VAT Control Accounts

The Internal Audit Department brought to our attention that there may be some discrepancies within the VAT controls accounts, VI and VO (on the summary trial balance) at some schools.

From 2011/12 reconciliation of VAT control accounts will be part of our year end procedures and we will be requesting evidence before you can close the year. Therefore, if you are not already doing so you need to be reconciling the VAT control accounts on a monthly basis.

If all reimbursements of VAT are processed according to the VAT return it relates to (See Appendix A for guidance) and any corrections you have been instructed to complete have been actioned or completed correctly, the balances on the VAT control accounts VI and VO should only ever be timing differences. However, schools that have changed from being a central school to a local bank account school in their current FMS database and used the petty cash route to enter imprest items onto their FMS will be an exception. These schools will always have a very small balance that is not a timing difference. Schools that recently became local cheque should have a print out of what the VAT control balance was on FMS before they became a Local Bank Account School.

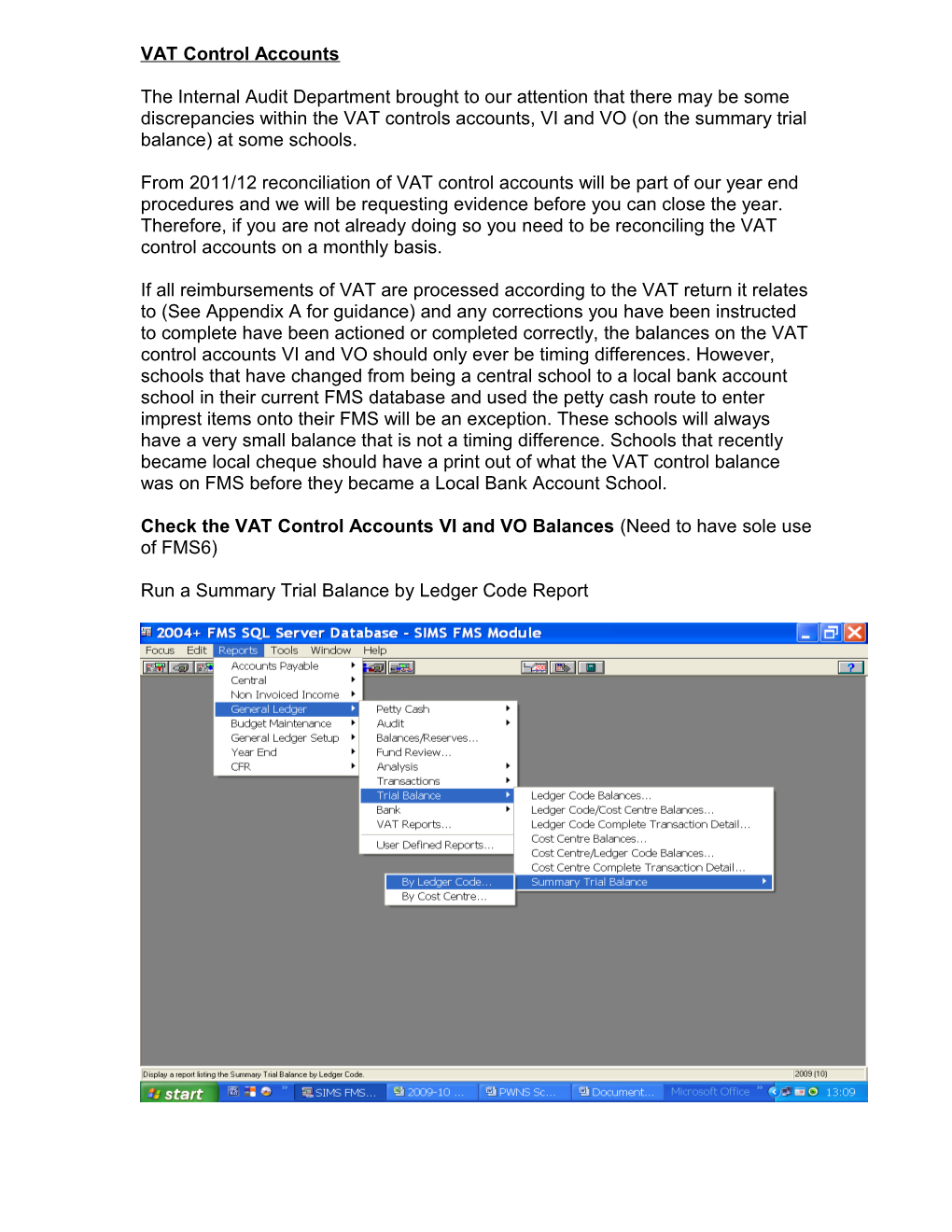

Check the VAT Control Accounts VI and VO Balances (Need to have sole use of FMS6)

Run a Summary Trial Balance by Ledger Code Report Choose current period and leave fund blank

OK Scroll down to last page of the report. This shows the VAT control accounts VI and VO balances. Print this page only.

The balances that appear in the above report should be timing differences.

Timing differences will be made up of balances on the current month’s short summary VAT report and any outstanding VAT reimbursements. To find out what the balances are on the current month’s short summary VAT report, go to Reports/General Ledger/VAT reports

Click on + to add a report Select VAT Short Summary Report The following report will appear, print this report

The figures on this report on each VAT code plus the outstanding VAT reimbursements figures on each VAT code that appear on the VAT Return (See VAT return on next page), should reconcile back to the balances on the Summary Trial Balance by Ledger Code Report. (See reconciliation spreadsheet on next page) Outstanding VAT reimbursement

VAT reconciliation spreadsheet Current Outstanding Ledger Ledger Trial Month Short VAT Return Type Code Balance Summary Reimbursement Variance VI 1 0 0 0 0 2 0 0 0 0 3 0 0 0 0 4 0 0 0 0 6 0 0 0 0 7 1615.12 952.06 663.06 0 8 0 0 0 0 Ledger Type Total 1615.12 952.06 663.06 0 VO A 0 0 0 0 B 0 0 0 0 D 0 0 0 0 E 0 0 0 0 K 0 0 0 0 L 0 0 0 0 M 0 0 0 0 N 0 0 0 0 Ledger Type Total 0 0 0 0

Net Total 1615.12 952.06 663.06 0

Appendix A

VAT REIMBURSEMENTS

Reimbursements of VAT should be processed via a vat reimbursement journal. The correct treatment is to refer to your VAT reimbursement spreadsheet and use this as a basis to debit and credit VAT the relevant codes (on the assumption that you are being reimbursed the same amount as you have claimed). (Processing a credit against VAT code 8 is not the correct accounting treatment).

Please see the example below:

VAT Return

Month: Apr-02

PAYMENTS NET VALUE VAT £ p £ p Standard Rated 13618 83 2383 34 Lower Rate 2100 00 100 00 Zero Rated 190 96 Exempt Input Tax Outside the Scope 15052 97 Input Totals 30962 76 2483 34

RECEIPTS Standard Rated 27 06 4 74 Lower Rate Zero Rated Exempt Input Tax Outside the Scope 7814 38 Non-business Output Totals 7841 44 4 74

Net Amount Claimed 2478 60

In this instance the following vat journal would be processed:

Dr Bank £2478.60 Cr Vat code for Standard Rated Expenditure £2383.34 Cr Vat code for Lower Rate Expenditure £ 100.00 Dr VAT code for Standard Rated Income £ 4.74

Please contact your School Financial Adviser for further guidance, by e mail to [email protected]