ANNUAL REPORT 2019-20 Awards Powered by Pharmaintelligence Informa

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pharmaceutical Industry of Bangladesh the Multi-Billion Dollar Industry

Pharmaceutical Industry of Bangladesh The multi-billion Dollar Industry BDT 205,118 15.6% CAGR 15% + Million (last 5 years) (Next 5 years) Industry Size Industry Growth Expected Growth Financials Industry Overview of listed Pharmaceutical Companies Ratings of Listed Pharmaceutical View of Industry Expert Companies Executive Summary : Pharmaceuticals industry, the next multi-billion dollar opportunity for Bangladesh, has grown significantly at Pharmaceuticals Industry of a CAGR of 15.6% in the last five years. The key Bangladesh growth drivers are - growing GNI per Capita, 3rd Edition population growth, changing disease profile, lifestyle change and rapid urbanization. These factors will continue to grow pharmaceutical industry in short to mid term as well. Export is opening new venues for the industry and it has grown significantly last Analyst: financial year. People in the emerging markets will Md. Abdullah Al Faisal consume more than half of the medicine used Research Associate globally. Pharmaceutical industry of Bangladesh can become a global player by targeting Pharmerging market which is expected to grow up by 3-6% CAGR for the next 5 years. We have to absorb modern technologies like AI, ML & Biopharma to compete with developed markets. More policy support is required to stay in competition. Still Backward linkage is the Achilles Heels for the overall sector as well as drug patent exemption 1st Edition: 1st November, 2016 remains in ambiguity amid graduation from LDC. 2nd Edition: 4th January 2018 More Greenfield investments are going raise 3rd Edition: 28th July 2019 competition among Pharmaceutical companies. This edition exclusively covers financial performance of pharmaceuticals companies on stand alone basis. -

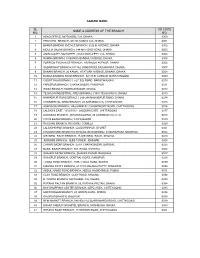

Agrani Bank Sl No. Name & Address of the Branch Ad Code

AGRANI BANK SL AD CODE NAME & ADDRESS OF THE BRANCH NO. NO. 1 HEAD OFFICE, MOTIJHEEL C/A, DHAKA 0000 2 PRINCIPAL BRANCH, 9/D DILKUSHA C/A, DHAKA 0001 3 BANGA BANDHU AVENUE BRANCH, 32 B.B. AVENUE, DHAKA 0002 4 MOULVI BAZAR BRANCH, 144 MITFORD ROAD, DHAKA. 0003 5 AMIN COURT, MOTIJHEEL, 62/63 MOTIJHEEL C/A, DHAKA 0004 6 RAMNA BRANCH, 18 BANGA BANDHU AVENUE, DHAKA 0005 7 FOREIGN EXCHANGE BRANCH, 1/B RAJUK AVENUE, DHAKA 0006 8 SADARGHAT BRANCH,3/7/1&2 JONSON RD,SADARGHAT, DHAKA. 0007 9 BANANI BRANCH, 26 KAMAL ATATURK AVENUE, BANANI, DHAKA. 0008 10 BANGA BANDHU ROAD BRANCH, 32/1 B.B. AVENUE, NARAYANGONJ 0009 11 COURT ROAD BRANCH, 52/1 B.B.ROAD, NARAYANGONJ 0010 12 FARIDPUR BRANCH, CHAWK BAZAR, FARIDPUR 0011 13 WASA BRANCH, KAWRAN BAZAR, DHAKA. 0012 14 TEJGAON INDUSTRIAL AREA BRANCH, 315/A TEJGAON I/A, DHAKA 0013 15 NAWABPUR ROAD BRANCH, 243-244 NAWABPUR ROAD, DHAKA 0014 16 COMMERCIAL AREA BRANCH, 28 AGRABAD C/A, CHITTAGONG 0015 17 ASADGONJ BRANCH, HAJI AMIR ALI CHOWDHURY ROAD, CHITTAGONG 0016 18 LALDIGHI EAST, 1012/1013 - LALDIGHI EAST, CHITTAGONG 0017 19 AGRABAD BRANCH, JAHAN BUILDING, 24 AGRABAD C/A, CTG 0018 20 COX'S BAZAR BRANCH, COX'S BAZAR 0019 21 RAJGANJ BRANCH, RAJGANJ, COMILLA 0020 22 LALDIGHIRPAR BRANCH, LALDIGHIRPAR, SYLHET 0021 23 CHAUMUHANI BRANCH,D.B.ROAD, BEGUMGONJ, CHAUMUHANI, NOAKHALI 0022 24 SIR IQBAL RAOD BRANCH, 25 SIR IQBAL RAOD, KHULNA 0023 25 JESSORE BRANCH, JESS TOWER, JESSORE 0024 26 CHAWK BAZAR BRANCH, 02/01 CHAWK BAZAR, BARISAL 0025 27 BARA BAZAR BRANCH, N.S. -

INTERNATIONAL FINANCE INVESTMENT and COMMERCE BANK LIMITED Audited Financial Statements As at and for the Year Ended 31 December 2019

INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Audited Financial Statements as at and for the year ended 31 December 2019 INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Consolidated Balance Sheet as at 31 December 2019 Amount in BDT Particulars Note 31 December 2019 31 December 2018 PROPERTY AND ASSETS Cash 18,056,029,773 16,020,741,583 Cash in hand (including foreign currency) 3.a 2,872,338,679 2,899,030,289 Balance with Bangladesh Bank and its agent bank(s) (including foreign currency) 3.b 15,183,691,094 13,121,711,294 Balance with other banks and financial institutions 4.a 5,637,834,204 8,118,980,917 In Bangladesh 4.a(i) 4,014,719,294 6,823,590,588 Outside Bangladesh 4.a(ii) 1,623,114,910 1,295,390,329 Money at call and on short notice 5 910,000,000 3,970,000,000 Investments 47,216,443,756 32,664,400,101 Government securities 6.a 41,369,255,890 27,258,506,647 Other investments 6.b 5,847,187,866 5,405,893,454 Loans and advances 232,523,441,067 210,932,291,735 Loans, cash credit, overdrafts etc. 7.a 221,562,693,268 198,670,768,028 Bills purchased and discounted 8.a 10,960,747,799 12,261,523,707 Fixed assets including premises, furniture and fixtures 9.a 6,430,431,620 5,445,835,394 Other assets 10.a 9,606,537,605 9,003,060,522 Non-banking assets 11 373,474,800 373,474,800 Total assets 320,754,192,825 286,528,785,052 LIABILITIES AND CAPITAL Liabilities Borrowing from other banks, financial institutions and agents 12.a 8,215,860,335 9,969,432,278 Subordinated debt 13 2,800,000,000 3,500,000,000 Deposits and other -

8Th Hsbc Export Excellence Awards’

News Release 23 September 2018 WINNERS RECOGNISED AT THE ‘8TH HSBC EXPORT EXCELLENCE AWARDS’ The Hongkong and Shanghai Banking Corporation Limited in Bangladesh has recognised six winners at the award ceremony of the ‘8th HSBC Export Excellence Awards’. The winners were awarded crests for their leadership in promoting the country and contributing to the nation’s sustainable growth. The categories and winners of ‘8th HSBC Export Excellence Awards’ are: Exporter of the year - Ready Made Garments: Group A Annual export turnover of US$ 100 Million and above DBL Group Award received by: M A Jabbar, Managing Director DBL Group (DBLG) is one of the leading knit garments/fabrics manufacturers/exporters in Bangladesh since 1991. The group exports to international buyers mainly in the EU and USA. The Group is currently composed of 25 concerns with a workforce of c.30000+ employees. Exporter of the year - Ready Made Garments: Group B Annual export turnover below USD100 million Urmi Group Award received by: Asif Ashraf, Managing Director & CEO Urmi Group started its journey in the mid fifties. Urmi is accredited by leading international clothing brands. Urmi exports to 49 countries across 6 continents for 13 retailers. Urmi group is committed to fulfilling its responsibility towards employees, environment and community. Exporter of the Year – Supply Chain and Backward Linkage: Apparel Annual export turnover of USD10 million and above Etafil Accessories Limited (EAL) Award received by: Gulzar A Chowdhury, Managing Director Established in 1998, Etafil Accessories Limited (EAL) is a concern of Tamishna Group who are manufacturer and exporter of sewing thread, garment accessories and yarn dyeing in Bangladesh. -

Send Us Victorious N Zeeshan Khan World

MONDAY, DECEMBER 16, 2013 | www.dhakatribune.com Victory Day 2013 Illustration: Sabyasachi Mistry Send us victorious n Zeeshan Khan world. The economic exploitation was our surprise when our language, our When Babur, the Mughal, encoun- Charjapadas. It ran through the Pala acute, resulting in death by the mil- culture, our ethnicity, our economy tered this kingdom for the first time, and Sena kingdoms of Gaur-Bongo to or the generations born lions, but the strains on our social and and then ultimately our votes were in the 1500s he made this observation: the Vangaladesa of the Cholas and was after December 16, 1971, psychological well-being were equally subordinated to a national pecking reborn in the Sultanate of Bangala that Bangladesh was an exis- catastrophic. Added to that, a British order that placed us at the bottom. A “There is an amazing custom in Babur encountered. tentially “normal” place policy of advancing some communi- rude awakening followed, and then Bengal: rule is seldom achieved by The emergence of Bangladesh was to grow up in. Nothing in ties at the expense of others created the guns came out. hereditary succession. Instead, there a historical inevitability. Repeatedly, Fthe atmosphere hinted at the violent sectarian tensions that wouldn’t go Truth is, the break from Pakistan, is a specific royal throne, and each the people of this land have resist- upheavals our preceding generations away when 1947 rolled around. even from India earlier, was the of the amirs, viziers or office holders ed authority that was oppressive or had to contend with and there was But an independent Bengal was in has an established place. -

Icmab 17Th Council Election February 07, 2020

ICMAB 17TH COUNCIL ELECTION FEBRUARY 07, 2020 CENTRAL VOTER LIST CENTRAL VOTER LIST ICMAB 17TH COUNCIL ELECTION The Institute of Cost and Management Accountants of Bangladesh (ICMAB) ICMA Bhaban, Nilkhet, Dhaka-1205 CENTRAL VOTER LIST ICMAB 17TH COUNCIL ELECTION FELLOW MEMBERS 1 F-0002 5 F-0030 Mr. Rafiq Ahmad FCMA Mr. A.B.M. Shamsuddin FCMA Executive Director Senior Financial Management Specialist T. K. Group of Industries Rural Transport Improvement Project-2 T.K. Bhaban (2nd floor) LGRD (World Bank Finance Project) 13, Kawran Bazar House # 289, Flat # A-3 Dhaka 1215 Road # 12, Block-A Bangladesh Bashundhara R/A Cell : 8801711566828 Dhaka E-mail : [email protected] Bangladesh Cell : 8801819252805 2 F-0016 E-mail : [email protected] Mr. Md. Afsarul Alam FCMA House No. 26 6 F-0032 Sonargaon Janapath (Chowrasta) Mr. D.P. Bhattacharyya FCMA Sector – 11 1403 Tropic Terrace Uttara Model Town FL 33903-5271 Dhaka 1230 United States of America (USA) Bangladesh Cell : 12396288687 Cell : 8801911216139 E-mail : [email protected] 3 F-0020 7 F-0034 Alhaj Md. Matior Rahman FCMA Mr. Md. Noor Baksh FCMA Makam-E-Mahmud, House # GA-117/2 House # 1, Road # 1, Block-B Middle Badda, Near Noor Moszid Palashpur, East Dania Gulshan, Dhaka 1212 Dhaka 1236 Bangladesh Bangladesh Cell : 8801778413531 Cell : 8801913805529 4 F-0027 8 F-0038 Mr. Md. Ishaque FCMA Mr. Muzaffar Ahmed FCMA Adviser President and CEO DBL Group Credit Rating Information and Services Ltd. Capita South Avenue (6th Floor) Nakshi Homes (4th floor) House # 50, Road # 3 6/1-A, Topkhana Road Gulshan Avenue Segunbagicha Gulshan- 1, Dhaka 1212 Dhaka 1000, Bangladesh Bangladesh Cell : 8801819213014 Cell : 8801713041913 E-mail : [email protected] E-mail : [email protected] Page 2 of 122 CENTRAL VOTER LIST ICMAB 17TH COUNCIL ELECTION 9 F-0042 15 F-0057 Mr. -

Rnöý S9 Ýý6ý Ýx Colonel Oli Ahmad, Bir Bikram (Retd. ) June 2003

rnöý S9 ýý6ý ýx REVOLUTION, MILITARY PERSONNEL AND THE WAR OF LIBERATION IN BANGLADESH BY Colonel Oli Ahmad, Bir Bikram (Retd.) A Thesis Submitted to the School of Social Science & Law OXFORD BROOKES UNIVERSITY In partial fulfillment of the requirement for the degree of DOCTOR OF PHILOSOPHY June 2003 ABSTRACT The study has focused on the role and motivations of the Bengali military officers in the Pakistan Army during the initial but critical phase of the Liberation War of 1971. Unlike the military in some other Third World Countries, at that point of time, the Bengali military officers made a move neither for grabbing political power nor for replacing a corrupt or inept regime but for establishing an independent state of Bangladesh. The concept of liberation war has been used in this study in the senseof an internal war between East and West Pakistan. The aims of this thesis are to explain why the Bengali military officers became actors in the Liberation War of 1971, how they were motivated for this war, when they took the crucial decision to revolt and declare independence of Bangladesh and how they proceeded till the formation of the Bangladesh Government-in-exile. The findings are also noteworthy. The Bengali political leaders prepared the people of East Pakistan for a revolutionary movement, but at the critical moment they faltered. As one of the dominant social forces in East Pakistan, the Bengali military officers watched from close quarters how the ethnically, linguistically and culturally different East Pakistanis were subjected to the discriminatory policies of the ruling elite in Pakistan which led to the wholesale alienation of the Bengalis. -

Ishares INC Form N-Q Filed 2017-01-27

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2017-01-27 | Period of Report: 2016-11-30 SEC Accession No. 0001193125-17-021399 (HTML Version on secdatabase.com) FILER iSHARES INC Mailing Address Business Address 400 HOWARD STREET 400 HOWARD STREET CIK:930667| IRS No.: 510396525 | State of Incorp.:MD | Fiscal Year End: 0831 SAN FRANCISCO CA 94105 SAN FRANCISCO CA 94105 Type: N-Q | Act: 40 | File No.: 811-09102 | Film No.: 17553046 (415) 670-2000 Copyright © 2017 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-09102 iShares, Inc. (Exact name of Registrant as specified in charter) c/o: State Street Bank and Trust Company 1 Iron Street, Boston, MA 02210 (Address of principal executive offices) (Zip code) The Corporation Trust Incorporated 351 West Camden Street, Baltimore, MD 21201 (Name and address of agent for service) Registrants telephone number, including area code: (415) 670-2000 Date of fiscal year end: August 31, 2017 Date of reporting period: November 30, 2016 Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Item 1. Schedules of Investments. Copyright © 2013 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Consolidated Schedule of Investments (Unaudited) iSHARES® CORE MSCI EMERGING MARKETS ETF November 30, 2016 Security Shares Value COMMON STOCKS 95.95% BRAZIL 4.34% AES Tiete Energia SA 748,700 $3,253,774 Aliansce Shopping Centers SA 477,400 2,087,434 Alupar Investimento SA Units 354,724 1,721,971 Ambev SA 17,451,600 88,483,353 Arezzo Industria e Comercio SA 243,300 1,978,049 B2W Cia. -

Important Notice the Depository Trust Company

Important Notice The Depository Trust Company B #: 5017-17 Date: February 1, 2017 To: All Participants Category: Dividends | International From: Global Tax Services Attention: Managing Partner/Officer, Cashier, Dividend Mgr., Tax Mgr. Subject: BNY Mellon | ADRs | Qualified Dividends for Tax Year 2016 Bank of New York Mellon Corporation (“BNYM”), as depositary for these issues listed below has reviewed and determined if they met the criteria for reduced U.S. tax rate as “qualified dividends” for tax year 2016. The Depository Trust Company received the attached correspondence containing Tax Information. If applicable, please consult your tax advisor to ensure proper treatment of this event. DTCC offers enhanced access to all important notices via a Web-based subscription service. The notification system leverages RSS Newsfeeds, providing significant benefits including real-time updates and customizable delivery. To learn more and to set up your own DTCC RSS alerts, visit http://www.dtcc.com/subscription_form.php. Non-Confidential CUSIP DR Name Country Exchange Qualified 88579N105 3I GROUP - Cash Dividend United Kingdom OTC Y 35104M102 4IMPRINT GROUP PLC - Cash Dividend United Kingdom OTC Y 00202F102 A.P. MOLLER - MAERSK - Cash Dividend Denmark OTC Y 002482107 A2A - Cash Dividend Italy OTC Y 000304105 AAC TECHNOLOGIES - Cash Dividend China OTC N 00254K108 AAREAL BANK - Cash Dividend Germany OTC Y 03524A108 AB INBEV - Cash Dividend Belgium NYSE Y 000380105 ABCAM - Cash Dividend United Kingdom OTC Y 003381100 ABERTIS INFRAESTRUCTURAS - Cash Dividend Spain OTC Y 003725306 ABOITIZ EQUITY VENTURES - Cash Dividend Philippines OTC Y 003730108 ABOITIZ POWER - Cash Dividend Philippines OTC Y 00400X103 ACACIA MINING - Cash Dividend United Kingdom OTC N 00433P101 ACCESS BANK - REG. -

ANNUAL REPORT | 2016-17 Annual Report 2016-17

ANNUAL REPORT | 2016-17 Annual Report 2016-17 BEXIMCO PHARMACEUTICALS LIMITED We take it minute by minute, drop by drop, molecule by molecule. The miracle of a pyramid is in the perfection of every stone. The miracle of life is in the health of every cell. At Beximco Pharma, we are tireless at achieving such perfection in every molecule of our medicines. That's our little contribution to life. Here's to perfection. Here's to life. Mission Contents We are committed to enhancing human health and wellbeing by providing contemporary and affordable medicines, manufactured in full compliance with global About the Company 05 quality standards. We continually strive to improve our core capabilities to address The Board of Directors 06 the unmet medical needs of the patients and to deliver outstanding results for our shareholders. Management Committee 07 Executive Committee 07 Key Events in History 08 Vision Managing Director’s Statement 11 We will be one of the most trusted, admired and successful pharmaceutical companies 2016-17 Highlights 18 in the region with a focus on strengthening research and development capabilities, Post Period Highlights 18 creating partnerships and building presence across the globe. What We Offer 20 Our Global Accreditations 21 Our Manufacturing Capabilities 23 Core Values Research and Development 25 Our core values define who we are; they guide us to take decisions and help realize Our People 29 our individual and corporate aspirations. Beyond Borders 33 Commitment to quality Awards and Accolades 34 We adopt industry best practices in all our operations to ensure highest quality What We Do for the Society 36 standards of our products. -

Beximco Private Placing To

Market News Page 1 of 3 Regulatory Announcement Go to market news section Beximco Company Pharmaceuticals Ltd TIDM BXP Private Placing to Headline GEM Global Yield Fund Limited Released 13:14 27-Jan-09 Number 3199M13 RNS Number : 3199M Beximco Pharmaceuticals Ltd 27 January 2009 BEXIMCO PHARMACEUTICALS LTD. News Release January 27, 2009 Private Placing to GEM Global Yield Fund Limited Beximco Pharmaceuticals Limited ("BPL" or the "Company"), the leading pharmaceutical manufacturer and the largest pharmaceutical exporter from Bangladesh, announces further details in respect of the anticipated private placing of shares to GEM Global Yield Fund Limited ("GEM"), announced earlier yesterday. BPL has signed a Subscription Agreement (the "Agreement") that enables it to issue ordinary shares up to Tk.4,100,000,000 (approximately £44.6m) ("Placing Shares") to GEM over the next three years through a number of allotments (the "Allotments") following the issue of Draw Down Notices by BPL. The Agreement states that the number of shares that can be placed in each Allotment is calculated by reference to the average volume of shares traded in the preceding 15 days period, as published by the Dhaka Stock Exchange Limited ("DSE"). The price per share at each Allotment is calculated by reference to the average price per share in the 15-day period following the issue of a Draw Down Notice by BPL, discounted to 90% (the Variable Pricing Method). The Company also intends to issue a further 2,500,000 warrants to GEM at an exercise price of Tk.200 (approximately £2.17). The warrants will have an exercise period of three years. -

Bpl-Annual-2010.Pdf

“Beximco Pharma aspires to become a nationally admired and globally reputed generic pharmaceutical company, committed to enhancing human health and life.” Annual Report 2010 Beximco Group Mission Each of our activities must benefit and add value to the common wealth of our society. We firmly believe that, in the final analysis we are accountable to each of the constituents with whom we interact, namely: our employees, our customers, our business associates, our fellow citizens and our shareholders. Beximco Pharmaceuticals Ltd. Contents Overview About the Company .................................................................................................................................................................... 5 Our Story ....................................................................................................................................................................................... 7 Corporate Directories ................................................................................................................................................................ 8 Managing Director’s Message ..................................................................................................................................................... 11 2010 Highlights ............................................................................................................................................................................ 15 Adding Value to Life Products ......................................................................................................................................................................................