For Personal Use Only Use Personal For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corel Wordperfect Office X7 R

Contents 1 | Introducing Corel WordPerfect Office X7 ................................ 1 2 | Customer profiles .................................................................... 3 3 | What’s included in the Standard Edition?............................... 5 4 | Key features ............................................................................. 9 Productivity.......................................................................................................... 9 Power ................................................................................................................ 12 Collaboration ..................................................................................................... 15 Value ................................................................................................................. 16 1 Introducing Corel® WordPerfect® Office X7 WordPerfect® Office X7 is a powerful, intuitive, and Collaboration highly compatible office suite that helps you do more with documents, spreadsheets, and presentations. WordPerfect Office has always been built to ensure More than 30 years since it first took the computing that you can easily collaborate and exchange your files world by storm, the legendary WordPerfect continues with others. to be trusted by governments, law firms, educational To that end, WordPerfect Office X7 offers extensive institutions, businesses, and consumers. support for more than 60 file formats, including the latest versions of Microsoft Office. Plus, its robust PDF Productivity import and -

Openoffice.Org News Highlights Table of Contents Octo Ber 2004

OpenOffice.org News Highlights Table of Contents Octo ber 2004 ................................................................................................ R eplacing FrameMaker with OOo Writer ............................................................................................. Ger mans claim Linux lowers costs ......................................................................................................... Ope n approach offers Mindef more choice ............................................................................................ Ball mer calls for horse-based attack on Star Office ............................................................................... Ope n for Business - The 2004 OfB Choice Awards .............................................................................. Sep tember 2004 ............................................................................................ Ope nOffice.org reveals marketing ambitions ......................................................................................... No nprofit brings Linux and open source to Hawaii ............................................................................... UK charity builds Linux network on a shoestring .................................................................................. N SW opens door to Linux offers ............................................................................................................ L eading Edge Forum Report 2004 - Open Source: Open for Business ................................................. -

Corel Wordperfect Office X5 Reviewer's Guide

Trusted by millions, it's everything you expect in an office suite Contents 1 | Introducing Corel WordPerfect Office X5 . 1 2 | Customer profiles . 3 3 | What’s included? . 4 4 | New and distinguishing features . 7 1 Introducing Corel® WordPerfect® Office X5 The productivity market has changed a lot in the productivity tools. While addressing emerging last 20 years; over the last two years, the pace of trends is critical, so is adding to the value of the that change has been exponential. New players core office suite. and business models have emerged that have expanded the scope of what is considered an office Drawing upon a rich history in office productivity productivity tool. And as functionality has innovation, Corel breaks new ground while still changed, so have users’ expectations. But as improving the most critical areas in the traditional always, the key to any new office suite is blending office suite, so users can do more with words, tools that users have come to rely on with new numbers, and ideas. Corel WordPerfect Office X5 features that fit into today’s workflow. redefines the office suite by providing: The Internet is impacting every technology • The ability to use WordPerfect® X5 in lockstep market because of its ability to connect people with document management systems, like ® ® and provide a vehicle for collaboration. Market Microsoft SharePoint . research indicates that business and government • Web Services integration, so users have the users are quickly adopting online tools to make time-saving capability of creating documents their organizations more collaborative and populated with data pulled from the Web. -

Corel History.Cdr

The History of ® 1985 1987 1989 TM 1991 1992 1995 1996 A ® 1985 – Corel is founded. Building desktop 1987 – The official beginning of CorelDRAW®. 1991 – CorelDRAW 2 launches in the fall and 1992 – Corel once again re-defines ‘value’ in 1995 – Blazing a trail, CorelDRAW 6 1996 – Corel Acquires WordPerfect , ® ® publishing systems, Corel delivers early text Code-named “WALDO” (represented by the customers experience effects including the software industry. Combining illustration, is the first graphics suite built for Quattro Pro , Paradox , and the ® effects tools that inspire developers to attractive guy above), CorelDRAW Envelope, Blend, Extrude, and Perspective in photo-editing, and more in one package, Windows® 95 and 32-bit power. PerfectOffice application suite from consider the ambitious task of building an development is started by a small but user-friendly graphics software for the very CorelDRAW 3 is the world’s first full-featured Novell. New WordPerfect Suite 7 easy-to-use, full featured graphics application passionate team of engineers, laying the first time. Copied by virtually every other graphics suite. debuts later that year. for the PC. foundation for what would become one of 1989 – CorelDRAW 1 launches in spring and is graphics application on the market, the world’s most popular software titles! absolutely stunning for its time. Version 1 CorelDRAW delivers these essential tools broke new ground for features and first, and challenges what customers can functionality and took full advantage of all the expect from their graphics software! power a 286 PC with a 40 MB hard drive and 2 MB of RAM could deliver. -

Symantec Web Security Service Policy Guide

Web Security Service Policy Guide Revision: NOV.07.2020 Symantec Web Security Service/Page 2 Policy Guide/Page 3 Copyrights Broadcom, the pulse logo, Connecting everything, and Symantec are among the trademarks of Broadcom. The term “Broadcom” refers to Broadcom Inc. and/or its subsidiaries. Copyright © 2020 Broadcom. All Rights Reserved. The term “Broadcom” refers to Broadcom Inc. and/or its subsidiaries. For more information, please visit www.broadcom.com. Broadcom reserves the right to make changes without further notice to any products or data herein to improve reliability, function, or design. Information furnished by Broadcom is believed to be accurate and reliable. However, Broadcom does not assume any liability arising out of the application or use of this information, nor the application or use of any product or circuit described herein, neither does it convey any license under its patent rights nor the rights of others. Policy Guide/Page 4 Symantec WSS Policy Guide The Symantec Web Security Service solutions provide real-time protection against web-borne threats. As a cloud-based product, the Web Security Service leverages Symantec's proven security technology, including the WebPulse™ cloud community. With extensive web application controls and detailed reporting features, IT administrators can use the Web Security Service to create and enforce granular policies that are applied to all covered users, including fixed locations and roaming users. If the WSS is the body, then the policy engine is the brain. While the WSS by default provides malware protection (blocks four categories: Phishing, Proxy Avoidance, Spyware Effects/Privacy Concerns, and Spyware/Malware Sources), the additional policy rules and options you create dictate exactly what content your employees can and cannot access—from global allows/denials to individual users at specific times from specific locations. -

Transitioning from Microsoft® Office to Wordperfect

Transitioning from Microsoft® Office to WordPerfect® Office Product specifications, pricing, packaging, technical support and information (“Specifications”) refer to the United States retail English version only. The United States retail version is available only within North America and is not for export. Specifications for all other versions (including language versions and versions available outside of North America) may vary. INFORMATION IS PROVIDED BY COREL ON AN “AS IS” BASIS, WITHOUT ANY OTHER WARRANTIES OR CONDITIONS, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, WARRANTIES OF MERCHANTABLE QUALITY, SATISFACTORY QUALITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, OR THOSE ARISING BY LAW, STATUTE, USAGE OF TRADE, COURSE OF DEALING OR OTHERWISE. THE ENTIRE RISK AS TO THE RESULTS OF THE INFORMATION PROVIDED OR ITS USE IS ASSUMED BY YOU. COREL SHALL HAVE NO LIABILITY TO YOU OR ANY OTHER PERSON OR ENTITY FOR ANY INDIRECT, INCIDENTAL, SPECIAL, OR CONSEQUENTIAL DAMAGES WHATSOEVER, INCLUDING, BUT NOT LIMITED TO, LOSS OF REVENUE OR PROFIT, LOST OR DAMAGED DATA OR OTHER COMMERCIAL OR ECONOMIC LOSS, EVEN IF COREL HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, OR THEY ARE FORESEEABLE. COREL IS ALSO NOT LIABLE FOR ANY CLAIMS MADE BY ANY THIRD PARTY. COREL’S MAXIMUM AGGREGATE LIABILITY TO YOU SHALL NOT EXCEED THE COSTS PAID BY YOU TO PURCHASE THE MATERIALS. SOME STATES/COUNTRIES DO NOT ALLOW EXCLUSIONS OR LIMITATIONS OF LIABILITY FOR CONSEQUENTIAL OR INCIDENTAL DAMAGES, SO THE ABOVE LIMITATIONS MAY NOT APPLY TO YOU. © 2005 Corel Corporation. All rights reserved. Corel, CorelDRAW, Grammar As-You-Go, Natural-Media, Painter, Paint Shop, Presentations, Quattro Pro, QuickCorrect, QuickWords, SpeedFormat, Spell-As-You-Go, TextArt, WordPerfect, and the Corel logo are trademarks or registered trademarks of Corel Corporation and/or its subsidiaries in Canada, the United States, and/or other countries. -

How-To Autoinstall Using Response Files

How-to Autoinstall using Response Files [How-to Autoinstall using Response Files] [1.0] First edition: [2002/9/27] First English edition: [2004/04/09 ] Contents Contents C ontents . .1 O verview . .4 C opyright and trademark information . .4 F eedback . .4 A cknowledgments . .4 M odifications and updates . .4 W hat is a Response File Installation? . .5 H ow Do I Install OpenOffice with Response Files? . .6 P reparing the Response File Installation . .6 P reparing the Response File Installation . .6 T esting the Response File . .8 I nstall OpenOffice Using the Response File . .8 R esponse File Structure and Sections . .9 R esponse File Structure . .9 S ection Environment . .9 [ Environment] . .9 S ection Module_Specify . .9 [ Module_Specify] . .9 S ection Procedures . .1 0 S ection Java . .1 0 S ection Environment . .1 0 I nstallation Mode . .1 0 V alues . .1 0 D efault - . .1 0 I nstallationType . .1 1 V alues . .1 1 D efault: STANDARD . .1 1 D estinationPath . .1 1 V alues . .1 1 How-to Autoinstall using Response Files 1 Contents D efault: <firstfree> + directory name of DefaultPath from the setup script . .1 1 S tartProcedure . .1 2 V alue . .1 2 D efault: None . .. -

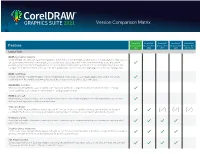

Coreldraw 2021 Version Comparison Matrix

Version Comparison Matrix CorelDRAW® CorelDRAW® CorelDRAW® CorelDRAW® CorelDRAW® Feature Graphics Suite Graphics Suite Graphics Suite Graphics Suite Graphics Suite 2021 2020 2019 2018 2017 & X8 Layout Tools NEW! Pages docker/Inspector CorelDRAW 2021 simplifies working with multipage documents thanks to the new Pages docker/inspector. It lists all pages in a design so you can easily manage them and quickly navigate a project. Each page has a scalable thumbnail preview that reflects its size and content. Reordering pages is as easy as dragging them in the docker/Inspector. What’s more, you can add, delete, and rename pages in one spot, saving you time and effort. And in a click, you can switch display modes to either focus on a single page or use the new Multipage View. NEW! Autofit Page Another time-saver in CorelDRAW 2021 is the Autofit Page feature. In just a click, you can resize a page to fit its content. You can also quickly customize the margin by specifying the space between design elements and the edge of the page. ENHANCED! Guidelines When working with guidelines, you can quickly switch views from world scale to page dimensions. In addition, it's easier to manage custom guidelines, so you can set up the framework for a design faster than ever. NEW! Snap to self When working in complex designs, a new setting allows you to prevent objects from snapping to their own snap points so you can move and transform design elements with ease and precision. Object distribution Improving on the Align and Distribute docker/Inspector, it’s now easier than ever to get the exact page layouts and precise designs in CorelDRAW. -

Tinkertool System 6 Reference Manual Ii

Documentation 0632-1969/2 TinkerTool System 6 Reference Manual ii Version 6.99, July 21, 2021. US-English edition. MBS Documentation 0632-1969/2 © Copyright 2003 – 2021 by Marcel Bresink Software-Systeme Marcel Bresink Software-Systeme Ringstr. 21 56630 Kretz Germany All rights reserved. No part of this publication may be redistributed, translated in other languages, or transmitted, in any form or by any means, electronic, mechanical, recording, or otherwise, without the prior written permission of the publisher. This publication may contain examples of data used in daily business operations. To illustrate them as completely as possible, the examples include the names of individuals, companies, brands, and products. All of these names are fictitious and any similarity to the names and addresses used by an actual business enterprise is entirely coincidental. This publication could include technical inaccuracies or typographical errors. Changes are periodically made to the information herein; these changes will be incorporated in new editions of the publication. The publisher may make improvements and/or changes in the product(s) and/or the program(s) described in this publication at any time without notice. Make sure that you are using the correct edition of the publication for the level of the product. The version number can be found at the top of this page. Apple, macOS, iCloud, and FireWire are registered trademarks of Apple Inc. Intel is a registered trademark of Intel Corporation. UNIX is a registered trademark of The Open Group. Broadcom is a registered trademark of Broadcom, Inc. Trademarks or service marks are used for identification purposes only. -

Coreldraw 2021 Product Family Comparison Matrix

TM Product Family Comparison For occasional graphics For graphics enthusiasts For graphics professionals users and those just starting out and home businesses in small to large businesses Main Applications Most Popular CorelDRAW® CorelDRAW Essentials CorelDRAW Standard Corel PHOTO-PAINT™ Corel PHOTO-PAINT Essentials Corel PHOTO-PAINT Standard Corel® Font Manager CAPTURE™ CorelDRAW.app™ Corel® AfterShot™ HDR Key Features and Tools (Highlights) ( ) Bitmap-to-vector tracing PowerTRACE™️ Quick Trace (one-click tracing) PowerTRACE™️ (Advanced with AI technology) Interactive Guidelines Alignment guides, Guidelines docker Bitmap adjustments: Color balance, Channel Mixer, Selective color, Desaturate, + many more! Gamma, Tone curve, + more NEW! Adjustments docker NEW! Perspective drawing Bevel docker, Shadow tool, Spiral, Smooth, Smear, Smudge, and Roughen tool Clone Tool, Artistic Media Symmetry drawing mode, Block Shadow tool, Impact tool, Pointillizer™, PhotoCocktail™ Object styles, Color styles, Color harmonies NEW! Pages docker Basic Basic NEW! Multipage View - Flexible design space Replace Colors NEW! More Basic Basic powerful, more intuitive Key Features and Tools (Highlights) Most Popular Enhanced Color management, Color proofing option, spot color support on output Professional Print options (CMYK features, Composite, Color separations, Postscript, Prepress tabs, large print preview) ENHANCED! Collaboration tools** Automation support (VSTA, VBA), Macro Manager Content Vector images 1,000 Over 7,000 High-resolution digital photos 100 1,000 -

Openoffice.Org for Dummies.Pdf

542222 FM.qxd 11/6/03 3:29 PM Page i OpenOffice.org FOR DUMmIES‰ by Gurdy Leete, Ellen Finkelstein, and Mary Leete 542222 FM.qxd 11/6/03 3:29 PM Page iv 542222 FM.qxd 11/6/03 3:29 PM Page i OpenOffice.org FOR DUMmIES‰ by Gurdy Leete, Ellen Finkelstein, and Mary Leete 542222 FM.qxd 11/6/03 3:29 PM Page ii OpenOffice.org For Dummies® Published by Wiley Publishing, Inc. 111 River Street Hoboken, NJ 07030-5774 Copyright © 2004 by Wiley Publishing, Inc., Indianapolis, Indiana Published by Wiley Publishing, Inc., Indianapolis, Indiana Published simultaneously in Canada No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600. Requests to the Publisher for permission should be addressed to the Legal Department, Wiley Publishing, Inc., 10475 Crosspoint Blvd., Indianapolis, IN 46256, (317) 572-3447, fax (317) 572-4447, e-mail: [email protected]. Trademarks: Wiley, the Wiley Publishing logo, For Dummies, the Dummies Man logo, A Reference for the Rest of Us!, The Dummies Way, Dummies Daily, The Fun and Easy Way, Dummies.com, and related trade dress are trademarks or registered trademarks of John Wiley & Sons, Inc. -

1,700+ Participating Online Stores

1,700+ Participating Online Stores Up to 26% of Each Purchase Benefits ViperBots Friends and Family 1&1 Internet Inc. Ahnu Ashley Stewart Beezid Booksamillion.com CarRentals.com Club Monaco CyberLink 1-800-Baskets.com Air Filters Delivered Ashro BeGood BookVIP CarrotInk CoachTube Cymax 1-800-FLOWERS.COM Air France USA Ashworth Golf Bellacor BoomStreet Carson Pirie Scott Coastal.com D'Artagnan 1-800-GET-LENS AirTurn AsianFoodGrocer BelleChic Boscov's Carter's Coffee Wholesale USA Daily Burn 1-800-GOT-JUNK? Alamo Rent a Car AT&T Ben Meadows Bose Canada Casa Coffee.org Dancing Deer Baking Co 1-800-Pet Meds ALDO AT-A-GLANCE Benefit Cosmetics Bose.com Cascio Interstate Music CoffeeForLess.com Danskin 1-800-PetSupplies.com Alex and Alexa Athleta BenQ America Bosky Optics Casetify Coggles Darphin Paris 101inks Alex and Ani Auburn University - Bentley Leathers Boston Proper Casual Male Gift Card Collections Etc. David's Cookies 101Phones.com Algenist Bookstore Ander's Bergdorf Goodman Boston Store CashStar from Colorful Images DAWGS 123-reg Alibaba Augusta Active Bergner's Botanic Choice Herbs & Casual Male XL Compact Appliance Day-Timer 123inkjets Alibris Auto Europe Car Rental Best Cigar Prices Vitamins Cat Footwear Compass Hospitality Days Inn 123Print Alibris UK Auto Parts Warehouse Best Deal Magazines Bourbon & Boots Catherines Condor Airlines Dazadi 180 Nutrition Alice & Trixie Aveda Best of Orlando Bowflex Caudalie Conrad Dazzlepro 1800AnyLens.com AliExpress Avenue Best of Vegas Boxed CB2 Constant Contact DC Shoes 1800Flowers.ca All About