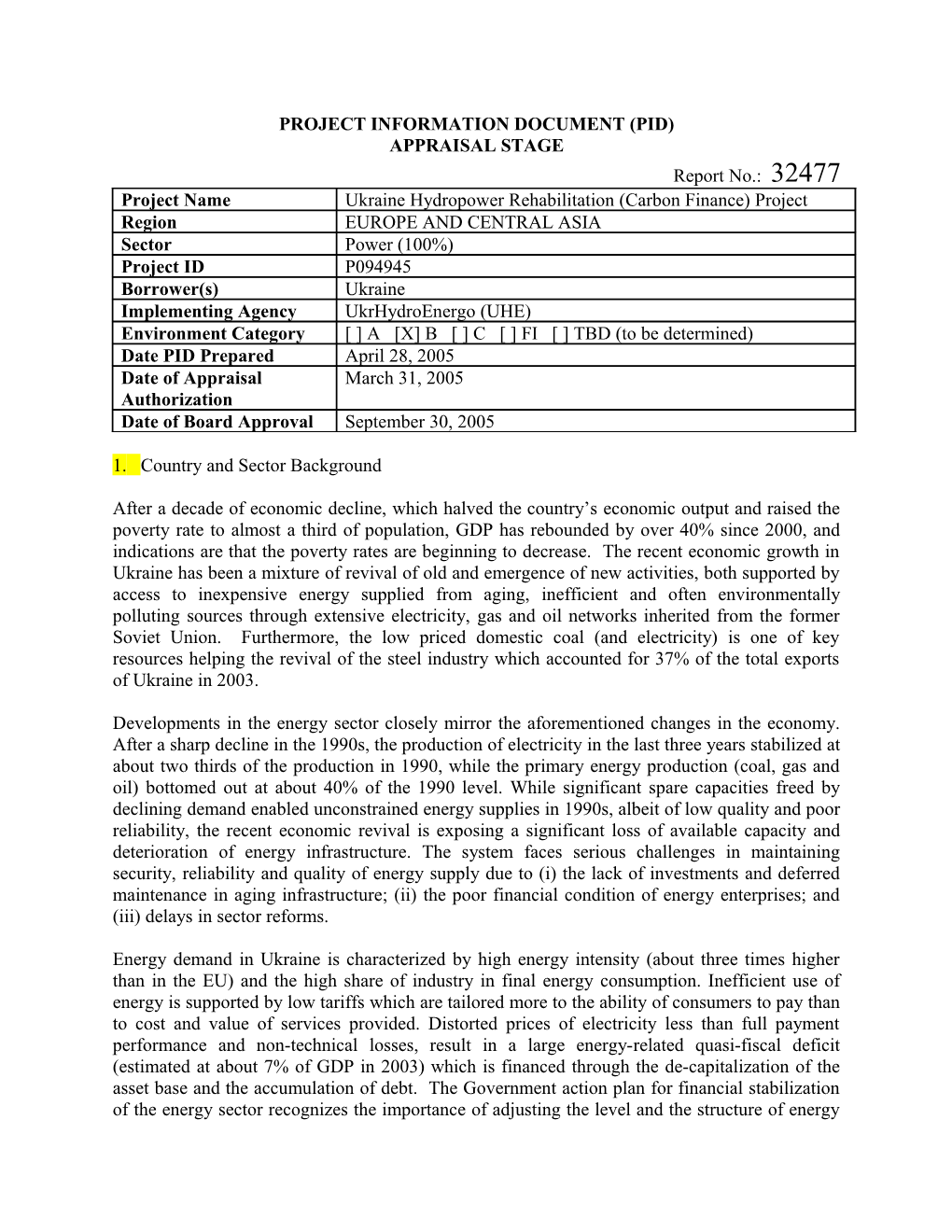

PROJECT INFORMATION DOCUMENT (PID) APPRAISAL STAGE Report No.: 32477 Project Name Ukraine Hydropower Rehabilitation (Carbon Finance) Project Region EUROPE AND CENTRAL ASIA Sector Power (100%) Project ID P094945 Borrower(s) Ukraine Implementing Agency UkrHydroEnergo (UHE) Environment Category [ ] A [X] B [ ] C [ ] FI [ ] TBD (to be determined) Date PID Prepared April 28, 2005 Date of Appraisal March 31, 2005 Authorization Date of Board Approval September 30, 2005

1. Country and Sector Background

After a decade of economic decline, which halved the country’s economic output and raised the poverty rate to almost a third of population, GDP has rebounded by over 40% since 2000, and indications are that the poverty rates are beginning to decrease. The recent economic growth in Ukraine has been a mixture of revival of old and emergence of new activities, both supported by access to inexpensive energy supplied from aging, inefficient and often environmentally polluting sources through extensive electricity, gas and oil networks inherited from the former Soviet Union. Furthermore, the low priced domestic coal (and electricity) is one of key resources helping the revival of the steel industry which accounted for 37% of the total exports of Ukraine in 2003.

Developments in the energy sector closely mirror the aforementioned changes in the economy. After a sharp decline in the 1990s, the production of electricity in the last three years stabilized at about two thirds of the production in 1990, while the primary energy production (coal, gas and oil) bottomed out at about 40% of the 1990 level. While significant spare capacities freed by declining demand enabled unconstrained energy supplies in 1990s, albeit of low quality and poor reliability, the recent economic revival is exposing a significant loss of available capacity and deterioration of energy infrastructure. The system faces serious challenges in maintaining security, reliability and quality of energy supply due to (i) the lack of investments and deferred maintenance in aging infrastructure; (ii) the poor financial condition of energy enterprises; and (iii) delays in sector reforms.

Energy demand in Ukraine is characterized by high energy intensity (about three times higher than in the EU) and the high share of industry in final energy consumption. Inefficient use of energy is supported by low tariffs which are tailored more to the ability of consumers to pay than to cost and value of services provided. Distorted prices of electricity less than full payment performance and non-technical losses, result in a large energy-related quasi-fiscal deficit (estimated at about 7% of GDP in 2003) which is financed through the de-capitalization of the asset base and the accumulation of debt. The Government action plan for financial stabilization of the energy sector recognizes the importance of adjusting the level and the structure of energy tariffs to fully cover supply costs and to provide price incentives for energy savings and investments in energy efficiency. Furthermore, the Government is committed to develop a strategic action plan for continuing ownership transformation and attracting private sector investments in the energy sector.

Ukraine has a potentially significant opportunity to attract revenue for energy sector projects that reduce emissions of greenhouse gases, such as renewable energy or energy efficiency activities. Under the terms of the Kyoto Protocol (KP) industrialized country signatories (including Ukraine) have committed to reduce their greenhouse gas or "carbon" emissions by an average of 5.2 percent compared with 1990 emissions in the period 2008-2012 (often referred to as the first commitment period). Due to the downturn in Ukraine’s economy, and under any plausible scenario of economic growth and energy efficiency, Ukraine will be emitting less greenhouse gas than its allowance under the Kyoto Protocol. Ukraine is estimated to have excess emission allowances at least until 2020

At the same time many industrialized countries have emissions that are substantially above their targets under the Kyoto Protocol and which are expected to increase by the end of 2012. 1 Industrialized countries together need around 5.5 billion tCO2e to meet their obligations under the Kyoto Protocol during the first commitment period. They are expected to fill more than half of this compliance gap through a combination of domestic measures and trading under the EU Emission Trading Scheme. The remaining shortage of emission reductions (approximately 2.5 2 billion tCO2e ) is expected to be fulfilled through: (i) engaging in project based transactions where a buyer in an industrialized country helps to finance a project in a developing or transition economy country that reduces greenhouse gas emissions3 and in return receives “emission credits”; and (ii) international emissions trading. Ukraine has potential access to both of these sources of revenue and is the second largest potential seller of surplus allowances after Russia.

2. Objectives

The main objectives of the Hydropower Rehabilitation (Carbon Finance) Project are to improve the reliability, efficiency and safety of the operation of UHE hydraulic structures and equipment and to improve their environmental performance. UHE environmental performance will improve through the reduction in emissions of greenhouse gases, the installation of nonpolluting turbine runners, and the elimination of oil leaks into Dnipro River.

Greenhouse gas emission (GHG) reductions will be reduced through: (i) the generation of renewable energy which will displace thermal power units which are dispatched on the basis of variable operating cost merit order after hydro and nuclear power units, and (ii) the improvement of energy efficiency through the rehabilitation and replacement of existing outdated and inefficient equipment. The Project will additionally increase the useful, safe and effective lifetime of existing UHE hydro plants using the same hydro resources of Dnipro and Dnistro Rivers. This will improve the

1 Carbon dioxide equivalent (CO2e) is the universal measurement used to indicate the global warming potential of each of the six greenhouse gases. Carbon dioxide is the reference gas against which the other greenhouse gases are measured. 2 Potentially worth between $18 and 30 billion in revenues depending upon the timing, price and nature of the sale 3 compared with the level of emissions that would have been generated in the absence of the proposed project overall management and technology standard of the company as well as the quality of generated energy. The project will furthermore allow the company to increase its annual revenues through the sale of additional energy to the wholesale market and by providing the Ukrainian power system with regulation services.

3. Rationale for Bank Involvement

Ukraine is the 11th largest emitter of GHGs in the world4 and has one of the largest “surpluses” of emission reductions (estimated at about 1.8 billion tons of CO2 equivalent) under the KP. GHG emissions in the energy sector of Ukraine account for about 75% of all GHG emissions in the country. The energy sector offers ample opportunities for the cost-effective reduction of GHG emissions which in turn could be used to attract significant financial support to meet the growing investment needs of the sector.

Unfortunately, Ukraine’s capacity to implement the KP’s mechanisms is low and the country is poorly prepared to capitalize on this opportunity. The World Bank can help Ukraine build its institutional capacity in this area through its unique Carbon Financing (CF) experience. In addition through its pivotal position in the Carbon Market, the World Bank can mobilize carbon finance support for projects that reduce greenhouse gases in the energy sector. These projects would provide a valuable learning opportunity for Ukraine’s further use of the KP mechanisms.

4. Description

The Ukraine Hydropower Rehabilitation (Carbon Finance) Project will rehabilitate at least 46 hydroelectric units5 at nine hydropower plants6 along the Dnipro River in central Ukraine by the end of 2012. Twenty six of these units will be rehabilitated by the end of 2006. Through the Project outdated and worn-out hydraulic power, electro-mechanical and hydro-mechanical equipment will be replaced. Civil works will also be conducted on hydraulic structures and computer-aided dam safety monitoring systems will be installed.

Rehabilitation of these units will increase the available hydropower capacity by 160 MW (by 2012). Through increased capacity and energy savings, hydropower generation is expected to rise to 78 GWh by 2007 and to continue to gradually increase to 471 GWh by 2012.

Between 2008 and 2012 (the first commitment period of the KP), around 1,300,000 tonnes of CO2e are expected to be reduced through the displacement of thermal power generation and a reduction in organic fuel firing.

5. Financing

4 This assessment is based on the study “Modeling and Analysis of Greenhouse Gases Emissions in Ukraine” conducted by the Pacific Northwest National Laboratory (USA) and Agency for Rational Energy Use and Ecology (Ukraine) in 2001. 5 out of at least 64 to be implemented by 2017 6 Kiev Pump Storage PP and HPP (Kiev), Kaniv HPP (Kaniv), Kreminchug HPP (Svetlovodsk), Dniprodzerzhinsk HPP (Dniprodzerzhinsk), DniproGES HPP-1 and DniproGES HPP-2 (Zaporizhya), Kakhovka HPP (Nova Kakhovka) Source: ($m.) UHE 246 INTERNATIONAL BANK FOR RECONSTRUCTION AND 100 DEVELOPMENT CARBON FINANCE 10 Total 356

6. Implementation

Implementation of the Hydropower Rehabilitation (Carbon Finance) Project would be the responsibility of the project beneficiary, UHE. It is the successor company of DHE (DniproHydroEnergo), which successfully implemented the first stage of hydropower rehabilitation under the Bank-supported Hydropower Rehabilitation and System Control Project (Loan 3865). UHE is a fully state-owned open joint stock company formed in February 2004 through a merger of the state-owned companies DHE (operating a cascade of hydropower plants on the Dnipro river) and DnisterHydroEnergo (operating a hydropower plant on the Dnister river). UHE operates nine hydropower plants (including the Kyiv pumped storage plant) with the total installed capacity of about 4,600 MW. These hydro power plants operate during peak-load hours, and are the main flexible, regulating and emergency source of energy in the Ukrainian power system.

The Project is implemented in the context of the Government Energy Sector Reform and Development Program that aims to improve the security and reliability of energy supplies and to facilitate the unimpeded operation of the energy market, both domestically and internationally.

7. Sustainability

The current situation and the outlook for the sustainable development of the energy and carbon markets can be briefly outlined as follows:

- Market participants. Despite some recent concentration of market power in holding companies in the electricity and coal sectors, these sectors are still dominated by relatively independent public and private market players which are engaged in electricity and coal trading. The gas sector is dominated by Naftogaz, a vertically integrated state-owned holding company which acts as the “single buyer” of all gas supplied in the country or transported through Ukraine. While unbundling in the gas sector does not appear very likely in the near-term, the electricity and coal sectors are in need of further market liberalization which would help improve sector performance and attract investments in aging power plants, distribution networks and coal mines.

- Market sophistication. The most advanced market mechanism is in the power sector which is based on the power pool (single-buyer) model established in mid-1990s. The next step in its development will be the introduction of a bilateral contracting market and a balancing mechanism which will be implemented over the next 4 to 5 years. Subject to the rationalization of state subsidies and mitigation of social and environmental impacts of coal sector restructuring, the coal market is also ripe for further opening which would further stimulate competition among power producers.

- Market regulation. The power and gas industry is regulated by the NERC while the coal prices are set by the Government. The Government still exerts a considerable amount of influence on regulatory decisions across the energy sector, which partially explains why energy tariffs are below the cost and value of services provided. To sustain its strong economic growth, Ukraine needs to restore macroeconomic fundamentals including the improvement of financial discipline and the gradual elimination of price distortions in the energy sector. The growing economy and falling poverty rate will also created a more favorable environment for further price adjustments, which will be best implemented through strengthening the independence of NERC and better targeting of fiscally affordable and socially adequate subsidies to the sector and/or to consumers.

- Harmonization with the EU Internal Energy Market. The EU and Russia are the major trading partners of Ukraine and energy is one of the main dimensions of this trade. By virtue of its location, Ukraine has been able to secure significant volumes of oil and gas transport through its pipelines and competitive prices for the oil and gas imports. Gradual convergence towards the principles governing the regulation and operation of the EU Internal Energy Market (gas and electricity) would strengthen Ukraine’s position as the preferred route for future increases in Russian gas deliveries to Europe. Furthermore, it will open new opportunities for increasing access to the EU electricity market and expand electricity trade. Finally and most importantly, by introducing best practices tested in the EU energy market, consumers in Ukraine would benefit from improved security, reliability and quality of energy supply.

- Carbon Finance. The window of opportunity for engaging in carbon transactions is rapidly closing. There is uncertainty in the market about what will happen at the end of the KP’s first commitment period (2012), and whether a second commitment period will be negotiated or not. The bulk of project transactions have therefore been targeted at meeting compliance needs up to 2012, emphasizing the need for quick action given the long lead time between project preparation and the ‘first yield’ of emission reductions. This is particularly true for infrastructure investments where some of the more sizeable project opportunities reside. Despite these constraints, in some segments of the market it is felt that even in the absence of a second commitment period under the KP emission reductions will continue to have value. As an example, many of the Bank’s carbon funds are prepared to purchase emission reductions for period of 10 years or more; although the preference is for the majority of reductions to be produced by 2012.

8. Lessons Learned from Past Operations in the Country/Sector

One factor that is critical for success is that the beneficiary requires very good technical skills, strong project ownership and commitment to results. UHE has already demonstrated that it has such ownership and commitment under the prior hydropower operation, which was implemented in an adverse reform environment when the power sector was operating mainly through barter and was not yet commercialized and thus required a downsizing of the investment program. The financial viability of the electricity market has greatly improved since that operation with payments to UHE at about 94% in the past two years. To better ensure that UHE would be able to carry out this follow-on operation, the parallel World Bank Energy Sector Reform and Development Program Adjustable Program Loan (Energy APL) would ensure that proper project management arrangements are in place and are supported by consultants and technical assistance as necessary.

Another important lesson learned is that projects intended to benefit energy producers, such as UHE, ultimately depend upon the ability of energy suppliers to collect revenues from consumers. This is particularly critical for large scope investment operations which require significant local financing. The past experience in Ukraine has shown that initial government commitment to ensure the enabling financial environment through comprehensive reforms requires sustained support from IFIs and bilateral donors throughout the program/ project implementation. In this context, cross-sector adjustment operations have led to the most tangible results on the ground. Therefore, the overarching Energy APL has been aligned with the Bank policy lending under which the Government has committed to further improve financial discipline in the energy sector, including reaching full payment performance, and adopted a comprehensive action plan for financial stabilization of energy enterprises.

9. Safeguard Policies (including public consultation)

Safeguard Policies Triggered by the Project Yes No Environmental Assessment (OP/BP/GP 4.01) [X] [ ] Natural Habitats (OP/BP 4.04) [ ] [X] Pest Management (OP 4.09) [ ] [X] Cultural Property (OPN 11.03, being revised as OP 4.11) [ ] [X] Involuntary Resettlement (OP/BP 4.12) [ ] [X] Indigenous Peoples (OD 4.20, being revised as OP 4.10) [ ] [X] Forests (OP/BP 4.36) [ ] [X] Safety of Dams (OP/BP 4.37) [X] [ ] Projects in Disputed Areas (OP/BP/GP 7.60)* [ ] [X] Projects on International Waterways (OP/BP/GP 7.50) [X] [ ]

10. List of Factual Technical Documents

Country Assistance Strategy (2003) Decision of the Cabinet of Ministers of Ukraine on the establishment of Commission for Energy Sector Reform and Development, No.1091, August 25, 2004. Signed Letter of Agreement on Japanese Grant No. 053330, November 18, 2004 Decision of the Cabinet of Ministers of Ukraine on the preparation of Hydropower Rehabilitation Project for possible financing under the Energy APL, December 29, 2004. Ukraine's Country Economic Memorandum (2004) Environmental Management Plan, March 9, 2005

* By supporting the proposed project, the Bank does not intend to prejudice the final determination of the parties' claims on the disputed areas Project Idea Note, Ukraine UkrHydroEnergo Hydro Rehabilitation Project in Support of the Energy Sector Reform and Development Program, January 25, 2005.

11. Contact:

Dejan R. Ostojic Title: Sr. Energy Specialist Tel: +380-44-490-6671 Fax: +380-44-490-6670 Email: [email protected]

12. For more information contact:

The InfoShop The World Bank 1818 H Street, NW Washington, D.C. 20433 Telephone: (202) 458-5454 Fax: (202) 522-1500 Web: http://www.worldbank.org/infoshop

wb12009 D:\Docs\2018-04-16\0687f6bedb549a9c4a60b5459ef6e8e6.doc