Aerospace & Defense Industry in Arizona

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Student Career Center 2013-2014 Calendar

Student Career Center 2013-2014 Calendar Scroll down to see 2013-2014 scheduled: Post-Secondary Planning Wednesday Program Representative Visits Post-Secondary Program Representatives Campus Lunch Visits Post-Secondary & Career Exploration Field Trips Other Important Dates & Events August 2013 POST-SECONDARY PLANING WEDNESDAY Sunnyslope Post-Secondary Education Visits 8:00-9:00 A.M. LUNCH SCHEDULES M-T-TH-F 11:00-12:35 Monday Tuesday Wednesday Thursday Friday 12 13 14 15 16 19 20 21 22 23 26 Senior Credit Checks 27 Senior Credit Checks 28 Senior Credit Checks 29 Senior Credit Checks 30 Senior Credit Checks And AZCIS – Media Center And AZCIS – Media Center And AZCIS – Media Center And AZCIS – Media Center And AZCIS – Media Center POST-SECONDARY PLANNING WEDNESDAY Sunnyslope September 2013 8:00-9:00 A.M. LUNCH SCHEDULES Post-Secondary Education Visits M-T-TH-F 11:00-12:35 Monday Tuesday Wednesday Thursday Friday 2 3 4 5 6 Post Plan: The Art Institutes Cafe: Brillare Hairdressing Academy Cafe: West-MEC Post Plan: Universal Tech Institute Cafe: Grand Canyon University Post Plan: ASU Cafe: College America Café: Army National Guard Post Plan: Brillare Hairdressing Academy Café: 9 10 11 12 Amigos de las Americas 13 Café: Post Plan: Paul Mitchell Cosmetology Cafe: Glendale Commuity College Cafe: Arizona Christian University Cafe: Goodwill Industries Post Plan: Cafe: Cafe: Studio Academy Beauty Cafe: GateWay CC Post Plan: ITT Technical Institute Café: Post Plan: Grand Canyon University Café: After School Career Ctr: U of A WEST FIELD TRIP -

PEENEMUENDE, NATIONAL SOCIALISM, and the V-2 MISSILE, 1924-1945 Michael

ABSTRACT Title of Dissertation: ENGINEERING CONSENT: PEENEMUENDE, NATIONAL SOCIALISM, AND THE V-2 MISSILE, 1924-1945 Michael Brian Petersen, Doctor of Philosophy, 2005 Dissertation Directed By: Professor Jeffrey Herf Departmen t of History This dissertation is the story of the German scientists and engineers who developed, tested, and produced the V-2 missile, the world’s first liquid -fueled ballistic missile. It examines the social, political, and cultural roots of the prog ram in the Weimar Republic, the professional world of the Peenemünde missile base, and the results of the specialists’ decision to use concentration camp slave labor to produce the missile. Previous studies of this subject have been the domain of either of sensationalistic journalists or the unabashed admirers of the German missile pioneers. Only rarely have historians ventured into this area of inquiry, fruitfully examining the history of the German missile program from the top down while noting its admi nistrative battles and technical development. However, this work has been done at the expense of a detailed examination of the mid and lower -level employees who formed the backbone of the research and production effort. This work addresses that shortcomi ng by investigating the daily lives of these employees and the social, cultural, and political environment in which they existed. It focuses on the key questions of dedication, motivation, and criminality in the Nazi regime by asking “How did Nazi authori ties in charge of the missile program enlist the support of their employees in their effort?” “How did their work translate into political consent for the regime?” “How did these employees come to view slave labor as a viable option for completing their work?” This study is informed by traditions in European intellectual and social history while borrowing from different methods of sociology and anthropology. -

Community College of the Air Force Alabama a & M University

Community College of the Air Force Alabama A & M University University of Alabama at Birmingham Amridge University University of Alabama in Huntsville Alabama State University University of Alabama System Office The University of Alabama Central Alabama Community College Athens State University Auburn University at Montgomery Auburn University Birmingham Southern College Chattahoochee Valley Community College Concordia College Alabama South University-Montgomery Enterprise State Community College James H Faulkner State Community College Faulkner University Gadsden State Community College New Beginning College of Cosmetology George C Wallace State Community College-Dothan George C Wallace State Community College-Hanceville George C Wallace State Community College-Selma Herzing University-Birmingham Huntingdon College Heritage Christian University J F Drake State Community and Technical College J F Ingram State Technical College Jacksonville State University Jefferson Davis Community College Jefferson State Community College John C Calhoun State Community College Judson College Lawson State Community College-Birmingham Campus University of West Alabama Lurleen B Wallace Community College Marion Military Institute Miles College University of Mobile University of Montevallo Northwest-Shoals Community College University of North Alabama Northeast Alabama Community College Oakwood University Alabama Southern Community College Prince Institute Southeast Reid State Technical College Bishop State Community College Samford University Selma University -

USSRC Annual 2004

ANNUAL REPORT 2004 Mars Exploration Rover: An artist's concept portrays a NASA Mars Exploration Rover on the surface of Mars. Two rovers, Spirit and Opportunity, have the mobility and toolkit to function as a robotic geologist. Resembling sparks from a fireworks display, this image taken by a JPL camera onboard NASA's Hubble Space Telescope shows delicate filaments that are sheets of debris from a stellar explosion in the nearby Large Magellanic Cloud galaxy. — Image Credit: NASA/JPL/Hubble Heritage Team (STScI/AURA) 2 SPECTRUM Celebrating Exploration PREFACE “Spirit” and “Opportunity” are more than just ideals to Americans. They are viewed as inalienable rights. The American Spirit that fueled a revolution in 1776 has always looked forward, believing that the “The urge to explore has been the opportunities are boundless. primary force in evolution since the first water creatures began to President Thomas Jefferson believed that when he commissioned reconnoiter the land. The quest for Meriwether Lewis and William Clark to embark on the exploration of the the larger reality, the need to see Louisiana Purchase in May 1804, a journey that took the American flag to the Pacific Ocean. President John Kennedy believed it in May 1961 when the whole — from the mountaintop he challenged the nation to reach the moon within a decade. The first or the moon is the basic imperative American flag was planted on the moon on July 20, 1969, and five others of consciousness, the hallmark of joined it later. This year, as the nation celebrated the two hundredth our species.” anniversary of the Lewis and Clark Expedition and the thirty-fifth —Dr. -

Arizona Nursing Programs Monthly Meeting Minutes

Arizona Nursing Programs Monthly Meeting Minutes Thursday, December 10, 2020 Meeting convened at 11:01 a.m. by AZBN Staff Hrabe 1) Attendance (Board Staff Dave Hrabe, Cindy George and Kathy Scott present; See Appendix A for list of Attendees) 2) Deans and Directors Education Meetings: a. Information coming soon: Kathy is reviewing topics and will get more information out to you at the beginning of the year. 3) Education Committee: a. Will be reviewing and updating the format/ membership to increase participation from practice settings 4) New fingerprint process (Cindy George) Board is accepting electronic fingerprints. a. Information is on AZBN.ORG website. Students must go all the way through the application and pay. Then they have to select ‘electronic’ fingerprinting which is a separate application. CNAs have been using this mechanism without major problems. https://azbn.gov/licenses-and-certifications/electronic-fingerprint-inst ructions 5) COVID Survey Preliminary Results, Q3 survey (Dave Hrabe) a. Dave Hrabe presented the preliminary results between cohorts graduation pre-pandemic vs cohorts graduating in Q2. The major findings were that the number of virtual/augmented reality hours increased 1061%; direct care clinical hours showed a 26.8% drop in Q2--both were statistically significant (p < .05). 6) NCSBN Education Survey (Dave Hrabe) a. The 2020 Education Survey will be sent early in January. This survey will allow AZ programs to benchmark with other programs across the country. AZ-specific data (e.g. concurrent enrollment programs) will be a part of the survey but analyzed separately. 7) Innovations/Concerns/ Problems a. No issues were identified. -

Approved CNA Programs

Arizona State Board of Nursing Approved Nursing Assistant Programs The following is a list of nursing assistant training programs currently approved by the Executive Director of the Arizona State Board of Nursing. Site visits are conducted on all nursing assistant programs every two years. To review the annual pass rates for these For programs with current violations/disciplinary action programs please click here or visit: please click here or visit: https://azbn.gov/education/nursing-assistant-and- https://azbn.gov/education/nursing-programs-lists medication-assistant-program Programs with an (*) after the name are currently offering an Advanced Placement Program. Please contact the program directly regarding program costs, start dates and other details you may need. Academy for Caregiving Excellence Program Code 3030 Program Type Independent Phone 520-338-4402 Year of Approval 2017 4725 N. 1st Ave. Tucson Accord Healthcare Institute* Program Code 8912 Program Type Independent Phone 602-714-3439 Year of Approval 2010 3816 N. 27th Ave. Phoenix Alhambra High School Program Code 9308 Program Type High School Phone 602-764-6002 Year of Approval 2019 3839 W. Camelback Rd. Phoenix Arizona Career Institute Program Code 4250 Program Type Private Non-Accredited School Phone 520-576-0606 Year of Approval 2020 6143 E. Fairmount St. Tucson Arizona Medical Training Institute* Program Code 4167 Program Type Private Post-Secondary Phone 480-835-7679 Year of Approval 2000 1530 N. Country Club Dr., Suite 11 Mesa Tuesday, March 24, 2020 Arizona Technical Training Institute Program Code 4500 Program Type Private Non-Accredited School Phone 602-607-5317 Year of Approval 2020 2515 E. -

Contents • Abbreviations • International Education Codes • Us Education Codes • Canadian Education Codes July 1, 2021

CONTENTS • ABBREVIATIONS • INTERNATIONAL EDUCATION CODES • US EDUCATION CODES • CANADIAN EDUCATION CODES JULY 1, 2021 ABBREVIATIONS FOR ABBREVIATIONS FOR ABBREVIATIONS FOR STATES, TERRITORIES STATES, TERRITORIES STATES, TERRITORIES AND CANADIAN AND CANADIAN AND CANADIAN PROVINCES PROVINCES PROVINCES AL ALABAMA OH OHIO AK ALASKA OK OKLAHOMA CANADA AS AMERICAN SAMOA OR OREGON AB ALBERTA AZ ARIZONA PA PENNSYLVANIA BC BRITISH COLUMBIA AR ARKANSAS PR PUERTO RICO MB MANITOBA CA CALIFORNIA RI RHODE ISLAND NB NEW BRUNSWICK CO COLORADO SC SOUTH CAROLINA NF NEWFOUNDLAND CT CONNECTICUT SD SOUTH DAKOTA NT NORTHWEST TERRITORIES DE DELAWARE TN TENNESSEE NS NOVA SCOTIA DC DISTRICT OF COLUMBIA TX TEXAS NU NUNAVUT FL FLORIDA UT UTAH ON ONTARIO GA GEORGIA VT VERMONT PE PRINCE EDWARD ISLAND GU GUAM VI US Virgin Islands QC QUEBEC HI HAWAII VA VIRGINIA SK SASKATCHEWAN ID IDAHO WA WASHINGTON YT YUKON TERRITORY IL ILLINOIS WV WEST VIRGINIA IN INDIANA WI WISCONSIN IA IOWA WY WYOMING KS KANSAS KY KENTUCKY LA LOUISIANA ME MAINE MD MARYLAND MA MASSACHUSETTS MI MICHIGAN MN MINNESOTA MS MISSISSIPPI MO MISSOURI MT MONTANA NE NEBRASKA NV NEVADA NH NEW HAMPSHIRE NJ NEW JERSEY NM NEW MEXICO NY NEW YORK NC NORTH CAROLINA ND NORTH DAKOTA MP NORTHERN MARIANA ISLANDS JULY 1, 2021 INTERNATIONAL EDUCATION CODES International Education RN/PN International Education RN/PN AFGHANISTAN AF99F00000 CHILE CL99F00000 ALAND ISLANDS AX99F00000 CHINA CN99F00000 ALBANIA AL99F00000 CHRISTMAS ISLAND CX99F00000 ALGERIA DZ99F00000 COCOS (KEELING) ISLANDS CC99F00000 ANDORRA AD99F00000 COLOMBIA -

Nclex® Results for All First-Time Candidates Educated in Arizona 2011 - 2017 Registered Nurse

NCLEX® RESULTS FOR ALL FIRST-TIME CANDIDATES EDUCATED IN ARIZONA 2011 - 2017 REGISTERED NURSE YEAR NATIONAL PASS RATE % AZ PASS RATE % 2011 87.90% 91.32% 2012 90.34% 94.02% 2013 83.04% 88.25% 2014 81.79% 89.99% 2015 84.51% 87.03% 2016 84.56% 86.03% 2017 87.12% 88.07% 2011 2012 2013 2014 2015 2016 2017 SCHOOL **Accred. Type Pass % Pass % Pass % Pass % Pass % Pass % Pass % Arizona College Board 75 80 Arizona State University Board/CCNE 90.09 94.5 88.55 87.67 85.91 86.99 92.83 Arizona Western College Board/ACEN 86.3 86.11 86.96 86.44 85.71 84.21 85.71 Brookline College f/k/a IIA College - BS Board/ACEN/ CCNE NA 100 93.18 88.1 94.19 86.99 83.2 Brown Mackie College – Phoenix (CLOSED) Board NA NA 94.74 75 70 100 60 Carrington College (FKA Apollo College) Board/ACEN 91.8 89.33 56.82 84.44 93.44 85.51 78.95 Central Arizona College Board/ACEN 86 92.88 83.64 82.98 97.83 83.02 83.33 Chamberlain College Board/CCNE 88.61 93.28 85.95 88.98 88.64 88.3 87.14 Cochise College Board/ACEN 75.41 98.08 82.35 91.49 89.06 86.25 86.15 Coconino CC Board 88.61 94.87 76.74 73.53 80 84.21 88.24 Eastern Arizona College Board 87.72 84.71 82.81 78.46 86.96 90.91 95.24 Grand Canyon University Board/CCNE 95.79 97.02 89.94 91.47 78.92 72.89 75.2 MaricopaNursing Chandler-Gilbert CC Board/ACEN 97.87 97.44 93.88 89.06 89.19 92.42 92.75 MaricopaNursing Estrella Mountain CC Board/ACEN 94.83 94.59 80.61 77.5 73.33 82.46 90 MaricopaNursing GateWay CC Board/ACEN 96.05 99.41 95.38 94.02 92.71 93.58 91.74 MaricopaNursing Glendale CC Board/ACEN 92.5 88.19 84.18 88.41 91.41 90.64 -

Business Administration/Business Management Education Report CIP 52.0201 Cochise, Pima, SC

Business Administration/Business Management Education Report CIP 52.0201 Cochise, Pima, SC Business Administration and Management, General CIP 2010: A program that generally prepares individuals to plan, organize, direct, and control the functions and processes of a firm or organization. Includes instruction in management theory, human resources management and behavior, accounting and other quantitative methods, purchasing and logistics, organization and production, marketing, and business decision-making. Target Occupations 17,426 6.7% $32.49/hr Jobs (2015) % Change (2016-2021) Median Hourly Earnings 8% below National average Nation: 5.3% Nation: $41.73/hr 2016 Annual Median Hourly Growth Location Occupation Jobs Openings Earnings (2016 - 2021) Quotient (2016) Social and Community Service 522 30 $25.43/hr 17.62% 1.11 Managers Cost Estimators 621 35 $28.25/hr 10.47% 0.88 General and Operations Managers 5,694 202 $35.50/hr 7.92% 0.85 Administrative Services Managers 800 26 $37.13/hr 7.63% 0.90 Management Analysts 2,011 63 $29.38/hr 7.46% 0.82 Chief Executives 581 21 $50.39/hr 7.06% 0.60 Transportation, Storage, and 258 9 $31.70/hr 6.20% 0.73 Distribution Managers First-Line Supervisors of Housekeeping and Janitorial 708 26 $14.67/hr 5.93% 1.05 Workers Sales Managers 1,043 35 $41.83/hr 5.47% 0.88 Gaming Supervisors 106 3 $21.72/hr 4.72% 1.27 Managers, All Other 2,889 91 $36.26/hr 4.36% 1.26 First-Line Supervisors of Personal 1,170 32 $13.68/hr 3.85% 1.87 Service Workers Construction Managers 959 26 $26.76/hr 2.29% 0.86 Industrial Production -

19960024281.Pdf

NASA Technical Paper 3615 Review of Our National Heritage of Launch VehiclesUsing Aerodynamic Surfaces and Current Use of These by Other Nations (Center Director's Discretionary Fund Project Number 93-05Part II) C. Barret April 1996 NASA Technical Paper 3615 Review of Our National Heritage of Launch VehiclesUsing Aerodynamic Surfaces and Current Use of These by Other Nations (Center Director's Discretionary Fund Project Number 93-05Part II) C. Barret Marshall Space Flight Center • MSFC, Alabama National Aeronautics and Space Administration Marshall Space Flight Center ° MSFC, Alabama 35812 April 1996 TABLE OF CONTENTS Page I. INTRODUCTION .................................................................................................................. 1 A. Background ....................................................................................................................... 1 B. Problem Statement ............................................................................................................ 1 C. Approach ........................................................................................................................... 2 II° REVIEW OF NATIONAL HERITAGE OF LAUNCH VEHICLES USING AERODYNAMIC SURFACES TO PROVIDE FLIGHT STABILITY AND CONTROL ............................................................................................................................. 3 A. Dr. Wemher von Braun's V-2 .......................................................................................... 4 B. Pershing ........................................................................................................................... -

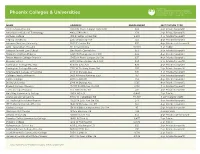

Phoenix Colleges & Universities

City of Phoenix Community and Economic Development Department Phoenix Colleges & Universities 200 W. Washington St., 20th Floor | Phoenix, AZ 85003 www.phoenix.gov/econdev | 602-262-5040 NAME ADDRESS ENROLLMENT INSTITUTION TYPE Allen School-Phoenix 15650 N Black Canyon Hwy B210 823 2-yr Private for-profit American Institute of Technology 440 S 54th Ave 278 2-yr Private for-profit Anthem College 1515 E Indian School Rd 2,238 4-yr Private for-profit Argosy University 2233 W Dunlap Ave 743 4-yr Private for-profit Arizona Christian University 2625 E Cactus Rd 635 4-yr Private not-for-profit ASU - Downtown Phoenix 411 N Central Ave 10,400 4-yr Public Arizona Summit Law School One North Central Ave 953 4-yr Private for-profit Brookline College-Phoenix 2445 W Dunlap Ave Ste 100 844 4-yr Private for-profit Brown Mackie College-Phoenix 13430 N Black Canyon Ste 190 637 4-yr Private for-profit Bryman School 2250 W Peoria Ave Ste A-100 594 2-yr Private for-profit Carrington College-Phoenix 8503 N 27th Ave 676 4-yr Private for-profit Carrington College-Phoenix 2701 W Bethany Home Rd 513 2-yr Private for-profit Chamberlain College of Nursing 2149 W Dunlap Ave 515 4-yr Private for-profit College America-Phoenix 9801 N Metro Parkway East 451 4-yr Private for-profit Collins College 4750 S 44th Pl 254 4-yr Private for-profit DeVry University 2149 W Dunlap Ave 1,565 4-yr Private for-profit Everest College-Phoenix 10400 N 25th Ave Ste 190 2,761 4-yr Private for-profit Fortis College-Phoenix 555 N 18 St Ste 110 271 2-yr Private for-profit GateWay Community -

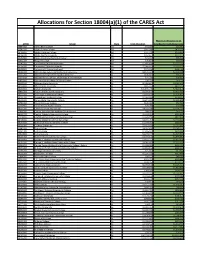

Allocations for Section 18004(A)(1) of the CARES Act

Allocations for Section 18004(a)(1) of the CARES Act Maximum Allocation to be OPEID School State Total Allocation Awarded for Institutional Costs 00884300 Alaska Bible College AK $42,068 $21,034 02541000 Alaska Career College AK $941,040 $470,520 04138600 Alaska Christian College AK $201,678 $100,839 00106100 Alaska Pacific University AK $254,627 $127,313 03160300 Alaska Vocational Technical Center AK $71,437 $35,718 03461300 Ilisagvik College AK $36,806 $18,403 01146200 University Of Alaska Anchorage AK $5,445,184 $2,722,592 00106300 University Of Alaska Fairbanks AK $2,066,651 $1,033,325 00106500 University Of Alaska Southeast AK $372,939 $186,469 00100200 Alabama Agricultural & Mechanical University AL $9,121,201 $4,560,600 04226700 Alabama College Of Osteopathic Medicine AL $186,805 $93,402 04255500 Alabama School Of Nail Technology & Cosmetology AL $77,735 $38,867 03032500 Alabama State College Of Barber Styling AL $28,259 $14,129 00100500 Alabama State University AL $6,284,463 $3,142,231 00100800 Athens State University AL $845,033 $422,516 00100900 Auburn University AL $15,645,745 $7,822,872 00831000 Auburn University Montgomery AL $5,075,473 $2,537,736 00573300 Bevill State Community College AL $2,642,839 $1,321,419 00101200 Birmingham-Southern College AL $1,069,855 $534,927 00103000 Bishop State Community College AL $2,871,392 $1,435,696 03783300 Blue Cliff Career College AL $105,082 $52,541 04267900 Brown Beauty Barber School AL $70,098 $35,049 00101300 Calhoun Community College AL $4,392,248 $2,196,124 04066300 Cardiac And