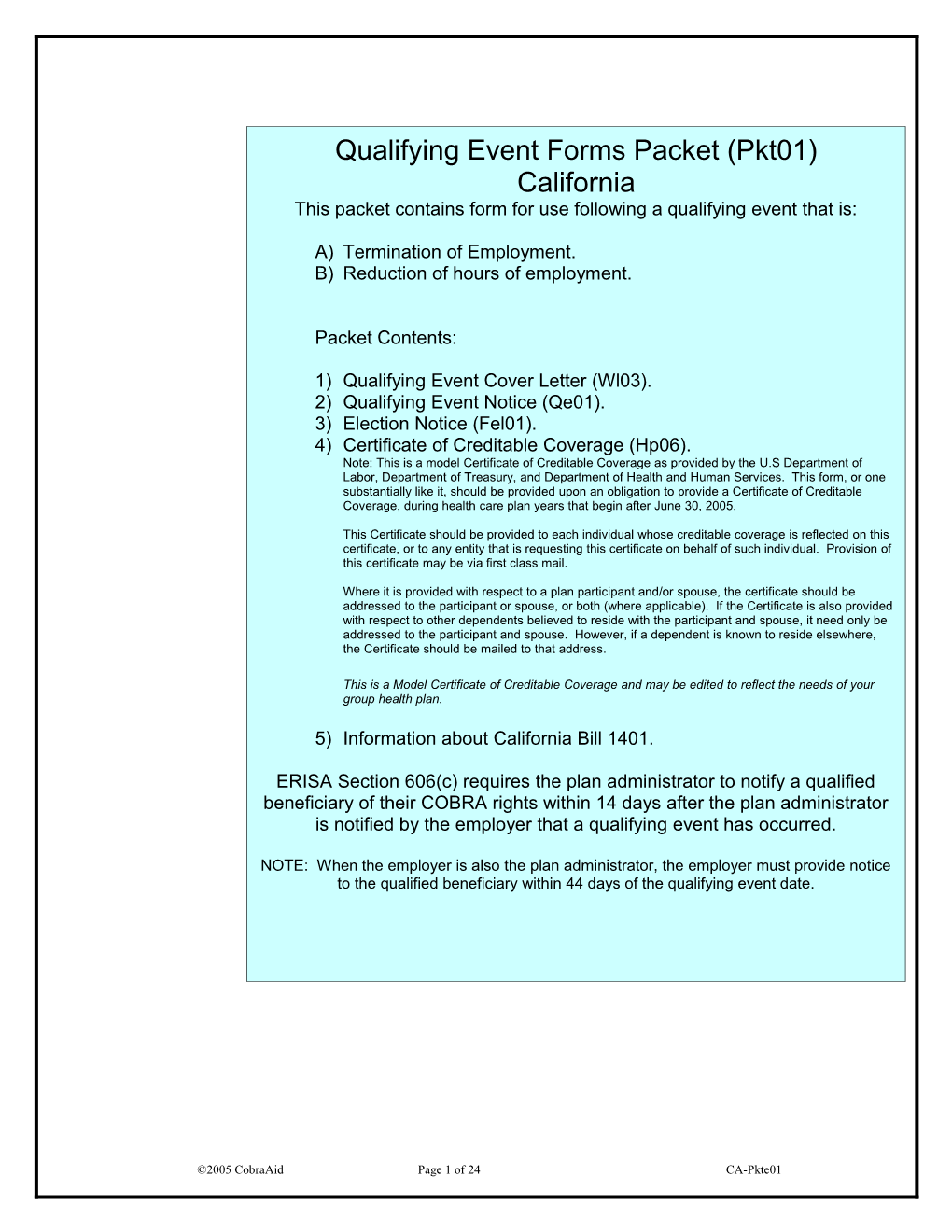

Qualifying Event Forms Packet (Pkt01) California This packet contains form for use following a qualifying event that is:

A) Termination of Employment. B) Reduction of hours of employment.

Packet Contents:

1) Qualifying Event Cover Letter (Wl03). 2) Qualifying Event Notice (Qe01). 3) Election Notice (Fel01). 4) Certificate of Creditable Coverage (Hp06). Note: This is a model Certificate of Creditable Coverage as provided by the U.S Department of Labor, Department of Treasury, and Department of Health and Human Services. This form, or one substantially like it, should be provided upon an obligation to provide a Certificate of Creditable Coverage, during health care plan years that begin after June 30, 2005.

This Certificate should be provided to each individual whose creditable coverage is reflected on this certificate, or to any entity that is requesting this certificate on behalf of such individual. Provision of this certificate may be via first class mail.

Where it is provided with respect to a plan participant and/or spouse, the certificate should be addressed to the participant or spouse, or both (where applicable). If the Certificate is also provided with respect to other dependents believed to reside with the participant and spouse, it need only be addressed to the participant and spouse. However, if a dependent is known to reside elsewhere, the Certificate should be mailed to that address.

This is a Model Certificate of Creditable Coverage and may be edited to reflect the needs of your group health plan.

5) Information about California Bill 1401.

ERISA Section 606(c) requires the plan administrator to notify a qualified beneficiary of their COBRA rights within 14 days after the plan administrator is notified by the employer that a qualifying event has occurred.

NOTE: When the employer is also the plan administrator, the employer must provide notice to the qualified beneficiary within 44 days of the qualifying event date.

©2005 CobraAid Page 1 of 24 CA-Pkte01 Important Notice Regarding Your Health Coverage

The enclosed materials contain important information regarding your rights to continue your health coverage, including premiums, election procedures, and due dates. If you have any questions about your rights, or need information on how to act on behalf of an incompetent beneficiary, please contact the plan administrator listed on the bottom of this page. Employee Information Employee Name: Date:

Address: City, St, Zip

Date of Notice Social Security# Important Information Type of Qualifying Event: Qualifying Benefits Event Date Termination Date Election Rights Termination Date

The following individuals are entitled to elect COBRA continuation coverage: Child who is losing coverage Employee Spouse or Dependent child covered under the plan because they or former former under the plan on the day are no longer dependent under employee spouse before the qualifying event. the terms of the plan.

If you choose to elect continuation coverage, please complete the enclosed election form. If you meet all other requirements your coverage will continue with no lapse in coverage. If this office does not receive the election form by the election expiration date, you forfeit all rights to COBRA continuation coverage. Coverage/Plan Type Premiums

If you have any questions, please call:

©2005 CobraAid Page 2 of 24 CA-Pkte01 Important Information Regarding Your Rights to COBRA Continuation Coverage Date, or b) the date of this notice, whichever is (Qualifying Event Noticelater. for TerminationEach of Employment or Reduction of Qualifiedhours ofBeneficiary employment) is entitled to make an Independent Election of any benefit plan for which they are eligible. If you elect continuation coverage, you are entitled to receive the same Company Address level of benefits as similarly situated nonCOBRA Name beneficiaries. Changes to plan benefits may be modified in accordance with Federal COBRA Name of Addressregulations. A separate Election Form must be Individual completed for Qualified Beneficiaries who wish to make an Independent Election. Please contact the Plan Administrator for additional forms. Coverage may also be Date

Under the terms of the Consolidated Omnibus Reconciliation Act of 1985 (COBRA), former covered employees and their eligible dependents have the right to temporarily continue coverage under the sponsoring employer’s group health plan for up to 18 months if coverage terminates due to a Qualifying Event that is: 1) Termination of employment, including voluntary resignations, involuntary termination, retirement or layoff, except for termination due to gross misconduct. 2) Reduction of hours worked, including work stoppage, strike, or leave of absence. A Qualifying Event is any of the above events elected for children born to or placed for adoption that would cause an employee, former employee, with a covered employee during the period of the covered spouse, or covered dependent child to Qualified Beneficiary’s continuation coverage in lose coverage under the sponsoring employer’s accordance with the group health plan. An employee, former Plan’s enrollment rules. Contact the Plan employee, spouse or dependent child who lost Administrator if this applies to you. coverage due to a Qualifying Event and was covered on the Plan the day Duration of Continuation Coverage before the Qualifying Event is known as a For Qualifying Events that are the termination of Qualified Beneficiary. A child born to or placed employment or reduction of hours, the period of for adoption with the covered employee during a COBRA continuation coverage may be continued period of COBRA continuation coverage will also for18 months, measured from the date of the be considered a Qualified Beneficiary. Qualifying Event. If the Qualified Beneficiary Qualified Beneficiaries are entitled to continue the makes a timely election, COBRA continuation same group health coverage in effect on the day coverage will be effective on the day after the before the Qualifying Event. This may include date that coverage would otherwise end. You do medical, dental, vision, prescription drug benefits not have to show evidence of insurability to be and certain Health Flexible Spending Accounts entitled to continuation coverage. However, (FSA’s). COBRA continuation coverage does not continuation coverage is provided subject to your extend to Life Insurance, Accidental Death and eligibility for coverage under the Plan. The Dismemberment, or Disability Benefits. You are sponsoring employer reserves the right to entitled to COBRA continuation coverage even if terminate continuation coverage retroactively if you have other health coverage, including you are determined to be ineligible for coverage. entitlement to Medicare, as long as this coverage If coverage is terminated, it cannot be reinstated. was in effect prior to electing COBRA You must notify the Plan Administrator if you or a continuation coverage. family member becomes covered under any other group health plan, or becomes entitled to Electing COBRA Continuation Coverage Medicare benefits during the continuation period. Enclosed is an Election Form that must be Coverage may be terminated prior to the completed by you if you wish to continue maximum coverage period for any of the coverage for yourself and/or your eligible spouse following reasons: and/or eligible dependent children. In order for 1) Payment of premium is not made in a timely your election to be considered “timely” and valid, manner. the Election Form must be postmarked, or 2) If all group health plans maintained by the received, by the Plan Administrator within 60 sponsoring employer are terminated. days from the later of the a) BenefitsTermination

©2005 CobraAid Page 3 of 24 CA-Pkte01 3) A participant becomes entitled to Medicare Security Administration must be provided to the after the date of election. Plan Administrator within 60 days of the 4) A participant becomes covered under another determination of disability. The notice must be group health plan, and that plan does not contain provided prior to the end of the 18-month any applicable pre-existing condition exclusion. continuation period. The sponsoring employer Payments for Continuation Coverage may charge up to 150% of the applicable The initial premium payment for continuation premium for continuation coverage during the 11- coverage must be made within 45 days of the month disability extension period. If the Qualified date the election is made. Payment is considered Beneficiary is determined by the Social Security made on the date sent. Payments are considered Administration to be no longer disabled under timely if a) postmarked by the U.S Postal Service Title II or XVI, the Qualified Beneficiary must on or before the applicable grace period notify the Plan Administrator within 30 days of the expiration date, and received by the Plan determination. Administrator, b) sent by an express delivery service (with proof) that payment was sent on or Claims before the applicable grace period expiration Claims are paid for each period of coverage only date, or c) delivered in person to the Plan after a premium payment for the coverage period Administrator during normal business hours. Late is made. Payment of claims may be delayed payments will not be accepted and will result in because of the time required to process your termination of coverage with no possibility of initial premium payments by reinstatement. The initial payment must include your sponsoring employer and group health premiums due for all months from the Benefits carrier. If you have claims, contact the Plan Termination Date through the date of your Administrator or the group health carrier’s claims payment. Subsequent premium payments are office. Payments not made in a timely manner will due on the due date, and must be made within result in a cancellation of coverage retroactively the 30-day grace period. The Plan with no possibility for reinstatement. Claims Importantincurred during theInformation period for which payment has Regarding Yournot Rights been made to COBRA will not be Continuation paid by Coverage the group health carrier. (Qualifying Event Notice for Termination of Employment/Reduction of hours) Inquiries from Health Care Providers The plan is required to make a complete response to inquiries from a health care provider regarding the Qualified Beneficiary’s Administrator may provide payment vouchers upon receipt of the Election Notice. However, you are responsible for making the monthly payments in a timely manner even if you fail to receive the payment vouchers.

Premium Rates for Continuation Coverage The cost for continuation coverage is the applicable premium for coverage elected, plus an administrative fee, if applicable. Please refer to the enclosed COBRA rate sheet. A Qualified Beneficiary who is determined to be disabled (under Title II or XVI of the Social Security Act) at the time of the Qualifying Event or within the first 60 days of continuation coverage, may right to coverage under the plan during the be charged up to 150% of the applicable election period. The plan is also required to premium during the disability extension period. If disclose, to health care providers, the status of only non-disabled Qualified Beneficiaries are continuation coverage during any applicable covered during the extension period, the premium payment grace periods. applicable premium, plus administrative fee (if applicable) will apply. If you wish to make a payment at the time of the election, make certain Conversion Option that the check is signed, dated, made out to the If the Qualified Beneficiary’s COBRA continuation sponsoring employer, and the total is the amount coverage ends as a result of the expiration of the required to fully pay your premium. maximum coverage period, the group health plan must, during the 180-day period that ends on that Disability Extension expiration date, provide the Qualified Beneficiary A Qualified Beneficiary who is determined under with the option of enrolling under a conversion Title II or XVI of the Social Security Act, to have health plan if such an option is otherwise been disabled at the time of the Qualifying Event generally available to similarly situated that is a termination of employment or reduction nonCOBRA beneficiaries under the group health of hours, or within the first 60 days of continuation plan. If such an option is not otherwise generally coverage for all Qualified Beneficiaries, may be available, it will not be made available to eligible for an additional 11 months (for a total of Qualified Beneficiaries. 29 months) of continuation coverage. A written determination of disability from the Social HIPAA and Open Enrollments

©2005 CobraAid Page 4 of 24 CA-Pkte01 Qualified Beneficiaries are entitled to the same open enrollment rights as nonCOBRA beneficiaries. HIPAA requires that group health plans provide special enrollment rights to add coverage for newly acquired family members. In addition, special enrollment rights must be extended to certain individuals who previously declined continuation coverage due to other coverageElection to enroll in the plan.Agreement to Continue Group Health Coverage

ApplicantWho to Contact:Information: Please complete this form to elect COBRA continuation coverage. For assistance, or if you are This notice does not fully describe continuation electingcoverage for anor other incompetent rights under beneficiary, the plan. More call the Plan Administrator. information about continuation coverage and your rights under the plan is available in your summaryApplicant Information plan description or from the plan administrator. EmployerPayments should be sent to the above listed Applicant Name address. If you have questions regarding yourName Phone rights under COBRA, please contact: Address Date of Birth Social Name Security# of Plan: Gender M / F Former Former Dependent Dependent Self Spouse Spouse Child Child

Do you wish to continue with a Flexible Spending Monthly Account, (FSA) if applicable? (Circle yes or no) YES Amount $ NO Plan Code/Coverage Type (Medical, Premium Dental, etc.) Amount $ Dependent Information Dependent Name Date of Birth Gender Relationship

M or F Spouse or Child Social Security #

Dependent Name Date of Birth Gender Relationship

Spouse or Child Social Security # M or F

IF NEEDED, ATTACH SEPARATE SHEETS FOR ADDITIONAL DEPENDENTS.

I authorize the above election for continuation coverage (COBRA). I certify that I am electing only those coverages that were in effect on the day before the qualifying event. I understand that I will no longer be eligible for COBRA continuation coverage if I fail to make timely premium payments, become entitled to Medicare, or become covered under another group health plan that does not contain a limitation or exclusion for a pre-existing condition. I also understand that I am responsible for making monthly premium payments even if I do not receive a billing statement and that failure to make timely payments will result in cancellation of continuation coverage with no chance for reinstatement. I also agree to notify the plan administrator of any changes in the address, eligibility, disability, or dependent status. I certify that the above statements are true to the best of my knowledge and that I have read the additional information with this form. Important: This form must be sent within 60 days of the benefits termination date, or date of this notice, whichever is later. The initial premium payment is due within©2005 45 days CobraAid of the date this election formPage is5 ofsent. 24 CA-Pkte01 Signature______Date ______©2005 CobraAid Page 6 of 24 CA-Pkte01 ©2005 CobraAid Page 7 of 24 CA-Pkte01 ©2005 CobraAid Page 8 of 24 CA-Pkte01 ©2005 CobraAid Page 9 of 24 CA-Pkte01 ©2005 CobraAid Page 10 of 24 CA-Pkte01 ©2005 CobraAid Page 11 of 24 CA-Pkte01 ©2005 CobraAid Page 12 of 24 CA-Pkte01 ©2005 CobraAid Page 13 of 24 CA-Pkte01 ©2005 CobraAid Page 14 of 24 CA-Pkte01 ©2005 CobraAid Page 15 of 24 CA-Pkte01 ©2005 CobraAid Page 16 of 24 CA-Pkte01 ©2005 CobraAid Page 17 of 24 CA-Pkte01 ©2005 CobraAid Page 18 of 24 CA-Pkte01 ©2005 CobraAid Page 19 of 24 CA-Pkte01 Certificate of Group Health Plan Coverage

Important

This certificate provides evidence of your prior group health coverage. You may need to furnish this certificate if you become eligible under a group health plan that excludes coverage for certain medical conditions that you have before you enroll. This certificate may need to be provided if medical advice, diagnosis, care, or treatment was recommended or received for the condition within the 6-month period prior to your enrollment in the new plan. If you become covered under another group health plan, check with the plan administrator to see if you need to provide this certificate. You may also need this certificate to buy, for yourself or your family, an insurance policy that does not exclude coverage for medical conditions that are present before you enroll.

Employee Information Date of Name of Participant Certificate: Identification Number of Participant Address: Name of Group Health City, St, Zip Plan:

Name of Individuals to Whom this Certificate Applies

Name Relationship

Name Relationship

Name Relationship

Company/Contact Information (for further information, call the plan administrator listed below) Company Name Plan Administrator

Company Address

Phone

Coverage Information Date Waiting or Affiliation Period (if any) Name of Group Health Plan Began Date Coverage Ended: If coverage is Date Coverage Began continuing, note “continuing” in this box. The individual(s) and/or dependents for whom this certificate applies has at least 18 months of creditable coverage (disregarding periods of coverage before a 63 day break). Yes No Note: Separate certificates will be furnished if information is not identical for the participant and each beneficiary. Please retain this document as proof of creditable coverage.

©2005 CobraAid Page 20 of 24 CA-Pkte01 Signature______Date______

Statement of HIPAA Portability Rights

IMPORTANT — KEEP THIS CERTIFICATE. This certificate is evidence of your coverage under this plan. Under a federal law known as HIPAA, you may need evidence of your coverage to reduce a preexisting condition exclusion period under another plan, to help you get special enrollment in another plan, or to get certain types of individual health coverage even if you have health problems.

Pre-existing condition exclusions. Some group health plans restrict coverage for medical conditions present before an individual’s enrollment. These restrictions are known as “preexisting condition exclusions.” A pre- existing condition exclusion can apply only to conditions for which medical advice, diagnosis, care, or treatment was recommended or received within the 6 months before your “enrollment date.” Your enrollment date is your first day of coverage under the plan, or, if there is a waiting period, the first day of your waiting period (typically, your first day of work). In addition, a pre- existing condition exclusion cannot last for more than 12 months after your enrollment date (18 months if you are a late enrollee). Finally, a pre-existing condition exclusion cannot apply to pregnancy and cannot apply to a child who is enrolled in health coverage within 30 days after birth, adoption, or placement for adoption.

If a plan imposes a pre-existing condition exclusion, the length of the exclusion must be reduced by the amount of your prior creditable coverage. Most health coverage is creditable coverage, including group health plan coverage, COBRA continuation coverage, coverage under an individual health policy, Medicare, Medicaid, State Children's Health Insurance Program (SCHIP), and coverage through high-risk pools and the Peace Corps. Not all forms of creditable coverage are required to provide certificates like this one. If you do not receive a certificate for past coverage, talk to your new plan administrator.

You can add up any creditable coverage you have, including the coverage shown on this certificate. However, if at any time you went for 63 days or more without any coverage (called a break in coverage) a plan may not have to count the coverage you had before the break.

Therefore, once your coverage ends, you should try to obtain alternative coverage as soon as possible to avoid a 63-day break. You may use this certificate as evidence of your creditable coverage to reduce the length of any preexisting condition exclusion if you enroll in another plan.

Right to get special enrollment in another plan. Under HIPAA, if you lose your group health plan coverage, you may be able to get into another group health plan for which you are eligible (such as a spouse’s plan), even if the plan generally does not accept late enrollees, if you request enrollment within 30 days. (Additional special enrollment rights are triggered by marriage, birth, adoption, and placement for adoption.)

©2005 CobraAid Page 21 of 24 CA-Pkte01 Therefore, once your coverage ends, if you are eligible for coverage in another plan (such as a spouse’s plan), you should request special enrollment as soon as possible.

Prohibition against discrimination based on a health factor. Under HIPAA, a group health plan may not keep you (or your dependents) out of the plan based on anything related to your health. Also, a group health plan may not charge you (or your dependents) more for coverage, based on health, than the amount charged a similarly situated individual.

Right to individual health coverage. Under HIPAA, if you are an “eligible individual,” you have a right to buy certain individual health policies (or in some states, to buy coverage through a high-risk pool) without a pre-existing condition exclusion. To be an eligible individual, you must meet the following requirements:

You have had coverage for at least 18 months without a break in coverage of 63 days or more; Your most recent coverage was under a group health plan (which can be shown by this certificate); Your group coverage was not terminated because of fraud or nonpayment of premiums; You are not eligible for COBRA continuation coverage or you have exhausted your COBRA benefits (or continuation coverage under a similar state provision); and You are not eligible for another group health plan, Medicare, or Medicaid, and do not have any other health insurance coverage.

The right to buy individual coverage is the same whether you are laid off, fired, or quit your job.

Therefore, if you are interested in obtaining individual coverage and you meet the other criteria to be an eligible individual, you should apply for this coverage as soon as possible to avoid losing your eligible individual status due to a 63-day break.

State flexibility. This certificate describes minimum HIPAA protections under federal law. States may require insurers and HMOs to provide additional protections to individuals in that state.

For more information. If you have questions about your HIPAA rights, you may contact your state insurance department or the U.S. Department of Labor, Employee Benefits Security Administration (EBSA) toll-free at 1-866- 444-3272 (for free HIPAA publications ask for publications concerning changes in health care laws). You may also contact the CMS publication hotline at 1-800-633-4227 (ask for “Protecting Your Health Insurance Coverage”). These publications and other useful information are also available on the Internet at: http://www.dol.gov/ebsa, the DOL’s interactive web pages - Health Elaws, or http://www.cms.hhs.gov/hipaa1.

©2005 CobraAid Page 22 of 24 CA-Pkte01 Notice to Terminating Medi-Cal from your health insurance must be at least twice the monthly insurance Employees in California premiums. If you have Medi-Cal Share of Cost, that amount will be subtracted from Health Insurance Premium your monthly health care costs to determine if paying the premiums is cost-effective; Payment Program (HIPP) 4) You must have a current health insurance The California Department of Health policy, COBRA or Cal-COBRA continuation Services will pay health insurance premiums policy, or a COBRA conversion policy in for certain persons who are losing effect or available at the time of application; employment and have a high cost medical condition. In order to qualify for the Health Insurance Premium Payment (HIPP) 5) Your health insurance policy must cover Program, you must meet ALL your high cost medical condition; of the following conditions: 6) Your application must be completed and 1) You must currently be on Medi-Cal; returned in time for the State of California to process your application and pay your premium; 2) Your Medi-Cal Share of Cost, if any, must be $200 or less; 7) Your health insurance policy must not be issued through the California Managed Risk 3) You must have an expensive medical Medical Insurance Board; and condition. The average monthly savings to

©2005 CobraAid Page 23 of 24 CA-Pkte01 This law revised certain provisions of Cal- 8) You must not be enrolled in a Medi-Cal COBRA and other existing laws that require related prepaid health plan, County Health plans and insurers to offer health benefit Initiative, Geographic Managed Care coverage to certain individuals. The law, Program, of the County Medical Services effective September 1, 2003, requires a health Program (CMSP). care service plan and a health insurer to offer specified individuals who begin receiving NOTE: If an absent parent has been ordered continuation coverage on or after by the court to January 1, 2003, and who have exhausted provide your health insurance, you will not their continuation coverage under federal be eligible for the HIPP Program. continuation coverage provisions an opportunity to extend the term of their coverage to 36 months. The law would also For Persons Disabled by extend continuation coverage for specified HIV/AIDS individuals under Cal-COBRA to 36 months. Section 10128.59 has been added to the CARE/HIPP Program California Insurance Code and reads: AIDS Hotline 1-800-367-2437 A health insurer that provides coverage under Under the Ryan White Comprehensive AIDS a group benefit plan to an employer shall Resources offer an insured who has exhausted Emergency (CARE) Act of 1990, persons continuation coverage under COBRA the unable to work because of disability due to opportunity to continue coverage for up to 36 HIV/AIDS and are losing their private health months from the date the insured’s insurance may qualify for premium payment continuation coverage began if assistance through the CARE Health the insured is entitled to less than 36 months Insurance Premium Payment (CARE/HIPP) of continuation coverage under COBRA. The program for up to 29 months, if they meet the health insurer shall offer coverage pursuant to following criteria: terms of this article, including the rate limitations contained in Section 10128.56 of the California Insurance Code. 1) Have applied for Social Security Disability Insurance (SSDI), Supplemental For purposes of this section, COBRA means Security Income (SSI), State Disability section 4980B of Title 26 of the United States Insurance (SDI), or other disability Code. programs;

2) Are currently covered by a health insurance plan (COBRA, Cal-COBRA individual or group), which includes outpatient prescription drug coverage and HIV-related treatment services;

3) Are not currently on the AIDS Drug Assistance Program (ADAP) for any outpatient prescription drug that can be covered by private insurance;

4) Have a total monthly income of no more than 400 percent of the current federal poverty level; and

5) Will be eligible for the Medi-Cal/HIPP or a County Organized Health System (COHS) HIPP program by the end of the 29- monthcoverage period (some clients may be eligible for extended program coverage).

Important Information about California Bill No. 1401

©2005 CobraAid Page 24 of 24 CA-Pkte01