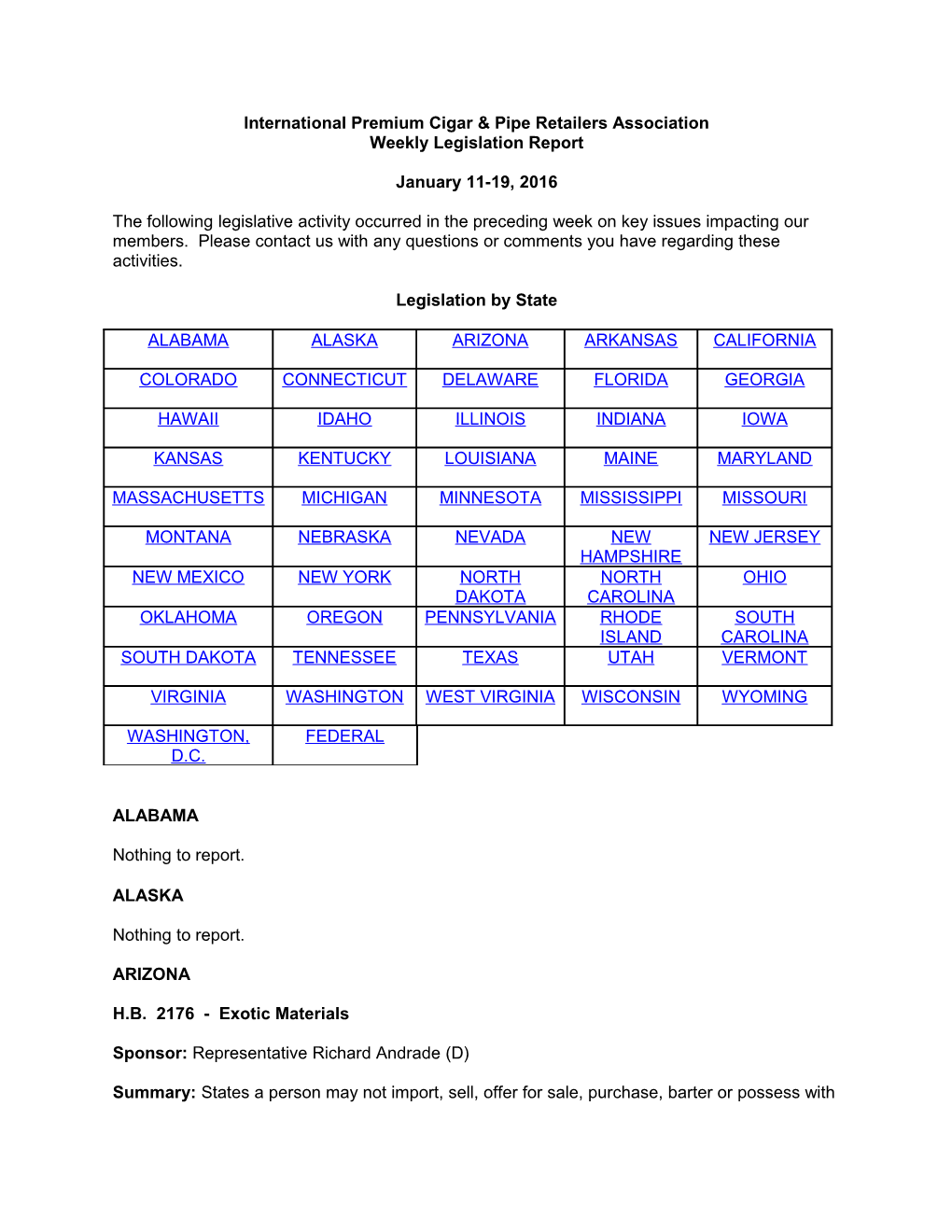

International Premium Cigar & Pipe Retailers Association Weekly Legislation Report

January 11-19, 2016

The following legislative activity occurred in the preceding week on key issues impacting our members. Please contact us with any questions or comments you have regarding these activities.

Legislation by State

ALABAMA ALASKA ARIZONA ARKANSAS CALIFORNIA

COLORADO CONNECTICUT DELAWARE FLORIDA GEORGIA

HAWAII IDAHO ILLINOIS INDIANA IOWA

KANSAS KENTUCKY LOUISIANA MAINE MARYLAND

MASSACHUSETTS MICHIGAN MINNESOTA MISSISSIPPI MISSOURI

MONTANA NEBRASKA NEVADA NEW NEW JERSEY HAMPSHIRE NEW MEXICO NEW YORK NORTH NORTH OHIO DAKOTA CAROLINA OKLAHOMA OREGON PENNSYLVANIA RHODE SOUTH ISLAND CAROLINA SOUTH DAKOTA TENNESSEE TEXAS UTAH VERMONT

VIRGINIA WASHINGTON WEST VIRGINIA WISCONSIN WYOMING

WASHINGTON, FEDERAL D.C.

ALABAMA

Nothing to report.

ALASKA

Nothing to report.

ARIZONA

H.B. 2176 - Exotic Materials

Sponsor: Representative Richard Andrade (D)

Summary: States a person may not import, sell, offer for sale, purchase, barter or possess with intent to sell any ivory, ivory product, rhinoceros horn or rhinoceros horn product.

Exempts employees or agents of the federal government or this state who are undertaking any law enforcement activities pursuant to federal or state law or any mandatory duties required by federal or state law and if the import is expressly authorized by federal law, license or permit.

http: //www .azle g.gov /legt ext/5 2leg/ 2r/bi lls/h b2176 p.pdf

Status: Filed 1/14/2016.

H.B. 2184 - Tobacco Taxes

Sponsor: Representative Darin Mitchell (R)

Summary: Provides that, in regards to tobacco products luxury tax refunds, the tax is imposed and shall be refunded when the amount of the tax has been paid when a distributor returns a luxury to the manufacturer or importer, for any reason and proof of the return is made to the Department.

http: //www .azle g.gov /legt ext/5 2leg/ 2r/bi lls/h b2184 p.pdf

Status: Filed 1/14/2016.

ARKANSAS

Nothing to report.

CALIFORNIA

A.B. 1594 - Smoking Bans

Sponsor: Assemblymember Kevin McCarty (D)

Summary: Prohibits any person from smoking a tobacco product or using an e-cigarette on a campus of the California State University or the California Community Colleges.

http: //www .legi nfo.c a.gov /pub/ 15-16 /bill /asm/ ab_15 51-16 00/ab _1594 _bill _2016 0106_ intro - duced .pdf

Status: Introduced 1/6/2016.

S.B. 24 - E-Cigarettes, Retail Licensing

Sponsor: Senator Jerry Hill (D)

Summary: Current version (1/5/2016): Authorizes a joint powers authority formed by the Cities of Belmont, Foster City and San Mateo on or after January 1, 2013, to provide employees who are not new members under PEPRA with the defined benefit plan or formula that was received by those employees from their respective employers on December 31, 2012, if they are employed by the joint powers authority within 180 days of the city providing for the exercise of a common power, to which the employee was associated, by the joint powers authority. Prohibits the formation of a joint powers authority on or after January 1, 2013, in a manner that would exempt a new employee or a new member from the requirements of PEPRA.

Current version (1/5/2016): http: //www .legi nfo.c a.gov /pub/ 15-16 /bill /sen/ sb_00 01-00 50/sb - _24_b ill_2 01601 05_am ended _sen_ v95.p df

Previous version (6/1/2015): http: //www .legi nfo.c a.gov /pub/ 15-16 /bill /sen/ sb_00 01-00 50/sb - _24_b ill_2 01506 01_am ended _sen_ v96.p df

Introduced version: http: //www .legi nfo.c a.gov /pub/ 15-16 /bill /sen/ sb_00 01-00 50/sb _24_b ill_2 - 01412 01_in trodu ced.h tml

Status: Introduced 12/1/2014. Referred to Senate Health Committee 1/15/2015. Amended 4/6/2015. Hearing canceled 4/8/2015. Hearing held; amended; passed committee; referred to Senate Appropriations Committee 4/15/2015. Amended 4/21/2015. Hearing held; placed in suspense file 5/4/2015. Hearing held; passed committee 5/28/2015. Amended 6/1/2015. Refused passage; reconsideration granted 6/2/2015. Placed in inactive file 6/8/2015. Amended 1/5/2016. Referred to Senate Committee on Public Employment and Retirement 1/7/2016.Hearing held; passed committee 1/14/2016. Hearing scheduled 1/19/2016.

COLORADO

Nothing to report.

CONNECTICUT

Nothing to report.

DELAWARE

S.B. 156 - Exotic Materials

Sponsor: Senator Karen Peterson (D)

Summary: Current version (1/13/2016): Prohibits a person from purchasing, selling, offering for sale, possessing with intent to sell or importing with intent to sell ivory or rhinoceros horn.

Exempts: (1) An employee or agent of the federal or state government undertaking a law- enforcement activity under federal or state law, or a mandatory duty required by federal law. (2) An activity that is authorized by an exemption or permit under federal law or that is otherwise expressly authorized under federal law. (3) Ivory or rhinoceros horn that is part of a musical instrument, including a string or wind instrument or piano, and that is less than 20% by volume of the instrument, if the owner or seller provides either of the following: a. Historical documentation demonstrating provenance and showing the item was manufactured no later than 1975. b. An appraisal performed by a member of the National Antique and Art Dealers Association of America or the Antique Dealers’ Association of America, Inc., demonstrating provenance and showing the item was manufactured no later than 1975. (4) Ivory or rhinoceros horn that is part of a bona fide antique and that is less than 20% by volume of the antique, if the antique status is established by the owner or seller of the antique by either of the following methods: a. Historical documentation demonstrating provenance and showing the antique to be not less than 100 years old. b. An appraisal performed by a member of the National Antique and Art Dealers Association of America or the Antique Dealers’ Association of America, Inc., demonstrating provenance and showing the antique to be not less than 100 years old. (5) Ivory or rhinoceros horn that is conveyed to a legal beneficiary upon the death of the owner of the ivory or rhinoceros horn or in anticipation of that death.

Current version (1/13/2016): http: //leg is.de lawar e.gov /LIS/ lis14 8.nsf /vwLe gisla tion/ SS+1+ for+S B+156 /$fil e/leg is.ht ml?op en

Introduced version: http: //leg is.de lawar e.gov /LIS/ lis14 8.nsf /vwLe gisla tion/ SB+15 6/$fi le/le gis.h tml?o pen

Status: Introduced; referred to Banking and Business Committee 6/24/2015. Passed committee; referred to Administrative Services and Elections Committee 6/30/2015. Carried over to 2016 Regular Session 7/1/2015. Hearing held; substituted; passed committee; referred to Senate Banking and Business Committee 1/13/2016.

FLORIDA

H.B. 1019 - Tobacco Taxes

Sponsor: Representative Tom Goodson (R)

Summary: Authorizes recognized Indian tribes to use excess Indian-tax-and-surcharge- exemption coupons when selling cigarettes to nontribal members on the reservation if, based on probable demand, the number of tax-and-surcharge-exemption coupons given to the governing body of a recognized Indian tribe exceeds the actual demand of the tribal members plus the number needed for official tribal use.

http: //www .flse nate. gov/S essio n/Bil l/201 6/101 9/Bil lText /File d/PDF

Status: Filed 12/21/2015. Referred to House Business and Professions Subcommittee; House Finance and Tax Committee; House Regulatory Affairs Committee 1/8/2016.

H.B. 1143 - Smoking Bans

Sponsor: Representative Shawn Harrison (R)

Summary: Redefines "smoking" to include "inhaling, exhaling, carrying or possessing a nicotine dispensing device as defined in s. 877.112."

Defines, within s. 877.112, “nicotine dispensing device” as any product that employs an electronic, chemical, or mechanical means to produce vapor from a nicotine product, including, but not limited to, an electronic cigarette, electronic cigar, electronic cigarillo, electronic pipe, or other similar device or product, any replacement cartridge for such device, and any other container of nicotine in a solution or other form intended to be used with or within an electronic cigarette, electronic cigar, electronic cigarillo, electronic pipe, or other similar device or product. Defines "smoking" as inhaling, exhaling, burning, carrying, or possessing any lighted tobacco product, including cigarettes, cigars, pipe tobacco and any other lighted tobacco product or inhaling, exhaling, carrying or possessing a nicotine dispensing device as defined in s. 877.112.

http: //www .flse nate. gov/S essio n/Bil l/201 6/114 3/Bil lText /File d/PDF

Status: Filed 1/6/2016. Referred to House Health Quality Subcommittee; House Business and Professions Subcommittee; House Health and Human Services Committee 1/13/2016. Hearing scheduled 1/19/2016.

H.B. 4063 - Smoking Bans

Sponsor: Representative George Moraitis (R)

Summary: Repeals the provision relating to the preemption to the state of the regulation of smoking, Section 386.209.

States that, in Section 386.209, this part expressly preempts regulation of smoking to the state and supersedes any municipal or county ordinance on the subject; however, school districts may further restrict smoking by persons on school district property.

http: //www .flse nate. gov/S essio n/Bil l/201 6/406 3/Bil lText /File d/PDF

Status: Filed 1/11/2016.

S.B. 1554 - Smoking Bans

Sponsor: Senator Thad Altman (R)

Summary: Repeals the provision relating to the preemption to the state of the regulation of smoking, Section 386.209.

States that, in Section 386.209, this part expressly preempts regulation of smoking to the state and supersedes any municipal or county ordinance on the subject; however, school districts may further restrict smoking by persons on school district property.

http: //www .flse nate. gov/S essio n/Bil l/201 6/155 4/Bil lText /File d/PDF

Status: Filed 1/8/2016.

S.B. 1558 - Tobacco Taxes

Sponsor: Senator Greg Evers (R)

Summary: Authorizes recognized Indian tribes to use excess Indian-tax-and-surcharge- exemption coupons when selling cigarettes to nontribal members on the reservation if, based on probable demand, the number of tax-and-surcharge-exemption coupons given to the governing body of a recognized Indian tribe exceeds the actual demand of the tribal members plus the number needed for official tribal use. http: //www .flse nate. gov/S essio n/Bil l/201 6/155 8/Bil lText /File d/PDF

Status: Filed 1/8/2016.

GEORGIA

H.B. 726 - Tobacco Taxes

Sponsor: Representative Kevin Tanner (R)

Summary: States that, in regards to the rate of the excise tax on tobacco products, if the dealer or distributor separately states the amount of any federal excise tax or shipping charges on the sales invoice for the tobacco product, such amount shall not be taxed pursuant to this chapter.

http: //www .legi s.ga. gov/L egisl ation /2015 2016/ 15423 5.pdf

Status: Filed 1/11/2016.

HAWAII

Nothing to report.

IDAHO

Nothing to report.

ILLINOIS

Nothing to report.

INDIANA

H.B. 1361 - Tobacco Taxes

Sponsor: Representative Robert Morris (R)

Summary: Defines "cigarette" for the purpose of including brown cigarettes or little cigars in taxation and pricing.

https ://ig a.in. gov/s tatic -docu ments /b/4/ 5/6/b 456d6 2c/HB 1361. 01.IN TR.pd f

Status: Introduced; referred to House Public Policy Committee 1/12/2016.

H.B. 1386 - E-Cigarettes

Sponsor: Representative Thomas Dermody (R)

Summary: Allows the commission to suspend or revoke tobacco sales certificate if holder sells or distributes tobacco products or electronic cigarettes at a location determined to be a public nuisance. https ://ig a.in. gov/s tatic -docu ments /4/6/ 3/5/4 63535 cf/HB 1386. 01.IN TR.pd f

Status: Introduced; referred to Public Policy Committee 1/13/2016.

H.B. 1393 - E-Cigarettes

Sponsor: Representative Dale DeVon (R)

Summary: Removes security requirements concerning e-liquids production.

https ://ig a.in. gov/s tatic -docu ments /a/a/ 7/8/a a7875 e3/HB 1393. 01.IN TR.pd f

Status: Introduced; referred to Public Policy Committee 1/13/2016.

S.B. 244 - Retail Licensing

Sponsor: Senator Jon Ford (R)

Summary: Stipulates that an applicant for a license to distribute tobacco products must submit a letter from the manufacturer that will be supplying the applicant with tobacco products that specifies the manufacturers intent to supply the applicant with tobacco products.

https ://ig a.in. gov/s tatic -docu ments /a/4/ 2/4/a 4248b f2/SB 0244. 01.IN TR.pd f

Status: Introduced; referred to Commerce and Technology Committee 1/7/2016.

S.B. 381 - Tobacco Taxes

Sponsor: Senator Ryan R. Mishler (R)

Summary: Modifies the stamp discount for cigarette distributors from $0.012 to $0.013 and changes the tax collection allowance from $0.006 to $0.007 for tobacco products other than cigarettes.

https ://ig a.in. gov/s tatic -docu ments /3/d/ a/f/3 daf5d 40/SB 0381. 01.IN TR.pd f

Status: Introduced; referred to Tax and Fiscal Policy Committee 1/11/2016.

S.B. 395 - E-Cigarettes

Sponsor: Senator Ryan R. Mishler (R)

Summary: Removes the requirement that the label on an e-liquid container must include a scannable code, including a quick response code, tied to a batch number.

https ://ig a.in. gov/s tatic -docu ments /9/7/ e/6/9 7e6db 0f/SB 0395. 01.IN TR.pd f

Status: Introduced; referred to Public Policy Committee 1/12/2016.

S.B. 396 - Retail Licensing Sponsor: Senator Ryan R. Mishler (R)

Summary: Stipulates that a valid tobacco sales certificate held by a retail tobacco store is transferable to subsequent owners of the retail tobacco store.

https ://ig a.in. gov/s tatic -docu ments /8/7/ e/c/8 7ec4d 79/SB 0396. 01.IN TR.pd f

Status: Introduced; referred to Public Policy Committee 1/12/2016.

IOWA

S.F. 2016 - E-Cigarettes, Smoking Bans, Tobacco Age Restrictions

Sponsor: Senator Herman Quirmbach (D)

Summary: Raises the legal age, beginning January 1, 2017, relating to tobacco, tobacco products, alternative nicotine products, vapor products, and cigarettes to 21.

Exempts any person who is 18 years of age or older before January 1, 2017, and at such time could lawfully smoke, use, posses, purchase, or attempt to purchase tobacco, tobacco products, alternative nicotine products, vapor products, or cigarettes.

https ://ww w.leg is.io wa.go v/doc s/pub licat ions/ LGI/8 6/SF2 016.p df

Status: Introduced; referred to Human Resources 1/13/2016.

KANSAS

Nothing to report.

KENTUCKY

H.B. 247 - E-Cigarettes, Tobacco Taxes

Sponsor: Representative David Watkins (D)

Summary: Requires every retailer and sub-jobber to take a physical inventory of all units of snuff, chewing tobacco, electronic cigarettes and all other types of tobacco products possessed by them or in their control at 11:59pm on July 31, 2016.

Requires every retailer and sub-jobber to file a return with Kentucky Department of Revenue on or before August 10, 2016 showing the entire inventory of units of snuff, chewing tobacco, electronic cigarettes and all other types of tobacco products possessed by them or in their control at 11:59pm on July 31, 2016.

Requires every retailer and sub-jobber to pay a floor tax rate equal to (a) $0.04 on each unit of snuff; (b)$0.04 on each single unit of chewing tobacco; (c) $0.08 on each half pound unit of chewing tobacco; (d) $0.13 on each pound unit of chewing tobacco; (e) 18% of the actual amount paid for the electronic cigarettes and (f) 5% of the actual amount paid for all other types of tobacco products in their possession or under their control on July 31, 2016. Requires that ever retailer, sub-jobber, resident wholesaler, nonresident wholesaler and unclassified acquirer of tobacco products to pay a floor stock tax at a proportionate rate equal to $0.50 on each (20 cigarettes in packages bearing a Kentucky tax stamp and unaffixed Kentucky tax stamps in their possession or control at 11:59 p.m. on July 31, 2016.

Requires that ever retailer, sub-jobber, resident wholesaler, nonresident wholesaler and unclassified acquirer of tobacco products shall take physical inventory of all cigarettes in packages bearing Kentucky tax stamps and all unaffixed Kentucky cigarette tax stamps possessed by them or in their control at 11:59 p.m. on July 31, 2016.

Requires that ever retailer, sub-jobber, resident wholesaler, nonresident wholesaler and unclassified acquirer of tobacco products to file a return with the Kentucky Department of Revenue on or before August 10, 2016 showing the entire wholesale and retail inventories of cigarettes in packages bearing Kentucky tax stamps and all unaffixed Kentucky cigarette tax stamps possessed by them or in their control at 11:59 p.m. on July 31, 2016.

Establishes that a licensed retail distributor of tobacco products shall be subject to the excise tax on purchases of untaxed tobacco products, except snuff and chewing tobacco, at 18% of the total purchase price as invoiced by the retail distributor's supplier.

Establishes that if the container, pouch, or package on which the tax is levied contains more than 16 ounces by net weight, the rate that shall be applied to the unit shall equal the sum of $0.78 plus $0.23 for each increment of 4 ounces or portion thereof exceeding 16 ounces sold and upon tobacco products sold, at the rate of 18% of the actual price for which the distributor sells tobacco products. Stipulates that snuff and chewing tobacco is exempted.

Stipulates that the floor stock tax may be paid in three installments. The first installment, in an amount equal to at least 1/3 of the total amount due is to be remitted with the return provided by the Kentucky Department of Revenue on or before August 10, 2016. The second installment, in an amount that brings the total amount paid to at least 2/3 of the total amount due is to be remitted on or before September 10, 2016 and the third installment, in an amount equal to the remaining balance is to be remitted on or before October 10, 2016.

Effective August 1, 2016 the excise tax upon chewing tobacco is increased from $0.65 to $0.78 per each pound unit sold.

Effective August 1, 2016 the excise tax upon chewing tobacco is increased from $0.40 to $0.48 per each half pound unit sold.

Effective August 1, 2016 the excise tax upon chewing tobacco is increased from $0.19 to $0.23 per each single unit sold.

Effective August 1, 2016 the excise tax upon snuff is increased from $0.19 to $0.23 per each 1.5 ounces or portion thereof by net weight sold.

Effective August 1, 2016 an additional tax of $1.06 will be levied on each twenty cigarettes.

Defines "cigarette" to specifically not include reference cigarettes or electronic cigarettes.

Defines "tobacco products" to include electronic cigarettes. Defines "electronic cigarette" to mean any device, regardless of shape or size, that (a) contains a heating element, battery, electronic circuit, power source or other electronic, chemical or mechanical means; and (b) can be used to deliver a vapor of nicotine or any other substance the use of which simulates smoking.

Stipulates that the definition of ""electronic cigarette" includes but is not limited to (a) the device, whether manufactured, distributed, marketed or sold as an e-cigarette, e-cigar, e-pipe or similar product and every variation thereof; (b) any vapor cartridge or other container of a liquid solution or other material that is intended to be used with or in the device and (c) any component of the device or related product, that may be sold with or without the device.

http: //www .lrc. ky.go v/rec ord/1 6RS/H B247/ bill. pdf

Status: Introduced 1/13/2016.

LOUISIANA

Nothing to report.

MAINE

Nothing to report.

MARYLAND

H.B. 71 - Tobacco Taxes

Sponsor: Delegate Eric Luedtke (D)

Summary: Requiring the Governor Larry Hogan (R) to include for fiscal year 2018 and each fiscal year thereafter an additional $11,000,000 in annual appropriations for tobacco use prevention and cessation programs.

Establishes the tobacco tax rate for cigarillos to be (a) $1.50 for each package of 10 or fewer cigarillos; (b) $3.00 for each package of at least 11 and not more than 20 cigarillos; (c) $0.15 for each cigarette in a package of more than 20 cigarillos and (d) $0.15 for each cigarette in a package of free sample cigarillos.

Increases the tobacco tax rate for cigarettes to (a) $1.50 for each package of 10 or fewer cigarettes; (b) $3.00 for each package of at least 11 and not more than 20 cigarettes; (c) $0.15 for each cigarette in a package of more than 20 cigarettes and (d) $0.15 for each cigarette in a package of free sample cigarettes.

Establishes the tax rate for "conventional moist snuff smokeless tobacco" is $3.00 per 1.5 ounce container, with a proportionate tax on weights of more than 1.2 ounces based on the net weight as provided by the manufacturer.

Establishes that for containers of "conventional moist snuff smokeless tobacco" that weigh less than 1.2 ounces the minimum tax rate shall be $3.00 per container.

Establishes that the tax rate for "single dose smokeless tobacco" is (a) $2.25 for each container of 15 or fewer doses and (b) $0.15 for each does in a container of more than 15 doses.

Stipulates that the tax rate for loose smoking tobacco is 74% of the wholesale price or $3.00 per 0.65 ounces whichever is greater.

Defines "cigarillo" to mean a roll for smoking, however labeled or named that (a) is made of tobacco or tobacco mixed with another ingredient; (b) weighs no more than 4.5 pounds per 1,000 rolls and (c) is wrapped in any substance containing tobacco and that has a cellulose acetate or other type of filter.

Defines "other tobacco products" to include "cigarillo".

Defines "cigar" to mean a cylindrical roll of cured tobacco.

Defines "conventional moist snuff smokeless tobacco" to mean any finely cut, ground or powdered tobacco intended for oral consumption without combustion that is not single-dose smokeless tobacco.

Defines "single dose smokeless tobacco" to mean any finely cut, ground or powdered tobacco or product derived from tobacco intended for consumption without combustion and is divided by the manufacturer into uniform individual dose servings. Stipulated that this includes snus, lozenges, tablets, sticks and strips.

Stipulates that "single dose smokeless tobacco" does not include any tobacco product that has been approved by the United States Food and Drug Administration for sale as tobacco cessation products, as a tobacco dependence product or for other medical purposes.

http: //mga leg.m aryla nd.go v/201 6RS/b ills/ hb/hb 0071f .pdf

Status: Introduced; referred to House Ways and Means Committee; House Economic Matters Committee 1/13/2016.

MASSACHUSETTS

Nothing to report.

MICHIGAN

Nothing to report.

MINNESOTA

Nothing to report.

MISSISSIPPI

Nothing to report.

MISSOURI

Nothing to report. MONTANA

Nothing to report.

NEBRASKA

Nothing to report.

NEVADA

Nothing to report.

NEW HAMPSHIRE

H.B. 1159 - E-Cigarettes, Retail Licensing

Sponsor: Representative John Hunt (R)

Summary: Modifies the definition of "tobacco products" applicable to retail licensing provisions.

Defines "tobacco products'' as any product containing tobacco including, but not limited to, cigarettes, smoking tobacco, cigars, chewing tobacco, snuff, pipe tobacco, smokeless tobacco, and smokeless cigarettes.

http: //www .genc ourt. state .nh.u s/bil l_sta tus/b illTe xt.as px?id =552& amp;t xtFor mat=p df&am p;v=c - urren t

Status: Filed 9/22/2015. Referred to House Commerce and Consumer Affairs Committee 1/6/2016. Hearing scheduled 1/21/2016.

H.B. 1208 - OTP Stamping, Tobacco Taxes

Sponsor: Representative Russell Ober (R)

Summary: Removes all reference to metering machines.

Requires all taxes on tobacco products be o be pre-collected for the purpose of convenience and facility only by the affixing of tax stamps for cigarettes and the filing of returns and payment of tax for other tobacco products under RSA 78:12.

Prohibits manufacturers, wholesalers, sub-jobbers and retailers from selling tobacco products in this state to any manufacturer, wholesaler, sub-jobber, vending machine operator, sampler, or retailer who does not possess a valid or current license.

States that manufacturers shall only sell tobacco products, without documentation to evidence tax paid under this chapter into this state to licensed wholesalers.

States that wholesalers shall only purchase tobacco products without documentation to evidence tax paid under this chapter from licensed manufacturers, and shall only sell tobacco products with documentation to evidence tax paid under this chapter to other licensed wholesalers, licensed sub-jobbers, licensed vending machine operators, licensed retailers and those persons exempted from the tobacco tax under RSA 78:7-b.

States that sub-jobbers shall only purchase tobacco products with documentation to evidence tax paid under this chapter from licensed wholesalers and other licensed sub-jobbers and shall only sell tobacco products with documentation to evidence tax paid under this chapter to other licensed sub-jobbers, licensed vending machine operators, licensed retailers and those persons exempted from the tobacco tax under RSA 78:7-b.

States that retailers shall only purchase tobacco products with documentation to evidence tax paid from a licensed wholesaler or licensed sub-jobber, and shall only sell in this state tobacco products with documentation to evidence tax paid to consumers.

Requires the Commissioner to adopt rules relative to the form for records of tobacco stamps and of all tobacco products manufactured, produced, purchased, distributed and sold. States that each manufacturer, wholesaler, sub-jobber, vending machine operator and retailer must keep complete and accurate records of all tobacco stamps and all such tobacco products manufactured, produced, distributed and sold.

Redefines "wholesaler" as any person engaged in the business of receiving, storing, purchasing and selling tobacco products from a manufacturer or wholesaler for distribution to other wholesalers, sub-jobbers, vending machine operators or retailers, but not directly to the consumer, except those persons exempted from the tobacco tax under RSA 78:7-b.

Redefines "sub-jobber" as any person engaged in the business of purchasing tobacco products from a wholesaler and selling tobacco products to other sub-jobbers, vending machine operators, and retailers.

Redefines "premium cigars" as cigars which: (a) are made entirely by hand of all natural tobacco leaf; (b) are hand constructed and hand wrapped; (c) weigh more than three pounds per 1,000 cigars; and (d) are kept in a humidor.

Defines “humidor” as a container or room specifically designed to store and age cigars within the optimal humidity range of 65% to 72% at room temperature, containing a humidification device or system designed to add or remove moisture from its interior space to maintain the desired level of humidity.

Defines "consumer” as a person who purchases, imports, receives or otherwise acquires any tobacco products subject to the tax imposed by this chapter for his or her own use.

Defines "licensed sampler" as s a sampler licensed under RSA 178.

http: //www .genc ourt. state .nh.u s/bil l_sta tus/b illTe xt.as px?id =307& amp;t xtFor mat=p df&am p;v=c - urren t

Status: Filed 9/16/2015. Introduced; referred to House Ways and Means Committee 1/6/2016. Hearing held 1/12/2016.

NEW JERSEY

A.B. 263 - Smoking Bans Sponsor: Assemblymember Jack Ciattarelli (R)

Summary: Prohibits tobacco use in dormitory and other student residence buildings of institutions of higher education.

Bill Text Unavailable.

Status: Filed 1/12/2016.

A.B. 559 - E-Cigarettes, OTP Stamping, Self-Service Display, Tobacco (Labeling/Packaging)

Sponsor: Assemblymember Nancy Pinkin (D)

Summary: Current version (12/7/2015): Provides that no person, either directly or indirectly by an agent or employee, or by a vending machine owned by the person or located in the person's establishment, shall sell, offer for sale, give, furnish, or distribute for commercial purpose at no cost or minimal cost or with coupons or rebate offers, liquid nicotine to any person unless the liquid nicotine is sold, offered for sale, given, furnished, or distributed for commercial purpose in a child-resistant container.

Defines “liquid nicotine container” to mean a bottle or other container of a liquid, wax, gel, or other substance containing nicotine, where the liquid or other contained substance is sold, marketed, or intended for use in a vapor product. States that “Liquid nicotine container” would not include a liquid or other substance containing nicotine in a cartridge that is sold, marketed, or intended for use in a vapor product, provided that such cartridge is prefilled and sealed by the manufacturer, with the seal remaining permanently intact through retail purchase and use; is only disposable, is not refillable, and is not intended to be opened by the consumer.

Defines “Vapor product” to mean any non-combustible product containing nicotine that employs a heating element, power source, electronic circuit, or other electronic, chemical, or mechanical means, regardless of shape or size, to produce vapor from nicotine in a solution or any form. States “Vapor product” would include, but not be limited to, any electronic cigarette, electronic cigar, electronic cigarillo, electronic pipe, or similar product or device, and any vapor cartridge or other container of nicotine in a solution or other form that is intended to be used with, or in, any such device. Further states “Vapor product” would not include any product that is approved, and that is regulated as a prescription drug delivery service, by the United States Food and Drug Administration under Chapter V of the Food, Drug, and Cosmetic Act.

Bill text is not yet available.

Status: Introduced 1/12/2016.

A.B. 617 - E-Cigarettes, Hookah

Sponsor: Assemblymember Joseph Lagana (D)

Summary: Permits the use of electronic smoking devices in vapor lounges.

Bill text not yet available.

Status: Introduced 1/12/2016.

A.B. 831 - E-Cigarettes, Tobacco Taxes

Sponsor: Assemblymember Angelica Jimenez (D)

Summary: Requires the Department of Treasury to create a fund for the purpose of supporting activities to prevent the use of tobacco and electronic smoking devices in the state and to promote awareness of health conditions associated with the use of tobacco and electronic smoking devices.

Requires a manufacturer of tobacco products or electronic smoking devices to relinquish $0.25 of every $1.00 spent on advertising or marketing of cigarettes, tobacco products or electric smoking devices in the state to the Department of Treasury for the use towards said fund.

Bill text unavailable.

Status: Filed 1/12/2016.

A.B. 842 - Tobacco Taxes

Sponsor: Assemblymember Annette Quijano (D)

Summary: Increases the tax imposed on little cigars to equal the rate of tax imposed on cigarettes. Defines "little cigar" to mean any roll for smoking made wholly or in part of tobacco, or other substance or substances other than tobacco, irrespective of size, shape or flavoring, which is wrapped or covered by a wrapper or cover made of tobacco, or any other substance or material containing tobacco, and which weighs, excluding the weight of any packaging or any mouthpiece or tip, not more than four pounds per 1,000 units.

Bill Text Unavailable.

Status: Filed 1/12/2016.

A.B. 893 - Smoking Bans

Sponsor: Assemblymember Valerie Vainieri Huttle (D)

Summary: Prohibits smoking at public parks and beaches.

No bill text is currently available.

Status: Introduced 1/12/2016

A.B. 1758 - Tobacco Taxes

Sponsor: Assemblymember Louis Greenwald (D)

Summary: Reduces cigarette tax rate by $00.30 per pack and reduces revenue dedicated to the Health Care Subsidy Fund. Bill text not yet available.

Status: Introduced 1/12/2016.

A.B. 1815 - Tobacco Taxes

Sponsor: Assemblymember Herbert Conaway (D)

Summary: Increases the sales and use tax imposed on tobacco products other than cigarettes, and upon moist snuff, to be parallel with the current cigarette tax rate.

Bill text not yet available.

Status: Introduced 1/12/2016.

A.B. 1832 - E-Cigarettes, Tobacco Taxes

Sponsor: Assemblymember Herbert Conaway (D)

Summary: Imposes a wholesale sales tax on electronic cigarettes and similar nicotine delivery products, changes tax base and requires licenses to conduct business in tobacco products.

Bill text not yet available.

Status: Introduced 1/12/2016.

A.B. 2129 - E-Cigarettes

Sponsor: Assemblymember Declan O'Scanlon (R)

Summary: Permits use of electronic smoking devices in vapor retail establishments.

Bill text not yet available.

Status: Introduced 1/12/2016.

A.B. 4251 - E-Cigarettes, Tobacco Taxes

Sponsor: Assemblymember Herbert Conaway (D)

Summary: Increases the general tax rate imposed on tobacco products under the tobacco products wholesale sales and use tax from $0.75 per ounce to $2.25 per ounce. Imposes a tobacco products wholesale sales and use tax on electronic cigarettes. Provides the wholesale sales tax rate for these unregulated products and their components is imposed at a rate of 75% to impose a tax burden in line with a similar tax burden imposed upon cigarettes under the Cigarette Tax Act.

Defines electronic cigarette as a device that can deliver nicotine, nicotine flavor or other chemicals or substances to a person inhaling from the device that electronically or by other means vaporizes a liquid solution into an aerosol mist or vapor, simulating the act of tobacco smoking. Provides that an electronic cigarette includes but is not limited to any components, parts or accessories thereof which contain nicotine, such as cartridges and vials, and includes any delivery device and components, whether or not sold separately.

Bill Text Unavailable.

Status: Filed 1/12/2016.

S.B. 284 - Tobacco Taxes

Sponsor: Senator Joseph Vitale (D)

Summary: Increases the sales and use tax imposed on tobacco products other than cigarettes, and upon moist snuff, to be parallel with the current cigarette tax rate.

http: //www .njle g.sta te.nj .us/2 016/B ills/ S0500 /284_ I1.PD F

Status: Introduced; referred to Senate Health, Human Services and Senior Citizens Committee 1/13/2016.

S.B. 293 - Smoking Bans

Sponsor: Senator Joseph Vitale (D)

Summary: Prohibits the use of smokeless tobacco in public schools. Defines the "use of smokeless tobacco" as the inhalation, chewing or placement in the oral cavity of snuff, chewing tobacco or any other matter or substance which contains tobacco.

http: //www .njle g.sta te.nj .us/2 016/B ills/ S0500 /293_ I1.PD F

Status: Introduced; referred to Senate Education Committee 1/12/2016.

S.B. 298 - E-Cigarettes, Flavored Products, Self-Service Display

Sponsor: Senator Joseph Vitale (D)

Summary: Expands the prohibition on the sale or distribution of flavored cigarettes to include flavored electronic smoking devices.

States that no person, either directly or indirectly by an agent or employee, or by a vending machine owned by the person or located in the person's establishment, shall sell, offer for sale, distribute for commercial purpose at no cost or minimal cost or with coupons or rebate offers, give or furnish, to a person any electronic smoking device or any cartridge or other component of the device or other related product, including a liquid refill, that has a characterizing flavor other than tobacco, clove or menthol.

http: //www .njle g.sta te.nj .us/2 016/B ills/ S0500 /298_ I1.PD F

Status: Introduced; referred to Senate Health, Human Services and Senior Citizens Committee 1/12/2016. S.B. 359 - E-Cigarettes, Tobacco Age Restrictions

Sponsor: Senator Richard Codey (D)

Summary: Raises the minimum age for purchase and sale of tobacco products and electronic smoking devices from 19 to 21. Provides that an electronic smoking device is a product that can be used to deliver nicotine or other substances to the person inhaling from the device, including, but not limited to, an electronic cigarette, cigar, cigarillo, or pipe, or any cartridge or other component of the device or related product.

http: //www .njle g.sta te.nj .us/2 016/B ills/ S0500 /359_ I1.PD F

Status: Introduced; referred to Senate Health, Human Services and Senior Citizens Committee 1/12/2016.

S.B. 376 - E-Cigarettes, Tobacco (Labeling/Packaging)

Sponsor: Senator Richard Codey (D)

Summary: Prohibits sale or distribution of liquid nicotine except in child-resistant containers.

Bill text not yet available.

Status: Introduced; referred to Senate Health, Human Services and Senior Citizens Committee 1/12/2016.

S.B. 531 - Smoking Bans

Sponsor: Senator Jennifer Beck (R)

Summary: Permits smoking in laboratories and other facilities that have been approved by the Department of Health to permit smoking for the purpose of medical or scientific health-related research.

http: //www .njle g.sta te.nj .us/2 016/B ills/ S1000 /531_ I1.PD F

Status: Introduced; referred Senate Health, Human Services and Senior Citizens committee 1/12/2016.

S.B. 602 - E-Cigarettes, Tobacco Age Restrictions

Sponsor: Senator Richard Codey (D)

Summary: Raises the minimum age for purchase and sale of tobacco products and electronic smoking devices from 19 to 21. Provides that electronic smoking device is a product that can be used to deliver nicotine or other substances to the person inhaling from the device, including, but not limited to, an electronic cigarette, cigar, cigarillo, or pipe, or any cartridge or other component of the device or related product.

http: //www .njle g.sta te.nj .us/2 014/B ills/ S1000 /602_ I1.HT M Status: Introduced; referred to Senate Health, Human Services and Senior Citizens Committee 1/14/2014. Hearing held; passed committee 6/5/2014. Passed Senate 6/30/2014. Referred to Assembly Health and Senior Services Committee 7/11/2014. Hearing held; passed committee; referred to Assembly Appropriations Committee 12/10/2015. Hearing held; passed committee 1/7/2016. Substituted for companion; passed Assembly 1/11/2016.

S.B. 3416 - Exotic Materials

Sponsor: Senator Raymond Lesniak (D)

Summary: Current version (12/17/2015): Establishes that no person may take, possess, transport, export, process, sell or offer for sale or ship, and no common or contract carrier may knowingly transport or receive for shipment any of the big five African species.

Defines "big five African species" as African elephant, African leopard, black and white rhinoceros and Cape buffalo.

Current version (12/17/2015): http: //www .njle g.sta te.nj .us/2 014/B ills/ S3500 /3416 _R2.H TM

Amended version (11/9/2015): http: //www .njle g.sta te.nj .us/2 014/B ills/ S3500 /3416 _R1.P DF

Introduced version: http: //www .njle g.sta te.nj .us/2 014/B ills/ S3500 /3416 _I1.P DF

Status: Introduced; referred to Senate Economic Growth Committee; hearing held; passed Committee; referred to Senate Budget and Appropriations Committee 8/10/2015. Amended; passed Committee 11/9/2015. Amended 12/17/2015. Passed Senate 1/7/2016. Substituted for companion; passed Assembly 1/11/2016.

NEW MEXICO

S.B. 77 - E-Cigarettes, Tobacco Taxes

Sponsor: Senator Howie Morales (D)

Summary: Establishes an excise tax at the rate of 26% on the product value of tobacco products.

Increases the excise tax on cigarettes packaged in lots of 20 or 25 from $0.083 to $0.133.

Increases the excise tax on cigarettes packaged in lots of ten from $0.166 to $0.266.

Increases the excise tax on cigarettes packaged in lots of five from $0.332 to $0.532.

Defines "tobacco product" to mean a product, other than cigarettes, that is (a) made of, contains or is derived from tobacco or nicotine and that is intended for human consumption through means that include smoking, heating, chewing, absorption, dissolution, inhalation, snorting and sniffing or (b) an electronic device that delivers nicotine or other substances to the person inhaling from the device.

Stipulates that the definition of "tobacco product" includes (a) a component, part or accessory of a tobacco product, regardless of whether it is sold separately and (b) a cigar, chewing tobacco, pipe tobacco, snuff, an electronic cigarette, an electronic cigar, an electronic pipe and an electronic hookah.

Excludes from the definition of "tobacco product" an time that is approved by the United States Food and Drug Administration for sale as a tobacco cessation product or for another therapeutic purpose.

http: //www .nmle gis.g ov/Se ssion s/16% 20Reg ular/ bills /sena te/SB 0077. pdf

Status: Filed 1/11/2016.

NEW YORK

A.B. 6505 - Smoking Bans

Sponsor: Assemblymember Marcos Crespo (D)

Summary: Stipulates that smoking is prohibited within a presumptively reasonable minimum distance of 15 feet from entrances or exits of public buildings or private buildings that contain state or municipal offices or educational facilities for elementary or secondary school students which shall be designated as no smoking zones. Stipulates that every rental agreement for a dwelling unit, in a multiple dwelling building with four or more units, shall include a disclosure of the smoking policy for the premises on which the dwelling unit is located. Requires the disclosure to state whether smoking is prohibited on the premises, allowed on the entire premises or allowed in limited areas on the premises. Stipulates that if the smoking policy allows smoking in limited areas on the premises, the disclosure must identify the areas on the premises where smoking is allowed.

http: //ass embly .stat e.ny. us/le g/?de fault _fld= %0D%0 A& ;bn=A 06505 & term= 2015& amp;T ext=Y

Status: Introduced; referred to Assembly Health Committee 3/25/2015. Referred to Assembly Health Committee 1/6/2016. Amended 1/12/2016.

NORTH CAROLINA

Nothing to report.

NORTH DAKOTA

Nothing to report.

OHIO

S.B. 54 - Retail Licensing

Sponsor: Representative Shannon Jones (R)

Summary: Current version (6/10/2015): States that no person shall knowingly sell at retail any liquid nicotine container that does not satisfy one of the following: a) the child-resistant effectiveness standards listed in 16 C.F.R. 1700.15(b), that are in effect on the effective date of this section; or b) child-resistant packaging guidelines adopted by the Department of Health. Exempts a) a liquid nicotine container that is prefilled and sealed by the manufacturer for use in an electronic cigarette and that is not intended to be opened by the consumer; and b) liquid nicotine container that is sold at retail on or after the date that final regulations are issued by the United States Food and Drug Administration, or any other federal agency with jurisdiction, that mandate child-resistant effectiveness standards for liquid nicotine containers.

Directs the Department of Health to develop guidelines and adopt rules establishing the standards for child-resistant packaging.

Defines liquid nicotine container as a bottle or other container of a liquid that contains nicotine and that is sold, marketed, or intended for use in an electronic cigarette.

Introduced version: States that unless specifically preempted by federal law, no person shall manufacture, regardless of location, for sale in; offer for sale in; sell in or into the stream of commerce in; or otherwise introduce into the stream of commerce in this state any liquid, whether or not the liquid contains nicotine, that is intended for human consumption and use in an electronic cigarette that is not in child-resistant packaging. Exempts electronic cigarette products sold in sealed, prefilled or disposable.

Directs the Department of Health to develop guidelines and adopt rules establishing the standards for child-resistant packaging.

Defines child resistant packaging as packaging to which both of the following apply: a) the packaging is designed or constructed to be significantly difficult, within a reasonable time, for a child under five years of age to open or to obtain a toxic or harmful amount of the substance contained in the packaging; b) the packaging is not difficult for a normal adult to open or to properly use the product packaged.

Current version (6/10/2015): http: //sea rch-p rod.l is.st ate.o h.us/ solar api/v 1/gen eral_ assem bly_1 - 31/bi lls/s b54/R S?for mat=p df

Introduced version: http: //sea rch-p rod.l is.st ate.o h.us/ solar api/v 1/gen eral_ assem bly_1 31/bi lls/s - b54/I N?for mat=p df

Status: Introduced 2/12/2015. Referred to Senate Transportation, Commerce and Labor Committee 2/18/2015. Hearing held 5/27/2015. Hearing held; substituted; passed committee 6/10/2015. Passed Senate 6/16/2015. Referred to House Health and Aging Committee 6/23/2015. Hearing held 10/14/2015. Hearing held 12/9/2015. Hearing scheduled 1/20/2016.

OKLAHOMA

H.B. 2272 - E-Cigarettes

Sponsor: Representative Mike Brown (D)

Summary: Prohibits the avertisement of vapor products on television and radio.

Defines "Vapor product" as noncombustible products, that may or may not contain nicotine, that employ a mechanical heating element, battery, electronic circuit, or other mechanism, regardless of shape or size, that can be used to produce a vapor in a solution or other form. States "Vapor products" shall include any vapor cartridge or other container with or without nicotine or other form that is intended to be used with an electronic cigarette, electronic cigar, electronic cigarillo, electronic pipe, or similar product or device and any vapor cartridge or other container of a solution, that may or may not contain nicotine, that is intended to be used with or in an electronic cigarette, electronic cigar, electronic cigarillo or electronic device. States "Vapor products" do not include any products regulated by the United States Food and Drug Administration under Chapter V of the Food, Drug, and Cosmetic Act.

http: //web serve r1.ls b.sta te.ok .us/c f_pdf /2015 -16%2 0INT/ hB/HB 2272% 20INT .PDF

Status: Introduced 2/1/2016.

OREGON

L.C. 5 - E-Cigarettes, Retail Licensing

Sponsor: Senator Laurie Monnes-Anderson (D)

Summary: Requires, on and after January 1, 2017, persons selling tobacco products or inhalant delivery systems in this state to be licensed by Department of Revenue. Provides department with power to discipline both licensees and persons selling tobacco products and inhalant delivery systems without license. Specifies that cities and counties may not require additional license to sell tobacco products and inhalant delivery systems and may not adopt ordinances imposing certain conditions on premises that sell tobacco products or inhalant delivery systems. Modifies provisions related to Oregon Health Authority’s power to inspect and impose civil penalties on persons selling tobacco products and inhalant delivery systems.

https ://ol is.le g.sta te.or .us/l iz/20 15I1/ Downl oads/ Commi tteeM eetin gDocu ment/ 82226

Status: Prefiled; Hearing held 1/13/2016.

PENNSYLVANIA

Nothing to report.

RHODE ISLAND

Nothing to report.

SOUTH CAROLINA

Nothing to report.

SOUTH DAKOTA

Nothing to report.

TENNESSEE

H.B. 1490 - Tobacco Taxes

Sponsor: Senator Mike Bell (R) Summary: Allows the Commissioner to require persons making sales of beer or tobacco products to retailers of such products to provide the Department of Revenue with information reports of such sales with the Department. Removes the requirement that persons making sales of such products to provide the Department of Revenue with information reports concerning sales and use taxes. Prohibits the Commissioner from issuing assessments based on such reports by other entities.

http: //www .capi tol.t n.gov /Bill s/109 /Bill /HB14 90.pd f

Status: Introduced 1/12/2016.

H.B. 1657 - Smoking Bans

Sponsor: Representative Jon Lundberg (R)

Summary: Authorizes political subdivisions to prohibit smoking on the grounds of any property owned by the political subdivision.

http: //www .capi tol.t n.gov /Bill s/109 /Bill /HB16 57.pd f

Status: Filed 1/14/2016.

TEXAS

Nothing to report.

UTAH

Nothing to report.

VIRGINIA

H.B. 627 - E-Cigarettes

Sponsor: Delegate Paul Krizek (D)

Summary: Authorizes the State of Virginia to tax vapor products at a rate of 15% of the manufacturer's sales price. Stipulates that vapor products include, vapor cartridge or other container of nicotine in a solution or other form that is intended to be used in an e-cigarette.

Authorizes counties, cities, and towns that are currently authorized to tax cigarettes to also tax vapor products.

http: //lis .virg inia. gov/c gi-bi n/leg p604. exe?1 61+fu l+HB6 27+pd f

Status: Introduced; referred to Finance Committee 1/11/2016.

H.B. 830 - Tobacco Taxes

Sponsor: Delegate Patrick Hope (D) Summary: Increases the cigarette tax from $0.30 per pack to $1.50 per pack.

http: //lis .virg inia. gov/c gi-bi n/leg p604. exe?1 61+fu l+HB8 30+pd f

Status: Filed 1/12/2016.

VERMONT

Nothing to report.

WASHINGTON

H.B. 2211 - E-Cigarettes, Retail Licensing, Tobacco Taxes

Sponsor: Representative Gerry Pollet (D)

Summary: Current version (6/25/2015): Imposes a 45% tax on vapor products. Creates the Public Health Services Account and directs a portion of vapor products tax revenue to the account. (Page 7)

States that no person may transport or cause to be transported in this state vapor products for sale other than: a) a licensed distributor in the distributor's own vehicle, a manufacturer's representative authorized to sell or distribute vapor products in this state or a licensed retailer in the retailer's own vehicle; or b) a person who has given notice to the board in advance of the commencement of transportation. (Page 11)

States that no person may qualify for a distributor's license or a retailer's license under this section without first undergoing a criminal background check. (Page 12)

States that a manufacturer that has manufacturer's representatives who sell or distribute the manufacturer's vapor products in this state must provide the board a list of the names and addresses of all such representatives and must ensure that the list provided to the board is kept current. (Page 15)

Stipulates that any vapor products in the possession of a person selling vapor products in this state acting as a distributor or retailer and who is not licensed as or a person who is selling vapor products in violation of this act, may be seized without a warrant. (Page 17)

Creates a tax exemption for the sale, use, consumption, handling, possession or distribution of vapor products by an Indian retailer during the effective period of a vapor product tax contract. (Page 34)

Authorizes the Governor to enter into vapor product tax contracts with federally recognized Indian tribes located within the geographical boundaries of the state. (Page 28)

Defines vapor product as any noncombustible product that employs a mechanical heating element, battery, or electronic circuit regardless of shape or size that can be used to produce vapor from a liquid solution or other substance, including an electronic cigarette, electronic cigar, electronic cigarillo, electronic pipe, or similar product or device. (Page 6) Current version (6/25/2015): http: //law files ext.l eg.wa .gov/ bienn ium/2 015-1 6/Pdf /Bill s/Hou se %20 Bills /2211 -S.pd f

Introduced version: http: //law files ext.l eg.wa .gov/ bienn ium/2 015-1 6/Pdf /Bill s/Hou se%20 Bills - /2211 .pdf

Status: Introduced; referred to Finance Committee 3/25/2015. Hearing held 4/3/2015. Executive session held 6/8/2015. Executive session held; substituted; passed committee 6/25/2015. Carried over to 2016 legislative session 7/10/2015. Introduced; referred to House Finance committee 1/11/2016.

S.B. 5124 - E-Cigarettes, Tobacco Age Restrictions

Sponsor: Senator Judy Warnick (R)

Summary: Current version (2/5/2015): Prohibits the sale of electronic smoking devices to minors.

Defines electronic smoking devices as any product containing or delivering nicotine or any other similar substance intended for human consumption that can be used by a person to simulate smoking through inhalation of vapor or aerosol from the product. Provides that electronic smoking device includes any component part of such product whether or not sold separately.

Current version (2/5/2015): http: //law files ext.l eg.wa .gov/ bienn ium/2 015-1 6/Pdf /Bill s/Sen ate%2 - 0Bill s/512 4-S.p df

Introduced version: http: //law files ext.l eg.wa .gov/ bienn ium/2 015-1 6/Pdf /Bill s/Sen ate%2 0Bill - s/512 4.pdf

Status: Introduced; referred to Law and Justice Committee 1/14/2015. Hearing held 1/22/2015. Executive session held; substituted; passed committee 2/5/2015. Placed on X file list 3/23/2015. Carried over to 2016 legislative session 7/10/2015. Introduced; referred to Senate Law and Justice committee 1/14/2016.

WEST VIRGINIA

Governor Earl Tomblin (D) State of the State - E-Cigarettes, Tobacco Taxes

Summary: During his State of the State address, Governor Earl Ray Tomblin (D) spoke of his priorities for 2016 and the 2016 Legislative Session.

The Governor stated that, “All of us in this chamber tonight and those watching and listening across the state know we are experiencing budget challenges unseen in more than a generation." He has proposed raising taxes, cutting spending and borrowing money from the Rainy Day Fund. The Governor says that the reasons are due primarily to the decline of the coal industry.

His proposed tax increases include an increase in taxes on tobacco products and a first ever tax on E-cigarettes. The Governor stated that, "I am introducing legislation to increase our state’s tobacco tax by $0.45 a pack to a total of $1.00. This increase will be considered too high by some people and too low by others. But it strikes a balance that protects retailers in our border counties and discourages our young people from smoking, while generating nearly $71.5 million annually in new revenue."

H.B. 2634 - Tobacco Taxes

Sponsor: Delegate Don Perdue (D)

Summary: Increases the excise tax on sales of cigarettes from $0.55 to $1.55 on each 20 cigarettes, or in like ration on any part thereof.

Statute defines "cigarettes" as any roll for smoking made, wholly or in part, of tobacco, irrespective of size or shape and whether or not the tobacco is flavored, adulterated or mixed with any ingredient, the wrapping or cover of which is made of paper or any substance or material, except tobacco. Provides that this includes any roll of tobacco wrapped in any substance containing tobacco which, because of its appearance, the type of tobacco used in the filler, or its packing and labeling, is likely to be offered to, or purchased by, consumers as a cigarette.

http: //www .legi s.sta te.wv .us/B ill_T ext_H TML/2 016_S ESSIO NS/RS /bill s/hb2 634%2 0intr .pdf

Status: Introduced; referred to House Health and Human Resources Committee; House Finance Committee 2/6/2015. Carried over to 2016 legislative session 3/14/2015. Reintroduced 1/13/2016.

H.B. 2953 - Tobacco Taxes

Sponsor: Delegate Tom Fast (R)

Summary: Raises the excise tax on a pack of 20 cigarettes from $0.55 to $1.00. Levies an excise tax is hereby levied and imposed on the sale or use of, other than cigarettes, tobacco products at a rate equal to 39% of the wholesale price of each article or item of tobacco product other than cigarettes sold by the wholesaler or subjobber dealer, whether or not sold at wholesale, or if not sold, then at the same rate upon the use by the wholesaler or dealer.

Statute defines "cigarettes" as any product that contains nicotine, is intended to be burned or heated under ordinary conditions of use, and consists of or contains 1) any roll of tobacco wrapped in paper or in any substance not containing tobacco; or 2) tobacco, in any form, that is functional in the product, which, because of its appearance, the type of tobacco used in the filler, or its packaging and labeling, is likely to be offered to, or purchased by, consumers as a cigarette; or 3) any roll of tobacco wrapped in any substance containing tobacco which, because of its appearance, the type of tobacco used in the filler, or its packaging and labeling, is likely to be offered to, or purchased by, consumers as a cigarette as that term is described in this subsection.

Statute defines "Other tobacco product" or "tobacco products other than cigarettes" as snuff and chewing tobacco and any other tobacco product that is intended by the seller to be consumed by means other than smoking and any cigar, pipe tobacco or other tobacco product other than cigarettes.

http: //www .legi s.sta te.wv .us/B ill_S tatus /bill s_tex t.cfm ?bill doc=h b2953 %20in tr.ht m& ;yr=2 015&a - mp;se sstyp e=RS& amp;i =2953 Status: Introduced; referred to House Health and Human Resources Committee 2/24/2015. Carried over to 2016 legislative session 3/14/2015. Reintroduced 1/13/2016.

H.B. 4023 - Tobacco Taxes

Sponsor: Representative Larry Rowe (D)

Summary: Increases the excise tax on sales of cigarettes from $0.55 to $1.55 per each 20 cigarettes.

Increases the excise tax on other tobacco products beginning January 1, 2017 from 7% to 39%.

Requires the Alcohol Beverage Control Commissioner to work with the Tax Commissioner of the State of West Virginia to raise an additional $120 million from the sales of alcohol beverages subject to the provisions of this chapter and tobacco products.

http: //www .legi s.sta te.wv .us/B ill_T ext_H TML/2 016_S ESSIO NS/RS /bill s/hb4 023%2 0intr .pdf

Status: Introduced; referred to House Health and Human Resources Committee 1/14/2016.

S.B. 125 - Tobacco Taxes

Sponsor: Senator Jeffrey Kessler (D)

Summary: Increases the excise tax on sales of cigarettes from $0.55 to $1.55 per pack of cigarettes.

Statute defines "cigarettes" as any roll for smoking made, wholly or in part, of tobacco, irrespective of size or shape and whether or not the tobacco is flavored, adulterated or mixed with any ingredient, the wrapping or cover of which is made of paper or any substance or material, except tobacco. Provides that this includes any roll of tobacco wrapped in any substance containing tobacco which, because of its appearance, the type of tobacco used in the filler or its packing and labeling, is likely to be offered to or purchased by, consumers as a cigarette.

http: //www .legi s.sta te.wv .us/B ill_T ext_H TML/2 016_S ESSIO NS/RS /bill s/hb2 634%2 0intr .pdf

Status: Introduced; referred to Senate Health and Human Resources Committee 1/15/2016.

S.B. 139 - Tobacco Taxes

Sponsor: Senator Robert Plymale (D)

Summary: Increases the excise tax on sales of cigarettes from $0.55 to $1.55 on every 20 cigarettes or in like ratio on any part thereof..

Statute defines "cigarettes" as any roll for smoking made, wholly or in part, of tobacco, irrespective of size or shape and whether or not the tobacco is flavored, adulterated or mixed with any ingredient, the wrapping or cover of which is made of paper or any substance or material, except tobacco. Provides that this includes any roll of tobacco wrapped in any substance containing tobacco which, because of its appearance, the type of tobacco used in the filler or its packing and labeling, is likely to be offered to or purchased by, consumers as a cigarette.

http: //www .legi s.sta te.wv .us/B ill_T ext_H TML/2 016_S ESSIO NS/RS /bill s/hb2 634%2 0intr .pdf

Status: Introduced; referred to Senate Health and Human Resources Committee 1/13/2016.

S.B. 248 - E-Cigarettes, Tobacco Age Restrictions

Sponsor: Senator Ron Stollings (D)

Summary: Raises the legal age for purchase of tobacco, tobacco products, tobacco-derived products, alternative nicotine products and vapor products to 21.

http: //www .legi s.sta te.wv .us/B ill_T ext_H TML/2 016_S ESSIO NS/RS /bill s/SB2 48%20 intr. pdf

Status: Introduced; referred to Senate Health and Human Services Committee 1/13/2016.

WISCONSIN

S.B. 30 - Retail Licensing

Sponsor: Senator Julie Lassa (D)

Summary: Prohibits the sale of novelty lighters to minors and prohibits the display for retail sale of novelty lighters in an area of a retail establishment that is accessible to the general public.

Defines "novelty lighter" as a device containing a combustible fuel intended for use in igniting cigarettes, cigars, or pipes, if any of the following applies:

1) The device is designed to resemble a cartoon character, toy, gun, watch, musical instrument, vehicle, animal, food or beverage. 2) The device plays musical notes, has flashing lights or has other features that are appealing to or intended for use by juveniles.

Excludes from this definition:

1) A device manufactured prior to 1980. 2) A device intended for use in igniting a fire in a fireplace or wood stove or in a charcoal or gas grill. 3) A standard disposable or refillable lighter that is printed or decorated with logos, labels, decals, artwork or heat−shrinkable sleeves.

Establishes a penalty of up to $100 for a person who violates this section.

http: //doc s.leg is.wi scons in.go v/201 5/rel ated/ propo sals/ sb30. pdf

Status: Introduced; referred to Senate Committee on Judiciary and Public Safety 2/11/2015. Hearing held 10/1/2015. Hearing held; passed committee 10/23/2015. Passed Senate 1/12/2016. S.B. 528 - Retail Licensing

Sponsor: Senator Alberta Darling (R)

Summary: Allows a municipality that has issued a cigarette or tobacco products retailer license to suspend, revoke, or refuse to renew the license under certain circumstances.

Establishes the following circumstances to allow a municipality to suspend, revoke, or renew a retail license: a)violates certain restrictions relating to the sale of cigarettes and tobacco b)keeps premises that are disorderly, riotous, indecent, or improper c)failed to maintain the premises according to sanitation standards d)convicted of manufacturing, distributing, or delivering, or possessing with the intent to manufacture, distribute, or deliver, a controlled substance e)knowingly allows another person on the licensed premises to manufacture, distribute, or deliver, or possess with the intent to manufacture, distribute, or deliver, a controlled substance.

http: //doc s.leg is.wi scons in.go v/201 5/rel ated/ propo sals/ sb528 .pdf

Status: Introduced; referred to Elections and Local Government Committee 1/8/2016.

WYOMING

Nothing to report.

WASHINGTON, D.C.

Nothing to report.

FEDERAL

Nothing to report.