Greater Austin Tax Rate Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Economic Potential Case Study #2 (Austin)

Economic Potential Evaluation of the Future of Hillsborough County Comprehensive Plan Case Study No. 2: Austin/Travis, Texas FINAL 9/7/2011 601 East Kennedy Blvd, Tampa, Florida 33601 (813) 272‐5940 www.theplanningcommission.org September 7, 2011 Representative Case Studies Case Study No. 2: City of Austin/Travis County, Texas Austin‐Round Rock‐San Marcos MSA BACKGROUND Located in the greater Austin‐Round Rock‐San Marcos Metropolitan Statistical Area (MSA) in Central Texas (see Map 1, below), the Austin area can be considered an economic rival to the Tampa Bay area. As of the 2010 U.S. Census, the MSA ranks No. 35 out of the top 50 largest MSAs in the nation. The MSA includes five counties: Williamson, Travis, Hays, Bastrop and Caldwell. Austin is the largest city in the region, the Travis County seat and capitol of Texas.1 Map 1: Location Austin is renowned for its attractiveness to young professionals seeking both cutting‐edge employment and a high quality of life. The Austin area is similar to Hillsborough County in terms of its population growth and demographic characteristics, its proximity to major universities, as well as its humid, subtropical climate; however, the Austin area was selected as a case study more for its differences. 1 Note: City of Austin is home to the Texas State Capitol, which employs approximately 150,000 employs statewide, although the majority work in the Central Texas region (Source: Texas State Auditor’s Office, Summary of the Texas State Workforce, FY 2006). 1 of 15 September 7, 2011 Uniquely, Austin area has capitalized on a quality of life ethos coupled with an economic development framework focused on attracting “location‐less” (e.g. -

African American Resource Guide

AFRICAN AMERICAN RESOURCE GUIDE Sources of Information Relating to African Americans in Austin and Travis County Austin History Center Austin Public Library Originally Archived by Karen Riles Austin History Center Neighborhood Liaison 2016-2018 Archived by: LaToya Devezin, C.A. African American Community Archivist 2018-2020 Archived by: kYmberly Keeton, M.L.S., C.A., 2018-2020 African American Community Archivist & Librarian Shukri Shukri Bana, Graduate Student Fellow Masters in Women and Gender Studies at UT Austin Ashley Charles, Undergraduate Student Fellow Black Studies Department, University of Texas at Austin The purpose of the Austin History Center is to provide customers with information about the history and current events of Austin and Travis County by collecting, organizing, and preserving research materials and assisting in their use. INTRODUCTION The collections of the Austin History Center contain valuable materials about Austin’s African American communities, although there is much that remains to be documented. The materials in this bibliography are arranged by collection unit of the Austin History Center. Within each collection unit, items are arranged in shelf-list order. This bibliography is one in a series of updates of the original 1979 bibliography. It reflects the addition of materials to the Austin History Center based on the recommendations and donations of many generous individuals and support groups. The Austin History Center card catalog supplements the online computer catalog by providing analytical entries to information in periodicals and other materials in addition to listing collection holdings by author, title, and subject. These entries, although indexing ended in the 1990s, lead to specific articles and other information in sources that would otherwise be time-consuming to find and could be easily overlooked. -

Arts and Entertainment Guide (Pdf) Download

ART MUSIC CULTURE Greater Austin & ENTERTAINMENTARTS Independence Title Explore www.IndependenceTitle.com “I didn't come here and I ain't leavin'. ” -Willie Nelson Austin’s artistic side is alive and well. including Austin Lyric Opera, Ballet institution serving up musical theater We are a creative community of Austin, and the Austin Symphony, as under the stars, celebrated its 50th designers, painters, sculptors, dancers, well as a rich local tradition of innovative anniversary in 2008. The Texas Film filmmakers, musicians . artists of all and avant-guarde theater groups. Commission is headquartered in Austin, kinds. And Austin is as much our and increasingly the city is being identity as it is our home. Austin is a creative community with a utilized as a favorite film location. The burgeoning circle of live performance city hosts several film festivals, The venues for experiencing art in theater venues, including the Long including the famed SXSW Film Festival Austin are very diverse. The nation's Center for the Performing Arts, held every Spring. Get out and about largest university-owned collection is Paramount Theatre, Zachary Scott and explore! exhibited at the Blanton Museum, and Theatre Center, Vortex Repertory you can view up-and-coming talent in Company, Salvage Vanguard Theater, our more intimate gallery settings. Scottish Rite Children's Theater, Hyde Austin boasts several world-renowned Park Theatre, and Esther's Follies. The classical performing arts organizations, Zilker Summer Musical, an Austin Performing Arts Choir A -

Strategic Plan for Population Health Innovation and Improvement University of Texas at Austin

Strategic Plan for Population Health Innovation and Improvement University of Texas at Austin — Prepared by — Monique Vasquez Ethan D’Silva Jaionn Griner Jayne C. Nussbaum, MPA William M. Tierney, MD ——— Department of Population Health, Dell Medical School University of Texas at Austin January 27, 2017 1 | Page Table of Contents: Page Introduction 3 Section 1: Identified Catchment Area for the Health Institutions 3 Section 2: Compiled Data on Health of the Population and Health Disparities 5 Section 3: Community Needs and Priorities Assessment 14 Section 4: Identified Resources in the Community 19 Section 5: Identified Health Priorities 22 Section 6: Identified Availability and Gaps in Technology and Infrastructure 25 Section 7: Identified Availability and Gaps in the Health Institution 27 Section 8: Assessment of Additional Needs 31 Section 9: Plan and Strategy to Implement Population Health 32 Section 10: Environment and Impact Assessment 37 References 38 Appendix: Questions: University of Texas Faculty and Staff Population Health Survey 45 Appendix: Results: University of Texas Faculty and Staff Population Health Survey 47 Appendix: Questions for Key Informant CST Members 60 Appendix: Questions for CST Applicant Dinner and Discussion Forum 61 2 | Page INTRODUCTION In 2011, Texas Senator Kirk Watson proposed building a medical school from the ground up as part of a 10 year plan to improve the health of Austin and Travis County residents; this would be the first medical school built at a top tier research university in nearly 50 years.1 One year later, these residents voted for Proposition 1, committing $35 million annually from increased property taxes as investment in the school, with the promise of improved health outcomes. -

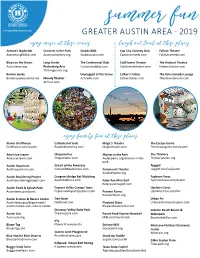

Greater Austin Area

summer fun heritagetitleofaustin.com GREATER AUSTIN AREA - 2019 enjoy music at these venues laugh out loud at these places Antone’s Nightclub Concerts in the Park Stubbs BBQ Cap City Comedy Club Fallout Theater Antonesnightclub.com Austinsymphony.org Stubbsaustin.com Capcitycomedy.com Falloutcomedy.com Blues on the Green Long Center The Continental Club ColdTowne Theater The Hideout Theatre Austintexas.org Performing Arts Continentalclub.com Coldtownetheater.com Hideoutheatre.com Thelongcenter.org Broken Spoke Unplugged at the Grove Esther’s Follies The Velv Comedy Lounge Brokenspokeaustintx.net Moody Theater Acl-radio.com Esthersfollies.com Thevelveetaroom.com Acl-live.com enjoy family fun at these places Alamo Drafthouse Cathedral of Junk Magic’s Theater The Escape Game Drafthouse.com/austin Roadsideamerica.com Magictheater.com Theescapegame.com/austin Amy’s Ice-cream Chaparral Ice Movies in the Park The Thinkery Amysicecream.com Chaparralice.com Austinparks.org/movies-in-the- Thinkeryaustin.org park Austin Aquarium Circuit of the Americas Topgolf Austinaquarium.com Circuitoftheamericas.com Paramount Theatre Topgolf.com/us/austin Austintheatre.org Austin Bouldering Project Congress Bridge Bat Watching Typhoon Texas Austinboulderingproject.com Austinbattours.com Peter Pan Mini Golf Typhoontexas.com/austin Peterpanminigolf.com Austin Pools & Splash Pads Cypress Valley Canopy Tours Upstairs Circus Austintexas.gov/pools Cypressvalleycanopytours.com Pioneer Farms Upstairscircus.com/atx Pioneerfarms.org Austin Science & Nature Center Dart -

Golf Courses Lack

CENTRAL TEXAS Golf Guide Independence Title LEARN MORE IndependenceTitle.com PUBLIC COURSES Blackhawk Golf Club 18 | Par 72 2714 Kelly Ln, Pflugerville | blackhawkgolf.com Measuring more than 7,000 yards from the championship tees, the course and slope ratings are 74.5 and 125 respectively. Blackhawk features a links-style layout that has proven tough enough to host several professional mini-tour events. Bluebonnet Hill Golf Club 18 | Par 72 9100 Decker Lane, Austin | bluebonnethillgolf.com Bluebonnet Hill Golf Course offers players of all skill levels a challenging and enjoyable round of golf. The course is laid out over the rolling hills just 15 minutes east of downtown Austin on Decker Lane. The course is in excellent shape with impeccable 328 Bermuda greens. Butler Park Pitch & Putt 9 | Par 27 201 Lee Barton Dr, Austin | butlerparkpitchandputt.com Butler Park Pitch and Putt is a nine hole, par 3 course near downtown Austin, the Hike and Bike Trail, and Lady Bird Lake. This is a golf course for everyone, from beginner golfers to pro's like Ben Crenshaw. It features large, shady pecan trees, water and grass traps, challenging holes, a very diverse clientèle, and friendly and helpful employees. Falconhead Golf Club 18 | Par 72 15201 Falconhead Blvd, Austin | falconheadaustin.com Falconhead Golf Club opened in 2003, an incredible addition to Austin golf. Laid out by the experts from the PGA Tour Design Center, this public daily-fee course offers golfers a taste of quality golf. Grey Rock Golf Club 18 | Par 72 7401 Texas Hwy 45, Austin | greyrockgolfclub.com Towering oaks provide the perfect runway on every drive. -

LAKELINE LAND OFFERING MEMORANDUM | AUSTIN, TEXAS 3.94 Acres - Adjacent to Lakeline Mall Lake Line | Austin, Tx

. VD BL NE ELI LAK S R. L D AL E M LIN KE 3.94 AC LA . P D E V L C B A N E N P I A L R E K G D B I L R V D D . LAKELINE MALL 1,097,799 SF LAKELINE LAND OFFERING MEMORANDUM | AUSTIN, TEXAS 3.94 Acres - Adjacent to Lakeline Mall Lake Line | Austin, Tx EXECUTIVE SUMMARY . LVD E B LIN AKE JLL is pleased to offer the unique opportunity to purchase Lakeline Land (the “Property” S L or the “Site”), 3.94 acres of raw land in Austin, Texas. Situated at the northwest corner of US-183 and FM-620, the Property offers convenient access to the adjacent Lakeline Mall and nearby Capital Metro Lakeline Station. Additionally, the Property is centrally located to major employers, rapidly growing residential areas, and significant business and retail R. centers across the city. L D AL E M Lakeline Land’s prime location along Austin’s path of northern growth provides quick LIN KE access to the western hill country, northern suburbs, and a major highway leading 3.4 AC LA directly into the heart of Austin. Situated north of booming central Austin and just south of some of the fastest growing suburbs in America, the Property’s location is one of the best in the Greater Austin area. Popular surrounding retail includes H-E-B plus!, Wal-Mart . P D E V Supercenter, Chick-fil-A, and the Austin Aquarium. The surrounding submarkets remain L C B A N some of the preferred destinations for major corporations in technology, engineering, E N P I financial services and more, further highlighting the Property’s prime location. -

Dog Parks GREATER AUSTIN AREA - 2019 OFF-LEASH

heritagetitleofaustin.com dog parks GREATER AUSTIN AREA - 2019 OFF-LEASH Ann and Roy Butler Hike-and-Bike Trail Davis White Northeast District Park Red Bud Isle Auditorium Shores Off-Leash Area Emma Long Metropolitan Park Round Rock Dog Depot Balcones District Park Harris Ridge Dog Park Shoal Creek Greenbelt Barkin’ Springs Lakeway City Dog Park St. Edward’s Park Barton Creek Greenbelt Preserve Mary Moore Searight Park Town Lake Metropolitan Park Bee Cave Dog Park Mills Pond Triangle Park Off-Leash Area Bob Wentz Park Mueller Lake Park Walnut Creek Metropolitan Park Brushy Creek Lake Park Norwood Estate Dog Park West Austin Park Bull Creek District Park Onion Creek District Park Zilker Dog Park Butler Park Pease Park Cedar Bark Park Pflugerville Bark Park DOWNTOWN ROLLINGWOOD TARRYTOWN Frost Bank Rollingwood Center The Carillon 401 Congress Ave | Ste 1500 2500 Bee Caves Rd | Bldg 1, Ste 100 2630 Exposition Blvd | Ste 105 Austin, TX 78701 | 512.505.5000 Austin, TX 78746 | 512.329.3900 Austin, TX 78703 | 512.380.8900 @heritagetitleatx heritagetitlecompanyofaustin @heritagetitle heritagetitleofaustin.com dog friendly hangouts GREATER AUSTIN AREA - 2019 Austin Java Crown & Anchor Pub Red’s Porch Austin Terrier Dog House Drinkery Dog Park Rudy’s BBQ Banger’s Sausage House & Beer Garden Draught House Pub & Brewery Scholz Garten Bouldin Creek Cafe Hops & Grain Shake Shack Bow Wow Bones Kerbey Lane Cafe Ski Shores Café Brentwood Social House Little Woodrow’s Spider House Cane Rosso Moontower Saloon The ABGB Caroline Mozart’s Coffee Roasters The Tavern Cenote P. Terry’s Burger Stand Whole Foods (Yappy Hour) Contigo Phil’s Icehouse Yard Bar DOWNTOWN ROLLINGWOOD TARRYTOWN Frost Bank Rollingwood Center The Carillon 401 Congress Ave | Ste 1500 2500 Bee Caves Rd | Bldg 1, Ste 100 2630 Exposition Blvd | Ste 105 Austin, TX 78701 | 512.505.5000 Austin, TX 78746 | 512.329.3900 Austin, TX 78703 | 512.380.8900 @heritagetitleatx heritagetitlecompanyofaustin @heritagetitle. -

Travis County Election Day Vote Centers Tuesday, December 15, 2020

Travis County Election Day Vote Centers subject to change Tuesday, December 15, 2020 sujeto a cambios Sitios de Votación del Condado de Travis para el Día de Elección, martes 15 de deciembre, 2020 (por precinto) Polls are open 7 am - 7 pm; Horas de Servicio 7 am - 7 pm Dana DeBeauvoir, VOTE CENTER ELECTION Elección de Centros de Votación On Election Day, eligible Travis County VOTERS MAY VOTE AT ANY of the locations listed on this page. Voters County Clerk are NOT limited to only voting in the precinct where they are registered to vote. En el día de elección votantes elegibles del Condado de Travis podrán votar en cualquier sitio indicado en esta página. Votantes tienen más opciones en dónde votar, sin limitarse al precinto en donde están registrados para votar. Combined Combined Pct. Polling Station Address City Zip Bus Pct. Polling Station Address City Zip Bus Precincts Precincts Código Recintos Código Recintos Lugar de votación Dirección Ciudad Lugar de votación Dirección Ciudad postal Combinados postal Combinados 117 Turner-Roberts Recreation Center 7201 Colony Loop Dr Austin 78724 121, 128, 131, 134 244 St. Luke's on the Lake Episcopal 5600 Ranch Rd 620 N Austin 78732 232, 245, 312, 359 122 University Hills Branch Library 4721 Loyola Ln Austin 78723 249 St Matthew's Episcopal 8134 Mesa Dr Austin 78759 246, 253, 262 124 Millennium Youth Complex 1156 Hargrave St Austin 78702 126 252 North Village Branch Library 2505 Steck Ave Austin 78757 243, 260 129 Greater Mt Zion Baptist 4301 Tannehill Ln Austin 78721 116 259 Milwood Branch Library -

Jamie Rhodes, Chair, Central Texas Angel Network

Jamie Rhodes Co-Founder, National NanoMaterials Director, Central Texas Angel Network, Angel Capital Association, Greater Austin Chamber of Commerce With over 30 years of experience in technology management, Jamie Rhodes is a serial entrepreneur. He is co-founder of National NanoMaterials, manufacturer of Graphenol™, a functionalized form of graphene. He previously founded Perceptive Sciences Corporation and before that was the co-founder of a venture capital funded start-up focused on the telecom industry which IPO’ed in 2011. Jamie spent the early years of his career working with numerous start-ups, most notably National Instruments in its early stage. He also spent nine years in management at IBM. In an effort to give back to the community, Jamie has lent his expertise to other entrepreneurs. With the support of the Greater Austin Chamber of Commerce (GACC), Jamie founded the Central Texas Angel Network, which provides funding and support to Texas entrepreneurs across a broad spectrum of industries. He has also organized angel groups around the state of Texas into the Alliance of Texas Angel Networks, which represents over 300 investors and investment in over 60 companies in 2012. He is vice- chair of the board of directors of the Angel Capital Association, a national organization spun out of the Kauffman Foundation representing seed stage investors. He has been on the board of directors of the Greater Austin Chamber of Commerce, the Central Texas Regional Center of Innovation and Commercialization and the Texas Tri-Cities Chapter of the National Association of Corporate Directors. Jamie is an active angel investor and serves on numerous start-up advisory boards. -

Greater Austin Farmers Markets

GREATER AUSTIN FARMERS MARKETS WWW.CHICAGOTITLEAUSTIN.COM AUSTIN CITY LIMITS BARTON CREEK FARMERS MARKET SPRINGDALE FARM STAND Saturdays: 9am - 1pm Wednesdays & Saturdays: 9am - 1pm Barton Creek mall parking lot 755 Springdale Rd., Austin www.bartoncreekfarmersmarket.org www.springdalefarmaustin.com BOGGY CREEK FARM STAND Wed-Sat: 8am - 1pm (Sept-July) Wed & Sat: 8am - 1pm (August) 3414 Lyons Road, Austin www.boggycreekfarm.com HOPE FARMERS MARKET Sundays: 11am - 3pm Plaza Saltillo, E 5th and Comal, Austin www.hopefarmersmarket.org TEXAS FARMERS MARKET AT MUELLER Sundays: 10am - 2pm 4209 Airport Blvd., Austin www.texasfarmersmarket.org/mueller SFC FARMERS MARKET DOWNTOWN Open Year-Round, Rain or Shine Saturdays: 9am - 1pm Republic Square Park, 422 Guadalupe St., Austin www.sfcfarmersmarket.org SFC FARMERS MARKET AT SUNSET VALLEY Open Year-Round, Rain or Shine Saturdays: 9am - 1pm Toney Burger Center, 3200 Jones Rd., Austin www.sfcfarmersmarket.org GEORGETOWN FARMERS MARKET Thursdays: 2:30pm - 5:30pm 900 N Austin Ave., Georgetown www.farmergeorge.market SUN CITY FARMERS MARKET SURROUNDING Tuesdays: 9am - 12pm 2 Texas Drive, Georgetown www.farmergeorge.market WOLF RANCH FARMERS MARKET Saturdays: 9am - 1pm 1015 W. University Ave., Georgetown AREAS www.wolfranchfarmersmarket.com HUTTO CO-OP FARMERS MARKET Wednesdays (March-October): 5pm - 8pm 420 US 79, Hutto www.visithutto.com LOCKHART MAIN STREET FARMERS MARKET BASTROP 1832 FARMERS MARKET Saturdays: 8:30am - 12pm Open Year-Round Corner of Market & Main St, Lockhart Saturday Hours: 10am -

A New Start: a Re-Entry Guide for Texas Re-Entry

A New Start: A Re-Entry Guide for Texas Key Information for Successful Reintegration To downooad the compoete guide, poease visit: www.criminaljusticecoalition.org/tools_for_re_entry/reentryguide Re-Entry Resources for Austin And the Surrounding Central Texas Area THE FOLLOWING PAGES CONTAIN RESOURCES WITH CONTACT INFORMATION FOR ORGANIZATIONS THAT MAY benefit peopoe upon reoease from confinement. Each entry has the name of the organization, address, phone number, and website (if avaioaboe), in addition to a brief description of the services offered by the organization. We recommend that peopoe contact an organization before attempting to use its services to ensure that services are stioo avaioaboe, and to ask if the organization has any eoigibioity requirements to use the services. If an organization is unaboe to assist a person at the present time, it is acceptaboe to ask to be put on a waiting oist. The organization may aoso have other resources or referraos avaioaboe. It never hurts to ask. In addition to the resources oisted on the foooowing pages, those interested can check out the foooowing: Reentry and Integration Division Hotline The foooowing tooo-free number has been estaboished to assist peopoe who are re-entering society, as weoo as their famioies and the generao puboic who may have questions reoated to programs and resources: 1-877-887- 6151. 2-1-1 A great poace to begin oooking for heop is by caooing 2-1-1. It provides free and confidentiao information and referraos to organizations that can assist peopoe with food, housing, empooyment, heaoth care, counseoing, and more. Peopoe can diao 2-1-1 from any teoephone and teoo the operator what information they are seeking.