Solutions Guide: This is meant as a solutions guide. Please try reworking the questions and reword the answers to essay type parts so as to guarantee that your answer is an original. Do not submit as your own.

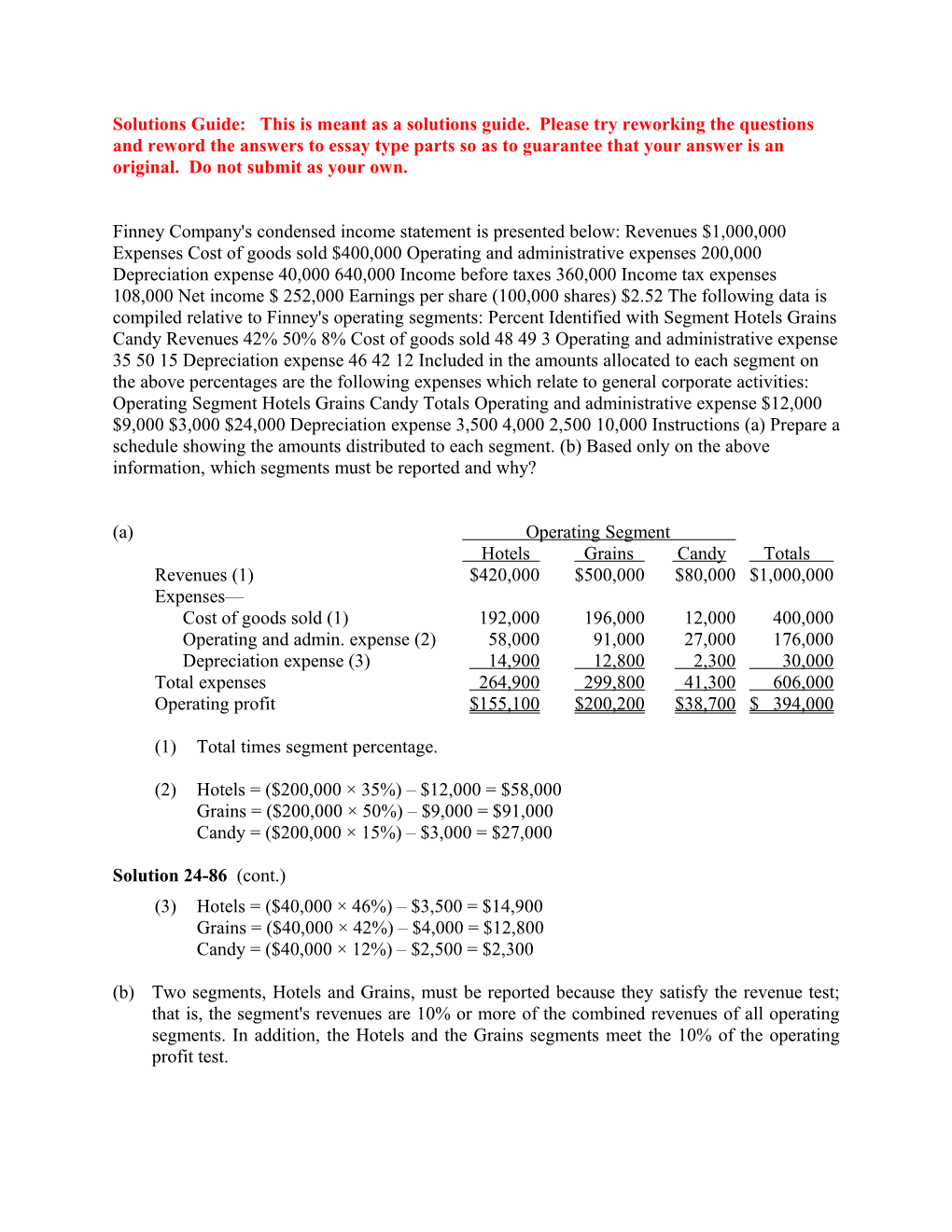

Finney Company's condensed income statement is presented below: Revenues $1,000,000 Expenses Cost of goods sold $400,000 Operating and administrative expenses 200,000 Depreciation expense 40,000 640,000 Income before taxes 360,000 Income tax expenses 108,000 Net income $ 252,000 Earnings per share (100,000 shares) $2.52 The following data is compiled relative to Finney's operating segments: Percent Identified with Segment Hotels Grains Candy Revenues 42% 50% 8% Cost of goods sold 48 49 3 Operating and administrative expense 35 50 15 Depreciation expense 46 42 12 Included in the amounts allocated to each segment on the above percentages are the following expenses which relate to general corporate activities: Operating Segment Hotels Grains Candy Totals Operating and administrative expense $12,000 $9,000 $3,000 $24,000 Depreciation expense 3,500 4,000 2,500 10,000 Instructions (a) Prepare a schedule showing the amounts distributed to each segment. (b) Based only on the above information, which segments must be reported and why?

(a) Operating Segment Hotels Grains Candy Totals Revenues (1) $420,000 $500,000 $80,000 $1,000,000 Expenses— Cost of goods sold (1) 192,000 196,000 12,000 400,000 Operating and admin. expense (2) 58,000 91,000 27,000 176,000 Depreciation expense (3) 14,900 12,800 2,300 30,000 Total expenses 264,900 299,800 41,300 606,000 Operating profit $155,100 $200,200 $38,700 $ 394,000

(1) Total times segment percentage.

(2) Hotels = ($200,000 × 35%) – $12,000 = $58,000 Grains = ($200,000 × 50%) – $9,000 = $91,000 Candy = ($200,000 × 15%) – $3,000 = $27,000

Solution 24-86 (cont.) (3) Hotels = ($40,000 × 46%) – $3,500 = $14,900 Grains = ($40,000 × 42%) – $4,000 = $12,800 Candy = ($40,000 × 12%) – $2,500 = $2,300

(b) Two segments, Hotels and Grains, must be reported because they satisfy the revenue test; that is, the segment's revenues are 10% or more of the combined revenues of all operating segments. In addition, the Hotels and the Grains segments meet the 10% of the operating profit test.