Final Exam - Study Questions for Web Site

Multiple Choice Identify the choice that best completes the statement or answers the question.

____ 1. How people choose among the alternatives available to them is: a. not part of the study of economics. b. impossible to describe. c. the study of microeconomics. d. not important. e. normative economics. ____ 2. For an economist, the cost of something is: a. the amount of money you paid for it. b. what you gave up to get it. c. always equal to its market value. d. the quantity of resources used to produce it. e. the value of your hourly wage. ____ 3. Periods in which output and employment are falling are known as: a. recessions. b. booms. c. expansions. d. deflations. e. recoveries.

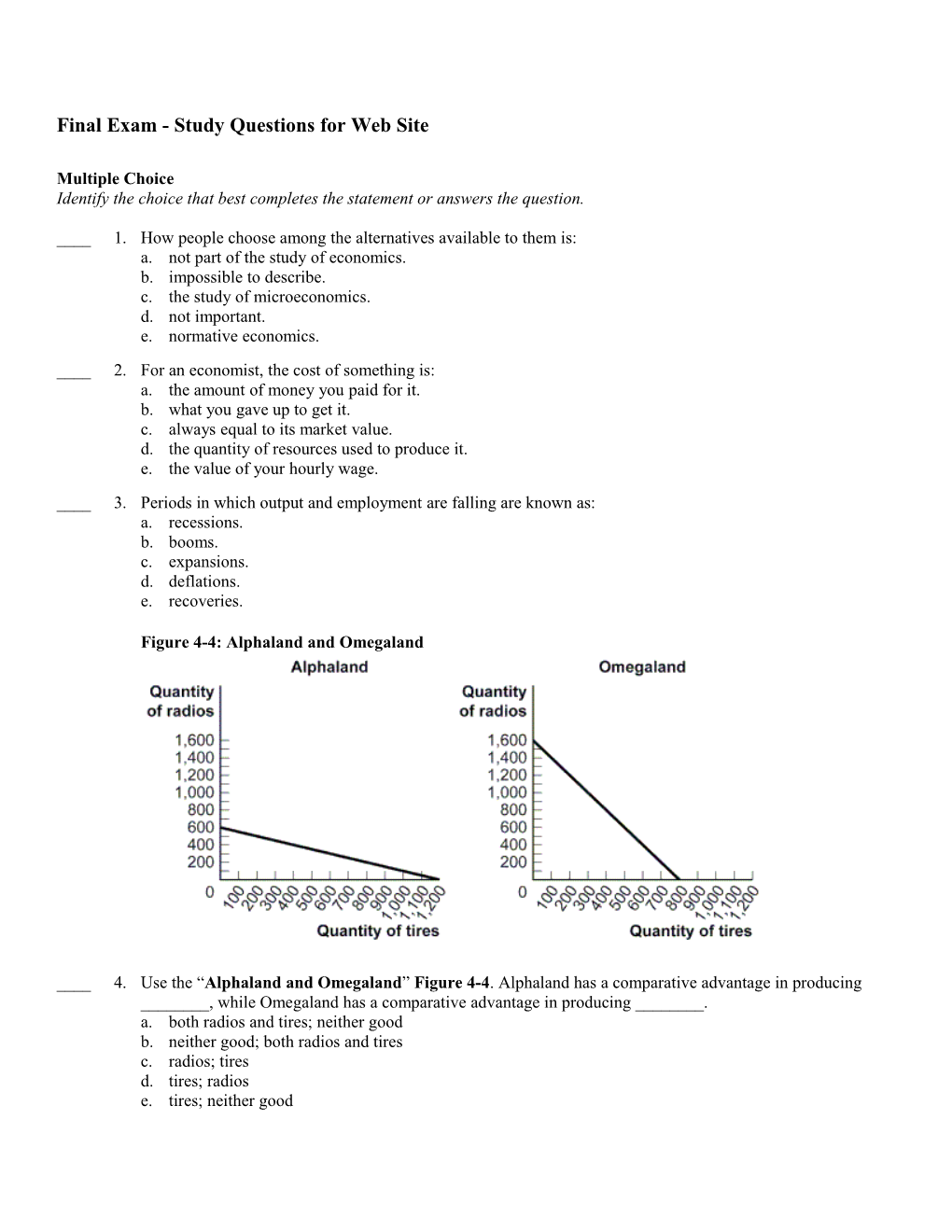

Figure 4-4: Alphaland and Omegaland

____ 4. Use the “Alphaland and Omegaland” Figure 4-4. Alphaland has a comparative advantage in producing ______, while Omegaland has a comparative advantage in producing ______. a. both radios and tires; neither good b. neither good; both radios and tires c. radios; tires d. tires; radios e. tires; neither good ____ 5. Steel is imported by many nations, and some nations apply a tariff to imported steel. In the importing country, the most likely effect of a tariff on steel is to: a. raise the price and decrease the quantity demanded. b. raise the price and increase the quantity demanded. c. raise the price without affecting the quantity demanded. d. decrease the quantity supplied. e. lower the price and increase the quantity demanded. ____ 6. When the price of gas goes up and the demand for tires goes down, this means tires and gas are: a. substitutes. b. complements. c. both expensive. d. both inexpensive. e. inferior goods. ____ 7. An inverse relationship between price and quantity is represented by: a. the demand curve. b. the supply curve. c. the production possibility frontier. d. equilibrium. e. the marginal cost curve. ____ 8. Markets that are characterized by many buyers and many sellers are referred to as: a. inefficient. b. competitive. c. foreign. d. monopolies. e. corrupt. ____ 9. Which of the following statements is true? a. The concept of equilibrium requires that all individuals have an equal amount of income. b. If equilibrium in a market exists, then the price in that market will not fluctuate by more than 5%. c. If equilibrium in a market exists, then there will be no remaining opportunities for individuals to make themselves better off. d. Equilibrium in a market will exist when the number of buyers is equal to the number of sellers. e. If equilibrium in a market exists, it is both an efficient and an equitable outcome. ____ 10. If the market for buffalo meat is in equilibrium, it means that the price of buffalo meat will probably ______in the near future. a. slightly increase b. not change c. slightly decrease d. greatly increase e. greatly decrease ____ 11. If the supply and demand curves intersect at a price of $47, then any price above that would result in a(n): a. shortage. b. surplus. c. equilibrium. d. increase in demand. e. decrease in supply ____ 12. The market for soybeans is initially in equilibrium. Because of “mad cow disease,” producers decide to replace bone meal with soybeans in cattle feed. The likely effect is that: a. the equilibrium price and quantity of soybeans will rise. b. the equilibrium price and quantity of soybeans will fall. c. the equilibrium quantity of soybeans will rise, but we can't determine what will happen to the equilibrium price. d. the equilibrium price of soybeans will rise, but we can't determine what will happen to the equilibrium quantity. e. there is likely to be no impact on the soybean market. ____ 13. The market for lemonade is currently in equilibrium and the price of lemons rises. How will this affect the lemonade market? a. Demand will decrease, decreasing the price and decreasing the quantity. b. Demand will decrease, increasing the price and decreasing the quantity. c. Supply will increase, decreasing the price and increasing the quantity. d. Supply will decrease, increasing the price and decreasing the quantity. e. Supply will decrease, increasing the price and increasing the quantity. ____ 14. An increase in supply, with no change in demand, will lead to ______in equilibrium quantity and ______in equilibrium price. a. an increase; an increase b. an increase; a decrease c. a decrease; an increase d. a decrease; a decrease e. no change; no change ____ 15. A maximum legal price is called: a. a price support. b. a price floor. c. a price ceiling. d. the parity price. e. the minimum wage ____ 16. The likely result of a price floor is: a. a transfer of wealth from producers to consumers. b. a shortage of the good at a price below the market equilibrium price. c. a surplus of the good at a price below the market equilibrium price. d. a shortage of the good at a price above the market equilibrium price. e. a surplus of the good at a price above the market equilibrium price. ____ 17. A market price support policy establishes a price floor, which: a. decreases the price paid by consumers. b. does not change the price paid by consumers. c. increases the price received by farmers. d. decreases the price received by farmers. e. reduces government spending in agricultural markets. ____ 18. A price floor or a price ceiling is an example of: a. a quantity control. b. a price control. c. market equilibrium price. d. a quota limit. e. an excise tax. ____ 19. If we add up the consumer spending on goods and services, investment spending, government purchases of goods and services, and the value of exports, then subtract the value of imports, we have measured the nation's _____. a. disposable income. b. gross domestic product. c. trade deficit. d. value added. e. national debt. ____ 20. Gross domestic product or GDP is: a. the total dollar value of intermediate goods and services produced in the economy in a given time period. b. the total dollar value of wages paid to producing workers in a given time period. c. the total dollar value of household income earned in a given time period. d. the total dollar value of government production in a given time period. e. the total dollar value of final goods and services produced in the economy in a given time period.

Year Output Price per Unit 1 2 $2 2 3 4 3 = base period 4 5 4 6 6 5 7 9 Table 11-5: Price and Output Data

____ 21. Use Table 11-5. The value of Year 4's output in real dollars is: a. $5.20. b. $6. c. $24. d. $36. e. $30. ____ 22. Anna recently moved to Boston in order for her husband Joe to begin a new job as an economics professor at Harvard. Anna is an experienced surgeon who is currently interviewing with several different hospitals in Boston. Anna is currently: a. seasonally unemployed. b. structurally unemployed. c. cyclically unemployed. d. counted as employed since she is likely to receive a job offer soon. e. frictionally unemployed. ____ 23. Labor unions that are effective at achieving wage rates: a. lower than the equilibrium wage rate may unintentionally cause frictional unemployment. b. equal to the equilibrium wage rate may cause shortages in that labor market. c. higher than the equilibrium wage rate may also result in structural unemployment. d. higher than the equilibrium wage rate may cause shortages in that labor market. e. equal to the equilibrium wage rate may cause surpluses in that labor market. ____ 24. The multiplier is equal to: a. 1/[1–MPC]. b. MPS/MPC. c. 1/[MPC]. d. 1/[1+MPC]. e. 1/[1–MPS]. ____ 25. Planned investment spending: a. is positively related to the nominal, but not the real interest rate. b. is negatively related to both the real and nominal interest rates. c. is independent of the interest rate. d. is negatively related to the nominal, but positively related to the real interest rate. e. is positively related to both the nominal and the real interest rates. ____ 26. If real GDP is $1000 billion and the aggregate expenditure is $850 billion, then the change in inventories will be: a. –$150 million. b. $1,850 million. c. $150 million. d. –$1,850 million. e. $850 million. ____ 27. The interest rate effect of an aggregate price level change causes: a. the long-run aggregate supply curve to be vertical. b. the aggregate demand curve to be negatively sloped. c. the short-run aggregate supply curve to be positively sloped. d. the aggregate demand curve to be positively sloped. e. the short-run aggregate demand curve to be vertical. ____ 28. Raising income taxes shifts the: a. aggregate demand curve to the left. b. long-run aggregate supply curve to the left. c. aggregate demand curve to the right. d. short-run aggregate supply curve to the left. e. short-run aggregate supply curve to the right. ____ 29. In the long run, the aggregate price level has: a. no effect on the quantity of aggregate output. b. a positive effect on the quantity of aggregate output. c. a negative effect on the quantity of aggregate output. d. A positive impact on aggregate output, but no impact on employment. e. a positive impact on employment, but no impact on aggregate output. ____ 30. According to the long-run aggregate supply curve, when ______, the quantity of aggregate output supplied ______. a. nominal wages rise; falls b. the aggregate price level rises; does not change c. the aggregate price level rises; falls d. the price of commodities falls; rises e. the unemployment rate rises; does not change

Figure 20-4: Inflationary and Recessionary Gaps ____ 31. Use the “Inflationary and Recessionary Gaps” Figure 20-4. At E1, the economy: a. is in long-run equilibrium. b. has an inflationary gap. c. has a recessionary gap. d. is booming. e. would benefit from contractionary fiscal policy. ____ 32. Suppose the MPC = 0.8 and the government cuts taxes by $40 billion. Which of the following will be the likely effect? a. Real GDP will expand by $200 billion. b. Real GDP will contract by $200 billion. c. Real GDP will expand by $160 billion. d. Real GDP will contract by $160 billion. e. Real GDP will expand by $400 billion. ____ 33. If the price of an asset is expected to rise in the future: a. asset owners will be more willing to sell it now. b. it will be more in demand today. c. the price of the asset will fall today. d. the supply of the asset will increase today. e. the demand for the asset will decrease today. ____ 34. For a bank, when a person deposits money into the bank, this: a. creates only an asset for the bank. b. creates only a liability for the bank. c. creates a liability and an asset for the bank. d. is most likely to result in a decrease in the money supply. e. creates a liability for the depositor. ____ 35. Suppose the economy experiences price inflation such that a typical basket of goods is now more expensive than it used to be. All else equal, we would expect: a. the demand for money to shift inward. b. a downward movement along a fixed money demand curve. c. the demand for money to shift outward. d. an upward movement along a fixed money demand curve. e. no impact on the money demand curve. ____ 36. An increase in the level of business optimism will generally: a. not change the loanable funds demand curve. b. shift the loanable funds demand curve to the left. c. cause a movement both down the loanable funds demand curve. d. shift the loanable funds demand curve to the right. e. the supply of loanable funds to increase. ____ 37. Expecting the inflation rate to be 3%, Adrianna decides to put her savings in bonds yielding a fixed 5% interest rate over a year. If the actual inflation rate is ______, it can be argued that ______is (are) better off. a. below 3%; Adrianna b. exactly 5%; both the corporation issuing the bonds and Adrianna c. above 3%; Adrianna d. below 3%; the corporation issuing the bonds e. below 3%; both Adrianna and the corporation issuing the bonds ____ 38. If there is too much deflation: a. people will switch from money to real assets. b. the nominal interest rate will be constrained by the zero interest rate bound. c. lenders will be harmed. d. aggregate demand will increase. e. borrowers will be helped. ____ 39. Classical economists point out that: a. there is a trade-off between unemployment and inflation. b. an increase in the money supply leads to an equal proportional rise in the price level. c. government spending can affect aggregate demand. d. there is the possibility of a liquidity trap. e. monetary policy can increase potential GDP. ____ 40. Keynes argued that the surest way to bring the economy out of the Great Depression was to: a. keep the economy in a liquidity trap until antitrust policy could be enforced. b. use expansionary fiscal policy. c. increase taxes and spend less. d. leave the economy alone, and flexible wages and prices would eventually lead to increases in income and employment. e. decrease the money supply to decrease interest rates and spur business investment. ____ 41. For the most part, Keynesians believe: a. monetary policy is best at fighting recessions. b. fiscal policy is best at fighting recessions. c. a monetary rule is best for evening out the business cycle. d. balancing the budget should be the policy prescription to follow. e. that the economy will self-correct in the long run to full employment.

Figure 41-2: International Capital Flows ____ 42. Use the “International Capital Flows” Figure 41-2. At an interest rate of 4%, the quantity of loanable funds demanded by British borrowers is ______the quantity of loanable funds supplied by British lenders. a. greater than b. less than c. equal to d. not related to e. falling to equal ____ 43. Foreign exchange controls refer to the: a. fixed exchange rate system maintained by a country. b. restrictions imposed by a foreign country on the amount of foreign exchange that a country's central bank can hold. c. system of a common currency such as euro used by several countries. d. licensing systems that limit the rights of individuals to buy foreign currency e. restrictions imposed by a nation on the quantity of the nation’s currency an individual can possess at any time. ____ 44. The difference between a fixed exchange rate regime and a floating exchange rate regime, is that: a. under a fixed exchange rate regime the central bank retains its ability to pursue independent monetary policy, whereas under a floating exchange rate regime it does not. b. under a floating exchange rate regime the central bank retains its ability to pursue independent monetary policy, whereas under a fixed exchange rate regime it does not. c. under a fixed exchange rate regime the government can pursue independent fiscal policy, whereas under a floating exchange rate regime it does not. d. under a floating exchange rate regime the government can pursue independent fiscal policy, whereas under a fixed exchange rate regime it does not. e. under a floating exchange rate regime the central bank retains its ability to pursue independent fiscal policy, whereas under a fixed exchange rate regime it does not. ____ 45. The price elasticity of demand measures the: a. responsiveness of quantity demanded to a change in income. b. responsiveness of price to a change in quantity demanded. c. extent to which prices are flexible and respond to market forces. d. responsiveness of demand when price is held constant and demand increases or decreases. e. responsiveness of quantity demanded to a change in price. ____ 46. If two goods are substitutes, their cross-price elasticity of demand should be: a. less than 0, but not less than -1. b. less than -1. c. equal to 0. d. greater than 0. e. equal to -1.

Table 49-1: Consumer Surplus and Phantom Tickets

Student Willingness to Pay

Jessica $150 Jacquelyn 125 Brad 105 Robert 60 Gwen 25 Table 49-1: Consumer Surplus and Phantom Tickets

____ 47. (Table 49-1: Consumer Surplus and Phantom Tickets) If the box-office price of a ticket to see Phantom of the Opera is $50, and there is no other market for tickets, then total consumer surplus for the five students is: a. $100. b. $175. c. $230. d. $240. e. $200. ____ 48. If an excise tax is imposed on wine and collected from the _____, the ______curve will shift ______by the amount of the tax. a. sellers; demand; upward b. consumers; demand; downward c. consumers; supply; upward d. sellers; supply; downward e. consumers; demand; upward ____ 49. A tax that takes a fixed percentage of income, regardless of the level of income, is a: a. proportional tax. b. benefits tax. c. progressive tax. d. regressive tax. e. sales tax. ____ 50. Consumers in a particular market will bear the greater burden of an excise tax: a. the more price-elastic supply is relative to demand. b. the less price-elastic supply is relative to demand. c. if supply has the same price elasticity as demand. d. regardless of the price elasticity of demand or supply. e. if supply is perfectly inelastic and supply is unit elastic. ____ 51. The principle of diminishing marginal utility: a. refers to the tendency of total utility to increase until an individual's budget is no longer constrained. b. refers to the tendency of marginal utility to decline as the amount of consumption of a good or service increases. c. indicates that, if a good is inferior, less of it will be purchased when income falls. d. assumes all goods are normal. e. refers to the possibility that some demand curves are upward sloping. ____ 52. Freddy has eaten three corn dogs at the county fair and knows that if he eats another, he will get sick on the roller coaster. Knowing this, and ignoring any impact that price might have on his decision, we can say that the: a. total utility of the fourth corn dog is less than zero. b. marginal utility of the fourth corn dog is less than zero. c. total utility curve is still increasing at the fourth corn dog. d. marginal utility curve is still increasing at the fourth corn dog. e. total utility is less than zero for both the third and fourth corn dogs. ____ 53. The price of popcorn is $0.50 per box and the price of peanuts is $0.25 per bag, and you have $10 to spend. You decide to purchase 8 bags of peanuts. The maximum quantity of popcorn that you can purchase is ______boxes. a. 4 b. 8 c. 10 d. 16 e. 12 ____ 54. Michael Kawamura, a careful maximizer of utility, consumes only two goods, peanut butter and ice cream. He had just achieved the utility-maximizing solution in his consumption of the two goods when the price of peanut butter fell. As he adjusts to this event the marginal utility of peanut butter: a. and of ice cream will rise. b. and of ice cream will fall. c. will fall, and the marginal utility of ice cream will rise. d. will rise, and the marginal utility of ice cream will fall. e. will be unchanged, and the marginal utility of ice cream will fall. ____ 55. If the marginal benefit received from a good is greater than the marginal cost of production, then: a. society's well-being can be improved if production increases. b. society's well-being can be improved if production decreases. c. society's well-being cannot be improved by changing production. d. the market is producing too much of the good. e. the market is producing the efficient quantity of the good.

Q = output, FC = fixed cost, VC = variable cost, TC = total cost, MC = marginal cost Q FC VC TC MC 1 20 10 30 2 20 18 38 13 3 20 31 17 4 20 68 Table 55-2: Output and Costs ____ 56. (Table 55-2: Output and Costs) Using the information in the table, when quantity increases from one to two, marginal cost equals: a. 13. b. 10. c. 18. d. 17. e. 8.

Figure 55-1: Average Total Cost Curve

____ 57. (Figure 55-1: Average Total Cost Curve) In the figure, the total cost of producing three pairs of boots is approximately: a. $24. b. $72. c. $75. d. $216. e. $125. ____ 58. (Figure 55-1: Average Total Cost Curve) In the figure, the total cost of producing 10 pairs of boots is approximately: a. $13. b. $54. c. $131. d. $1,308. e. $1,150. ____ 59. Situations in which the more users of a product there are, the more useful the product becomes are called: a. network effects. b. monopolies. c. conglomerates. d. exclusive franchises. e. duopolies. ____ 60. Output Total Cost 0 $10 1 60 2 80 3 110 4 170 5 245 Table: Total Cost and Output

The table describes Bart's perfectly competitive ice cream-producing firm. If the market price is $67.50, how many units of output will the firm produce? a. one b. two c. three d. four e. five ____ 61. The marginal revenue received by a firm in a perfectly competitive market: a. is unrelated to the market price. b. is less than the market price. c. is greater than the market price. d. is the change in total revenue divided by the change in output. e. is equal to total output times the price at which it sells that output. ____ 62. If a perfectly competitive firm is producing a quantity that generates P < MC, then profit: a. is maximized. b. can be increased by decreasing the price. c. can be increased by increasing production. d. can be increased by decreasing production. e. is negative and less than total fixed cost. ____ 63. A perfectly competitive firm will not produce any output in the short run and will shut down if price is: a. greater than marginal cost. b. less than marginal cost. c. less than average variable cost. d. greater than average variable cost and less than average total cost. e. less than marginal revenue.

Figure 59-2: Cost Curve and Profits

____ 64. (Figure 59-2: Cost Curves and Profits) In the figure, if market price is $12, this firm will: a. minimize its losses by shutting down. b. exit the market in the long run. c. break even. d. earn an economic profit. e. minimize its losses by continuing to produce. ____ 65. If some firms in a perfectly competitive industry are earning positive economic profits, then in the long run, the: a. industry is in long-run equilibrium. b. industry supply curve will shift to the right. c. number of firms in the industry will not change. d. number of firms in the industry will decrease. e. industry demand curve will shift to the right.

Quantity Price per (megawatts) Megawatt Total Cost 1 $550 $1,000 2 500 1,075 3 450 1,200 4 400 1,375 5 350 1,600 6 300 1,875 7 250 2,200 8 200 2,575 Table 61-1: Demand and Total Cost

____ 66. (Table 61-1: Demand and Total Cost) Lenoia runs a natural monopoly producing electricity for a small mountain village. The table shows Lenoia's demand and total cost of producing electricity. The price effect of increasing production from 3 megawatts to 4 megawatts is: a. –$150. b. $500. c. $450. d. –$50. e. - $400

Figure 61-4: Monopoly Model ____ 67. (Figure 61-4: Monopoly Model) The profit-maximizing price is the one indicated by: a. Z. b. P. c. E. d. F. e. I.

Figure 65-4: Payoff Matrix for Ajinomoto and ADM

____ 68. (Figure 65-4: Payoff Matrix for Ajinomoto and ADM) Given the payoff matrix in the figure, the Nash equilibrium combination is for: a. each firm to produce 30 million pounds. b. each firm to produce 40 million pounds. c. ADM to produce 30 million pounds and for Ajinomoto to produce 40 million pounds. d. ADM to produce 40 million pounds and for Ajinomoto to produce 30 million pounds. e. No Nash equilibrium exists in this game.

Figure 67-10: The Market for Gas Stations ____ 69. (Figure 67-10: The Market for Gas Stations) Assume that the market is characterized by many firms, differentiated products, easy entry, and easy exit. In long-run equilibrium, the economic profit earned by the typical gas station in the community will be: a. negative, as price will be less than average total cost. b. zero, as price will equal average total cost. c. positive, as price will exceed average total cost. d. negative, as price will be equal to average total cost. e. zero, as price will exceed average total cost. ____ 70. Human capital: a. consists of man-made resources such as buildings and machines. b. is the improvement in labor created by education and knowledge that is embodied in the workforce. c. has become less important due to the progress in technology. d. is the same factor as labor. e. consists of natural resources made more productive by entrepreneurs. ____ 71. The largest component of the factor distribution of income in the United States is: a. interest. b. taxes. c. corporate profits. d. rents. e. compensation of employees. ____ 72. Which of the following is not a factor of production at a college? a. the faculty b. classroom buildings c. electricity d. the computer labs e. the gymnasium ____ 73. In terms of contribution to total income, the single most important factor of production is: a. physical capital. b. labor. c. natural resources. d. entrepreneurship. e. financial capital. ____ 74. Suppose all perfectly competitive fast-food firms are hiring the profit-maximizing quantity of labor and are paying their workers $7 per hour. Then suppose the government decides to raise the minimum wage to $8 per hour. Then: a. since the value of the marginal product would exceed the wage, firms would hire more workers. b. since the value of the marginal product would be less than the wage, firms would lay off some workers. c. the firms would increase their prices to keep the value of the marginal product equal to the wage. d. firms would have to exit the industry since the value of the marginal product is less than the wage. e. firms would be unable to alter their hiring because the minimum wage is set by the government. ____ 75. Max employs both labor and capital to produce his trinkets. Currently the last unit of labor employed has a marginal product of 100 units. The last unit of capital employed has a marginal product of 40 units. The price of labor is $25 per unit and the price of capital is $10 per unit. Max should: a. Increase the hiring of both labor and capital. b. Increase the hiring of labor and decrease the hiring of capital. c. Decrease the hiring of labor and increase the hiring of capital. d. Do nothing; he is hiring the optimal quantity of labor and capital. e. Decrease the hiring of both labor and capital. ____ 76. Which of the following is an example of environmental standards? a. tradable pollution permits b. taxes on the level of pollution c. taxes imposed on each gallon of gasoline purchased d. production subsidies

e. legal limits on SO2 emissions ____ 77. A common resource is a good or service for which exclusion is: a. possible and which is rival in consumption. b. possible and which is nonrival in consumption. c. not possible and which is rival in consumption. d. not possible and which is nonrival in consumption. e. not possible and which is rival in production.

Figure 76-1: Market Failure ____ 78. (Figure 76-1: Market Failure) If the market produces quantity F, then: a. marginal benefit is equal to marginal cost. b. marginal benefit is less than marginal cost. c. marginal benefit is greater than marginal cost. d. price is equal to marginal cost and greater than marginal benefit. e. the market is underproducing this good.

Quantity of Dave's Art's Streetlights in Individual Individual the Neighborhood Marginal Benefit Marginal Benefit 0 1 $15 $20 2 10 15 3 5 10 4 2 3 Table 76-4: Marginal Benefit from Additional Streetlights

____ 79. (Table 76-4: Marginal Benefit from Additional Streetlights) Dave and Art live in a new housing development and would like to have streetlights installed to illuminate the streets and sidewalks at night. The table shows Dave and Art's individual marginal benefits of different quantities of streetlights that could be installed in the neighborhood. Suppose that the marginal cost of installing a streetlight is $6. What is the maximum that Art would be willing to pay to have one streetlight installed in the neighborhood? a. $20 b. $15 c. $35 d. $5 e. $48 ____ 80. A sudden loss of income or a significant increase in costly medical expenses are examples of: a. economic insecurity. b. economic inequality. c. poverty thresholds. d. the Great Compression. e. discrimination. Final Exam - Study Questions for Web Site Answer Section

MULTIPLE CHOICE

1. ANS: C PTS: 1 DIF: M REF: Module 1 MSC: Critical Thinking 2. ANS: B PTS: 1 DIF: E REF: Module 1 MSC: Definitional 3. ANS: A PTS: 1 DIF: E REF: Module 2 MSC: Definitional 4. ANS: D PTS: 1 DIF: M REF: Module 4 MSC: Analytical Thinking 5. ANS: C PTS: 1 DIF: M REF: Module 4 MSC: Concept-Based 6. ANS: B PTS: 1 DIF: D REF: Module 5 MSC: Critical Thinking 7. ANS: A PTS: 1 DIF: E REF: Module 5 MSC: Concept-Based 8. ANS: B PTS: 1 DIF: E REF: Module 5 MSC: Definitional 9. ANS: C PTS: 1 DIF: D REF: Module 6 MSC: Critical Thinking 10. ANS: B PTS: 1 DIF: E REF: Module 6 MSC: Definitional 11. ANS: B PTS: 1 DIF: M REF: Module 6 MSC: Critical Thinking 12. ANS: A PTS: 1 DIF: M REF: Module 7 MSC: Critical Thinking 13. ANS: D PTS: 1 DIF: M REF: Module 7 MSC: Analytical Thinking 14. ANS: B PTS: 1 DIF: M REF: Module 7 MSC: Critical Thinking 15. ANS: C PTS: 1 DIF: E REF: Module 8 MSC: Definitional 16. ANS: E PTS: 1 DIF: M REF: Module 8 MSC: Concept-Based 17. ANS: C PTS: 1 DIF: M REF: Module 8 MSC: Concept-Based 18. ANS: B PTS: 1 DIF: E REF: Module 8 MSC: Definitional 19. ANS: B PTS: 1 DIF: E REF: Module 10 MSC: Definitional 20. ANS: E PTS: 1 DIF: E REF: Module 10 MSC: Definitional 21. ANS: E PTS: 1 DIF: M REF: Module 11 MSC: Critical Thinking 22. ANS: E PTS: 1 DIF: M REF: Module 13 MSC: Critical Thinking 23. ANS: C PTS: 1 DIF: M REF: Module 13 MSC: Concept-Based 24. ANS: A PTS: 1 DIF: M REF: Module 16 MSC: Definitional 25. ANS: B PTS: 1 DIF: E REF: Module 16 MSC: Concept-Based 26. ANS: C PTS: 1 DIF: M REF: Module 16 MSC: Analytical Thinking 27. ANS: B PTS: 1 DIF: M REF: Module 17 MSC: Concept-Based 28. ANS: A PTS: 1 DIF: M REF: Module 17 MSC: Concept-Based 29. ANS: A PTS: 1 DIF: E REF: Module 18 MSC: Concept-Based 30. ANS: B PTS: 1 DIF: E REF: Module 18 MSC: Concept-Based 31. ANS: C PTS: 1 DIF: M REF: Module 20 MSC: Concept-Based 32. ANS: C PTS: 1 DIF: M REF: Module 21 MSC: Critical Thinking 33. ANS: B PTS: 1 DIF: M REF: Module 22 MSC: Critical Thinking 34. ANS: C PTS: 1 DIF: M REF: Module 25 MSC: Critical Thinking 35. ANS: C PTS: 1 DIF: M REF: Module 28 MSC: Critical Thinking 36. ANS: D PTS: 1 DIF: M REF: Module 29 MSC: Concept-Based 37. ANS: A PTS: 1 DIF: M REF: Module 34 MSC: Critical Thinking 38. ANS: B PTS: 1 DIF: M REF: Module 34 MSC: Critical Thinking 39. ANS: B PTS: 1 DIF: M REF: Module 35 MSC: Fact-Based 40. ANS: B PTS: 1 DIF: M REF: Module 35 MSC: Concept-Based 41. ANS: B PTS: 1 DIF: M REF: Module 35 MSC: Fact-Based 42. ANS: B PTS: 1 DIF: M REF: Module 41 MSC: Critical Thinking 43. ANS: D PTS: 1 DIF: E REF: Module 43 MSC: Definitional 44. ANS: B PTS: 1 DIF: M REF: Module 44 MSC: Concept-Based 45. ANS: E PTS: 1 DIF: E REF: Module 47/11 MSC: Definitional 46. ANS: D PTS: 1 DIF: E REF: Module 48/12 MSC: Fact-Based 47. ANS: D PTS: 1 DIF: M REF: Module 49/13 MSC: Critical Thinking 48. ANS: B PTS: 1 DIF: M REF: Module 50/14 MSC: Concept-Based 49. ANS: A PTS: 1 DIF: E REF: Module 50/14 MSC: Definitional 50. ANS: A PTS: 1 DIF: M REF: Module 50/14 MSC: Critical Thinking 51. ANS: B PTS: 1 DIF: M REF: Module 51/15 MSC: Definitional 52. ANS: B PTS: 1 DIF: D REF: Module 51/15 MSC: Concept-Based 53. ANS: D PTS: 1 DIF: M REF: Module 51/15 MSC: Analytical Thinking 54. ANS: C PTS: 1 DIF: M REF: Module 51/15 MSC: Critical Thinking 55. ANS: A PTS: 1 DIF: M REF: Module 53/17 MSC: Fact-Based 56. ANS: E PTS: 1 DIF: M REF: Module 55/19 MSC: Critical Thinking 57. ANS: D PTS: 1 DIF: M REF: Module 55/19 MSC: Critical Thinking 58. ANS: D PTS: 1 DIF: M REF: Module 55/19 MSC: Critical Thinking 59. ANS: A PTS: 1 DIF: M REF: Module 57/21 MSC: Definitional 60. ANS: D PTS: 1 DIF: M REF: Module 58/22 MSC: Critical Thinking 61. ANS: D PTS: 1 DIF: E REF: Module 58/22 MSC: Concept-Based 62. ANS: D PTS: 1 DIF: M REF: Module 58/22 MSC: Concept-Based 63. ANS: C PTS: 1 DIF: M REF: Module 59/23 MSC: Concept-Based 64. ANS: E PTS: 1 DIF: M REF: Module 59/23 MSC: Critical Thinking 65. ANS: B PTS: 1 DIF: M REF: Module 60/24 MSC: Concept-Based 66. ANS: A PTS: 1 DIF: M REF: Module 61/25 MSC: Critical Thinking 67. ANS: B PTS: 1 DIF: D REF: Module 61/25 MSC: Critical Thinking 68. ANS: B PTS: 1 DIF: M REF: Module 65/29 MSC: Critical Thinking 69. ANS: B PTS: 1 DIF: M REF: Module 67/31 MSC: Critical Thinking 70. ANS: B PTS: 1 DIF: M REF: Module 69/33 MSC: Definitional 71. ANS: E PTS: 1 DIF: E REF: Module 69/33 MSC: Fact-Based 72. ANS: C PTS: 1 DIF: M REF: Module 69/33 MSC: Critical Thinking 73. ANS: B PTS: 1 DIF: E REF: Module 69/33 MSC: Fact-Based 74. ANS: B PTS: 1 DIF: M REF: Module 69/33 MSC: Critical Thinking 75. ANS: D PTS: 1 DIF: M REF: Module 72/36 MSC: Analytical Thinking 76. ANS: E PTS: 1 DIF: M REF: Module 75/39 MSC: Fact-Based 77. ANS: C PTS: 1 DIF: E REF: Module 76/40 MSC: Definitional 78. ANS: A PTS: 1 DIF: M REF: Module 76/40 MSC: Critical Thinking 79. ANS: A PTS: 1 DIF: E REF: Module 76/40 MSC: Analytical Thinking 80. ANS: A PTS: 1 DIF: M REF: Module 78/42 MSC: Critical Thinking