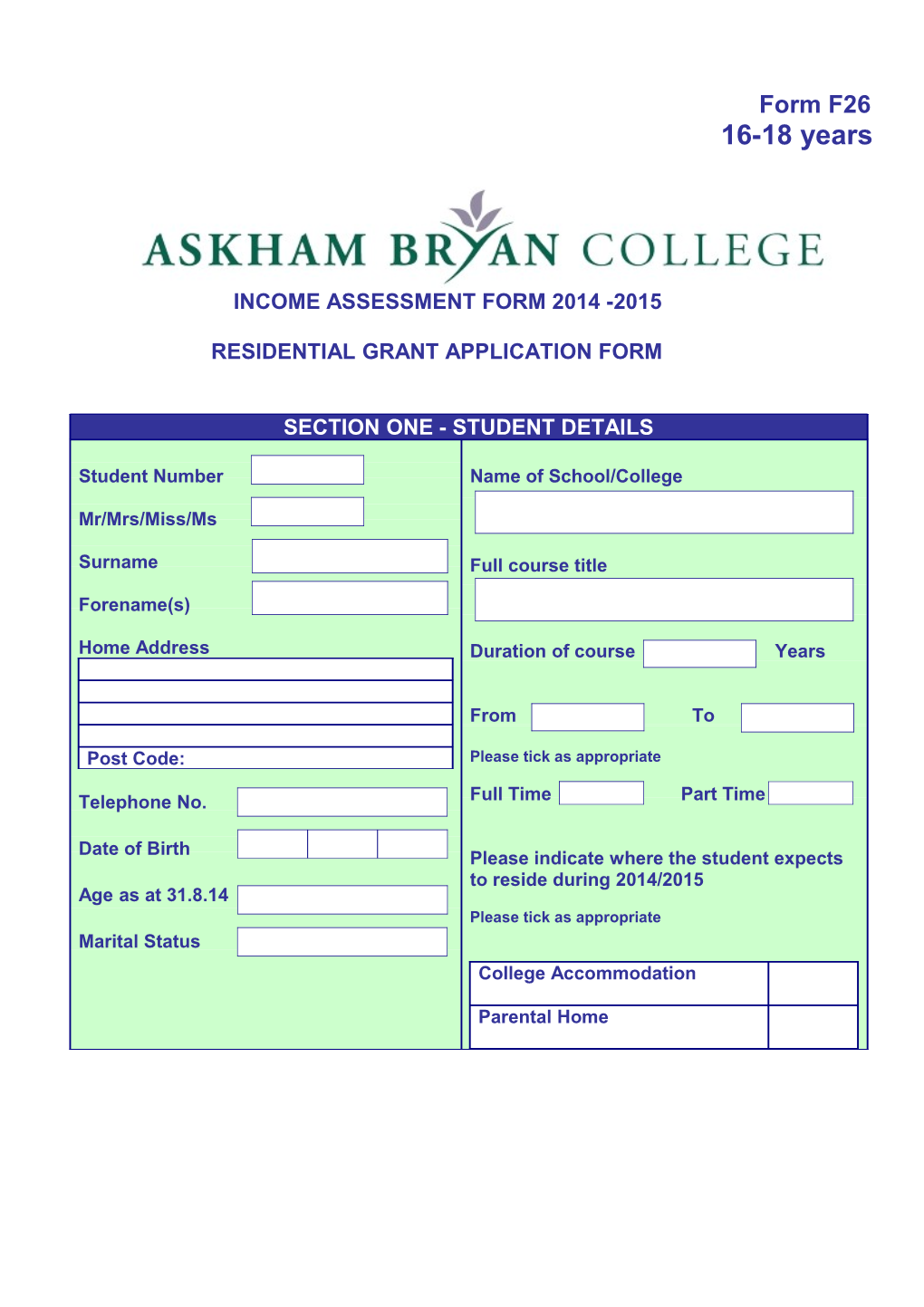

Form F26 16-18 years

INCOME ASSESSMENT FORM 2014 -2015

RESIDENTIAL GRANT APPLICATION FORM

SECTION ONE - STUDENT DETAILS

Student Number Name of School/College

Mr/Mrs/Miss/Ms

Surname Full course title

Forename(s)

Home Address Duration of course Years

From To

Post Code: Please tick as appropriate

Telephone No. Full Time Part Time

Date of Birth Please indicate where the student expects to reside during 2014/2015 Age as at 31.8.14 Please tick as appropriate Marital Status College Accommodation

Parental Home

SECTION TWO - PARENTS’ DETAILS

Name and Address of Parents /Carers with whom the student normally resides

Full name of Father/Stepfather Full name of Mother/Stepmother (Delete as appropriate) (Delete as appropriate)

Address: Address: (if different from Father/Stepfather)

Post Code: Post Code:

Telephone No.

Occupation of Father/Stepfather Occupation of Mother/Stepmother (Delete as appropriate) (Delete as appropriate)

Name & Address of Employer: Name & Address of Employer: (During year ended 5th April 2014 (During year ended 5th April 2014)

Post Code: Post Code: If you had more than one employer during the tax year ended 5th April 2014, please list further details below.

Father/Stepfather Mother/Stepmother Name & Address of Employer: Name & Address of Employer:

Post Code: Post Code: SECTION THREE and FOUR

PARENTS’ INCOME AND ALLOWANCES FOR THE YEAR ENDED 5TH APRIL 2014

The following sections, 3 and 4, should be completed by the parents/step-parents of the student applying for a grant.

Please enter total gross income from all sources for the year ended 5th April 2014. It is important that under any heading where there is no income the word none is written.

Please complete Income from Benefits if either parents or step-parents have received any state benefits during the period 6/04/13to 5/04/14.

SECTION THREE - INCOME DETAILS

Income source Examples Father Mother Gross Taxable Salary P60 2013/2014 or * March payslip 31/03/14. Business Profits Sole See notes and guidance Trader * after Section 6 Business Profits See notes and guidance Partnership * after Section 6 See notes and guidance Directors Fees * after Section 6 Taxable Benefits, e.g. P11D 2013/2014 or P2 Car, BUPA, etc. * 2013/2014 Spare time and casual See notes and guidance work * after Section 6 Pensions - Please P60 2013/2014 or letter give details of each from Job Centre Plus pension * Income from Property See notes and guidance or letting rooms * after Section 6 Bank or Building Please indicate whether Society interest on you have entered a deposits gross or net figure Please enter gross Investment/Annuities amount including tax etc. credits Any other income

SECTION THREE - INCOME FROM BENEFITS Please enter details of all benefits you received, except Child Benefit. Please enter the amount you received during the 2013/2014 tax year not the amount you receive weekly, fortnightly or monthly.

Benefit Father Mother Income Support*

Tax Credits*

Job Seekers Allowance*

Housing Benefit*

Care Allowance*

Disability Living Allowance*

Other* Please state

Evidence of Income and Benefits received

PLEASE ENSURE THAT IN ALL CASES WHERE THERE IS AN ASTERISK (*) DOCUMENTARY EVIDENCE IS SUBMITTED. ALL DOCUMENTATION SHOULD BE PHOTOCOPIED CLEARLY.

IF YOU ARE UNABLE TO PROVIDE EVIDENCE OF YOUR INCOME THEN YOUR ASSESSMENT WILL BE MARKED AS PROVISIONAL ONLY. WE WILL REQUIRE THIS INFORMATION SENDING TO US BY THE START OF THE TERM IN SEPTEMBER AND IF IT IS NOT RECEIVED IT MAY RESULT IN THE PAYMENT OF THE STUDENT’S GRANT BEING WITHELD.

If you have declared income from benefits please provide either a letter confirming the amount you have received from Job Centre Plus, or from whoever pays the benefit to you, or ask them to complete the enclosed form. SECTION FOUR - ALLOWANCES

Please enter allowances relating to the year ended 5th April 2014.

Example of Father Mother Allowances Evidence Retirement Annuities/Personal Photocopy of original Pensions * policy or annual Do not enter company statement pensions

Please give details of any dependant children other than the student, including those who will be at school, college or university between 01/09/14 and 31/08/15. Please include letter of confirmation for student loan or University place. Allowance will be given.

Name Date of School/College to Details of any Birth be attended 1/9/14 education award to 31/08/15 granted

SECTION FIVE

STUDENT’S DECLARATION PLEASE READ THIS SECTION CAREFULLY AND SIGN THE FOLLOWING

This information supplied by me to the best of my knowledge is correct and complete. I undertake to inform the Local Education Authority immediately of any changes in my financial circumstances or of any alterations in the particulars given and to supply any additional information which may be required to verify the facts stated. If a change in my circumstances results in a revised financial award for the academic year then I undertake to repay any amounts overpaid to me back to the Authority.

Signature of Student Date

SECTION FIVE CONTINUED PARENTS’ DECLARATION PLEASE READ THIS SECTION CAREFULLY AND SIGN THE FOLLOWING

This information supplied by me to the best of my knowledge is correct and complete. I undertake to inform the Local Education Authority immediately of any changes in my financial circumstances or of any alterations in the particulars given and to supply any additional information which may be required to verify the facts stated.

Signature of parent/ step parent/carer(s) Date

DATA PROTECTION ACT 1998 - The information provided will be used to determine whether financial assistance will be awarded. North Yorkshire County Council may make enquiries about the validity of the information provided from other central and / or local government bodies, as deemed appropriate by the County Council. The County Council has a duty to protect public funds it administers and to this end may use the information provided on this form within the County Council for the prevention and detection of fraud. It may also share this information with other bodies solely for the purpose of administering public funds.

ACCOUNTANT’S DECLARATION

Only have this section completed if this form has been completed by your accountant.

Are the figures declared final figures as submitted to the Inland Revenue for the tax year 2014/2015?

YES NO

Signature of Accountant

Accountant’s stamp

Date

SECTION SIX Checklist

1. Have sections 1-4 been completed fully?

2. Have the declarations at section 5 been signed as necessary?

3. Is all the relevant photocopied documentary evidence attached?

Please return your completed form and documents to:

Student Support Services Askham Bryan College Askham Bryan York YO23 3FR

If you need to contact us please call us on telephone number: 01904 772201 / 01904 772222 9.00am to 5pm Monday to Thursday 9.00am to 4.30pm Friday

NOTES AND GUIDANCE

SECTION THREE.

Salary details should be parent’s total taxable pay for the year ended 31 st March 2014 as shown on your March payslip. Please remember to enclose copies of payslips dated 31st March 2014 or Form P60 for 2013/2014 as evidence.

Business Profits – if parents are self employed or in a partnership you need to provide details of net profits for the year end 5th April 2014. If you are unable to provide the exact figures at present you should enter an estimated figure on the form so that a provisional assessment of grant can be made. You will be required to confirm the figures which you have submitted to the Inland Revenue for the year ended 5th April 2014 before the beginning of the term in September 2014.

Director’s Fees or salaries received by either parent as a director of his/her own or any other company should be entered here. If this figure is estimated a form will be sent to you in due course and you will be required to confirm the figures which you have submitted to the Inland Revenue for the year ended 5 th April 2014.

Taxable Benefits include Car and Fuel benefit, BUPA subscriptions etc. received in the course of employment. Please enclose a P11D for 2013/2014 or P2 for 2013 /2014.

Pensions include all taxable pensions such as State Retirement Pensions, Widow’s Pensions and pensions from employers. A form P60 2013 /2014 or a letter from Job Centre Plus should be enclosed as evidence. Pensions from employers for dependent children should also be entered here unless that pension id paid direct to the child.

Income from Property/Letting/Accommodation can be estimated if the exact figures are not yet available.

Bank or Building Society interest earned on deposits should be entered as a gross amount for the year ended 5th April 2014. Investments which have paid dividends during the year ended 5th April 2014 please enter the amounts here, including tax credits.

SECTION FOUR

Retirement Annuities or Personal Pensions can only include private or personal pension premiums only. Do not enter Superannuation contributions made through your employment. Please send copies of the policies as evidence.

THE AUTHORITY RESERVES THE RIGHT TO REQUEST DOCUMENTARY EVIDENCE WHICH HAS NOT BEEN REQUIRED PREVIOUSLY, SHOULD IT BE CONSIDERED NECESSARY.