AVG Technologies N.V

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hostscan 4.8.01064 Antimalware and Firewall Support Charts

HostScan 4.8.01064 Antimalware and Firewall Support Charts 10/1/19 © 2019 Cisco and/or its affiliates. All rights reserved. This document is Cisco public. Page 1 of 76 Contents HostScan Version 4.8.01064 Antimalware and Firewall Support Charts ............................................................................... 3 Antimalware and Firewall Attributes Supported by HostScan .................................................................................................. 3 OPSWAT Version Information ................................................................................................................................................. 5 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.890.0 for Windows .................................................. 5 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.890.0 for Windows ........................................................ 44 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.824.0 for macos .................................................... 65 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.824.0 for macOS ........................................................... 71 Cisco AnyConnect HostScan Antimalware Compliance Module v4.3.730.0 for Linux ...................................................... 73 Cisco AnyConnect HostScan Firewall Compliance Module v4.3.730.0 for Linux .............................................................. 76 ©201 9 Cisco and/or its affiliates. All rights reserved. This document is Cisco Public. -

Nessus and Antivirus

Nessus and Antivirus January 31, 2014 (Revision 4) Table of Contents Introduction ......................................................................................................................................... 3 Standards and Conventions........................................................................................................................... 3 Overview .............................................................................................................................................. 3 A Note on SCAP Audits ................................................................................................................................. 4 Microsoft Windows Defender ............................................................................................................. 4 Kaspersky Internet Security 2012 ...................................................................................................... 4 AVG 2012 ............................................................................................................................................. 7 Norton Internet Security 2012 .......................................................................................................... 10 Norton 360 ......................................................................................................................................... 14 Panda Internet Security 2012 ........................................................................................................... 18 Trend Micro Titanium -

2012 Consumer Security Products Performance Benchmarks (Edition 2) Antivirus and Internet Security Windows 7

2012 Consumer Security Products Performance Benchmarks (Edition 2) Antivirus and Internet Security Windows 7 November 2011 Document: 2012 Consumer Security Products Performance Benchmarks (Edition 2) Authors: M. Baquiran, D. Wren Company: PassMark Software Date: 14 November 2011 Edition: 2 File: antivirus_12-performance-testing-ed2.docx Consumer Internet Security and Antivirus Solutions PassMark Software Table of Contents TABLE OF CONTENTS ......................................................................................................................................... 2 REVISION HISTORY ............................................................................................................................................ 4 REFERENCES ...................................................................................................................................................... 4 EXECUTIVE SUMMARY ...................................................................................................................................... 5 OVERALL SCORE ................................................................................................................................................ 6 PRODUCTS AND VERSIONS ............................................................................................................................... 8 INTERNET SECURITY SOFTWARE .................................................................................................................................. 8 ANTIVIRUS SOFTWARE ............................................................................................................................................. -

Avast Modern Slavery Transparency Statement for the Financial Year 2020

Avast Modern Slavery Transparency Statement for the financial year 2020 Introduction This statement on slavery and human tracking is published on behalf of Avast plc and its wholly owned subsidiaries Avast Software s.r.o., AVG Technologies UK Limited, AVG Technolo- gies AU Pty Limited, Piriform Software Limited (trading as CCleaner) and Privax Limited (trading as HideMyAss) (together, “Avast”) pursuant to section 54(1) of the UK Modern Slavery Act 2015 and section 13 of the Australian Modern Slavery Act 2018. References to “we”, “us”, “our”, and “Avast” are to all of these companies. This statement applies to the financial year ending 31 December 2020. Modern slavery encompasses slavery, servitude, human tracking and forced labour. Avast is committed to preventing slavery and human tracking in our business and our supply chain. This statement sets out the steps that Avast has taken, and is continuing to take, to ensure that modern slavery or human tracking is not taking place within our business or supply chain. The impact of Covid 2020 has been unparalleled in terms of challenges and change for us all. As the pandemic unfolded Avast moved quickly to support our suppliers, employees and the communities in which we operate. In light of disruption to supply chains and the global impact and pressures of the pandemic on all aspects of life, it is widely recognised that the vulnerability of individuals to modern slavery and human tracking has increased. As a result, it has never been more important to maintain our vigilance and commitment to ensure that modern slavery or human tracking is not taking place within our business or supply chain. -

Piper Jaffray Cybersecurity Earnings Update

Piper Jaffray Cybersecurity Earnings Update Third Quarter 2017 Marc Steifman Greg Klancher Co-Head of Technology Principal Investment Banking Piper Jaffray & Co. Piper Jaffray & Co. MINNEAPOLIS | BOSTON | CHICAGO | HOUSTON | LONDON | LOS ANGELES | NEW YORK | SAN FRANCISCO | ZÜRICH Piper Jaffray Companies (NYSE: PJC) is an investment bank and asset management firm headquartered in Minneapolis with offices across the U.S. and in London, Zurich and Hong Kong. Securities brokerage and investment banking services are offered in the United States through Piper Jaffray & Co., member NYSE and SIPC, in Europe through Piper Jaffray Ltd., authorized and regulated by the Financial Conduct Authority, and in Hong Kong through Piper Jaffray Hong Kong, authorized and regulated by the Securities and Futures Commission. Asset management products and services are offered through three separate investment advisory affiliates registered with the U.S. Securities and Exchange Commission: Advisory Research Inc., Piper Jaffray Investment Management LLC and PJC Capital Partners LLC. Piper Jaffray & Co., Member SIPC and FINRA 11/17 Piper Jaffray Case Study: Vista Equity Partners acquires majority stake in Jamf Vista Equity Partners: Undisclosed . Vista Equity Partners is a U.S.-based investment firm with more than $30 billion in cumulative capital commitments, currently invests in software, data and technology-enabled organizations. The firm invests in middle market management and leveraged buyouts, growth and acquisition Has purchased a majority financing, recapitalizations, private transactions, spin-outs and corporate divestitures. stake in . The firm was founded in 2000 and is headquartered in Austin, Texas. Jamf: . Jamf focuses on helping businesses, education and government organizations succeed with November 2017 Apple through its Jamf Pro and Jamf Now solutions. -

Cisco Identity Services Engine Supported Windows AV/AS/PM/DE

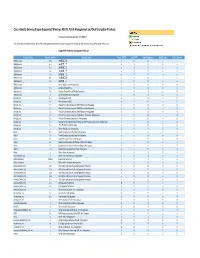

Cisco Identity Services Engine Supported Windows AS/AV, Patch Management and Disk Encryption Products Compliance Module Version 3.6.10363.2 This document provides Windows AS/AV, Patch Management and Disk Encryption support information on the the Cisco AnyConnect Agent Version 4.2. Supported Windows Antispyware Products Vendor_Name Product_Version Product_Name Check_FSRTP Set_FSRTP VirDef_Signature VirDef_Time VirDef_Version 360Safe.com 10.x 360安全卫士 vX X v v 360Safe.com 4.x 360安全卫士 vX X v v 360Safe.com 5.x 360安全卫士 vX X v v 360Safe.com 6.x 360安全卫士 vX X v v 360Safe.com 7.x 360安全卫士 vX X v v 360Safe.com 8.x 360安全卫士 vX X v v 360Safe.com 9.x 360安全卫士 vX X v v 360Safe.com x Other 360Safe.com Antispyware Z X X Z X Agnitum Ltd. 7.x Outpost Firewall Pro vX X X O Agnitum Ltd. 6.x Outpost Firewall Pro 2008 [AntiSpyware] v X X v O Agnitum Ltd. x Other Agnitum Ltd. Antispyware Z X X Z X AhnLab, Inc. 2.x AhnLab SpyZero 2.0 vv O v O AhnLab, Inc. 3.x AhnLab SpyZero 2007 X X O v O AhnLab, Inc. 7.x AhnLab V3 Internet Security 2007 Platinum AntiSpyware v X O v O AhnLab, Inc. 7.x AhnLab V3 Internet Security 2008 Platinum AntiSpyware v X O v O AhnLab, Inc. 7.x AhnLab V3 Internet Security 2009 Platinum AntiSpyware v v O v O AhnLab, Inc. 7.x AhnLab V3 Internet Security 7.0 Platinum Enterprise AntiSpyware v X O v O AhnLab, Inc. 8.x AhnLab V3 Internet Security 8.0 AntiSpyware v v O v O AhnLab, Inc. -

Vendor Comparison Matrix Example – Comparison of Antivirus Software

Vendor Comparison Matrix Example – Comparison of Antivirus Software https://protectourpower.org/best-practices/pop-bp-vendor-comparison-matrix-example-antivirus.pdf In summary, this paper provides and discusses a cut-and-paste of a Wikipedia antivirus matrix into the PoP analysis matrix and provides the resultant Vendor Comparison Matrix. Introduction The Protect Our Power (PoP) Best Practices in Cybersecurity for Utilities Project has 2 Goals: 1. Provide organized and comprehensive information to the electric Utilities related to specific actionable subsets (Topics) of cybersecurity. 2. Provide an analysis of suppliers for each Topic that allows a Utility to understand better which suppliers are more related to each Utility’s interest in using best practices. The first Goal is addressed via a literature search specific to the Topic under consideration. The second Goal is addressed via a Vendor Comparison Matrix. These represent two of the Work Products expected for each Topic. The Topics and associated Vendors are contained in the Taxonomy. Educational Institutions are used to complete all Work Products and have final authority to ensure an independent analysis. Companies like Forrester and Gartner produce analyses of Vendors related to specific software areas – but are not targeting specific Utility needs. The Vendor Comparison Matrix in Protect Our Power’s Project can be thought of as like a Magic Quadrant or other analyses of vendors sometimes produced by such companies. Wikipedia, interestingly, provides a “Comparison of Antivirus Software.” It is unusual to locate such an analysis – and we use the data here to populate a PoP Vendor Comparison Matrix and furnish the result. -

North Dakota Homeland Security Anti-Terrorism Summary

UNCLASSIFIED NORTH DAKOTA HOMELAND SECURITY ANTI-TERRORISM SUMMARY The North Dakota Open Source Anti-Terrorism Summary is a product of the North Dakota State and Local Intelligence Center (NDSLIC). It provides open source news articles and information on terrorism, crime, and potential destructive or damaging acts of nature or unintentional acts. Articles are placed in the Anti-Terrorism Summary to provide situational awareness for local law enforcement, first responders, government officials, and private/public infrastructure owners. UNCLASSIFIED UNCLASSIFIED NDSLIC Disclaimer The Anti-Terrorism Summary is a non-commercial publication intended to educate and inform. Further reproduction or redistribution is subject to original copyright restrictions. NDSLIC provides no warranty of ownership of the copyright, or accuracy with respect to the original source material. QUICK LINKS North Dakota Energy Regional Food and Agriculture National Government Sector (including Schools and Universities) International Information Technology and Banking and Finance Industry Telecommunications Chemical and Hazardous Materials National Monuments and Icons Sector Postal and Shipping Commercial Facilities Public Health Communications Sector Transportation Critical Manufacturing Water and Dams Defense Industrial Base Sector North Dakota Homeland Security Emergency Services Contacts UNCLASSIFIED UNCLASSIFIED North Dakota Sheriff prepares for neo-Nazi's visit to Leith. LEITH, N.D. – Grant County Sheriff Steve Bay said he’s not sure what to expect Sunday when Jeff Schoep, the leader of a national neo-Nazi group, drives into town. Source: http://www.inforum.com/event/article/id/412720/ Regional (Minnesota) State wood quarantine could cause problems in Minnesota. The discovery of the emerald ash borer in northwestern Wisconsin has led to a quarantine on transporting firewood from outside of Wisconsin’s Douglas County and halted transportation of unprocessed ash trees. -

ESAP 2.6.6 Release Notes

ESAP 2.6.6 Release Notes Version Mac and Windows 3.6.9366.2 (V2 Unified + V3) Published July 2015 ESAP 2.6.6 Release Notes Note: The SDK embedded in this ESAP version has been tested and qualified to interoperate with an extensive list of endpoint security applications covering most products listed in the supported products list Noteworthy changes: • This ESAP version contains additional files in preparation of new features that will be enabled in the next major release of SA and IC. ESAP 2.6.6 and Pulse Secure Access/Access Control Service Compatibility Chart: This ESAP package can be installed on the following Pulse Secure Access/Access Control Service software versions. • SA 8.0Rx • SA 7.4Rx • SA 7.3Rx • SA 7.2Rx • SA 7.1Rx • SA 7.0Rx • SA 6.5Rx • UAC 5.0Rx • UAC 4.4Rx • UAC 4.3Rx • UAC 4.2Rx • UAC 4.1Rx • UAC 4.0Rx • UAC 3.1Rx Note: The ESAP package may install and function without any errors on older releases however as the install has not been tested, we recommend that it be used only on the above versions of software releases. © 2015 by Pulse Secure, LLC. All rights reserved 2 ESAP 2.6.6 Release Notes Support has been added for the following products in ESAP2.6.6 Windows OS Antivirus Products [360Safe.com] 360 Total Security (4.x) [ArcaBit] Arcabit Endpoint AntiVirus (2014.x) [ArcaBit] Arcabit Endpoint Security (2014.x) [ArcaBit] ArcaVir Antivirus (2014.x) [ArcaBit] ArcaVir Internet Security (2014.x) [Avira GmbH] Avira Antivirus Pro (14.x) [MSecure Data Labs] MSecure Antivirus (9.x) [Agnitum Ltd.] Outpost Security Suite Pro (9.x) -

2,300+ Participating Online Stores

2,300+ Participating Online Stores Up to 26% of Each Purchase Benefits Bridges Oregon 0cm Agoda AnchorFree Hotspot Shield b-glowing Bench Boden USA buybuy Baby CBD Essence 1-800 CONTACTS Agora Cosmetics VPN Elite Baabuk Sarl Benefit Cosmetics Bodum BuyWake.com CBD Oil Solutions 1-800-Baskets.com AHAVA Andrew Marc Babo Botanicals BenQ America Body Spartan Cabany co CBTL The Coffee Bean & 1-800-FLOWERS.COM Aidance Scientific Angels' Cup Baby Quasar Bentley Leathers BodyBoss Caesars Entertainment Leaf Tea 1-800-GET-LENS Air Filters Delivered Animoto Back in the Saddle Beretta USA BodyGuardz City Atlantic Celestia 1-800-GOT-JUNK? Air-Purifiers-America Anjay's Designs Backcountry.com Bergdorf Goodman Bodyography Caesars Rewards Certblaster 1-800-Pet Meds Airocide Ann Taylor BackJoy Besame Cosmetics Bogner Cafe Britt Gourmet Coffee Certified Piedmontese 1-800-PetSupplies.com Airport Parking Annie's BagAmour Box Best Bully Sticks Bogs Footwear Cafe Joe Chaco 100% Pure Airport Parking Antop Antenna Inc. Baggallini Best Buy Eye Glasses Bokksu Cakeflix Champion 101Phones.com Reservations Anytime Costumes Bakblade Best Choice Products Bombinate Calendars.com Chantelle Lingerie 123-reg AirTurn Aphrodite's Bake Me a Wish Best Cigar Prices Bonafide California Chamber of Chaparral Motorsports 123inkjets Airvape Apollo Box Baked by Melissa Best Western Bonanza Commerce Chapters.Indigo.ca 123Print AJ Madison Apple Balance by Bistro MD BestBuy.com Bonobos Caliper CBD Charles & Colvard 180 Nutrition Alala Apple Canada Balance of Nature BestUsedTires Boob -

Antivirus App Free

1 / 2 Antivirus App Free Sophos Anti-Virus software is the UW's preferred choice for UW faculty, staff and students. AVG AntiVirus FREE is a fast, effective and extremely popular antivirus .... A free antivirus that will protect your phone from malware and theft. Avast Mobile Security & Antivirus protects your Android and iOS phone from the dangers of .... Strong malware protection; Ad-free across all versions; Competitively priced Premium app. Free version doesn't automatically scan new apps. Price $14.95/year.. Download the free version of Kaspersky Security Cloud Free. This advanced cloud ... Access our best apps, features and technologies under just one account.. Windows Defender · Kaspersky Security · AVG Free Antivirus · Avast Free Antivirus · Avira Free Antivirus · Panda Free Antivirus.. Adaware free antivirus protection safeguards your computer from online threats, ... Each year, Adaware Antivirus software is submitted to independent labs for .... You've installed antivirus software on your desktop — but your ... note that many companies offer both free and paid versions of their apps.. Typically, antivirus apps scan your device, its software and incoming apps and ... The Avast Mobile Security free version comes with just about .... Avast antivirus has also app analyzing option. This analyze the apps before download whether the app is at risk with its malicious data or not. Call blocking and ... AVG AntiVirus for Android ... PRO features are included free for 14 days, and can be bought anytime with an in‑app purchase. Google Play 4.5/5 rating .... TotalAV Antivirus is a free to use antivirus packed with all the essential features to find & remove malware keeping you safe. -

Avg Antivirus Free 2013 Cnet

Avg antivirus free 2013 cnet AVG Antivirus Free is an antimalware security suite that includes an active file and email scanner, plus Web browsing protection. Avast Software (AVG's main. by: Eddie Cho on September 03, AVG's Anti-Virus and Internet Security line follows on the heel of last year's highly-ranked security suite. AVG AntiVirus scans your Android device for malicious software and offers a wealth of related security tools if you buy an annual subscription. From AVG Technologies: Get AVG AntiVirus FREE (Virus Cleaner) for Android to help protect your phone and tablet from harmful viruses. The company acquired its rival AVG in September of , and now both use Avast Free Antivirus has been redesigned to be easier to use while staying light. Articleby Seth Rosenblatt January 16, PM PST Microsoft's free antivirus Security Essentials is now the top antivirus product in the world, Newegg is offering everything from AVG Anti-Virus to Webroot SecureAnywhere Complete. AVG Internet Security wants to convince you that an antimalware security suite is worth paying for, in a climate where free options from Avast (Windows, Mac). Download FREE AVG antivirus software. Get protection against viruses, malware and spyware. Easy-to-use virus scanner for PC, Mac & mobile. Download. Some of the sites are clearly not AVG, I can ignore those. [dot]yahoo[dot]com/software/windows-security-avg-anti-virus-free-edition-s Have a look @ this Announcement post link AVG Free Edition - Summary. Update · Installation · AVG · AVG · Internet and Network · Update. AVG AntiVirus FREE Receives Top Ratings from CNET, PC Mag and Software Magazine AMSTERDAM & SAN.