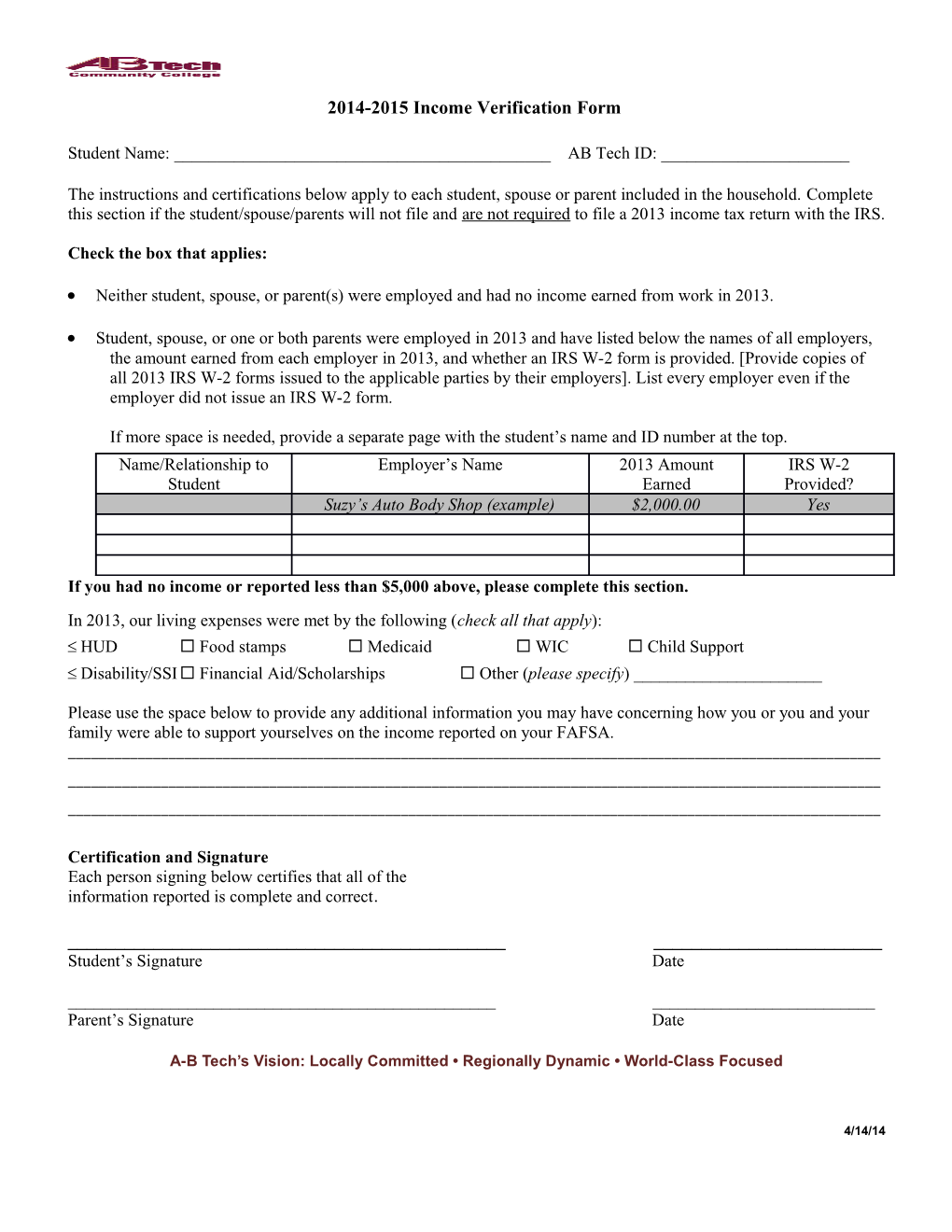

2014-2015 Income Verification Form

Student Name: ______AB Tech ID: ______

The instructions and certifications below apply to each student, spouse or parent included in the household. Complete this section if the student/spouse/parents will not file and are not required to file a 2013 income tax return with the IRS.

Check the box that applies:

Neither student, spouse, or parent(s) were employed and had no income earned from work in 2013.

Student, spouse, or one or both parents were employed in 2013 and have listed below the names of all employers, the amount earned from each employer in 2013, and whether an IRS W-2 form is provided. [Provide copies of all 2013 IRS W-2 forms issued to the applicable parties by their employers]. List every employer even if the employer did not issue an IRS W-2 form.

If more space is needed, provide a separate page with the student’s name and ID number at the top. Name/Relationship to Employer’s Name 2013 Amount IRS W-2 Student Earned Provided? Suzy’s Auto Body Shop (example) $2,000.00 Yes

If you had no income or reported less than $5,000 above, please complete this section. In 2013, our living expenses were met by the following (check all that apply): HUD Food stamps Medicaid WIC Child Support Disability/SSI Financial Aid/Scholarships Other (please specify) ______

Please use the space below to provide any additional information you may have concerning how you or you and your family were able to support yourselves on the income reported on your FAFSA. ______

Certification and Signature Each person signing below certifies that all of the information reported is complete and correct.

______Student’s Signature Date

______Parent’s Signature Date

A-B Tech’s Vision: Locally Committed • Regionally Dynamic • World-Class Focused

4/14/14