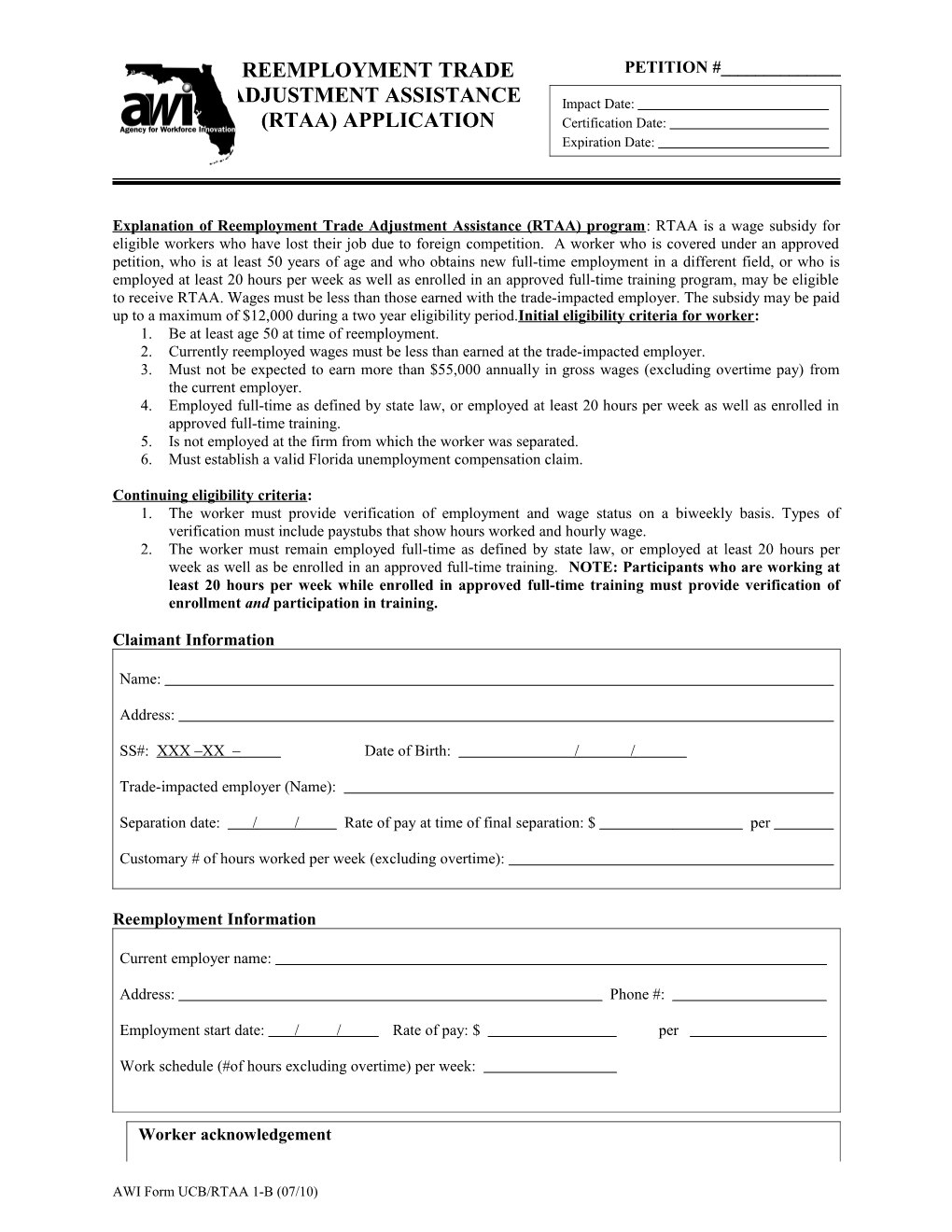

REEMPLOYMENT TRADE PETITION #______

ADJUSTMENT ASSISTANCE Impact Date: (RTAA) APPLICATION Certification Date: Expiration Date:

Explanation of Reemployment Trade Adjustment Assistance (RTAA) program: RTAA is a wage subsidy for eligible workers who have lost their job due to foreign competition. A worker who is covered under an approved petition, who is at least 50 years of age and who obtains new full-time employment in a different field, or who is employed at least 20 hours per week as well as enrolled in an approved full-time training program, may be eligible to receive RTAA. Wages must be less than those earned with the trade-impacted employer. The subsidy may be paid up to a maximum of $12,000 during a two year eligibility period.Initial eligibility criteria for worker: 1. Be at least age 50 at time of reemployment. 2. Currently reemployed wages must be less than earned at the trade-impacted employer. 3. Must not be expected to earn more than $55,000 annually in gross wages (excluding overtime pay) from the current employer. 4. Employed full-time as defined by state law, or employed at least 20 hours per week as well as enrolled in approved full-time training. 5. Is not employed at the firm from which the worker was separated. 6. Must establish a valid Florida unemployment compensation claim.

Continuing eligibility criteria: 1. The worker must provide verification of employment and wage status on a biweekly basis. Types of verification must include paystubs that show hours worked and hourly wage. 2. The worker must remain employed full-time as defined by state law, or employed at least 20 hours per week as well as be enrolled in an approved full-time training. NOTE: Participants who are working at least 20 hours per week while enrolled in approved full-time training must provide verification of enrollment and participation in training.

Claimant Information

Name:

Address:

SS#: XXX –XX – Date of Birth: / /

Trade-impacted employer (Name):

Separation date: / / Rate of pay at time of final separation: $ per

Customary # of hours worked per week (excluding overtime):

Reemployment Information

Current employer name:

Address: Phone #:

Employment start date: / / Rate of pay: $ per

Work schedule (#of hours excluding overtime) per week:

Worker acknowledgement

AWI Form UCB/RTAA 1-B (07/10) I understand that I will be required to provide verification of employment and wages to the Special Payment Unit on a biweekly basis.

I understand that I may apply for Health Coverage Tax Credit benefits and any other services for which I may qualify.

I understand that the RTAA supplement shall cease in the event of one of the following: 1. My annualized wage is projected to exceed $55,000 a year. 2. I have received $12,000 in RTAA benefits. 3. I have reached the end of the two-year eligibility period. 4. I am not employed full-time, or employed at least 20 hours per week as well as enrolled in approved full-time training. I have read and understand the initial and continuing eligibility criteria, as well as the restrictions associated with the RTAA program, and choose to participate.

Signature of Worker: Date:

PRIVACY ACT STATEMENT: Information you provide to this agency is voluntary and confidential but is required to process your claim. Pursuant to the Internal Revenue Code of 1986, the Social Security Act, 42 U.S.C. 1320b-7(a)1, and s. 443.091(1)(g), F.S., disclosure of your Social Security number is mandatory. Social Security numbers will be used by the Agency to report the benefits you receive to the Internal Revenue Service as potential taxable income. In accordance with the Federal Deficit Reduction Act, an amendment to the Federal Social Security Act, and 5 U.S.C. 552a(o)(1)(D), information you provide is subject to verification through computer matching programs and information about your wages and claim may be provided to other federal, state and local agencies or their contractors for verification of eligibility under other government programs to ensure benefits have been properly paid and for statistical and research purposes.

TO BE COMPLETED BY LOCAL AGENCY REPRESENTATIVE

Claimant’s Name: Social Security Number: 1. Annualized wages at the time of separation from trade-impacted employer.

Calculation: Hourly rate of pay at time of separation $ X number of hours worked during last full week of employment = $ X 52 = $______.

2. Annualized wages at reemployment

Calculation: Hourly rate of pay at reemployment $______X ______number of hours worked during first full week of employment (excluding overtime) = $______X 52 = $______.

The information contained in this section is only an estimate. I have advised the worker that he/she will be required to submit documentation related to his/her reemployment wages to the Special Payment Unit on a biweekly basis. Signature of Local Agency Representative: Date:

TO BE COMPLETED BY STATE AGENCY REPRESENTATIVE RTAA Application Approved: (YES) or (NO)

If YES, amount of initial wage subsidy:

If NO, reason:

Signature of State Representative: Date:

AWI Form UCB/RTAA (07/10)