Promotion Boards (RSPB). 10. Provisional Member means a football Association of a State or Union Territory admitted as such by the AIFF as provisional member. 11. Constituent or Affiliated Unit means any District Association, Club, Board or any other Association or Institution affiliated to a Member. 12. Leagues means a Tournament for Clubs affiliated to a Member, organized by the Member or any of its constituent units or by the AIFF based on league format of competition. 13. Bodies mean the General Body, Executive Committee, the General Secretariat, the Standing Committees and Boards. 14. Financial Year means the period from 1st April to the 31st of March of the subsequent year. 1 15. AGM means the Annual General Body Meeting of the AIFF. 16. SGM means the Special General Body Meeting of the AIFF. 17. Official means every Board Member, Committee(s) or Sub Committee(s) member, Referee, Assistant Referee, Manager, Coach, Trainer and other persons responsible for the technical, medical and administrative matters of AIFF or of a Member or of a unit affiliated to the Member or of any competition of AIFF. -

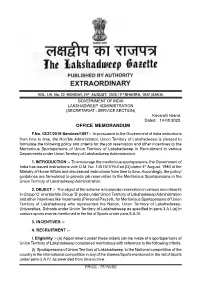

OFFICE MEMORANDUM F.No

VOL. LVI. No. 22 MONDAY, 24th AUGUST, 2020 / 2nd BHADRA, 1942 (SAKA) GOVERNMENT OF INDIA LAKSHADWEEP ADMINISTRATION (SECRETARIAT - SERVICE SECTION) Kavaratti Island, Dated : 14-08-2020. OFFICE MEMORANDUM F.No. 12/27/2019-Services/1897 :- In pursuance to the Government of India instructions from time to time, the Hon’ble Administrator, Union Territory of Lakshadweep is pleased to formulate the following policy and criteria for the job reservation and other incentives to the Meritorious Sportspersons of Union Territory of Lakshadweep in Recruitment in various Departments under Union Territory of Lakshadweep Administration. 1. INTRODUCTION :- To encourage the meritorious sportspersons, the Government of India has issued instructions vide O.M. No. 14015/1/76-Estt (D) dated 4th August, 1980 of the Ministry of Home Affairs and also issued instructions from time to time. Accordingly, the policy/ guidelines are formulated to provide job reservation to the Meritorious Sportspersons in the Union Territory of Lakshadweep Administration. 2. OBJECT :- The object of the scheme is to provide reservation in various recruitments in Group ‘C’ or erstwhile Group ‘D’ posts under Union Territory of Lakshadweep Administration and other incentives like Increments (Personal Pay) etc. for Meritorious Sportspersons of Union Territory of Lakshadweep who represented the Nation, Union Territory of Lakshadweep, Universities, Schools under Union Territory of Lakshadweep as specified in para-3.A.I.(a) in various sports events mentioned in the list of Sports under para-3.A.IV. 3. INCENTIVES :- 4. RECRUITMENT :- I. Eligibility :- (a) Appointment under these orders can be made of a sportspersons of Union Territory of Lakshadweep considered meritorious with reference to the following criteria. -

ADMINISTRATION of UNION TERRITORY of LADAKH LAW DEPARTMENT, UNION TERRITORY of LADAKH, 194101 Email: [email protected]

ADMINISTRATION OF UNION TERRITORY OF LADAKH LAW DEPARTMENT, UNION TERRITORY OF LADAKH, 194101 Email: [email protected] Subject: - Engagement of Standing Counsels in the Union Territory of Ladakh. Order No: 04-(SC)/L&J/UTL of 2021 Dated: 12.04.2021 Sanction is accorded to the engagement of the following Advocates as Standing Counsels for conducting/defending the cases before District Courts and the Subordinate Courts in Ladakh pertaining to the Administration of Union territory of Ladakh till further orders: Leh District 1. Advocate Sonam Paljor Kargil District 1. Advocate Khadim Hussain The Standing Counsels shall be engaged on the following terms and conditions:- a. Monthly retainership: f 8000/- per month b. Incidental expenses f 1000/- for filing of each written statement: 1. Counsel fee: f 2000/- per case in three installments- (i) First installment on filing of suit/written statement; (ii) Second installment on completion of evidence; and (iii) Third installment on pronouncement of judgment. d. Suit dismissed in default: f 1000/- per case e. Civil Appeal/Revision: f 1500/- per case f. Contempt cases:- f 1500/-per case • The Department of Law and Justice shall pay the monthly retainership, whereas the charges listed under clauses (b) to (f) shall be paid by the respective Departments/Ladakh Autonomous Hill Development Council. By order of the Competent Authority. Sd/- (Preet Pal Singh) Secretary Department Law and Justice. No: Secy/L&JjUTLj2021j423-44 Dated: 12.04.2021 Copy to the: 1. Advisor to Hon'ble Lieutenant Governor, Union Territory of Ladakh. 2. Joint Secretary (Jammu and Kashmir and Ladakh Affairs), North Block, Ministry of Home Affairs, New Delhi, Government of India.