QUESTIONS FROM MEMBERS OF THE COUNCIL NO.1 Under Procedure Rule No 11, Councillor C Cooke will ask the Leader of the Council, Councillor D Cook, the following question:-

"We are told the decision to close Tamworth’s Golf Course was based on a forecast on-going loss to the Council of £140,000 per year. Please can you itemise in detail the incomes and expenditures forecast to show exactly what is expected to be spent on what items and what each of the sources of income are expected to be?"

Since re-opening the course in March 2013 the Council has focused on providing good quality affordable golf. This has been achieved in the most cost effective way possible. The Councils annual budget pages show clearly the budgeted expenditure by type and also the expected income. So far this year the golf Course budget has under recovered on its income targets. The overall net effect this financial year is that the course will require a net revenue subsidy of circa £100k. This is in addition to the £100k capital spent in re-opening the course. We simply do not have the required finance at present to re-open the very dated club house.

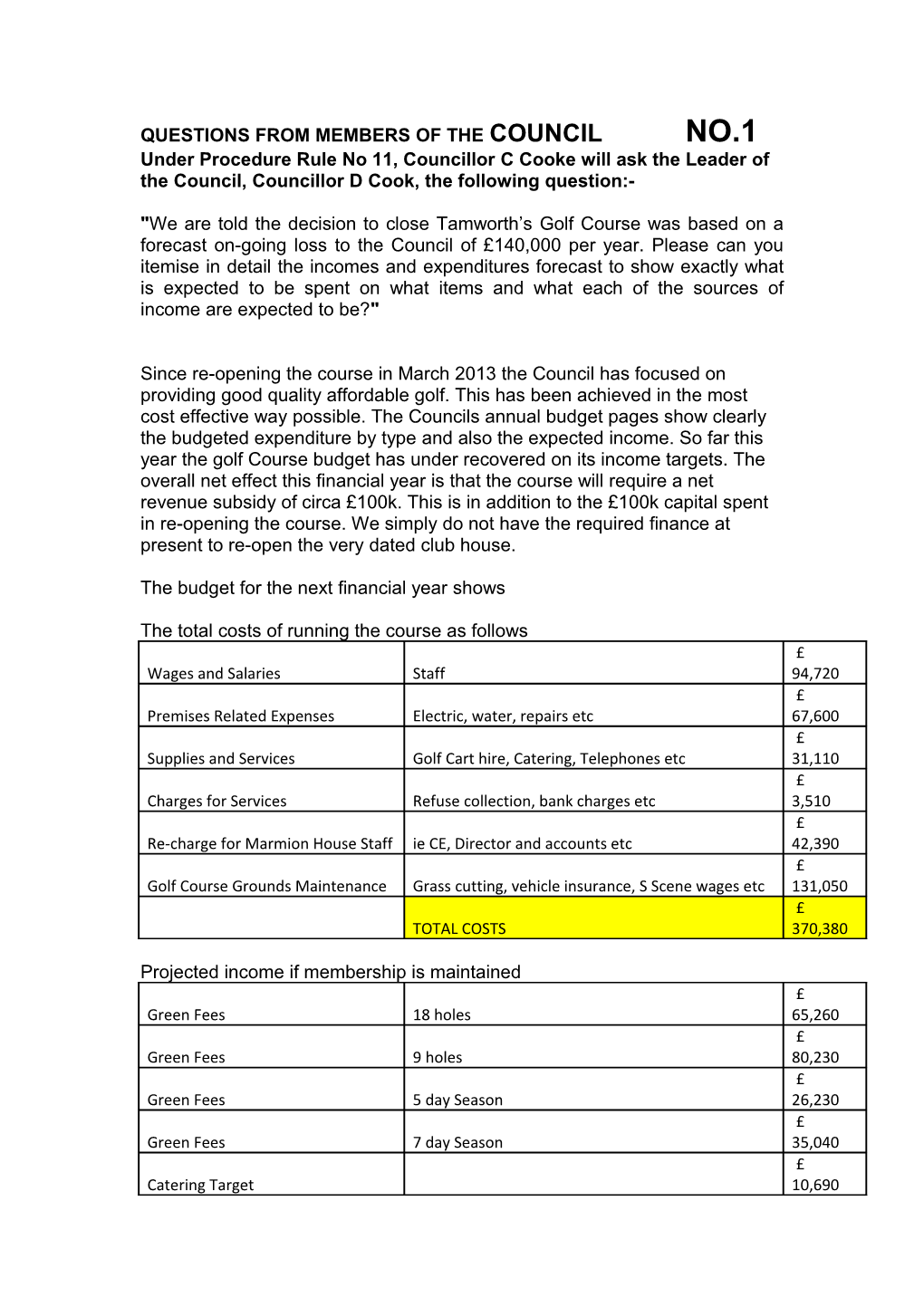

The budget for the next financial year shows

The total costs of running the course as follows £ Wages and Salaries Staff 94,720 £ Premises Related Expenses Electric, water, repairs etc 67,600 £ Supplies and Services Golf Cart hire, Catering, Telephones etc 31,110 £ Charges for Services Refuse collection, bank charges etc 3,510 £ Re-charge for Marmion House Staff ie CE, Director and accounts etc 42,390 £ Golf Course Grounds Maintenance Grass cutting, vehicle insurance, S Scene wages etc 131,050 £ TOTAL COSTS 370,380

Projected income if membership is maintained £ Green Fees 18 holes 65,260 £ Green Fees 9 holes 80,230 £ Green Fees 5 day Season 26,230 £ Green Fees 7 day Season 35,040 £ Catering Target 10,690 £ Sales ie golf balls etc 1,000 £ Buggy hire 9,000 £ TOTAL projected income 227,450

So projected income is £227,450, less projected costs of £370,380 means the tax-payer will subsidise the course in 2014/15 to the tune of £142,930.

I have the full breakdown that will appear in the 2014/15 budget book here with me now, you can have it with pleasure. You were also given this year’s budget book which carries similar costs for the golf course.

I have stated there is nothing to hide, nothing will be confidential where humanly possible and I have stuck to this.

Cllr Cooke, I have read a few things on the Herald web-site about these costs being artificially inflated, if you have concerns please raise them as this would be a crime.

2014/2015 GX0304 Golf Course (In House)

Base Total Technical Policy Budget Budget Adjustment Changes 2013/14 2014/15 Account Details £ £ £ £

Expenditure 0 Employees 00101 Salaries 0 92,700 0 92,700 01101 Wages 0 2,020 0 2,020 0 Employees 0 94,720 0 94,720 1 Premises Related 10001 Structural Repairs 0 7,190 0 7,190 Expenses Fire & Security 10018 0 2,060 0 2,060 Arrangement 11010 Electricity 0 12,330 0 12,330 13010 Rates 0 23,070 0 23,070 Water Charges 14010 0 1,250 0 1,250 Metered Cleaning & Domestic 16001 0 1,540 0 1,540 Supplies 16020 Contract Cleaning 0 8,870 0 8,870 18010 Contents Insurance 0 1,010 0 1,010 Contrib Building 19010 0 10,280 0 10,280 Repairs Fund 1 Premises Related Expenses 0 67,600 0 67,600 3 Supplies and Equipment Furniture & 30101 0 3,200 0 3,200 Services Material Golf Cart Hire 30148 0 7,000 0 7,000 Expenditure 30160 Purch Stock Retail 0 3,080 0 3,080 30340 Other Expenses 0 8,460 0 8,460 30511 Catering Purchases 0 3,080 0 3,080 31010 Protective Clothing 0 200 0 200 32070 Crb Personnel Checks 0 200 0 200 33040 Telephones 0 1,500 0 1,500 Public Liability 35010 0 1,390 0 1,390 Insurance Promotion & 35022 0 3,000 0 3,000 Marketing 3 Supplies and Services 0 31,110 0 31,110 4 Charges for Commercial Refuse 41010 0 1,500 0 1,500 Services Recharge 45040 Cash Security 0 790 0 790 45050 Bank Charges 0 1,220 0 1,220 4 Charges for Services 0 3,510 0 3,510 6 Charges within Chief Executives 62040 0 9,380 0 9,380 Fund Office Corporate Director 62041 0 9,540 0 9,540 Resources Corp Director 62042 0 23,470 0 23,470 Community Serv 6 Charges within Fund 0 42,390 0 42,390 Expenditure Sub Total 0 239,330 0 239,330

83 Customer and Income 83101 Green Fees - 18 Holes 0 (65,260) 0 (65,260) Client Receipts 83102 Green Fees - 9 Holes 0 (80,230) 0 (80,230) Green Fees - 5 Day 83104 0 (26,230) 0 (26,230) Season Green Fees - 7 Day 83106 0 (35,040) 0 (35,040) Season 83141 Catering Sales 0 (10,690) 0 (10,690) 83158 Sale Of Retail Stock 0 (1,000) 0 (1,000) Golf Course Buggy 83198 0 (9,000) 0 (9,000)