Plus500 Annual Report 17.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Corporate Banking at Investec

Corporate Banking at Investec A unique Corporate At Investec, our clients share an appetite for our people remain invested in our clients’ growth and the need for the right banking long-term success. Banking offering partner to support them on their journey. We pride ourselves on our agility, speed, Founded in 1974, Investec has grown exceptional service and refreshingly human successfully through its client-focused approach. We offer deep expertise across approach and its ability to serve diverse lending, advisory and treasury risk and evolving financial needs. management, which means our clients benefit from our unique breadth of services We believe that not all businesses are the across corporate and investment banking. same and as such their journeys are different. So, wherever our clients are on their journey, That’s why we tailor solutions to our clients’ we believe that we have solutions to help needs, taking the time to fully understand their them achieve their ambitions. requirements and challenges while ensuring A comprehensive range of services that support client growth Working capital – invoice Treasury risk solutions – foreign Asset and vehicle finance discounting, asset-based exchange, interest rates and lending and supplier finance commodity price hedging Lending – growth capital, Advice and ideas – Cash products – a range of acquisition and leverage finance, mergers & acquisitions call, notice and fixed deposits integrated asset-based & cash and equity advisory flow lending and structured lending Solutions. Capital. Empowered people. Our clients Our business in numbers • SMEs and corporates • Private equity • Intermediaries and introducers £3.9 bn c.150,000 assets financed* asset finance deals* c.61,000 £530m SMEs supported* receivables purchased** *From 1 April 2014 to 31 March 2019. -

Investec/Lowes 8:8 Plan 3

Structured Products Investec/Lowes 8:8 Plan 3 Potential for maturity every 6 months from the end of year 2 onwards, with a fixed payment equal to 7.5% per annum (not compounded). If the Plan runs until the Final Maturity Date and the FTSE 100 finishes lower than 60% of its starting level, you will lose some or all of your initial investment. Limited offer ends: 18 June 2018. oducts & Pr D d er re iv u a t t c iv u e r t s S A e w p a o EIGHT TIMES r r d u s E 2 0 h t 1 5 8 1 SRP AWARDS Award 2010 -2017 Best Distributor, UK & Ireland Investec Investec/Lowes 8:8 Plan 3 This Plan has been jointly developed by Investec Bank plc and Lowes Financial Management Ltd. Investec Bank plc is the Plan Manager and Product Manufacturer of this Plan. About Investec This brochure has been prepared by Investec Structured Products which is a trading name of Investec Bank plc, which is part of the Investec group of companies. Investec (comprising Investec Limited and Investec plc) is an international specialist bank and asset manager that provides a diverse range of financial products and services to a niche client base in three principal markets, the UK and Europe, South Africa and Asia/Australia as well as certain other countries. The group was established in 1974 and currently has approximately 9,900 employees. Investec focuses on delivering distinctive profitable solutions for its clients in three core areas of activity namely, Asset Management, Wealth & Investment and Specialist Banking. -

An Introduction to Our Wealth & Investment Services

An introduction to our Wealth & Investment services Welcome I am delighted to have the opportunity to introduce Investec Wealth & Investment to you. We would like to give you a snapshot of our business so that you have a better feel for who we are and what we do. I hope that, as you read through these pages, two features will become very apparent. Namely, that our business is fundamentally about people and service. Our job is to offer you, as a client or a potential client, a service of the highest possible standard delivered by high calibre people with expertise and integrity. It is as simple as that. At the back of the brochure you will find various contact details if you would like further information. Please do not hesitate to get in touch. Eddie Clarke Head of Investec Wealth & Investment Ireland 3 A snapshot of our business “Our wide-ranging We look after clients’ savings, expertise, and combination pensions and other financial assets, by using our expertise of local presence and and knowledge to invest global resources are their money wisely to build at your service.” and preserve their wealth. What we do at the same time, offering more resource, Bobby Hassett depth of expertise and robust systems compared Investment Management Investec Wealth & Investment provides Investment with other firms. Management services and Financial Planning advice to private clients, pensions, corporates, Our approach allows us the freedom to build charities, family offices and credit unions. investment portfolios appropriate for the needs of each individual client, without any inbuilt bias. Who we are Experience counts Investec Wealth & Investment in Ireland arose from the acquisition of NCB Wealth Management Investec Wealth & Investment is ideally positioned in 2012, which had been advising Irish clients for to help our clients meet their long-term investment 30 years. -

Finn-Ancial Times Finncap Financials & Insurance Quarterly Sector Note

finn-ancial Times finnCap Financials & Insurance quarterly sector note Q3 2020 | Issue 9 Highlights this quarter: Elevated uncertainty and volatility have been hallmarks of the last 18 months, with Brexit, the UK General Election and more recently COVID-19 all contributing to the challenges that face investors wishing to carve out solid and stable returns amid these ‘unprecedented’ times. With this is mind, and simulating finnCap’s proven Slide Rule methodology, we found the highest quality and lowest value stocks across the financials space, assessing how the make-up of these lists changed over the period January 2019 to July 2020, tracking indexed share price performance over the period as well as movements in P/E and EV/EBIT valuations. The top quartile list of Quality companies outperformed both the Value list and the FTSE All Share by rising +2.5% over the period versus -5.4% for the All Share and -14.3% for Value stocks. Furthermore, the Quality list had protection on the downside in the market crash between February and March 2020, and accelerated faster amid the market rally between late March and July 2020. From high to low (January to March), Quality moved -36.3% against the Value list at -45.5%, while a move off the lows to July was +37.4% for Quality and +34.0% for Value. There was some crossover between the Quality and Value lists, with 7 companies of the top quartile (16 companies in total) appearing in both the Quality and Value lists. This meant that a) investors could capture what we call ‘Quality at Value’ (i.e. -

FTSE Factsheet

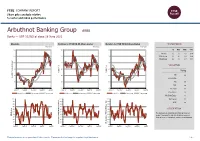

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Arbuthnot Banking Group ARBB Banks — GBP 10.025 at close 18 June 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 18-Jun-2021 18-Jun-2021 18-Jun-2021 12 120 130 1D WTD MTD YTD Absolute 0.2 5.0 -4.1 28.9 11 110 120 Rel.Sector 3.1 8.1 2.0 10.9 Rel.Market 2.0 6.7 -3.7 18.4 10 100 110 VALUATION 9 90 100 Trailing Relative Price Relative Price Relative 8 80 90 PE -ve Absolute Price (local (local currency) AbsolutePrice EV/EBITDA - 7 70 80 PB 0.8 PCF -ve 6 60 70 Div Yield 0.0 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Jun-2020 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Price/Sales 1.7 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 1.5 100 100 100 Div Payout 0.0 90 90 90 ROE -ve 80 80 80 70 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The Company is a banking and financial services 40 40 40 RSI RSI (Absolute) group. It operates through two divisions, personal 30 30 30 financial services and private and merchant banking. -

Cineworld Group

CINEWORLD GROUP plc Interim Results for the period ended 30 June 2020 Cineworld Group plc (“the Group”) presents its interim results for the 6 month period ended 30 June 2020. These results are presented in US Dollars. Summary The COVID-19 global pandemic has adversely affected the Group’s results for the period, with all sites across the Group closed between mid-March to late June/August 2020 561 out of 778 sites are re-opened as at the date of this report, with 200 theatres in the US (mostly in CA and NY), 6 in the UK and 11 in Israel still closed Group revenue of $712.4m (2019: $2,151.2m) and Group Adjusted EBITDA $53.0m (2019: $758.6m) for the period was severely impacted by these cinema closures Management’s main priorities have been the safety of customers and employees, cash preservation and cost reduction $360.8m additional liquidity raised during the period At the date of reporting negotiations with the banks remain ongoing in order to obtain covenant waivers in respect of December 2020 and June 2021. This has resulted in a disclaimer conclusion being issued by the auditor. Termination of Cineplex transaction in June 2020 Outlook Steady performance of re-opened sites in ROW territories and initial admission build-up in the UK and US driven by the release of “Tenet” and local movies There can be no certainty as to the future impact of COVID-19 on the Group. If Governments were to strengthen restrictions on social gathering, which may therefore oblige us to close our estate again or further push back movie releases, it would have a negative impact on our financial performance and likely require the need to raise additional liquidity. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.9% Finland 1.0% AGL Energy Ltd. 437,255 4,269,500 Metso OYJ 153,708 2,078,669 ASX Ltd. 80,181 4,687,834 UPM-Kymmene OYJ 36,364 1,106,808 BHP Group Ltd. 349,229 9,021,842 Valmet OYJ 469,080 11,570,861 Breville Group Ltd. 153,867 2,792,438 Total 14,756,338 Charter Hall Group 424,482 3,808,865 France 9.5% CSL Ltd. 21,611 4,464,114 Air Liquide SA 47,014 7,452,175 Data#3 Ltd. 392,648 1,866,463 Capgemini SE 88,945 11,411,232 Fortescue Metals Group Ltd. 2,622,808 30,812,817 Cie de Saint-Gobain(a) 595,105 24,927,266 IGO Ltd. 596,008 1,796,212 Cie Generale des Etablissements Michelin CSA 24,191 2,596,845 Ingenia Communities Group 665,283 2,191,435 Electricite de France SA 417,761 4,413,001 Kogan.com Ltd. 138,444 2,021,176 Elis SA(a) 76,713 968,415 Netwealth Group Ltd. 477,201 5,254,788 Legrand SA 22,398 1,783,985 Omni Bridgeway Ltd. 435,744 1,234,193 L’Oreal SA 119,452 38,873,153 REA Group Ltd. 23,810 1,895,961 Orange SA 298,281 3,106,763 Regis Resources Ltd. -

Infrastructure NSW Board Members

Infrastructure NSW Board Members Positions in Expiry Date Positions and Name of Board Date of Term of Date of Re-Appointment or Professional/ Business Expiry Date of Appointment of Re- Board and Committee Memberships Interests in Other interests Member Appointment Appointment Retirement Associations and Trade Appointment Corporations Unions Arlene Tansey 11 June 2014 4 years Expiring 11 June 2018 Reappointed 14 June 2018 Expiring 10 June 2022 • Primary Healthcare Ltd • Co-owner of Hunter • Lendlease Investment Management (subsidiary of Lendlease Corporation) Phillip Japan • Hunter Phillip Japan Pty Ltd • Mantan Superannuation Fund • Mantan Nominees Pty Ltd • Serco Asia-Pacific Pty Ltd • Aristocrat Leisure Ltd • Australian National Maritime Museum Foundation • Wisetech Global (WTC) • TPG Telecom Limited • Healius (retired 22/10/2020) • Adelaide Brighton Ltd (retired 4/10/19) • Australian Research Alliance for Children & Youth (ended 30/10/2015) • Future Fibre Technologies Ltd (ended 14/10/2016) • Urbanise Pty Ltd (ended 14/10/2016) Graham Bradley, AM 4 July 2013 4 years Expiring 3 July 2017 Reappointed 3 July 2017 Expiring 3 July 2021 • Stockland Corporation Ltd • Shareholdings in • Australian Institute of Chair • The Hong Kong & Shanghai Banking Corporation Ltd numerous Australian Company Directors • EnergyAustralia Holdings Ltd companies (none • European-Australian • Virgin Australia International Holdings Ltd substantial Business Council • State Library of New South Wales shareholding) • Australian School of • Stilmark Pty Ltd Business -

Broker Upgrades and Downgrades & Key Uk

Shard Capital Stockbrokers T +44 (0) 207 186 9950 rd 23 Floor, F +44 (0) 207 186 9979 20Fenchurch St, E [email protected] London, EC3M 3BY W shardcapitalstockbrokers.com BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS 14 February 2018 UK Broker Upgrades / Downgrades Please contact us for more information Code Company Broker Recomm. From Recomm. To Price From Price To Upgrades GNS Genus Plc Liberum Capital Hold Hold 2100 2400 HSTG Hastings Group Holdings Ltd Berenberg Buy Buy 315 341 OCDO Ocado Group Plc Peel Hunt Buy Buy 520 570 PLUS Plus500 Ltd Liberum Capital Buy Buy 1232 1507 TALK TalkTalk Telecom Group Plc SocGen Sell Hold 125 105 Downgrades BAG A.G.Barr Plc JP Morgan Cazenove Neutral Underweight 630 570 DLG Direct Line Insurance Group Plc Berenberg Hold Hold 390 378 ESUR Esure Group Plc Berenberg Sell Sell 247 230 VEC Vectura Group Plc Peel Hunt Hold Hold 160 120 Initiate/Neutral/Unchanged ACSO Accesso Technology Group Plc Berenberg Buy 2700 ESL Eddie Stobart Logistics PLC Berenberg Buy 190 MCL Morses Club Plc Peel Hunt Buy 165 OTB On the Beach Group Plc Peel Hunt Buy Buy 600 600 https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ https://www.shardcapitalstockbrokers.com/trading-platform/ BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS Code Company Broker Recomm. From Recomm. To Price From Price To Initiate/Neutral/Unchanged WIN Wincanton Plc Berenberg Hold 210 WPP WPP Plc Liberum Capital Buy Buy 1815 1815 2 BROKER UPGRADES AND DOWNGRADES & KEY UK CORPORATE SNAPSHOTS Key UK Corporate Snapshots Today AIM 88 Energy Limited (88E.L) Announced that the 3D seismic acquisition has commenced across the Western Margin of the Project Icewine acreage, located on the North Slope of Alaska.