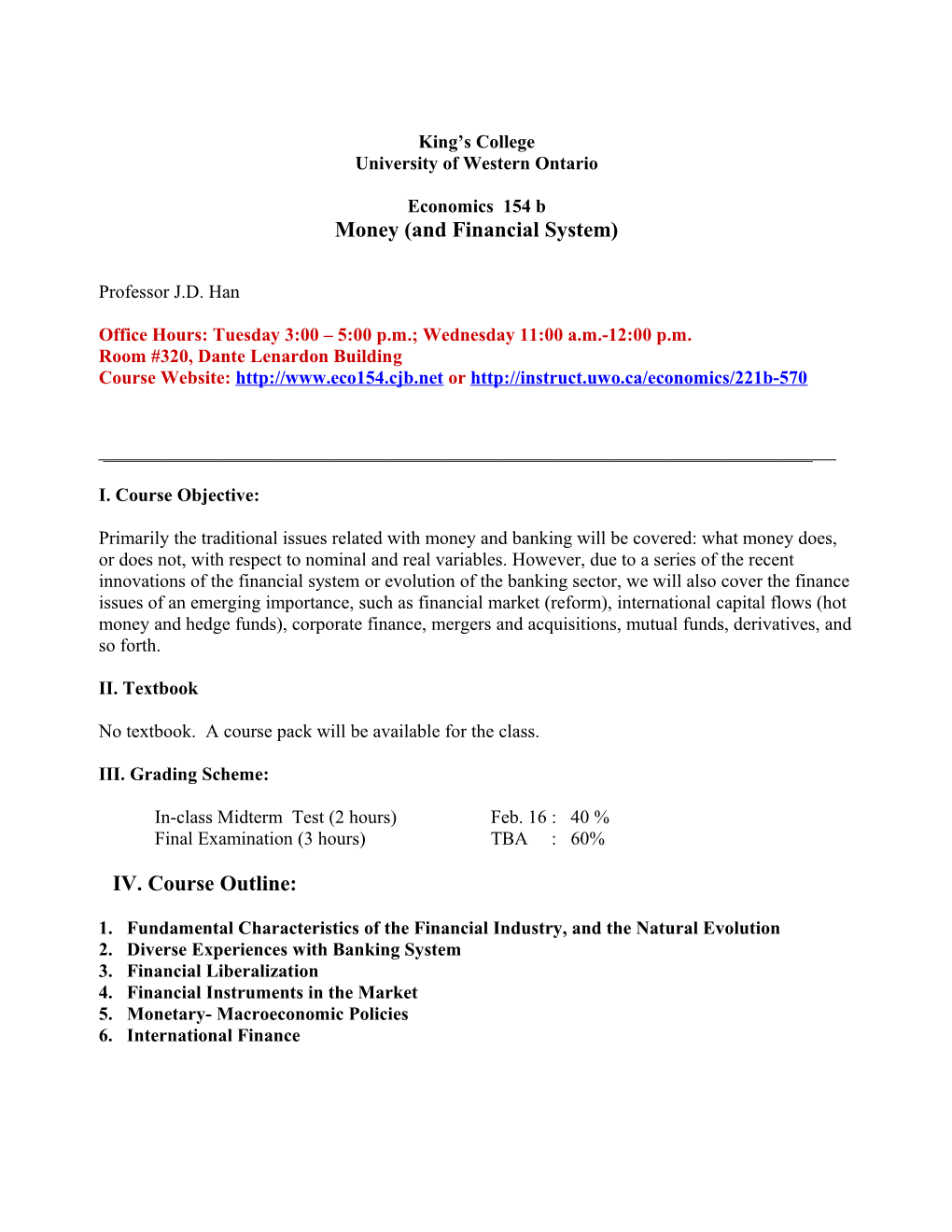

King’s College University of Western Ontario

Economics 154 b Money (and Financial System)

Professor J.D. Han

Office Hours: Tuesday 3:00 – 5:00 p.m.; Wednesday 11:00 a.m.-12:00 p.m. Room #320, Dante Lenardon Building Course Website: http://www.eco154.cjb.net or http://instruct.uwo.ca/economics/221b-570

______

I. Course Objective:

Primarily the traditional issues related with money and banking will be covered: what money does, or does not, with respect to nominal and real variables. However, due to a series of the recent innovations of the financial system or evolution of the banking sector, we will also cover the finance issues of an emerging importance, such as financial market (reform), international capital flows (hot money and hedge funds), corporate finance, mergers and acquisitions, mutual funds, derivatives, and so forth.

II. Textbook

No textbook. A course pack will be available for the class.

III. Grading Scheme:

In-class Midterm Test (2 hours) Feb. 16 : 40 % Final Examination (3 hours) TBA : 60%

IV. Course Outline:

1. Fundamental Characteristics of the Financial Industry, and the Natural Evolution 2. Diverse Experiences with Banking System 3. Financial Liberalization 4. Financial Instruments in the Market 5. Monetary- Macroeconomic Policies 6. International Finance Economics 154b 2 ______

IV. Detailed Course Outline:

1.Fundamental Characteristics of the Financial Industry, and the Natural Evolution

Key issues: Apparent Features and Trends (what are the unique features of the financial market?); Fundamental Causes (why are they being so?); Policy Implication (why should the financial system be regulated by government?)

F. Mishkin, "An Economics Analysis of Financial Structure," The Economics of Money, Banking, and Financial Markets, 3rd ed., Chapter 8, Harper Collin Co., 1992.

Instructor’s Note

2. Diverse Experiences with Banking System

Key ideas: the uniqueness of the Canadian Financial System, and its evolution

Mishkin, F.S., “ The (U.S.) Banking Industry”, The Economic of Money, Banking and Financial Markets, 4th ed., Chapter 10, Harper Collin Co.

Hugh Rockoff, “The Wizard of Oz as a Monetary Allegory”, Journal of Political Economy, 1990, vol. 98, no. 4.

“How (American) banks merge”, The Economists, January 5th, 1991.

Kroszner, Randall S., “ The Legacy of the Separation of Banking and Commerce Continues in Gramm-Leach-Bliley”, Federal Reserves of Mineapolis, June 2001

Charles Freedman, “The Canadian Banking System”, Conference on Development in the Financial System: National and International Perspectives, The Jerome Levy Economics Institute of Bard College, April 1997.

Sun Bae Kim, “Banking and Commerce: The Japanese Case”, Federal Reserve Bank of San Francisco Weekly Newsletter, March 1991.

3. Financial Liberalization

*Why should the financial system be left alone?

A.J.R. Rolnick and W. Weber, "New Evidence on the Free Banking Era," American Economic Review, 1983, Vol. 73, No. 5:1080-1091 Economics 154b 3 ______

A.J.R. Rolnick and W. Weber, "Explaining the Demand for Free Bank Notes," Journal of Monetary Economics, 1988, Vol. 21: 47-71.

Benjamin Klein, “The Competitive Supply of Money”, Money, Credit, and Banking.

George A. Selgin, “The Implications of Freedom in Banking and Note Issue”, Austrian Economic Letter, The Ludwig von Mises Institute, Winter 1989.

4. Financial Instruments in the Market

Key Ideas: Asset Pricing Models, Efficient Market Theory *Are these bonds and equities priced right? *Risk Management and Portfolio Diversification

* Basic Concepts and Formulas

Lusztig, et al., “Bond and Common Stock Valuation”, Finance in a Canadian Setting, Chapter 6, John Wiley & Sons Canada, Ltd., Chapter 6.

*What does the term structure of interest rates tell you about the economy of the future?: Yield Curves

Siklos, “Understanding Interest Rates: The Structure of Interest Rates, Chapter 15.

____, “Economic forecasting made easy by professor”, Toronto Star, March 11, 1990.

*What determines Stock Prices?

Siklos, “Stock Prices”, Money, Banking, and Financial Institutions: Canada in the Global Environment, Chapter 12, McGraw-Hill Ryerson Ltd., 1994. (or, alternatively)

Lusztig, et al, “Market Efficiency”, Finance in a Canadian Setting, Chapter 9.

*What is the best portfolio of investment and diversification?

CAPM Model- Siklos, "Asset Demand and Supply under Uncertainty," Money, Banking, and Financial Institutions: Canada in the Global Environment, McGraw-Hill Ryerson Ltd., 1994.

Shearer, Chant, and Bond, “The Theory of Financial Markets: Part II”, Economics of The Economics 154b 4 ______

Canadian Financial System, Chapter 5.

“Portfolio Selection”, Shazam Online Manual

“Monthly Market Report: A Special Report for Individual Canadian Investors”, Special Edition: Asset Allocation, Merryll Lunch, October 2001.

James Pesando, “Art as Investment: The Market for Modern Print”, American Economic Review, Dec 1993.

5. Monetary- Macroeconomic Policies

Key ideas: Relations among Money, Output, and Inflation; Activist Monetary Policy versus Policy Invariance Theorem; Optimal Rate of Inflation; Time Inconsistency

Peter D. McClelland, “A Layman’s Guide to the Keynesian-Monetarist Dispute”.

Instructor's Typed Manuscript

6. International Finance

*What is the global trend?

Singh, Kavaljit, The Globalisation of Finance, Zeds Books Ltd., London, 1999 (HG 3881.S537 1998), Chapters 1-4, pp. 1-41.

Griffith-Jones, S., Global Capital Flows, MacMillan, 1998, pp. 25-51; pp.79-81 (HG 3891 G75 1998x).

BIS, Annual Report of Financial Market, recent edition

*Lesson from the recent Asian Financial Crisis

Aivazian, V., Hejazi, W., and Han, J.D., "How much does finance matter in East Asia?", Fiscal Frameworks and Financial System in East Asia: How Much Do They Matter?, University of Toronto Press, October 1998.

Haq, M., Kaul, I., and Grunberg, I., ed., The Tobin Tax: Coping with Financial Volatility, Oxford University Press, 1996 (HG 3853 T63 1996x).