Date Here 2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Corporate Banking at Investec

Corporate Banking at Investec A unique Corporate At Investec, our clients share an appetite for our people remain invested in our clients’ growth and the need for the right banking long-term success. Banking offering partner to support them on their journey. We pride ourselves on our agility, speed, Founded in 1974, Investec has grown exceptional service and refreshingly human successfully through its client-focused approach. We offer deep expertise across approach and its ability to serve diverse lending, advisory and treasury risk and evolving financial needs. management, which means our clients benefit from our unique breadth of services We believe that not all businesses are the across corporate and investment banking. same and as such their journeys are different. So, wherever our clients are on their journey, That’s why we tailor solutions to our clients’ we believe that we have solutions to help needs, taking the time to fully understand their them achieve their ambitions. requirements and challenges while ensuring A comprehensive range of services that support client growth Working capital – invoice Treasury risk solutions – foreign Asset and vehicle finance discounting, asset-based exchange, interest rates and lending and supplier finance commodity price hedging Lending – growth capital, Advice and ideas – Cash products – a range of acquisition and leverage finance, mergers & acquisitions call, notice and fixed deposits integrated asset-based & cash and equity advisory flow lending and structured lending Solutions. Capital. Empowered people. Our clients Our business in numbers • SMEs and corporates • Private equity • Intermediaries and introducers £3.9 bn c.150,000 assets financed* asset finance deals* c.61,000 £530m SMEs supported* receivables purchased** *From 1 April 2014 to 31 March 2019. -

Investec/Lowes 8:8 Plan 3

Structured Products Investec/Lowes 8:8 Plan 3 Potential for maturity every 6 months from the end of year 2 onwards, with a fixed payment equal to 7.5% per annum (not compounded). If the Plan runs until the Final Maturity Date and the FTSE 100 finishes lower than 60% of its starting level, you will lose some or all of your initial investment. Limited offer ends: 18 June 2018. oducts & Pr D d er re iv u a t t c iv u e r t s S A e w p a o EIGHT TIMES r r d u s E 2 0 h t 1 5 8 1 SRP AWARDS Award 2010 -2017 Best Distributor, UK & Ireland Investec Investec/Lowes 8:8 Plan 3 This Plan has been jointly developed by Investec Bank plc and Lowes Financial Management Ltd. Investec Bank plc is the Plan Manager and Product Manufacturer of this Plan. About Investec This brochure has been prepared by Investec Structured Products which is a trading name of Investec Bank plc, which is part of the Investec group of companies. Investec (comprising Investec Limited and Investec plc) is an international specialist bank and asset manager that provides a diverse range of financial products and services to a niche client base in three principal markets, the UK and Europe, South Africa and Asia/Australia as well as certain other countries. The group was established in 1974 and currently has approximately 9,900 employees. Investec focuses on delivering distinctive profitable solutions for its clients in three core areas of activity namely, Asset Management, Wealth & Investment and Specialist Banking. -

An Introduction to Our Wealth & Investment Services

An introduction to our Wealth & Investment services Welcome I am delighted to have the opportunity to introduce Investec Wealth & Investment to you. We would like to give you a snapshot of our business so that you have a better feel for who we are and what we do. I hope that, as you read through these pages, two features will become very apparent. Namely, that our business is fundamentally about people and service. Our job is to offer you, as a client or a potential client, a service of the highest possible standard delivered by high calibre people with expertise and integrity. It is as simple as that. At the back of the brochure you will find various contact details if you would like further information. Please do not hesitate to get in touch. Eddie Clarke Head of Investec Wealth & Investment Ireland 3 A snapshot of our business “Our wide-ranging We look after clients’ savings, expertise, and combination pensions and other financial assets, by using our expertise of local presence and and knowledge to invest global resources are their money wisely to build at your service.” and preserve their wealth. What we do at the same time, offering more resource, Bobby Hassett depth of expertise and robust systems compared Investment Management Investec Wealth & Investment provides Investment with other firms. Management services and Financial Planning advice to private clients, pensions, corporates, Our approach allows us the freedom to build charities, family offices and credit unions. investment portfolios appropriate for the needs of each individual client, without any inbuilt bias. Who we are Experience counts Investec Wealth & Investment in Ireland arose from the acquisition of NCB Wealth Management Investec Wealth & Investment is ideally positioned in 2012, which had been advising Irish clients for to help our clients meet their long-term investment 30 years. -

FTSE Factsheet

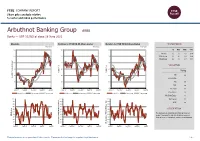

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Arbuthnot Banking Group ARBB Banks — GBP 10.025 at close 18 June 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Jun-2021 18-Jun-2021 18-Jun-2021 12 120 130 1D WTD MTD YTD Absolute 0.2 5.0 -4.1 28.9 11 110 120 Rel.Sector 3.1 8.1 2.0 10.9 Rel.Market 2.0 6.7 -3.7 18.4 10 100 110 VALUATION 9 90 100 Trailing Relative Price Relative Price Relative 8 80 90 PE -ve Absolute Price (local (local currency) AbsolutePrice EV/EBITDA - 7 70 80 PB 0.8 PCF -ve 6 60 70 Div Yield 0.0 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Price/Sales 1.7 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 1.5 100 100 100 Div Payout 0.0 90 90 90 ROE -ve 80 80 80 70 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The Company is a banking and financial services 40 40 40 RSI RSI (Absolute) group. It operates through two divisions, personal 30 30 30 financial services and private and merchant banking. -

Cineworld Group

CINEWORLD GROUP plc Interim Results for the period ended 30 June 2020 Cineworld Group plc (“the Group”) presents its interim results for the 6 month period ended 30 June 2020. These results are presented in US Dollars. Summary The COVID-19 global pandemic has adversely affected the Group’s results for the period, with all sites across the Group closed between mid-March to late June/August 2020 561 out of 778 sites are re-opened as at the date of this report, with 200 theatres in the US (mostly in CA and NY), 6 in the UK and 11 in Israel still closed Group revenue of $712.4m (2019: $2,151.2m) and Group Adjusted EBITDA $53.0m (2019: $758.6m) for the period was severely impacted by these cinema closures Management’s main priorities have been the safety of customers and employees, cash preservation and cost reduction $360.8m additional liquidity raised during the period At the date of reporting negotiations with the banks remain ongoing in order to obtain covenant waivers in respect of December 2020 and June 2021. This has resulted in a disclaimer conclusion being issued by the auditor. Termination of Cineplex transaction in June 2020 Outlook Steady performance of re-opened sites in ROW territories and initial admission build-up in the UK and US driven by the release of “Tenet” and local movies There can be no certainty as to the future impact of COVID-19 on the Group. If Governments were to strengthen restrictions on social gathering, which may therefore oblige us to close our estate again or further push back movie releases, it would have a negative impact on our financial performance and likely require the need to raise additional liquidity. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.9% Finland 1.0% AGL Energy Ltd. 437,255 4,269,500 Metso OYJ 153,708 2,078,669 ASX Ltd. 80,181 4,687,834 UPM-Kymmene OYJ 36,364 1,106,808 BHP Group Ltd. 349,229 9,021,842 Valmet OYJ 469,080 11,570,861 Breville Group Ltd. 153,867 2,792,438 Total 14,756,338 Charter Hall Group 424,482 3,808,865 France 9.5% CSL Ltd. 21,611 4,464,114 Air Liquide SA 47,014 7,452,175 Data#3 Ltd. 392,648 1,866,463 Capgemini SE 88,945 11,411,232 Fortescue Metals Group Ltd. 2,622,808 30,812,817 Cie de Saint-Gobain(a) 595,105 24,927,266 IGO Ltd. 596,008 1,796,212 Cie Generale des Etablissements Michelin CSA 24,191 2,596,845 Ingenia Communities Group 665,283 2,191,435 Electricite de France SA 417,761 4,413,001 Kogan.com Ltd. 138,444 2,021,176 Elis SA(a) 76,713 968,415 Netwealth Group Ltd. 477,201 5,254,788 Legrand SA 22,398 1,783,985 Omni Bridgeway Ltd. 435,744 1,234,193 L’Oreal SA 119,452 38,873,153 REA Group Ltd. 23,810 1,895,961 Orange SA 298,281 3,106,763 Regis Resources Ltd. -

Infrastructure NSW Board Members

Infrastructure NSW Board Members Positions in Expiry Date Positions and Name of Board Date of Term of Date of Re-Appointment or Professional/ Business Expiry Date of Appointment of Re- Board and Committee Memberships Interests in Other interests Member Appointment Appointment Retirement Associations and Trade Appointment Corporations Unions Arlene Tansey 11 June 2014 4 years Expiring 11 June 2018 Reappointed 14 June 2018 Expiring 10 June 2022 • Primary Healthcare Ltd • Co-owner of Hunter • Lendlease Investment Management (subsidiary of Lendlease Corporation) Phillip Japan • Hunter Phillip Japan Pty Ltd • Mantan Superannuation Fund • Mantan Nominees Pty Ltd • Serco Asia-Pacific Pty Ltd • Aristocrat Leisure Ltd • Australian National Maritime Museum Foundation • Wisetech Global (WTC) • TPG Telecom Limited • Healius (retired 22/10/2020) • Adelaide Brighton Ltd (retired 4/10/19) • Australian Research Alliance for Children & Youth (ended 30/10/2015) • Future Fibre Technologies Ltd (ended 14/10/2016) • Urbanise Pty Ltd (ended 14/10/2016) Graham Bradley, AM 4 July 2013 4 years Expiring 3 July 2017 Reappointed 3 July 2017 Expiring 3 July 2021 • Stockland Corporation Ltd • Shareholdings in • Australian Institute of Chair • The Hong Kong & Shanghai Banking Corporation Ltd numerous Australian Company Directors • EnergyAustralia Holdings Ltd companies (none • European-Australian • Virgin Australia International Holdings Ltd substantial Business Council • State Library of New South Wales shareholding) • Australian School of • Stilmark Pty Ltd Business -

Investec Global Strategy Fund R.C.S

GSF Investec Global Strategy Fund R.C.S. Luxembourg B139420 Investment Fund under Luxembourg Law Annual report and accounts | For the year ended 31 December 2012 Investec Global Strategy Fund Registered address 49 Avenue J.F. Kennedy, L-1855 Luxembourg Grand Duchy of Luxembourg Correspondence address – Global Distributor c/o Investec Asset Management Guernsey Limited P.O. Box 250, Glategny Court, Glategny Esplanade St. Peter Port, Guernsey GY1 3QH Channel Islands Investment Fund under Luxembourg Law Annual report and accounts For the year ended 31 December 2012 Contents Market overview 2-3 Material changes to the Fund 4 Annualised performance over 5 years 5-8 Calendar year performance over 5 years 9-10 The Fund 11-13 Directors of the Fund 14 Report of the Directors 15 Statistical Information 16-22 Portfolio details – Schedule of Investments 23-231 Statement of Operations 232-239 Statement of Changes in Shareholders’ Equity 240-247 Statement of Assets and Liabilities 240-247 Notes forming part of the financial statements 248-297 Independent Auditor’s report to the Shareholders 298 Performance Records 300-317 Investment objectives and policy 318-327 Risk considerations 328-334 Risk Management 335-338 Fair Value Hierarchy 339-347 Additional Information for Investors in the Federal Republic of Germany 348 Notice to investors in Switzerland 348 Notice of Meeting 349 Portfolio Turnover 350 European Union Savings Directive 351 Report of the custodian 351 Administration of the Fund 352 How to contact Investec 353 Investec Global Strategy Fund | 1 Market overview All returns and indices are in US dollar terms, 1 January 2012 to 31 December subsequent eleventh hour deal to avoid the fi scal cliff, helped 2012, unless otherwise stated. -

Market Overview

Market Overview Update 23 June 2020 • EUR / USD jumps on strong PMI data • UK coronavirus rule announcements • UK & Europe down / US up • Irish Economy Contact us: T: +353 (0) 1 421 0091 E: [email protected] EUR/USD jumps on strong PMI data : PMI Tuesday kicked off in an upbeat fashion as the Japanese prints released overnight, provide further signs of the economy coming up off its coronavirus lows in June. The flash composite PMI rose to 37.9 in June from 27.8 in May. The recovery was driven by the services sector, whilst manufacturing dipped. Importantly though the Japanese recovery clearly still has a long way to go with index still well below the 50 breakeven mark. Next up was the French PMI, which has seen all three prints beating market expectations significantly and more importantly all three components clicked over the 50.0 expansionary mark. Strong German numbers followed shortly thereafter, taking the three components slightly over market consensus to sit in/around 45, a bit off the 50.0 breakeven mark. The benchmark EUR/USD rate has jumped back up over the $1.13 level on the news, over 100 points from yesterday’s lows. Next up we have US prints due later in the day. Here’s hoping the positive trend continues, so far so good. UK coronavirus rule announcements: Later today, UK PM, Boris Johnson is set to announce that he has decided to reduce the 2m social distancing rule. Newspapers are rife with speculation of what conditions might be attached, with a “1-meter plus” system trailed in the Sunday Telegraph, such that people will be allowed to sit one meter apart in venues provided mitigating factors are in place – these might include face coverings, perspex screens, ventilation and strict hygiene. -

To Our 2017 Qualification Award Winners

CONGRATULATIONS to our 2017 qualification award winners The Chartered Institute for Securities & Investment (CISI), the leading professional body for the securities, investment, wealth and financial planning industry, provides globally-recognised qualifications and membership for financial services practitioners. Each year, we hold an awards ceremony to recognise the outstanding achievements of our top-scoring students. This year, we celebrated successes from the UK and globally, with winners from Belgium, Hong Kong, Lebanon, Malta, Nigeria, Oman, Russia, Singapore, South Africa, Spain, Sri Lanka and the UAE. Below, we recognise this year’s award winners. SCHOOLS, COLLEGES Vasila Babakhanova International In honour and memory CORPORATE FINANCE/ Investment Advice AND UNIVERSITIES Jordy Bolton Introduction to of Pen Kent FCSI(Hon): CAPITAL MARKETS Diploma Investment Investment Operations Charles Marten ACSI Certificate for Timothy Carver Certificate Certificate in Corporate Introduction to Securities Kokombat Akpan Finance Smith & Williamson Fry Family Office Greg Fedden Investment Management & Investment Pavan K Bhogal Jonathan Mida Matthew Fry DST Financial Services Europe Alex Kitsberg Chun Kit Lau RBC Jack Whittaker ACSI Brooks Macdonald Asset Thomas Rich City of London School for Boys Kristian Michael Martinez Brewin Dolphin Management Nomura International Diploma in Corporate Certificate in Finance, Grace Gliksten Finance Private Client Investment Risk & Decision Making ISLAMIC FINANCE Advice & Management Bibek Gurung RISK AND COMPLIANCE -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, March 31, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 96.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.4% Legrand SA 131,321 8,375,908 AGL Energy Ltd. 880,686 9,216,678 L’Oreal SA 104,607 27,073,419 Aristocrat Leisure Ltd. 728,775 9,443,206 Orange SA 949,535 11,496,452 ASX Ltd. 162,820 7,642,885 Peugeot SA 1,014,598 13,209,331 BHP Group Ltd. 471,264 8,549,345 Schneider Electric SE 553,434 46,777,833 CIMIC Group Ltd. 332,784 4,713,315 STMicroelectronics NV 400,446 8,608,225 CSL Ltd. 166,037 30,097,798 Total SA 1,095,152 41,264,011 Fortescue Metals Group Ltd. 4,669,354 28,614,857 Total 209,274,345 (a),(b) IDP Education Ltd. 447,152 3,487,548 Germany 4.2% Inghams Group Ltd. 1,200,179 2,405,115 Adidas AG 22,586 5,014,708 Magellan Financial Group Ltd. 729,823 19,356,167 Allianz SE, Registered Shares 319,746 54,451,936 Regis Resources Ltd. 1,318,187 2,929,557 Continental AG 32,324 2,304,645 Santos Ltd. 4,606,425 9,460,470 Dialog Semiconductor PLC(c) 82,878 2,154,248 (c) Saracen Mineral Holdings Ltd. 3,513,246 7,900,242 Hugo Boss AG 273,602 6,848,821 Technology One Ltd. 897,813 4,336,750 MTU Aero Engines AG 74,698 10,801,095 Total 148,153,933 SAP SE 91,344 10,198,367 Austria 0.2% Siemens Healthineers AG 179,517 6,939,504 OMV AG 81,189 2,221,890 Total 98,713,324 Raiffeisen Bank International AG 111,223 1,599,856 Hong Kong 3.9% Total 3,821,746 CK Hutchison Holdings Ltd.