ChangeWave Research: Corporate Software Purchasing Trends February 2, 2007

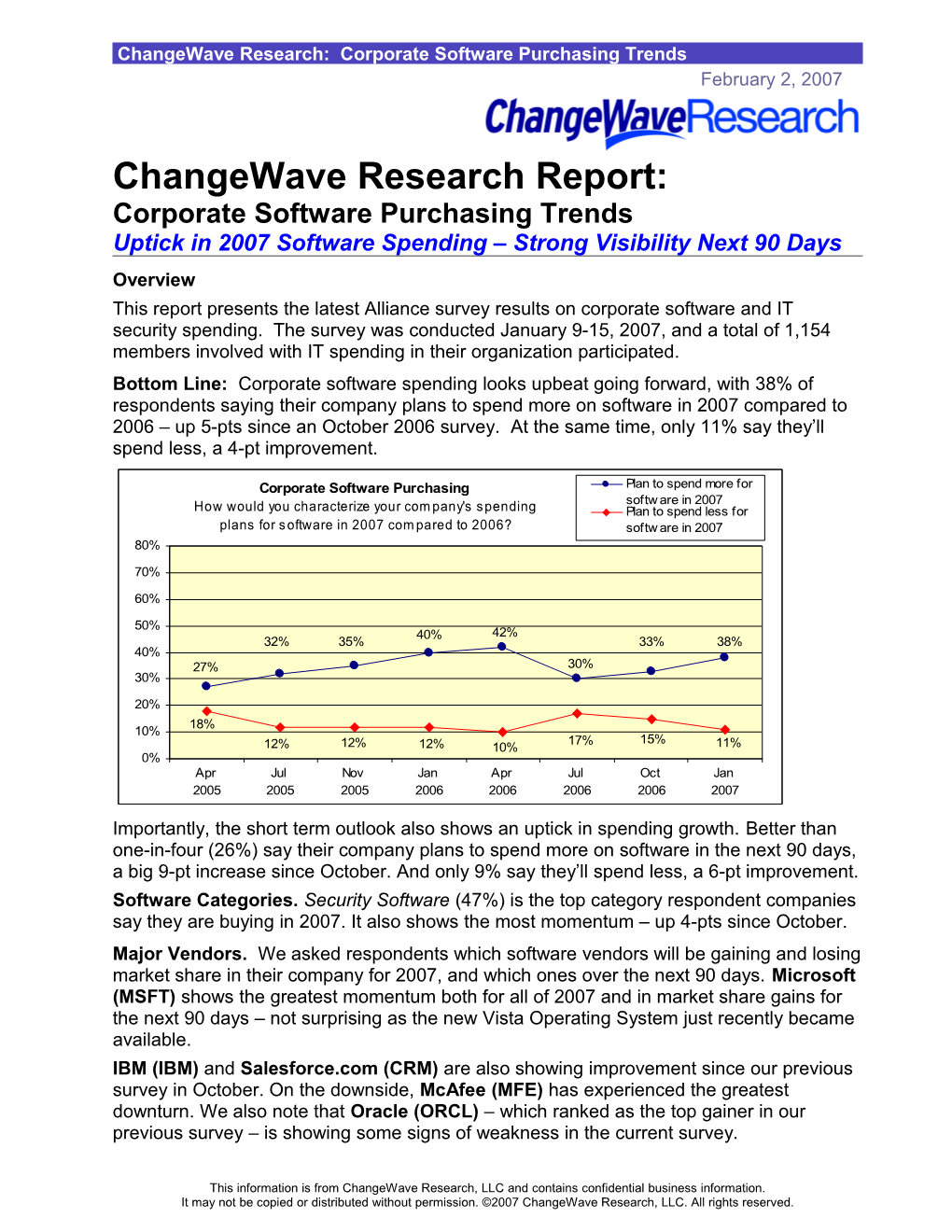

ChangeWave Research Report: Corporate Software Purchasing Trends Uptick in 2007 Software Spending – Strong Visibility Next 90 Days Overview This report presents the latest Alliance survey results on corporate software and IT security spending. The survey was conducted January 9-15, 2007, and a total of 1,154 members involved with IT spending in their organization participated. Bottom Line: Corporate software spending looks upbeat going forward, with 38% of respondents saying their company plans to spend more on software in 2007 compared to 2006 – up 5-pts since an October 2006 survey. At the same time, only 11% say they’ll spend less, a 4-pt improvement.

Corporate Software Purchasing Plan to spend more for softw are in 2007 How would you characterize your com pany's spending Plan to spend less for plans for s oftware in 2007 com pared to 2006? softw are in 2007 80%

70%

60%

50% 40% 42% 32% 35% 33% 38% 40% 27% 30% 30%

20% 18% 10% 17% 15% 12% 12% 12% 10% 11% 0% Apr Jul Nov Jan Apr Jul Oct Jan 2005 2005 2005 2006 2006 2006 2006 2007

Importantly, the short term outlook also shows an uptick in spending growth. Better than one-in-four (26%) say their company plans to spend more on software in the next 90 days, a big 9-pt increase since October. And only 9% say they’ll spend less, a 6-pt improvement. Software Categories. Security Software (47%) is the top category respondent companies say they are buying in 2007. It also shows the most momentum – up 4-pts since October. Major Vendors. We asked respondents which software vendors will be gaining and losing market share in their company for 2007, and which ones over the next 90 days. Microsoft (MSFT) shows the greatest momentum both for all of 2007 and in market share gains for the next 90 days – not surprising as the new Vista Operating System just recently became available. IBM (IBM) and Salesforce.com (CRM) are also showing improvement since our previous survey in October. On the downside, McAfee (MFE) has experienced the greatest downturn. We also note that Oracle (ORCL) – which ranked as the top gainer in our previous survey – is showing some signs of weakness in the current survey.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. ChangeWave Research: Corporate Software Purchasing Trends

Vista Impact on PC Purchases. One-in-ten (9%; up 2-pts) say their company has been deferring PC purchases to wait for Vista’s initial release. Another 11% say their company has been deferring and will continue to wait for a later version, also up 2-pts. Importantly, just 13% report that the Vista rollout is causing an ‘Acceleration’ of their company’s normal computer upgrade cycle during the next six months – and that’s 5-pts less than in November 2006. In addition, 7% say it’s causing a ‘Deceleration’ – up 1-pt. Vista Impact on IT Security. Better than one-in-four (27%) say it’s Very or Somewhat Likely that when their company upgrades they’ll rely primarily on Vista for security protection –unchanged from previously. Moreover, 22% say spending on other types of non-Microsoft security will decrease once they upgrade to Vista, while only 5% say it will increase. All in all, this is bad news for IT Security giants Symantec and McAfee. We do note that Spam Filtering Software (Change in Net Difference Score = +2) is the one IT Security category that has experienced gains since our previous survey. Summary of Key Findings Uptick in 2007 Major Vendors Impact of Vista Software Spending Most Momentum On PC Purchases 38% of respondents say Microsoft (up 18-pts) 9% say their company has been deferring PC purchases their company plans to spend Declining Momentum to wait for Vista (up 2-pts) more on software in 2007 – McAfee (down 6-pts) up 5-pts from October 11% will continue to defer till Oracle (down 5-pts 11% say they’ll spend less later version (up 2-pts) – a 4-pt improvement Software Categories 2% have increased PC purchases (up 1-pt) Strong Visibility – With Momentum 68% say Vista’s had no Next 90 Days Security (47%; up 4-pts) effect Data Storage & Mgmt 26% say their company plans On IT Security (29%; up 2-pts) to spend more for software – 27% say when their company CRM (15%; up 2-pts) a 9-pt increase since Oct upgrades they’ll rely primarily Supply Chain Only 9% say less – a 6-pt on Vista for security Management /Procurement improvement protection, same as Nov ‘06 (9%;up 2-pts) Moreover, 22% say spending on other non-Microsoft security will decrease

The ChangeWave Alliance is a group of 10,000 highly qualified business, technology, and medical professionals in leading companies of select industries—credentialed professionals who spend their everyday lives working on the frontline of technological change. ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, and converts the information into proprietary quantitative and qualitative reports.

Helping You Profit From A Rapidly Changing World ™ www.ChangeWave.com

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 2 ChangeWave Research: Corporate Software Purchasing Trends

Table of Contents

Summary of Key Findings...... 2

The Findings...... 4

(A) Corporate Software Purchasing Trends ...... 4

(B) Company Findings ...... 8

(C) Microsoft Vista ...... 17

(D) IT Software Security Purchasing ...... 20

ChangeWave Research Methodology...... 22

About ChangeWave Research...... 23

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 3 ChangeWave Research: Corporate Software Purchasing Trends

I. The Findings

Introduction

This report presents the latest Alliance survey results on corporate software and IT security spending. The survey was conducted January 9-15, 2007. Total Respondents (n = 1,154)

(A) Corporate Software Purchasing Trends

(1) Question Asked: How would you characterize your company's spending plans for software in 2007 compared to 2006?* Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Jan ‘07 Oct ‘06 Jul ‘06 Apr ‘06 Jan ‘06 Nov ‘05 We are planning to spend 38% 33% 30% 42% 40% 35% more for software in 2007 compared to 2006 We are planning to spend 11% 15% 17% 10% 12% 12% less for software in 2007 compared to 2006 There has been no 44% 44% 46% 40% 43% 41% change in spending plans for software in 2007 compared to 2006 Don't Know 7% 8% 7% 6% 5% 11% Other 0% 0% 1% 1% 1% 1% *Note: In the Nov ’05 through Jul ’06 surveys, the question asked “How would you characterize your company’s spending plans for software in 2006 compared to 2005?”

Corporate Software Purchasing Plan to spend more for softw are in 2007 How would you characterize your com pany's spending Plan to spend less for plans for s oftware in 2007 com pared to 2006? softw are in 2007 80%

70%

60%

50% 40% 42% 32% 35% 33% 38% 40% 27% 30% 30%

20% 18% 10% 17% 15% 12% 12% 12% 10% 11% 0% Apr Jul Nov Jan Apr Jul Oct Jan 2005 2005 2005 2006 2006 2006 2006 2007 Uptick in Software Spending for 2007. Thirty-eight percent (38%) of respondents say their company plans to spend more on software in 2007 compared to 2006 – up 5-pts since our October 2006 survey. At the same time, only 11% say they’ll spend less, a 4-pt improvement. This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 4 ChangeWave Research: Corporate Software Purchasing Trends

(2) Question Asked: How would you characterize your company's spending plans for software over the next 90 days compared to the previous 90 days? Current Previous Previous Previous Survey Survey Survey Survey Jan ‘07 Oct ‘06 Jul ‘06 Apr ‘06 We are planning to spend more for software 26% 17% 18% 27% compared to previous 90 days We are planning to spend less for software 9% 15% 15% 7% compared to previous 90 days There has been no change in spending plans 54% 58% 54% 51% for software compared to previous 90 days Don't Know 10% 10% 13% 13% Other 1% 0% 1% 0%

Strong Visibility Next 90 Days. Importantly, the short term outlook also shows an uptick in spending growth. Better than one-in-four (26%) say their company plans to spend more on software in the next 90 days, a big 9-pt increase since October. And only 9% say they’ll spend less, a 6-pt improvement.

(3) Question Asked: Looking at the following areas, which one is most driving your software purchasing decisions? Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Jan ‘07 Oct ‘06 Jul ‘06 Apr ‘06 Jan ‘06 Nov ‘05 Existing software is getting 35% 34% 34% 31% 35% 39% outdated and must be replaced A general improvement in business 14% 13% 12% 20% 16% 13% conditions and capital budgets New software capabilities are 14% 14% 14% 13% 15% 11% accelerating the replacement cycle We currently do not need to 11% 12% 16% 12% 12% 13% purchase any new software Improved customer service 10% 10% 6% 7% 7% 8% New software is easier to use 4% 4% 4% 4% 4% 3% We are waiting for new technology 4% 5% 4% 6% 5% 5% enhancements before purchasing new software General slowdown in business 3% 5% 6% 3% 3% 4% conditions and capital budgets Other 5% 4% 4% 4% 3% 4%

Driving Force in Purchasing Decisions. A total of 35% say replacing outdated software is the driving force behind their company’s software purchasing decisions, up 1-pt from October. Fourteen percent (14%) cite improvement in business conditions, also a 1-pt increase, and another 14% say new software capabilities, unchanged from previously.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 5 ChangeWave Research: Corporate Software Purchasing Trends

(4) Question Asked: What types of software will your company be purchasing in 2007? (Check All That Apply)* Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Jan ‘07 Oct ‘06 Jul ‘06 Apr ‘06 Jan ‘06 Nov ‘05 Security Software 47% 43% 42% 49% 46% 49% Data Storage and Management 29% 27% 25% 28% 28% 27% Database Management 21% 20% 19% 20% 21% 22% Network Management 18% 18% 16% 18% 17% 18% Application Server Software 17% 18% 17% 20% 20% 22% Customer Resource 15% 13% 13% 16% 16% 14% Management (CRM) Business Intelligence and 14% 13% 14% 18% 17% 14% Reporting Document and Content 13% 15% 14% 15% 17% 13% Management Portal and E-Business 11% 11% 10% 15% 12% 14% Development Supply Chain Management/ 9% 7% 7% 10% 7% 8% Procurement Enterprise Resource Planning 9% 9% 9% 12% 9% 8% (ERP) Business Process Management 8% 9% NA NA NA NA (BPM) Legacy Platforms 5% 5% 4% 6% 4% 5% No Plans to Purchase Software 9% 11% 14% 9% 11% 10% in 2007 Don't Know 9% 11% 12% 9% 7% 11% Other 6% 8% 7% 8% 7% 9% *Note: In the previous surveys, the question asked “What types of software will your company be purchasing in 2006?”

Change Score – Current Survey (January 2007) minus Previous Survey (October 2006) Current Previous Change Survey Survey Score Jan ‘07 Oct ‘06 Security Software 47% 43% +4 Data Storage and Management 29% 27% +2 Customer Resource Management (CRM) 15% 13% +2 Supply Chain Management/Procurement 9% 7% +2 Database Management 21% 20% +1 Business Intelligence and Reporting 14% 13% +1 Network Management 18% 18% 0 Portal and E-Business Development 11% 11% 0 Enterprise Resource Planning (ERP) 9% 9% 0 Legacy Platforms 5% 5% 0 Business Process Management (BPM) 8% 9% -1 Application Server Software 17% 18% -1 Document and Content Management 13% 15% -2

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 6 ChangeWave Research: Corporate Software Purchasing Trends

Software Categories. Security Software (47%) is the top category respondent companies say they are buying in 2007. It also shows the most momentum – up 4-pts since October. Data Storage and Management (29%), Customer Resource Management (15%), and Supply Chain Management/Procurement (9%) show slight momentum – each up 2-pts.

(5) Question Asked: Service Oriented Architecture (SOA) involves using a universal front-end interface to deliver the functionality of one or more applications regardless of platform or operating system (e.g., web-based applications). SOA can be utilized by end users, other applications or both. Does your company currently use, or are you planning to use, any Service Oriented Architecture (SOA)? Yes, Currently Use SOA 15% Yes, Planning to Use SOA 8% No, Do Not Currently Use or Plan to Use SOA 56% Don't Know 20%

(5A) Question Asked: For those whose company currently uses Service Oriented Architecture (SOA), would you say your budget for SOA will increase during 2007, decrease, or will it remain the same compared to 2006? (n=169) Increase 60% Decrease 0% Remain the 31% Same Don't Know 9%

Service Oriented Architecture. A total of 15% say their company is currently using Service Oriented Architecture (SOA). Another 8% say they’re planning to use it. Among current users, 60% expect their SOA budget to increase in 2007, while another 31% say their budget will remain the same as in 2006.

(5B) Question Asked: Why? Budget for Service Oriented Architecture Increasing in 2007 (n=64) Business Demand/ Wave of the Future 33% Ease of Use and Integration Capabilities 28% Cost Efficiency 16% Replacing Outdated Software/Upgrade Cycle 8% Other 16% When asked why their SOA budget will increase, one-third (33%) cited Business Demand/Wave of the Future as the reason, and another 28% say SOA’s Ease of Use and Integration Capabilities. PJA46319 says, “SOA is the next wave due to its application for the end user, irrespective of the platform they are using...” PCM1964 adds, “It allows easy external access to internal systems and data, for example sharing product information with vendors.” BRA03904 writes, SOA makes it “easier to deploy applications across the world.”

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 7 ChangeWave Research: Corporate Software Purchasing Trends

A Sample of Alliance Member Responses can be found in Appendix A. (B) Company Findings

We asked respondents about their company’s purchasing of software from major vendors, including which ones are gaining and losing share in their company in 2007. We also asked about the next 90 days. We then compared our current findings with those of our October 2006 survey results, and produced a Composite Score for each vendor. Vendors that Next 90 Gaining vs. Days – Losing Vendors Market Share Gaining vs. within their Composite Losing Company Score Market Share This Year (Change in (Change Net Diff. in Net Score) Diff. Score) Microsoft (MSFT) +6 +12 +18 IBM (incl. FileNet) (IBM) +1 +3 +4 Salesforce.com (CRM) +1 +3 +4 Akamai Technologies (AKAM) +2 +2 +4 Symantec (SYMC) (incl. Veritas) +2 +2 +4 Hewlett-Packard (HPQ) (incl. Mercury +1 +2 +3 Interactive) BEA Systems (BEAS) +2 +1 +3 Cognos (COGN) +3 0 +3 EMC Corp (EMC) +2 0 +2 Sun Microsystems (SUNW) +1 0 +1 CA (CA) (formerly Computer Associates) +2 -1 +1 Adobe (ADBE) (incl. Macromedia) 0 0 0 Business Objects (BOBJ) -2 +1 -1 MicroStrategy (MSTR) -1 0 -1 MatrixOne (Dassault Systemes)(DASTY) -1 0 -1 Hyperion Solutions (HYSL) 0 -1 -1 Tibco Software (TIBX) 0 -1 -1 SAP (SAP) -3 +1 -2 Oracle (ORCL) (incl. Siebel Systems) -3 -2 -5 McAfee (MFE) -2 -4 -6

Major Vendors. Microsoft (MSFT) shows the greatest momentum both for all of 2007 and in market share gains for the next 90 days – not surprising as the new Vista Operating System just recently became available. IBM (IBM) and Salesforce.com (CRM) are also showing improvement since our previous survey in October.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 8 ChangeWave Research: Corporate Software Purchasing Trends

On the downside, McAfee (MFE) has experienced the greatest downturn. We also note that Oracle (ORCL) – which ranked as the top gainer in our previous survey – is showing some signs of weakness in the current survey.

See Questions 6A, 6B, 7A and 7B for further details on the above Master Summary Chart.

Vendors Gaining and Losing Market Share in 2007

(6A) Question Asked: Which of the following major software vendors are gaining market share in your company in 2007? (Check All That Apply) (n=784) Current Previous Survey Survey Jan ‘07 Oct ‘06 Microsoft (MSFT) 51% 45% Adobe (ADBE) (incl. Macromedia) 24% 24% Symantec (SYMC) (incl. Veritas) 22% 18% Oracle (ORCL) (incl. Siebel Systems) 17% 19% McAfee (MFE) 15% 15% SAP (SAP) 14% 15% IBM (incl. FileNet) (IBM) 12% 12% Hewlett-Packard (HPQ) (incl. Mercury 9% 9% Interactive) EMC Corp (EMC) 8% 6% Akamai Technologies (AKAM) 6% 4% Sun Microsystems (SUNW) 6% 7% CA (CA) (formerly Computer Associates) 5% 4% Salesforce.com (CRM) 5% 3% Cognos (COGN) 4% 4% BEA Systems (BEAS) 3% 2% Business Objects (BOBJ) 3% 4% Digital River (DRIV) 3% NA Hyperion Solutions (HYSL) 2% 2% Tibco Software (TIBX) 2% 2% MatrixOne (Dassault Systemes)(DASTY) 1% 1% MicroStrategy (MSTR) 1% 1%

*Note: In the previous survey, the question asked “Which of the following major software vendors are gaining market share in your company in 2006?”

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 9 ChangeWave Research: Corporate Software Purchasing Trends

(6B) Question Asked: And which of the following major software vendors are losing market share in your company in 2007? (Check All That Apply) (n=784) Current Previous Survey Survey Jan ‘07 Oct ‘06 McAfee (MFE) 11% 9% Symantec (SYMC) (incl. Veritas) 9% 7% Oracle (ORCL) (incl. Siebel Systems) 9% 8% Microsoft (MSFT) 8% 8% IBM (incl. FileNet) (IBM) 7% 8% Sun Microsystems (SUNW) 7% 9% CA (CA) (formerly Computer Associates) 6% 7% Hewlett-Packard (HPQ) (incl. Mercury 5% 6% Interactive) SAP (SAP) 4% 2% Adobe (ADBE) (incl. Macromedia) 2% 2% BEA Systems (BEAS) 2% 3% Business Objects (BOBJ) 2% 1% Cognos (COGN) 2% 3% EMC Corp (EMC) 2% 2% MicroStrategy (MSTR) 2% 1% Salesforce.com (CRM) 2% 1% Akamai Technologies (AKAM) 1% 1% Digital River (DRIV) 1% NA Hyperion Solutions (HYSL) 1% 1% MatrixOne (Dassault Systemes)(DASTY) 1% 0% Tibco Software (TIBX) 1% 1%

*Note: In the previous survey, the question asked “And which of the following major software vendors are losing market share in your company in 2006?”

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 10 ChangeWave Research: Corporate Software Purchasing Trends

Change in Net Difference Score – Current Survey (January 2007) vs. Previous Survey (October 2006) Current Previous Survey Survey Change in Net Net Net Differenc Difference Difference e Score Score Score (Jan ’07) (Oct ’06) Microsoft (MSFT) +43 +37 +6 Cognos (COGN) +2 -1 +3 Symantec (SYMC) (incl. Veritas) +13 +11 +2 EMC Corp (EMC) +6 +4 +2 Akamai Technologies (AKAM) +5 +3 +2 BEA Systems (BEAS) +1 -1 +2 CA (CA) (formerly Computer Associates) -1 -3 +2 IBM (incl. FileNet) (IBM) +5 +4 +1 Hewlett-Packard (HPQ) (incl. Mercury Interactive) +4 +3 +1 Salesforce.com (CRM) +3 +2 +1 Sun Microsystems (SUNW) -1 -2 +1 Adobe (ADBE) (incl. Macromedia) +22 +22 0 Hyperion Solutions (HYSL) +1 +1 0 Tibco Software (TIBX) +1 +1 0 MatrixOne (Dassault Systemes)(DASTY) 0 +1 -1 MicroStrategy (MSTR) -1 0 -1 McAfee (MFE) +4 +6 -2 Business Objects (BOBJ) +1 +3 -2 SAP (SAP) +10 +13 -3 Oracle (ORCL) (incl. Siebel Systems) +8 +11 -3

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 11 ChangeWave Research: Corporate Software Purchasing Trends

Overall Software Spending for the Next 90 Days – Vendors Gaining vs. Losing Market Share

(7A) Question Asked: Over the next 90 days, which of the following major software vendors is most likely to pick-up market share within your company? (Check All That Apply) (n=627) Current Previous Survey Survey Jan ‘07 Oct ‘06 Microsoft (MSFT) 47% 37% Symantec (SYMC) (incl. Veritas) 15% 12% Adobe (ADBE) (incl. Macromedia) 15% 14% SAP (SAP) 10% 8% Oracle (ORCL) (incl. Siebel Systems) 10% 11% McAfee (MFE) 9% 10% IBM (incl. FileNet) (IBM) 8% 9% Hewlett-Packard (HPQ) (incl. Mercury 6% 6% Interactive) Akamai Technologies (AKAM) 4% 3% EMC Corp (EMC) 4% 4% Salesforce.com (CRM) 4% 2% Sun Microsystems (SUNW) 4% 5% Business Objects (BOBJ) 3% 3% Cognos (COGN) 3% 3% BEA Systems (BEAS) 2% 2% CA (CA) (formerly Computer Associates) 2% 3% Digital River (DRIV) 2% NA Hyperion Solutions (HYSL) 1% 2% MicroStrategy (MSTR) 1% 0% Tibco Software (TIBX) 1% 2% MatrixOne (Dassault Systemes)(DASTY) 0% 0%

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 12 ChangeWave Research: Corporate Software Purchasing Trends

(7B) Question Asked: And over the next 90 days, which of the following major software vendors is most likely to lose market share within your company? (Check All That Apply) (n=627) Current Previous Survey Survey Jan ‘07 Oct ‘06 McAfee (MFE) 11% 8% Symantec (SYMC) (incl. Veritas) 8% 7% Microsoft (MSFT) 7% 9% Oracle (ORCL) (incl. Siebel Systems) 7% 6% Sun Microsystems (SUNW) 6% 7% CA (CA) (formerly Computer Associates) 5% 5% IBM (incl. FileNet) (IBM) 5% 9% Hewlett-Packard (HPQ) (incl. Mercury 4% 6% Interactive) SAP (SAP) 3% 2% Adobe (ADBE) (incl. Macromedia) 2% 1% Cognos (COGN) 2% 2% EMC Corp (EMC) 2% 2% BEA Systems (BEAS) 1% 2% Business Objects (BOBJ) 1% 2% Digital River (DRIV) 1% NA Hyperion Solutions (HYSL) 1% 1% MicroStrategy (MSTR) 1% 0% Salesforce.com (CRM) 1% 2% Tibco Software (TIBX) 1% 1% Akamai Technologies (AKAM) 0% 1% MatrixOne (Dassault Systemes)(DASTY) 0% 0%

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 13 ChangeWave Research: Corporate Software Purchasing Trends

Net Difference Score – Current Survey (January 2007) Gaining Losing Net Market Market Difference Share Share Score Microsoft (MSFT) 47% 7% +40 Adobe (ADBE) (incl. Macromedia) 15% 2% +13 Symantec (SYMC) (incl. Veritas) 15% 8% +7 SAP (SAP) 10% 3% +7 Akamai Technologies (AKAM) 4% 0% +4 Oracle (ORCL) (incl. Siebel Systems) 10% 7% +3 IBM (incl. FileNet) (IBM) 8% 5% +3 Salesforce.com (CRM) 4% 1% +3 Hewlett-Packard (HPQ) (incl. Mercury Interactive) 6% 4% +2 EMC Corp (EMC) 4% 2% +2 Business Objects (BOBJ) 3% 1% +2 Cognos (COGN) 3% 2% +1 BEA Systems (BEAS) 2% 1% +1 Digital River (DRIV) 2% 1% +1 Hyperion Solutions (HYSL) 1% 1% 0 MicroStrategy (MSTR) 1% 1% 0 Tibco Software (TIBX) 1% 1% 0 MatrixOne (Dassault Systemes)(DASTY) 0% 0% 0 McAfee (MFE) 9% 11% -2 Sun Microsystems (SUNW) 4% 6% -2 CA (CA) (formerly Computer Associates) 2% 5% -3

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 14 ChangeWave Research: Corporate Software Purchasing Trends

Change in Net Difference Score – Current Survey (January 2007) vs. Previous Survey (October 2006) Current Previous Survey Survey Change in Net Net Net Differenc Difference Difference e Score Score Score (Jan ’07) (Oct ’06) Microsoft (MSFT) +40 +28 +12 IBM (incl. FileNet) (IBM) +3 0 +3 Salesforce.com (CRM) +3 0 +3 Symantec (SYMC) (incl. Veritas) +7 +5 +2 Akamai Technologies (AKAM) +4 +2 +2 Hewlett-Packard (HPQ) (incl. Mercury Interactive) +2 0 +2 SAP (SAP) +7 +6 +1 Business Objects (BOBJ) +2 +1 +1 BEA Systems (BEAS) +1 0 +1 Adobe (ADBE) (incl. Macromedia) +13 +13 0 EMC Corp (EMC) +2 +2 0 Cognos (COGN) +1 +1 0 MatrixOne (Dassault Systemes)(DASTY) 0 0 0 MicroStrategy (MSTR) 0 0 0 Sun Microsystems (SUNW) -2 -2 0 Hyperion Solutions (HYSL) 0 +1 -1 Tibco Software (TIBX) 0 +1 -1 CA (CA) (formerly Computer Associates) -3 -2 -1 Oracle (ORCL) (incl. Siebel Systems) +3 +5 -2 McAfee (MFE) -2 +2 -4

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 15 ChangeWave Research: Corporate Software Purchasing Trends

BEA Systems (BEAS) provides enterprise application and service infrastructure. Their software packages include the Tuxedo Product Family, as well as several WebLogic Platforms. Akamai Technologies (AKAM) offers content and application delivery, application performance services, and business performance management services based on its technological platform, EdgePlatform. Digital River (DRIV) provides e-commerce outsourcing solutions, including Website development and hosting, order management, digital product delivery and physical product fulfillment.

(8) Question Asked: (For those who have previously purchased products from or had experiences with BEA Systems, Akamai Technologies or Digital River) How satisfied is your company with their software/services?

Akamai Digital River BEA Systems Technologies (n=88) (n=112) (n=98) Very Satisfied 52% 47% 28% Somewhat Satisfied 36% 36% 49% Somewhat Unsatisfied 10% 11% 18% Very Unsatisfied 2% 6% 5%

Satisfaction Ratings. We asked respondents how satisfied they were with three specific vendors

88% of those who have previously purchased products from Akamai Technologies reported their company is Very/Somewhat Satisfied with their software & services. 83% of Digital River customers say they are Very or Somewhat Satisfied. Less remarkable but still positive, BEA Systems received a 77% satisfaction rating. However, 23% said they were either Somewhat or Very Unsatisfied.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 16 ChangeWave Research: Corporate Software Purchasing Trends

(C) Microsoft Vista

(9) Question Asked: Which of the following statements best describes your company's Vista upgrade plan?

We Have a Formal Vista Upgrade Plan in Place 4% We Have an Informal/Tentative Vista Upgrade Plan 18% We are Currently Working on a Vista Upgrade Plan 18% We Currently Have No Plans to Upgrade to Vista 50% Don't Know /No Answer 9%

Upgrade Plans. Only 4% report their company already has a formal Vista upgrade plan, however 18% say they have an informal plan and another 18% are currently working on a plan. Notably, half (50%) say they have no plans to upgrade.

(10) Question Asked: In which of the following ways has the release of Vista been affecting your company's PC Purchasing plans?* Current Previous Survey Survey Jan ‘07 Nov ‘06 We Have Been Deferring PC Purchases Until Vista's Initial Release 9% 7% We Have Been Deferring PC Purchases - And Will Continue to Wait 11% 9% for a Later Version of Vista We Have Been Increasing our PC Purchases 2% 1% No Effect 68% 74% Don't Know / No Answer 9% 8% Other 2% 1% *Note: In the previous survey, the question asked “In which of the following ways has Vista's upcoming release been affecting your company's PC Purchasing plans?”

(11) Question Asked: Most companies tend to have a fairly regular computer upgrade cycle. Is the Vista rollout having any effect on your company's normal computer upgrade cycle for the next 6 months?* Current Previous Survey Survey Jan ‘07 Nov ‘06 The Vista Rollout Is Causing a Significant Acceleration in our 2% 3% Normal Upgrade Cycle for the Next 6 Months The Vista Rollout Is Causing a Modest Acceleration in our Normal 5% 6% Upgrade Cycle for the Next 6 Months The Vista Rollout Is Causing a Very Slight Acceleration in our 6% 9% Normal Upgrade Cycle for the Next 6 Months No Effect on our Normal Upgrade Cycle for the Next 6 Months 69% 67% The Vista Rollout Is Causing a Deceleration in our Normal Upgrade 7% 6% Cycle for the Next 6 Months Don't Know 9% 8% *Note: In the previous survey, the question asked “Will the Vista rollout have any effect on your company's normal computer upgrade cycle for the next 6 months?” This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 17 ChangeWave Research: Corporate Software Purchasing Trends

Vista Impact on PC Purchases. One-in-ten (9%; up 2-pts) say their company has been deferring PC purchases to wait for Vista’s initial release. Another 11% say their company has been deferring and will continue to wait for a later version, also up 2-pts. Importantly, just 13% report that the Vista rollout is causing an ‘Acceleration’ of their company’s normal computer upgrade cycle for the next six months – and that’s 5-pts less than in November 2006. In addition, 7% say it’s causing a ‘Deceleration’ – up 1-pt.

(12) Question Asked: In which quarter do you think your company will purchase its first computer with Vista already installed? Current Previous Survey Survey Jan ‘07 Nov ‘06 Already Purchased First Vista 4% NA Computer 1Q 2007 10% 16% 2Q 2007 12% 16% 3Q 2007 13% 11% 4Q 2007 9% 8% 1Q 2008 or Later 21% 16% Will Not Upgrade to Vista 11% 11% Don't Know / No Answer 20% 20%

(12A) Question Asked: And in which quarter do you think your company will completely finish its upgrade to Vista? Current Previous Survey Survey Jan ‘07 Nov ‘06 Vista Upgrade Already Completed 0% NA 1Q 2007 1% 1% 2Q 2007 2% 2% 3Q 2007 2% 3% 4Q 2007 6% 8% 1Q 2008 or Later 42% 40% Will Not Upgrade to Vista 12% 13% Don't Know / No Answer 34% 33%

Timing of Upgrades. In terms of timing, 4% report their company has already purchased its first Vista-installed computer. And while 22% say it will be in the first half of 2007, that’s down 10-pts from just two months ago. Moreover, only 11% now believe their company will finish upgrading by the end of 2007, 3- pts less than previously. Forty-two percent (42%) say they won’t finish their Vista upgrade until 1Q 2008 or later, up 2-pts.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 18 ChangeWave Research: Corporate Software Purchasing Trends

(13) Question Asked: Microsoft claims that Vista contains built-in protection from viruses, spyware, and malware. If and when your company upgrades to Vista, how likely is it that you will rely primarily on Vista for protection from viruses, spyware, and malware?* Current Previous Survey Survey Jan ‘07 Oct ‘06 Very Likely 8% 8% Somewhat Likely 19% 19% Unlikely 49% 48% Will Not Upgrade to Vista 8% 9% Don't Know 16% 15%

(13A) Question Asked: If and when your company upgrades to Vista, do you think your company's spending on other non-Microsoft security software (such as McAfee or Symantec software) will increase, decrease or will there be no change? Current Previous Survey Survey Jan ‘07 Oct ‘06 Increase in Other Security Software Spending 5% 5% Decrease in Other Security Software Spending 22% 21% No Change in Other Security Software Spending 47% 47% Will Not Upgrade to Vista 8% 8% Don't Know 19% 20%

Vista Impact on IT Security. Nearly one-in-four (27%) say it’s Very or Somewhat Likely that when their company upgrades they’ll rely primarily on Vista for security protection – unchanged from previously. Moreover, 22% say spending on other types of non-Microsoft security will decrease once they upgrade to Vista, while only 5% say it will increase. All in all, this is bad news for IT Security giants Symantec and McAfee.

(14) Question Asked: What do you think is the biggest barrier within your company to the rapid adoption of Vista? Open-ended (n=735) Current Previous Survey Survey Jan ‘07 Nov ‘06 Uncertainty with Reliability and Vulnerability 29% 22% Budget/Cost Constraints 18% 18% No Need / Currently Not A Priority 15% 26% Need for Hardware Upgrades/ Resource Requirements 7% 10% Compatibility with Existing Software/ Applications 8% 10% Lack of Confidence in Microsoft's New Products 5% 3% Training Requirements/User Learning Curve 4% 3% Effort of Testing for Compatibility/Integration Process 4% 4% Currently Using or Switching To Other OS 1% 3% Other 11% 11% This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 19 ChangeWave Research: Corporate Software Purchasing Trends

Barriers to Vista Adoption. Nearly three-in-ten (29%) respondents cite Uncertainty With Reliability and Vulnerability as the biggest barrier to rapid adoption of Vista within their company, up 7-pts since November 2006.

(D) IT Security Software

(15) Question Asked: Where are you seeing the greatest increases in IT security spending within your company? (Check All That Apply)* (n=614) Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Jan ‘07 Oct ‘06 Jul ‘06 Apr ‘06 Jan ‘06 Nov ‘05 Anti-Virus Software 40% 43% 46% 48% 51% 52% Backup/Recovery Software 39% 41% 37% 38% 41% 38% Anti-Spyware Software 32% 36% 36% 41% 43% 39% Spam Filtering Software 32% 32% 32% 34% 32% 35% Enterprise/Network Security 29% 31% 36% 36% 35% 34% Software Authentication and 23% 26% 28% 28% 25% 23% Identification Software Disaster Recovery 20% 20% 21% 22% 22% 26% Software/Services Other Security 4% 4% 3% 2% 2% 2% *Note: Excludes survey respondents who did not answer this question.

(15A) Question Asked: And where are you seeing the smallest increases (or no increase) in IT security spending within your company? (Check All That Apply)* (n=614) Current Previous Previous Previous Previous Previous Survey Survey Survey Survey Survey Survey Jan ‘07 Oct ‘06 Jul ‘06 Apr ‘06 Jan ‘06 Nov ‘05 Disaster Recovery 26% 24% 24% 27% 27% 25% Software/Services Backup/Recovery Software 25% 21% 25% 29% 29% 28% Authentication and 23% 21% 20% 22% 26% 22% Identification Software Spam Filtering Software 22% 24% 24% 21% 24% 22% Anti-Virus Software 18% 21% 20% 16% 15% 16% Anti-Spyware Software 17% 20% 18% 14% 14% 16% Enterprise/Network Security 14% 14% 14% 16% 17% 14% Software Other Security 1% 3% 2% 1% 2% 1% *Note: Excludes survey respondents who did not answer this question.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 20 ChangeWave Research: Corporate Software Purchasing Trends

IT Security Spending Increase vs. Decrease – Current Survey (January 2007) Net Greatest Smallest Difference Increases Increases Score Anti-Virus Software 40% 18% +22 Anti-Spyware Software 32% 17% +15 Enterprise/Network Security Software 29% 14% +15 Backup/Recovery Software 39% 25% +14 Spam Filtering Software 32% 22% +10 Authentication and Identification Software 23% 23% 0 Disaster Recovery Software/Services 20% 26% -6

Change in Net Difference Score - IT Security Spending Increase vs. Decrease – Current Survey (January 2007) vs. Previous Survey (October 2006) Current Previous Survey Survey Change Net Net In Net Differenc Differenc Difference e Score e Score Score (Jan ’07) (Oct ’06) Spam Filtering Software +10 +8 +2 Anti-Virus Software +22 +22 0 Anti-Spyware Software +15 +16 -1 Enterprise/Network Security Software +15 +17 -2 Disaster Recovery Software/Services -6 -4 -2 Authentication and Identification Software 0 +5 -5 Backup/Recovery Software +14 +20 -6 Areas of IT Security Spending Increases. Spam Filtering Software (Change in Net Difference Score = +2) is the only IT Security category that has experienced gains since our previous survey. Backup/Recovery Software (-6) shows the biggest momentum loss.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 21 ChangeWave Research: Corporate Software Purchasing Trends

II. ChangeWave Research Methodology

This report presents the findings of our latest ChangeWave Alliance survey on corporate spending for software and IT security. The survey was conducted January 9-15, 2007 and a total of 1,154 Alliance members involved with IT spending in their company participated.

The Alliance’s proprietary research and business intelligence gathering system is based upon the systematic gathering of valuable business and investment information directly over the Internet from accredited members.

ChangeWave surveys its Alliance members on a range of business and investment research and intelligence topics, collects feedback from them electronically, interprets and reconciles the information in a cohesive manner and converts the information into valuable quantitative and qualitative reports.

The Alliance has assembled its membership team from senior technology and business executives in leading companies of select industries. Nearly 3 out of every 5 members (56%) have advanced degrees (e.g., Master’s or Ph.D.) and 93% have at least a four-year bachelor’s degree.

The business and investment intelligence provided by the Alliance provides a real-time view of companies, technologies and business trends in key market sectors, along with an in-depth perspective of the macro economy – well in advance of other available sources.

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 22 ChangeWave Research: Corporate Software Purchasing Trends

III. About ChangeWave Research

ChangeWave Research, a subsidiary of Phillips Investment Resources, LLC, identifies and quantifies "change" in industries and companies through surveying a network of thousands of business executives and professionals working in more than 20 industries.

ChangeWave has a very unique asset in its 10,000-member Alliance. We have assembled our membership team from a broad cross section of more than 20 vertical markets such as telecom, semiconductors, data storage, and biotechnology, along with a wide range of professional disciplines including CIOs, IT managers and programmers, executive management, scientists, engineers and sales personnel.

The ChangeWave Alliance is composed of senior technology and business executives in leading companies - credentialed professionals who spend their everyday lives working on the frontline of technological change.

This proprietary research and business intelligence gathering system provides a real-time view of companies, technologies and business trends in key market sectors along with an in-depth perspective of the macro economy - well in advance of other available sources. ChangeWave surveys its 10,000 Alliance members on a wide range of investment research topics and converts the findings into valuable investment and business intelligence reports. ChangeWave delivers its products and services on the Web at www.ChangeWave.com.

ChangeWave Research does not make any warranties, express or implied, as to results to be obtained from using the information in this report. Investors should obtain individual financial advice based on their own particular circumstances before making any investment decisions based upon information in this report.

For More Information:

ChangeWave Research Telephone: 301-279-4200 9420 Key West Avenue Fax: 301-610-5206 Rockville, MD 20850 www.ChangeWave.com USA [email protected]

Helping You Profit From A Rapidly Changing World ™ www.ChangeWave.com

This information is from ChangeWave Research, LLC and contains confidential business information. It may not be copied or distributed without permission. ©2007 ChangeWave Research, LLC. All rights reserved. 23