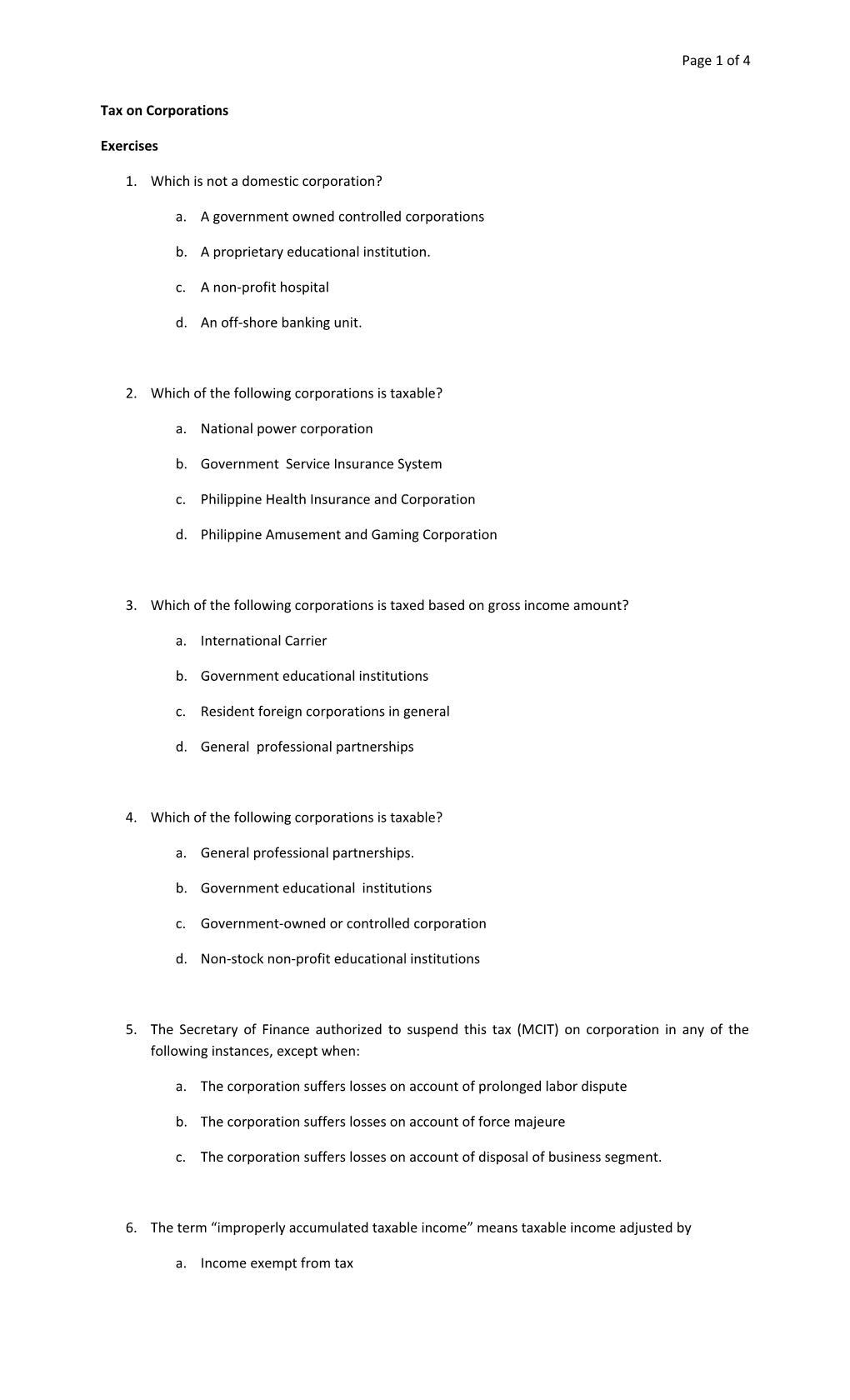

Page 1 of 4

Tax on Corporations

Exercises

1. Which is not a domestic corporation?

a. A government owned controlled corporations

b. A proprietary educational institution.

c. A non-profit hospital

d. An off-shore banking unit.

2. Which of the following corporations is taxable?

a. National power corporation

b. Government Service Insurance System

c. Philippine Health Insurance and Corporation

d. Philippine Amusement and Gaming Corporation

3. Which of the following corporations is taxed based on gross income amount?

a. International Carrier

b. Government educational institutions

c. Resident foreign corporations in general

d. General professional partnerships

4. Which of the following corporations is taxable?

a. General professional partnerships.

b. Government educational institutions

c. Government-owned or controlled corporation

d. Non-stock non-profit educational institutions

5. The Secretary of Finance authorized to suspend this tax (MCIT) on corporation in any of the following instances, except when:

a. The corporation suffers losses on account of prolonged labor dispute

b. The corporation suffers losses on account of force majeure

c. The corporation suffers losses on account of disposal of business segment.

6. The term “improperly accumulated taxable income” means taxable income adjusted by

a. Income exempt from tax Page 2 of 4

b. Income excluded from gross income

c. Income subject to final tax

d. All of the above

7. Statement 1: In computing for improperly accumulated earnings tax, income exempt from income tax is an item deductible from taxable income.

Statement 2: In computing for improperly accumulated earnings tax, income tax paid for the taxable year is an item to be added to the taxable income.

a. Only statement 1 is correct c. Both statements are correct

b. Only statement 2 is correct d. Both statements are wrong

8. A corporation, in its first year of operations, had the following data:

Philippines Foreign Gross Income P400, 000 P300, 000 Expense 200, 000 200, 000

The taxable income, if a domestic corporation and the data are on business, is:

a. P200, 000 c.P100, 000

b. P300, 000 d. P400, 000

9. In number 8, if the taxpayer is a resident corporation, and the data or on business, the taxable income is:

a. P200, 000 c. P100, 000

b. P300, 000 d. P400, 000

10. In number 8, if the taxpayer is a non-resident corporation, and the income and expenses are on an isolated transactions, the taxable income is:

a. P200, 000 c. P100, 000

b. P300, 000 d. P400, 000

11. A domestic corporation in its fifth year of operations in 2010, had the following data:

Sales P2, 000, 000

Cost of Sales 1, 000, 000

Business Expense 950, 000 Page 3 of 4

The income tax due of the corporation is:

a. P17, 500 c. P1, 000

b. P20, 000 d. P340, 000

12. AB is a general professional partnership with A, married and B, single, participating equally in the income and expenses. The following are data for the partnership and the partners in a calendar year:

AB A B Gross Income P600, 000 P150, 000 P200, 000 Expenses 350, 000 70, 000 120, 000

The gross income of A from the partnership:

a. P300, 000 c. None

b. P125, 000 d. P600, 000

13. In number 12, the taxable income of A is

a. P80, 000 c. P173, 000

b. P205, 000 d. Not given

14. During 2011, MacDo Inc., branch of a foreign company doing business in the Philippines had the following income and expense:

Gross Income, business within P80, 000, 000

Less: Expenses within 30, 000, 000

Taxable Income P50, 000, 000

Less: Income Tax (P50, 000, 000 x 30%) 15, 000, 000

Net Income after tax P30, 000, 000

During the year, the branch received a dividend of P5, 000, 000 from SMC (domestic). The following year, it earmarked for remittance to the head office the dividend of P5, 000, 000 and P20, 000, 000 of its net income after tax in the previous year. The branch profit remittance tax is:

a. P2, 000, 000 c. P4, 000, 000

b. P3, 000, 000 d. 0

15. A domestic corporation had the following data for 2011, the accumulated earnings for which year the Bureau of Internal revenue considered to be improper: Page 4 of 4

Sales P6, 000, 000 Cost of Sales 2, 000, 000 Business Expenses 1, 000, 000 Interest on Philippine Currency bank deposit 50, 000 Capital gain on sale directly to buyer of shares domestic corporation 120, 000 Dividend income from Domestic corporation 60, 000 Dividend declared and paid during the year 500, 000

The improperly accumulated earnings tax is:

a. P175, 300 c. P181, 300

b. P221, 000 d. 166, 300

16. Amby Company, a domestic corporation, had the following data on computations of the normal tax (NT) and minimum corporate income tax (MCIT) for five years:

2007 2008 2009 2010 2011 MCIT 80, 000 50, 000 30, 000 40, 000 35, 000 NT 20, 000 30, 000 40, 000 20, 000 70, 000

The income tax done for the year 2007 is:

a. P20, 000 c. P60, 000

b. P80, 000 d. P0

17. In no. 16, the income tax due for the year 2008 is

a. P50, 000 c. P20, 000

b. P30, 000 d. P0

18. In no. 16, the income tax due for the year 2010 is:

a. P40, 000 c. P10, 000

b. P20, 000 d. P0

19. In no. 16, the income tax due for the year 2011 is:

a. P30, 000 c. P40, 000

b. P70, 000 d. P0

***NOTHING FOLLOWS***