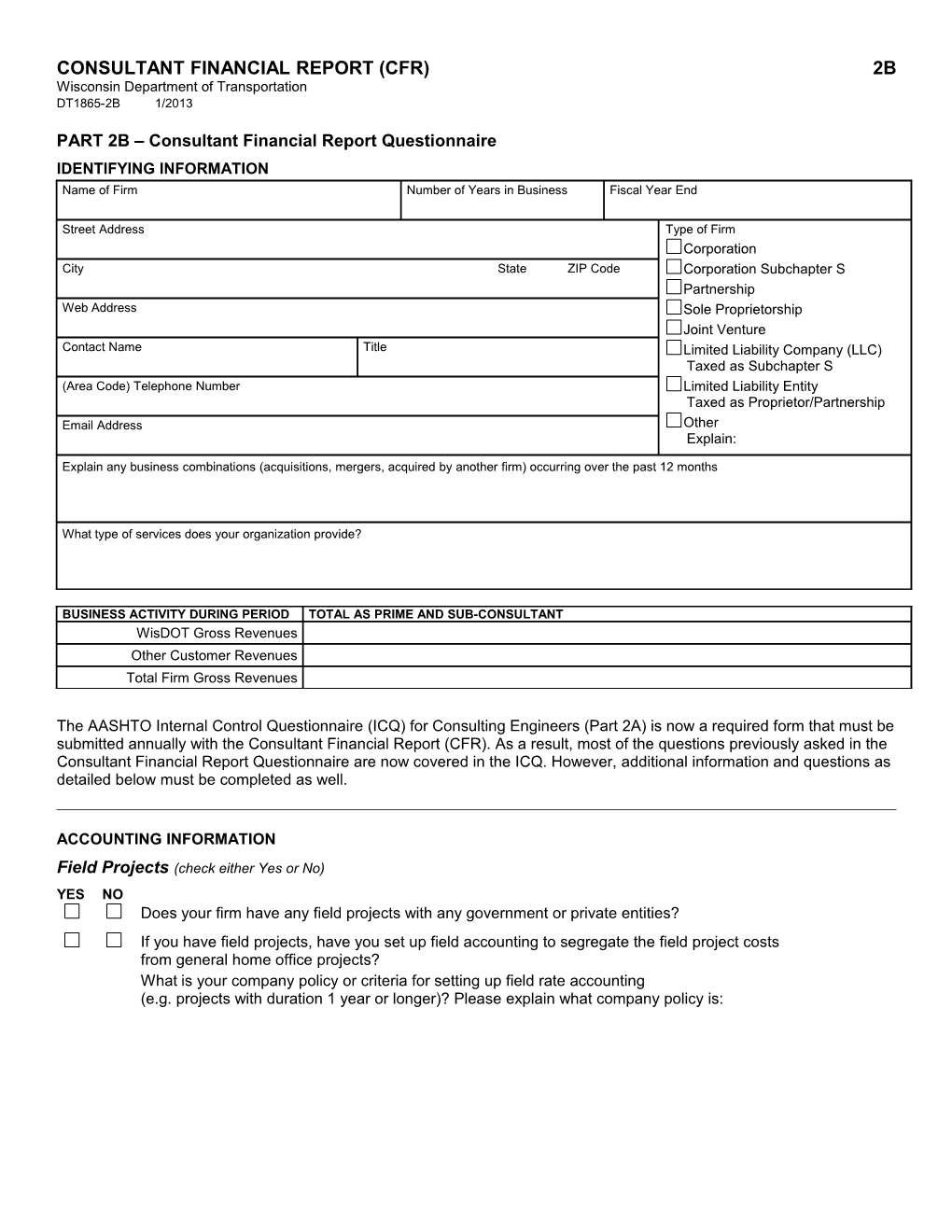

CONSULTANT FINANCIAL REPORT (CFR) 2B Wisconsin Department of Transportation DT1865-2B 1/2013

PART 2B – Consultant Financial Report Questionnaire IDENTIFYING INFORMATION Name of Firm Number of Years in Business Fiscal Year End

Street Address Type of Firm Corporation City State ZIP Code Corporation Subchapter S Partnership Web Address Sole Proprietorship Joint Venture Contact Name Title Limited Liability Company (LLC) Taxed as Subchapter S (Area Code) Telephone Number Limited Liability Entity Taxed as Proprietor/Partnership Email Address Other Explain: Explain any business combinations (acquisitions, mergers, acquired by another firm) occurring over the past 12 months

What type of services does your organization provide?

BUSINESS ACTIVITY DURING PERIOD TOTAL AS PRIME AND SUB-CONSULTANT WisDOT Gross Revenues Other Customer Revenues Total Firm Gross Revenues

The AASHTO Internal Control Questionnaire (ICQ) for Consulting Engineers (Part 2A) is now a required form that must be submitted annually with the Consultant Financial Report (CFR). As a result, most of the questions previously asked in the Consultant Financial Report Questionnaire are now covered in the ICQ. However, additional information and questions as detailed below must be completed as well.

ACCOUNTING INFORMATION Field Projects (check either Yes or No) YES NO Does your firm have any field projects with any government or private entities? If you have field projects, have you set up field accounting to segregate the field project costs from general home office projects? What is your company policy or criteria for setting up field rate accounting (e.g. projects with duration 1 year or longer)? Please explain what company policy is:

CONSULTANT FINANCIAL REPORT (CFR) (continued) 2B Wisconsin Department of Transportation DT1865-2B

Part 2B – ACCOUNTING INFORMATION (continued)

Cost Accounting Standards (check either Yes or No) YES NO Is your firm required to follow Cost Accounting Standards (CAS) under 48 CFR Part 9903.201-2? If yes, is your firm Full CAS covered under 48 CFR Part 9903.201-2? Or Modified CAS covered under 48 CFR 9903-201-2)? If your firm is CAS covered, was a Disclosure Statement submitted to your federal cognizant agency? If so, what is the most recent date of your last submission?

If you have not previously submitted a current Disclosure Statement, please submit with your CFR.

Temporary Help (check either Yes or No) YES NO Does your firm apply indirect cost rates to contract employees (those that receive 1099 forms)? Does your firm apply indirect cost rates to temporary employees (those hired through temp agencies)? Does your firm apply indirect cost rates to part-time limited term employees that receive W-2 Forms (interns, summer help etc.)? If indirect cost rates are applied to any of the above situations, is this labor included in the direct labor base of your proposed schedule of indirect cost? Please explain. If less than the full indirect cost rate is applied to any of the above situations how is the overhead rate determined? Please explain.

Attach Parts 3A though 3E and AASHTO/Consultants Supporting Documentation per instructions (Form DT1865-INST).

Additional information may be attached on a separate sheet.