Business INNOVATION and LEARNING DYNAMICS in THE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wines by the Glass Champagne & Sparkling Chardonnay Sauvignon Blanc Pinot Grigio & Pinot Gris Interesting Whites Caberne

Wine Feature Mohua Sauvignon Blanc, Marlborough, 2015 Ripe and juicy tropical fruits, rich stone fruit and fresh cut lime combined with notes of fresh picked summer herbs. glass 12 bottle 47 champagne & sparkling cabernet sauvignon & blends Veuve Clicquot Ponsardin, Brut Reims NV 120 Caymus Vineyards Napa Valley 2013 150 Domaine Chandon, Blanc de Noirs Carneros NV 50 Alexander Valley Vineyards Alexander Valley 2013 55 Moët & Chandon, Imperial Épernay NV 105 Jordan Alexander Valley 2012 119 Moët & Chandon, Dom Pérignon Épernay 2003 275 Silver Oak Alexander Valley 2011 149 Santa Margherita, Prosecco Brut Italy NV 54 Caymus, Special Selection Napa Valley 2013 250 Taittinger Comtes de Champagne France 2000 395 Nickel & Nickel, Sullenger Vineyard Oakville 2013 165 Cakebread Cellars Napa Valley 2012 149 chardonnay William Hill Napa Valley 2012 80 Jordan Russian River Valley 2013 75 Estancia Meritage Paso Robles 2013 72 Sonoma-Cutrer Russian River Valley 2014 59 Red Diamond California 2012 31 Ferrari-Carano Alexander Valley 2014 70 Quintessa Rutherford 2011 205 Grgich Hills Napa Valley 2012 110 Opus One Napa Valley 2012 295 Lindeman’s Bin 65 Australia 2015 27 Hogue Cellars Columbia Valley 2014 28 Cakebread Cellars Napa Valley 2013 95 Louis M. Martini Napa Valley 2012 52 Far Niente Napa Valley 2014 120 J. Lohr Hilltop Vineyard Paso Robles 2013 70 Kistler ‘Les Noisetiers’ Sonoma County 2014 145 Cryptic Red California 2012 39 Stags’ Leap Winery Stags Leap District 2013 72 Louis Latour Meursault 2013 115 J. Lohr ‘Seven Oaks’ Paso Robles 2013 43 Louis Latour Puligny-Montrachet 2013 125 Murphy-Goode ‘Homefront Red’ Blend California 2012 39 Casa Lapostolle Casablanca Vineyard 2013 39 Concha Y Toro ‘Gran Reserva’ Chile 2013 43 Chateau Ste. -

Wine Listopens PDF File

Reservations Accepted | 10/1/2021 1 Welcome to Virginia’s First Urban Winery! What’s an Urban Winery, you ask? Well, we are. Take a look around, and you’ll see a pretty unique blend of concepts. First and foremost, you’ll see wine made here under our Mermaid label, highlighting the potential of Virginia’s grapes and wine production. Virginia has a rich history of grape growing and winemaking, and we’ve selected the best grapes we can get our hands on for our Mermaid Wines. We primarily work with fruit from our Charlottesville vineyard, with occasional sourcing from other locations if we see the opportunity to make something special. We’ve put together some really enjoyable wines for you to try – some classic, some fun, all delicious. Secondly, you’ll see wines from all around the world. Some you’ll recognize, others you might not. These selections lend to our wine bar-style atmosphere and really enrich the experience by offering a wide range of wines to be tried. They’re all available by the bottle, and most by the glass and flight as well, right alongside our Mermaid Wines. The staff can tell you all about any of them, so rest assured that you’ll never be drinking blind. These wines also rotate with the season, and there’s always something new to try. We have a full kitchen too, with a diverse menu that can carry you through lunch, brunch and dinner from the lightest snack to a full-on meal. With dishes that can be easily paired with a variety of our wines, make sure you try anything that catches your eye. -

Evaluation of the Oenological Suitability of Grapes Grown Using Biodynamic Agriculture: the Case of a Bad Vintage R

Journal of Applied Microbiology ISSN 1364-5072 ORIGINAL ARTICLE Evaluation of the oenological suitability of grapes grown using biodynamic agriculture: the case of a bad vintage R. Guzzon1, S. Gugole1, R. Zanzotti1, M. Malacarne1, R. Larcher1, C. von Wallbrunn2 and E. Mescalchin1 1 Edmund Mach Foundation, San Michele all’Adige, Italy 2 Institute for Microbiology and Biochemistry, Hochschule Geisenheim University, Geisenheim, Germany Keywords Abstract biodynamic agriculture, FT-IR, grapevine, wine microbiota, yeast. Aims: We compare the evolution of the microbiota of grapes grown following conventional or biodynamic protocols during the final stage of ripening and Correspondence wine fermentation in a year characterized by adverse climatic conditions. Raffaele Guzzon, Edmund Mach Foundation, Methods and Results: The observations were made in a vineyard subdivided Via E. Mach 1, San Michele all’Adige, Italy. into two parts, cultivated using a biodynamic and traditional approach in a E-mail: [email protected] year which saw a combination of adverse events in terms of weather, creating 2015/1999: received 11 June 2015, revised the conditions for extensive proliferation of vine pests. The biodynamic 12 November 2015 and accepted approach was severely tested, as agrochemicals were not used and vine pests were 14 November 2015 counteracted with moderate use of copper, sulphur and plant extracts and with intensive use of agronomical practices aimed at improving the health of the doi:10.1111/jam.13004 vines. Agronomic, microbiological and chemical testing showed that the response of the vineyard cultivated using a biodynamic approach was comparable or better to that of vines cultivated using the conventional method. -

WINE LIST Gl / Btl HOUSE Canyon Road / Vista Point - Chardonnay, Pinot Grigio, Pinot Noir, Cabernet Sauvignon, Merlot 6 / 20

WINE LIST gl / btl HOUSE Canyon Road / Vista Point - Chardonnay, Pinot Grigio, Pinot Noir, Cabernet Sauvignon, Merlot 6 / 20 BUBBLES gl / btl ROSE gl / btl Lamarca, Prosecco, split, Italy 12 La Vieille Ferme, Rose, Rhone Valley, France 8 / 30 J. Roget, Brut, American Champagne, New York 6 / 20 Chloe, Rose, Central Coast, California 9 / 35 Campo Viejo, Cava Brut Rose, Sparkling Wine, Spain 8 / 30 Del Rio Estate, Grenache Rose, Rogue Valley, Oregon 38 G.H. Mumm, Grand Cordon Brut, Champagne, France 75 Daou, Rose, Paso Robles, California 45 WHITES gl / btl REDS gl / btl William Hill, Chardonnay, Central Coast, California 9 / 35 Cannonball, Cabernet Sauvignon, Healdsburg, California 9 / 35 Acrobat, Chardonnay, Eugene, Oregon 10 / 38 Freak Show, Cabernet Sauvignon, Graton, California 12 / 45 Buehler, Chardonnay, Russian River Valley, California 12 / 45 Del Rio, Cabernet Sauvignon, Rogue Valley, Oregon 50 Annabella, Chardonnay, Napa Valley, California 35 Substance, Cabernet Sauvignon, Benton City, Washington 60 Cave de Lugny, Chardonnay, Macon-Lugny, France 40 Kenwood, Cabernet Sauvignon, Sonoma Mountain, California 75 Walt, Chardonnay, Sonoma Coast, California 75 Arrowood, Cabernet Sauvignon, Knights Valley, Sonoma, California 90 Grounded, Sauvignon Blanc, Hopland, California 9 / 35 Stemmari, Pinot Noir, sustainable, Sicily, Italy 9 / 35 Oyster Bay, Sauvignon Blanc, Marlborough, New Zealand 10 / 38 Meiomi, Pinot Noir, tri-county Coastal, California 12 / 45 Los Cardos, Sauvignon Blanc, Mendoza, Argentina 30 Montinore Estate, Pinot Noir, Willamette -

WINE BOOK United States Portfolio

WINE BOOK United States Portfolio January, 2020 Who We Are Blue Ice is a purveyor of wines from the Balkan region with a focus on Croatian wineries. Our portfolio of wines represents small, family owned businesses, many of which are multigenerational. Rich soils, varying climates, and the extraordinary talents of dedicated artisans produce wines that are tempting and complex. Croatian Wines All our Croatian wines are 100% Croatian and each winery makes its wine from grapes grown and cultivated on their specific vineyard, whether they are the indigenous Plavac Mali, or the global Chardonnay. Our producers combine artisan growing techniques with the latest production equipment and methods, giving each wine old-world character with modern quality standards. Whether it’s one of Croatia’s 64 indigenous grape varieties, or something a bit more familiar, our multi-generational wineries all feature unique and compelling offerings. Italian Wines Our Italian wines are sourced from the Friuli-Venezia Giulia region, one of the 20 regions of Italy and one of five autonomous regions. The capital is Trieste. Friuli- Venezia Giulia is Italy’s north-easternmost region and borders Austria to the north, Slovenia to the east, and the Adriatic Sea and Croatia, more specifically Istria, to the south. Its cheeses, hams, and wines are exported not only within Europe but have become known worldwide for their quality. These world renown high-quality wines are what we are bringing to you for your enjoyment. Bosnian Wines With great pride, we present highest quality wines produced in the rocky vineyards of sun washed Herzegovina (Her-tsuh-GOH-vee-nuh), where limestone, minerals, herbs and the Mediterranean sun are infused into every drop. -

Duval's Retail Wines

Duval’s Retail Wines Exceptional Value Whites Veuve du Vernay – Split - Brut Sparkling – France 6 Valdo – Split - Brut Prosecco – Italy 5 Beringer White Zinfandel – CA 8 Vie Vité Rosé – Côtes de Provence, France 19 Essence Riesling – Mosel, Germany 17 Moonlight White Blend – Tuscany, Italy 17 Benvolio Pinot Grigio – Friuli, Italy 10 La Crema Pinot Gris – Monterey, CA 10 Justin Sauvignon Blanc – Paso Robles, CA 14 Dog Point Vineyard Sauvignon Blanc – Marlborough, New Zealand 17 Parducci Chardonnay – Mendocino, CA 11 Cambria “Benchbreak Vineyard” Chardonnay – Santa Maria Valley, CA 13.5 Trefethen Chardonnay – Oak Knoll, Napa Valley, CA 19 Exceptional Value Reds Steelhead Pinot Noir – Sonoma, CA 13 Acrobat Pinot Noir – Oregon 18 Meiomi Pinot Noir – Sonoma, CA 16.5 Collina Chianti – Tuscany, Italy 10 Santa Ema Merlot – Chile 17.5 Michel Torino “Colección” Malbec – Calchaquí Valley, Argentina 17 Brazin “Old Vine” Zinfandel – Lodi, CA 13.5 Trapiche “Broquel” Malbec – Mendoza, Argentina 15 Wente S. Hill Cabernet Sauvignon – Livermore Valley, CA 14 One Hope Cabernet Sauvignon - CA 13 Uppercut Cabernet Sauvignon – California 19 Robert Mondavi Cabernet Sauvignon – Napa Valley, CA 23.5 Champagne & Sparkling Wines Valdo Brut DOC Prosecco – Valdobiaddene, Italy 16 Segura Viudas Brut Reserva Cava – Spain 14 Roederer Estate Brut Rosé Sparkling – Anderson Valley, CA 33 Argyle Brut Sparkling – Willamette Valley, Oregon 23 Veuve Cliquot “Yellow Label” Brut – Champagne, France 76.5 Laurent-Perrier Brut Cuvée Rosé – Champagne, France 63 Light To Medium-Bodied -

House Wines by the Glass $7

Rick’s Club American House Wines by the Glass $7. Yellow Tail (Australia) Chardonnay · Cabernet Sauvignon · Merlot · Pinot Noir · Shiraz Trapiche Malbec (Argentina) Cavit “Lunetta” Prosecco (Italy) Placido Pinot Grigio (Italy) Vendange White Zinfandel (California) White Wines By the Bottle Glass Bottle Kendall Jackson "Grand Estate" Chardonnay 8. 28. (California) A well balanced and medium bodied wine with lemon-lime on the nose and flavors of pear and green apple. Francis Ford Coppola "Diamond Collection" 7.5 25. Chardonnay (California) Light creamy texture with a hint of Creme Brulee from the oak; fragrant flavors of tropical fruits, apples and pears. Barone Fini Pinot Grigio (Italy) 22. Flavors of ripe peaches and fresh clean fruit. Balanced with a layer of acidity and vibrant white currants. Domino Moscato (California) 7. 22. Citrus and floral notes with honey, nectarine and tropical fruit. Blue Fish Sweet Riesling (Germany) 7. 26. Fruity sweetness with a full-bodied structure and refreshing acidity. Sterling Sauvignon Blanc (California) 7.5 28. Ripe flavors of peach and passion fruit with classic herbaceous Sauvignon Blanc characters. 1200245 Red Wines By the Bottle Glass Bottle Estancia Cabernet Sauvignon (California) 8. 28. Black currant, plum and blackberry flavors with oak notes. Cocoa and mocha tones slide through a harmonious finish. Red Diamond Cabernet Sauvignon (Washington) 8. 28. Red fruit jam and a sweet touch of toasty oak on the long finish. Trapiche Malbec (Argentina) 7. 22. Jammy cherry aromas with mocha hints; medium bodied with bright acidity and cherry, mint and leather flavours on the medium finish. Red Diamond Merlot (Washington) 8. -

Wine & Spirits

WINE & SPIRITS “VINO DA TAVOLA” HOUSE WINES WHITE WINE CRAFT COCKTAILS SPECIALLY SELECTED BY BY THE BOTTLE OUR SOMMELIER LA DOLCE VITA ........................... 14 SPARKLING & ROSÉ tito’s vodka, fresh citrus, peach purée WINE COTE DES ROSES ROSÉ (FRANCE) .........................48 BROOKLYN BORN ........................ 14 BY THE GLASS CAPOSALDO PROSECCO DOC (ITALY) ................... 35 knob creek bourbon, blood orange MIONETTO PROSECCO (187ML) ...... 13 & basil muddle, orange bitters (ITALY) PINOT GRIGIO IL VINCE DOC (VENEZIE) ...................................... 35 FIGURA LEMON DROP .................. 14 MIONETTO MOSCATO (187ML) ........ 13 MONTASOLO (VENETO) ........................................39 fig infused vodka, vanilla, fresh citrus (ITALY) BANFI SAN ANGELO (TUSCANY) ............................ 42 IAVARONE OLD FASHIONED ........ 14 PINOT GRIGIO .............................. 12 SANTA MARGHERITA (ITALY) ................................ 62 woodford reserve bourbon, (ITALY) orange bitters, amaro CHARDONNAY ..................... 12 SAUVIGNON BLANC NOBLE VINES 446 (CALIFORNIA) ...........................39 CLASSIC NEGRONI ....................... 14 (NEW ZEALAND) hendrick's gin, campari, sweet vermouth KENDALL JACKSON (CALIFORNIA) ......................... 42 CHARDONNAY ............................. 12 CHALK HILL SONOMA COAST (CALIFORNIA) ...........45 - MAKE IT A SBAGLIATO- (CALIFORNIA) CAKEBREAD CELLARS (CALIFORNIA) .....................70 made with Prosecco ROSÉ ........................................... 12 SAUVIGNON BLANC -

Villa Sandi Prosecco Valdobbiadene, Italy Pine Ridge Chenin Blanc

WILHELMINA’S WINE SELECTION SPARKLING Villa Sandi Prosecco Valdobbiadene, Italy 12 56 WHITE Pine Ridge Chenin Blanc-Viognier Clarksburg, USA 13 60 Tarani Sauvignon Blanc Lanquedoc, France 12 56 Markus Huber “Terrassen” Grüner Veltliner Traisental, Austria 13 60 Banfi Principessa Gavia Cortese Gavi, Italy 13 60 De Wetshof “Sur Lie” Chardonnay Robertson, South Africa 14 63 Rutherford Ranch Chardonnay Napa Valley, USA 16 72 Domaine William Fevre Chablis Burgundy, France 18 81 Two Vines Riesling Washington State, USA 13 60 ROSÉ AIX Rose de Provence, France 14 63 RED Louis Jadot Pinot Noir Burgundy, France 16 72 Stemmari Nero d’Avola Sicily, Italy 13 60 Decoy by Duckhorn Merlot Sonoma County, USA 17 76 Wilow Bridge Estate “Dragonfly” Shiraz Western Australia 16 72 Famille Jouffreau Clos de Gamot Malbec Cahors, France 14 63 Trapiche Medalla Cabernet Sauvignon Mendoza, Argentina 13 60 Decoy by Duckhorn Cabernet Sauvignon Sonoma County, USA 17 76 Rancho Zabaco Zinfandel Dry Creek Sonoma County, USA 16 72 “Cannot find anything to your liking, please ask for our premium wine list” All prices are in USD and exclude sales tax All wines are served in the proper crystal Riedel glassware WILHELMINA’S UNIQUE BY THE BOTTLE SELECTION CHAMPAGNE & SPARKLING NV Veuve Clicquot Ponsardin Brut Champagne, France 120 NV Laurent Perrier Brut Champagne, France (last btl.) 120 NV Domaine Carneros by Taittinger Rosé Napa Valley, USA 90 SAUVIGNON BLANC 2017 Cloudy Bay Marlborough, New Zealand 115 VIOGNIER 2014 Ogier Condrieu Blanc Rhône Valley, France 99 CHARDONNAY -

2007 Contents

Merlot in South Africa and Internationally Seminar submitted in partial requirement for the CWM Diploma Completed by Chris de Klerk _______________________________________________________________________________________________ Merlot in South Africa & Internationally 1 C. de Klerk, February 2007 CONTENTS: 1. Objectives of the study.................................................................... 4 2. The History of Merlot ....................................................................... 5 2.1 The Origins and development of the Merlot Cultivar........... 5 2.1.1 Origin of the Name Merlot........................................ 6 2.2 The History of Merlot in France............................................. 7 3. Overview of Terroir looking at Old and New World ....................... 9 3.1 Overview of Terroir ................................................................ 9 3.2 Natural Terroir Unit............................................................... 10 3.3 Terroir in the Old World ....................................................... 12 3.4 Terroir in the New World...................................................... 13 4. Viticultural Requirements of Merlot.............................................. 14 4.1 Preferred Soil Types ............................................................ 14 4.2 Ampelography ...................................................................... 15 5. Oenology - Production of Merlot................................................... 18 6. Significant Merlot –Producing Areas of -

Stunning Loire Valley Wines

Stunning Loire Valley Wines Spring / Summer 2018 Stunning Loire Valley Wines We are thrilled to present our full Loire Valley selection with this new offer: a range that we hope will show you why HH&C so loves this region and its wines. Perhaps even-more-so given the tremendous value to be found - there is not a single wine here that breaks the £20 per bottle mark. The Loire Valley is in reality many separate regions, linked by their proximity to the river. The changing landscape and the varied vineyard micro-climates demand many different grape varieties, offering a huge range of styles. Dry whites made from Melon de Bourgogne (Muscadet), Sauvignon Blanc and Chenin Blanc alternate between crisp and concentrated, light and powerful, floral and mineral. There are unctuous sweet whites from Chenin Blanc, which flash with lively brilliance. Reds range from bright and fruity, drink-outside-in-the-summer styles to perfumed, rich, age-worthy Cabernet Francs. Beautiful, pale-hued, dry rosés are also a Loire speciality. As we know from elsewhere in France, the appellation name on a label is no guarantee of quality, merely of place. For quality we must look to the grower’s name. As a specialist shipper, it is our job to ensure only the bottles from the finest domaines reach your table. On our most recent buying trip this year, we noticed a trend of impressive, next generation growers, who are confident, well-experienced and bursting with energy – increasingly working organically or biodynamically. These young vignerons are driving Loire Valley wines onwards to greater levels. -

Wine Best Buys Imported Cabernet Sauvignon

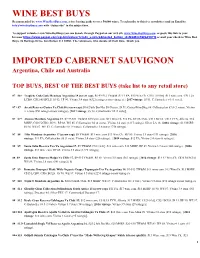

WINE BEST BUYS Recommended by www.WineBestBuys.com, a free buying guide to over 50,000 wines. To subscribe to this free newsletter send an Email to [email protected] with “Subscribe” in the subject box. To support volunteer-run WineBestBuys you can donate through Paypal on our web site www.WineBestBuys.com or paste this link to your browser https://www.paypal.com/cgi-bin/webscr?cmd=_s-xclick&hosted_button_id=MGM4LKWG85KFQ or mail your check to Wine Best Buys, 70 Heritage Drive, San Rafael, CA 94901. The volunteers, who donate all their time, thank you. IMPORTED CABERNET SAUVIGNON Argentina, Chile and Australia TOP BUYS, BEST OF THE BEST BUYS (take list to any retail store) 87 $6+ Trapiche Oak Cask Mendoza Argentina 18 (screw cap). $6.49-$12 TW&M. $7.19 PA. $10 WineCh. C$10.10 SAQ. $11 wine.com. C$11.25 LCBO. C$12.45 BCLS. JS 92. TP 90. Vivino 3.4 stars (6322 ratings across vintages). [2017 vintage: JS 91. Cellartracker 81 (1 vote)]. 87+ $7 Aresti Reserva Curico Va Chile16 (screw cap). $14/2 btls BevMo. $8 Costco. JS 91. CostcoWineBlog 88. Cellartracker 87.8 (3 votes). Vivino 3.3 stars (250 ratings across vintages). [2017 vintage: JS 90. Cellartracker 85 (1 vote)]. 87 $7+ Alamos Mendoza Argentina 17. $7.77-$11 TW&M. $10 wine.com. $11 WineCh. $12 PA. $13 BevMo. C$13 BCLS. C$13 ZYN, Alberta. $14 MSRP. C$16 LCBO. JS 91. RP 88. WS 85. Cellartracker 86 (4 votes). Vivino 3.6 stars (1317 ratings). Silver LA 18.