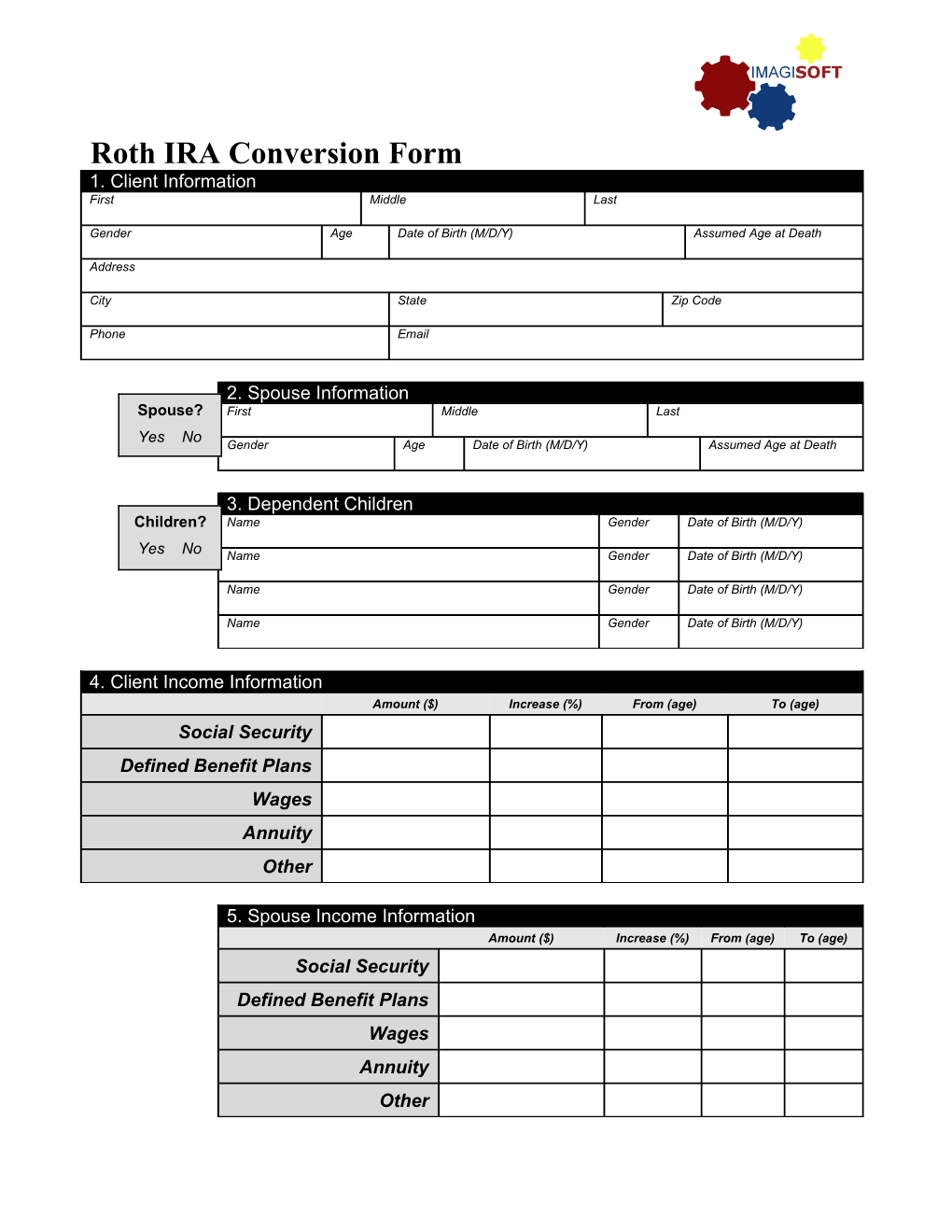

Roth IRA Conversion Form 1. Client Information First Middle Last

Gender Age Date of Birth (M/D/Y) Assumed Age at Death

Address

City State Zip Code

Phone Email

2. Spouse Information Spouse? First Middle Last Yes No Gender Age Date of Birth (M/D/Y) Assumed Age at Death

3. Dependent Children Children? Name Gender Date of Birth (M/D/Y)

Yes No Name Gender Date of Birth (M/D/Y)

Name Gender Date of Birth (M/D/Y)

Name Gender Date of Birth (M/D/Y)

4. Client Income Information Amount ($) Increase (%) From (age) To (age) Social Security Defined Benefit Plans Wages Annuity Other

5. Spouse Income Information Amount ($) Increase (%) From (age) To (age) Social Security Defined Benefit Plans Wages Annuity Other Roth IRA Conversion Form cont. 6. Tax Assumptions □ Single Itemized Deductions (excluding mortgage interest) □ Married Filing Jointly Filing Status: Amount ($) □ Married Filing Separately □ Head of Household

7. Assumed Future Tax Law Changes Percent (%) Tax Bracket Inflation Adjustment Percent (%) Year Tax Bracket Percentage Change

□ Proposed 28% Limit on Itemized Deductions □ Proposed Health Care Surcharge

8. Asset Information Rate of Cost To Deposit Fro To Account Withdrawal Increase From Increase Return Basis (age Amount m (age Value ($) Amount ($) (%) (age) (%) (%) ($) ) ($) (age) ) Savings, Money Markets

CDs, Bonds

Non-Qualified Annuities IRA, 401(k), 403(b) Plans

Roth IRA

Stocks, Investments □ Reinvest RMD for IRA, 401(k), or 403(b) Plans 9. Residence Information Residence Mortgage Equity Line of Credit Current Value ($) Balance ($) Current Value ($)

Appreciation Rate (%) Interest Rate (%) Appreciation Rate (%)

Purchase Price Monthly Payment Purchase Price

10. Client Main Objective □ Higher After-Tax Income □ Higher Personal After-Tax □ Larger Estate for Posterity for Spouse Income □ Other ______