Q3 2011 Investment Strategy

Sample Bank Anywhere, US Economic and Fed Overview U.S. economic growth clearly slowed in the second quarter as households continued to retrench in the face of a weak jobs market, low wage growth, and still-heavy debt burdens. Current estimates place GDP growth in the first half of 2011 at around 2%, far below the average for post-war recoveries. The jobs market has remained Portfolio June 30, 2011 stubbornly weak as evidenced by a mere 54K new payrolls added in May and an Book Value $50,000,000 uptick in the unemployment rate to 9.1%. In the midst of this economic performance, bond yields generally fell throughout the quarter. The 2Yr T-Note dropped 32bps from Portfolio/TA 50% 0.78% to 0.46%, and the 10Yr Note finished 28bps lower at a 3.16% yield. $ Gain/(Loss) $1,050,000

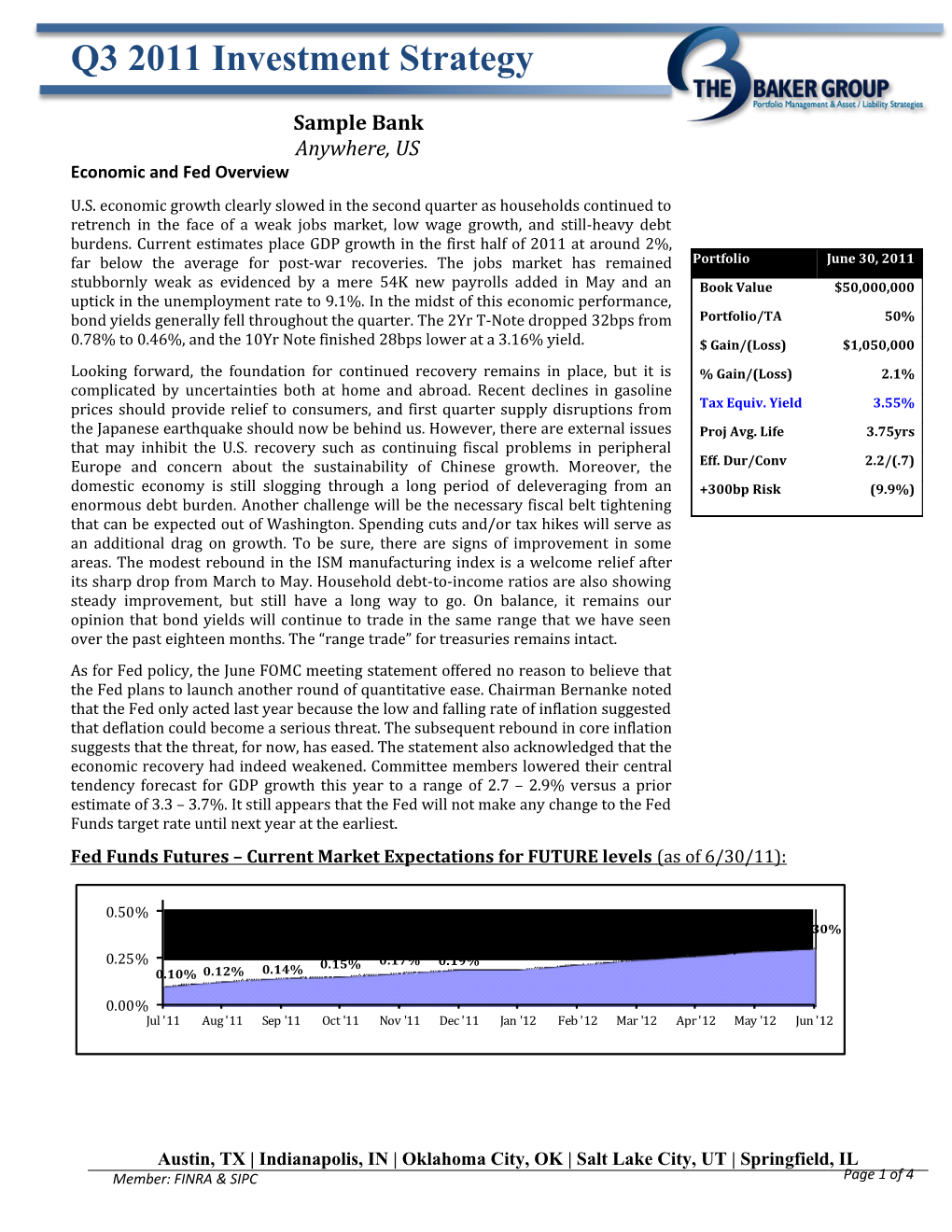

Looking forward, the foundation for continued recovery remains in place, but it is % Gain/(Loss) 2.1% complicated by uncertainties both at home and abroad. Recent declines in gasoline prices should provide relief to consumers, and first quarter supply disruptions from Tax Equiv. Yield 3.55% the Japanese earthquake should now be behind us. However, there are external issues Proj Avg. Life 3.75yrs that may inhibit the U.S. recovery such as continuing fiscal problems in peripheral Europe and concern about the sustainability of Chinese growth. Moreover, the Eff. Dur/Conv 2.2/(.7) domestic economy is still slogging through a long period of deleveraging from an +300bp Risk (9.9%) enormous debt burden. Another challenge will be the necessary fiscal belt tightening that can be expected out of Washington. Spending cuts and/or tax hikes will serve as an additional drag on growth. To be sure, there are signs of improvement in some areas. The modest rebound in the ISM manufacturing index is a welcome relief after its sharp drop from March to May. Household debt-to-income ratios are also showing steady improvement, but still have a long way to go. On balance, it remains our opinion that bond yields will continue to trade in the same range that we have seen over the past eighteen months. The “range trade” for treasuries remains intact. As for Fed policy, the June FOMC meeting statement offered no reason to believe that the Fed plans to launch another round of quantitative ease. Chairman Bernanke noted that the Fed only acted last year because the low and falling rate of inflation suggested that deflation could become a serious threat. The subsequent rebound in core inflation suggests that the threat, for now, has eased. The statement also acknowledged that the economic recovery had indeed weakened. Committee members lowered their central tendency forecast for GDP growth this year to a range of 2.7 – 2.9% versus a prior estimate of 3.3 – 3.7%. It still appears that the Fed will not make any change to the Fed Funds target rate until next year at the earliest. Fed Funds Futures – Current Market Expectations for FUTURE levels (as of 6/30/11):

0.50% 0.28% 0.30% 0.24% 0.26% 0.19% 0.21% 0.25% 0.15% 0.17% 0.19% 0.10% 0.12% 0.14%

0.00% Jul '11 Aug '11 Sep '11 Oct '11 Nov '11 Dec '11 Jan '12 Feb '12 Mar '12 Apr '12 May '12 Jun '12

Austin, TX | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 1 of 4 Q3 2011 Investment Strategy

四月 2018

Current Rates and Portfolio Strategy

The Bank took advantage of higher reinvestment opportunities in 4Q10 and 1Q11 Sector Distribution and continued to deploy idle cash which resulted in the first quarterly increase in overall portfolio yield in the last 4 years. Portfolio yield increased 2bp during the Other, quarter to 3.55% after falling 70bp over the previous 12 months. This helped 2% nd CMO, Agency maintain margin in the current weak lending environment. However, the 2 15% 20% Quarter of 2011 saw Treasury yields fall again with the 2-, 5- and 10-year yields down 36bp, 52bp and 31bp respectively. Portfolio duration fell slightly during the quarter as the Bank selectively reduced extension risk, especially by continuing to eliminate longer maturity callable Agency bonds and replacing them will more Muni, MBS, 24% defensive Municipals and Mortgages. The Bank will continue using short-end 36% Tax Muni, MBS/CMO cashflow and long-end Municipal bonds to maintain a cashflow 3% barbell that will supply the Bank with necessary liquidity without sacrificing too much yield. As markets continue to anticipate the fed funds rate will remain “exceptionally low for an extended period”, the Bank will work hard to fully deploy idle funds in an effort to fight margin erosion. The Bank expects to maintain duration and not be tempted to chase yield in the wrong sectors. However, if the current trading range continues, the Bank will look for ways to take advantage of yields moving higher and lower within that range by slightly adjusting duration in an attempt to increase performance. This could be accomplished by focusing on higher coupon, higher premium, more defensive securities near the bottom of the range and lower coupon, lower price (and even possibly discounts) securities near the top of the range.

Historical U.S. Treasury Yield Curves

Sector Strategies

Austin, TX | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 2 of 4 Q3 2011 Investment Strategy

四月 2018

Agencies Treasury yields fell during the 2nd Quarter, falling 20-30bps on the short- and long- Agency % end and 40-60bps in the belly of the curve. Agency spreads to treasuries ended Current Target the quarter slightly wider (2-10bps) across the curve. Longer-term economic and interest rate uncertainty will continue to preclude the Bank from chasing yield 20% 15-25% with longer maturity, negatively convexed callable agency products. The Bank Eff. Duration / Convexity will moderate sector duration by primarily purchasing securities with 3- to 7-year maturities. Favored structures will be premium one-time callable securities with Current Target at least one year, if not more, of call protection. The Bank will look to take 2.0/(0.8) 1.5-2.5/(0.5)- advantage of any pull-back in rates by adding deeply-discounted (<97 $price) (1.0) callable agencies. Such securities will provide a large yield kick if rates fall and they are called. Step-ups with 1x-call, 1x-step structures will also be utilized when the step coupon provides sufficient probability of call. Step-up issuance remains high and with a varying range of structures. The Bank will resist the temptation to chase yield and avoid longer maturity, multi-step bonds in favor the shorter 1x- step, 1x-call bonds with higher back-end coupons. The Bank will continue to look for opportunities to sell short maturities and deploy the proceeds on the intermediate portion of the curve. In general, the Bank will look to take advantage of market fluctuations by adding deep discounts and extending duration if rates rise, then focusing on premium 1x-calls as rates fall.

Municipals Municipals rallied in the second quarter as new supply dropped by 40% from last year and this trend should continue in the future. The Bank has made an extensive effort to analyze and monitor the credit metrics of all municipal holdings and will be very diligent in reviewing the creditworthiness of all future purchases. Given prudent credit analysis, the environment continues to offer excellent opportunities to add to the Municipal sector. As the Bank continues to employ a barbell strategy, the Bank will maximize longer municipal holdings and explore opportunities to swap out of shorter maturities and deploy the proceeds out on the preferred range of the curve. The Bank will continue to buy general obligation municipals and will purchase essential-purpose revenue municipals with a minimum of 1.25x coverage and preferring a 1.50x or higher coverage. The Taxable Municipal % Bank will also purchase BABs with 5-10 year maturities, preferring shorter Current Target maturities because they do not have the same reduced duration benefit as the tax- free issues. The Bank will carefully review the creditworthiness of all municipal 3% 5-10% issuers in addition to assessing the strength of the bond insurer. Preferred Eff. Duration / Convexity insurers of municipal holdings will be the Texas PSF, Nevada PSF, AGM, Assured Current Target Guarantee as well as State Aid Withholding , Qualified School Bond Funds and issues rated A or better on their own. 6.0/0.2 5.0-7.0/0.25- (0.25)

MBS

Austin, TX | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 3 of 4 Q3 2011 Investment Strategy

四月 2018

Mortgage rates steadily declined by about 3/8% over the 2nd quarter, bringing MBS % the current 30yr effective mortgage rate down to 4.75%. Even with the drop in rates, ongoing hurdles to access the mortgage market have caused the Mortgage Current Target Bankers Association Refinance Index to remain stuck around 2,500. The current 36% 35-45% readings are only up 15% from the 1Q average of 2,200. Seeing the 1Q activity resulted in overall prepayments slowing significantly over the first half of 2011, Eff. Duration / Convexity prepayment expectations for the 2nd half 2011 are quite tepid. Prepayments continue to be a tale of the “Haves” versus the “Have Nots”. The mortgage market Current Target is still very difficult to enter as only those with 750+ FICO scores and 50% LTV ratios seem to be able to access refinancing options. As a result, voluntary 1.8/(0.9) 1.5-2.0/(.75)- (1.25) prepayment speeds for lesser credit MBS pools continue to come in far below historic norms, as extremely tight underwriting standards, declining home prices, and increasing refinancing costs more than offset the impact of the historically low 30-year mortgage rates experienced last year. However, borrowers fitting the “Haves” profile proved to be very responsive to low rates and thus pools comprised of such loans were very fast in 2010 and could prove to get fast once again if mortgage rates we to fall further. It is imperative to manage the MBS portfolio with a balance of protecting against both extension and prepayment risks. The #1 loan attribute to curtail fast prepayments and also provide higher base case turnover rates continues to be pools comprised of lower loan balance mortgages. These loan holders have less economic incentive to refinance into lower rates when they are low but have increased mobility due to smaller loan sizes when rates are higher. To balance extension and prepayment risks, the Bank will continue to focus on higher coupon (>=5%) specified agency MBS pools with one or more of the following loan characteristics: 1) seasoned underlying mortgages (e.g. 2005 and earlier origination), 2) pools with particular loan attributes that should provide prepay protection (e.g. low loan balance, investor properties, NY, FL, TX geographic concentrations, etc.), or 3) short weighted average maturities (e.g. WAM <120 months). In the event of a pullback in prices of lower coupon MBS, the Bank may selectively purchase a few lower coupon "total return" MBS pools to supplement the existing portfolio. MBS ARM: The Bank’s MBS ARM sector continues to be quite small. 3x1 and 5x1 Hybrid ARMs (preferably GNMA) to enhance short-term cash flow and lower duration.

CMO % CMO Current Target The Bank has continued to reinvest cash flows in the Agency CMO sector to 15% 10-20% maintain a 15% allocation. To diversify mortgage prepayment exposure and take advantage of the more stable prepayment characteristics of FHA loans, GNMA MBS Eff. Duration / Convexity will be the preferred CMO collateral. FHA loans currently offer superior extension Current Target protection as base case turnover should remain brisk due to ongoing buyouts of lesser credit FHA borrowers, while faster prepayments should be 1.3/(1.1) 1.0-1.5/(.75)- curtailed by the 60bp increase in annual Mortgage Insurance Premium (1.25) (now 110bp) since October 2010. Preferred FNMA/FHLMC collateral will be either Seasoned or have lower Loan balance characteristics. CMO’s will be prudently analyzed for both extension and call risks and will pass all FFIEC stress tests.

Austin, TX | Indianapolis, IN | Oklahoma City, OK | Salt Lake City, UT | Springfield, IL Member: FINRA & SIPC Page 4 of 4