October 12, 2006 Research Associate: Sheetal Jalan, MF, CS Zacks Research Digest Editor: Christopher R. Jones, CFA Sr. Editor: Ian Madsen, CFA; [email protected]; 1-800-767-3771, x417

www.zackspro.com 155 North Wacker Drive Chicago, IL 60606

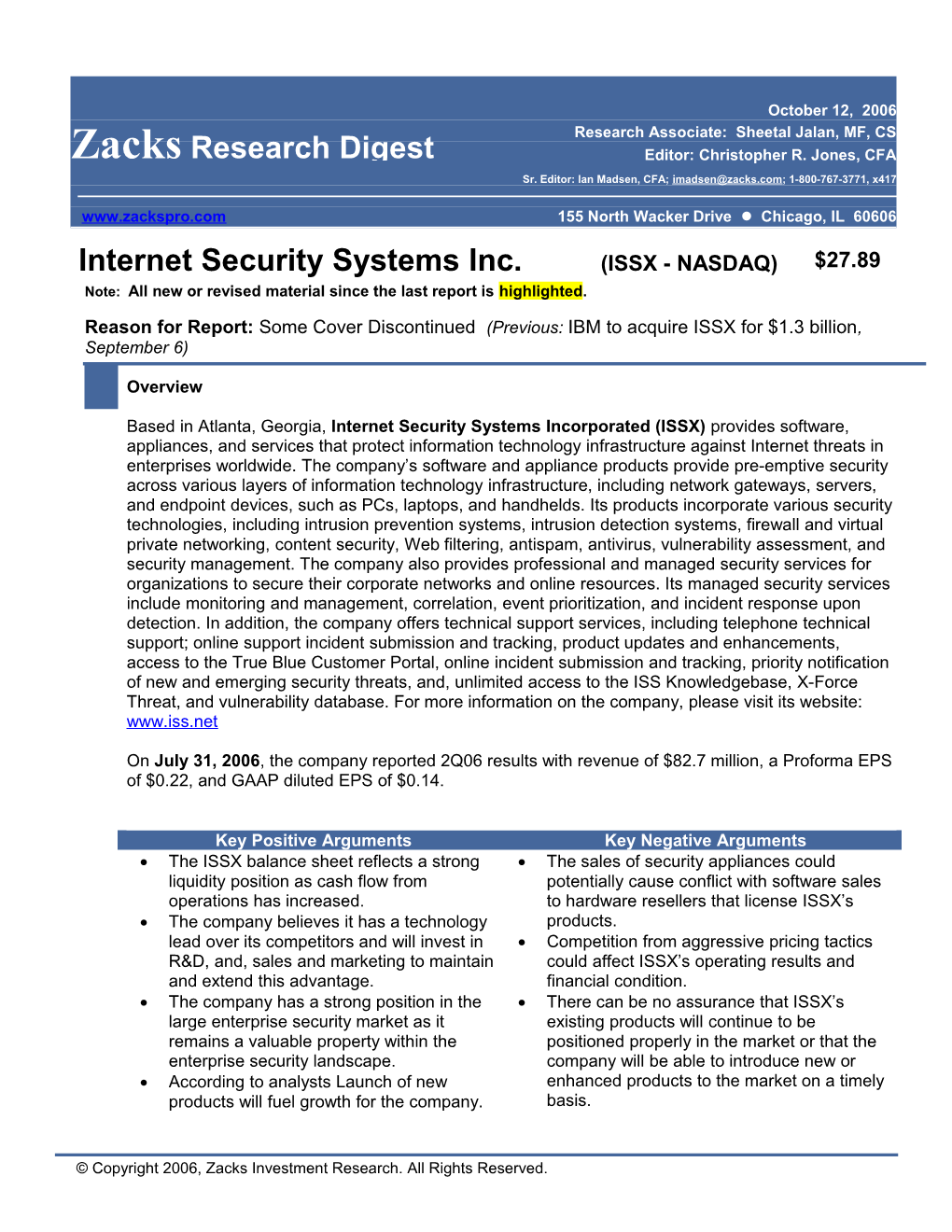

Internet Security Systems Inc. (ISSX - NASDAQ) $27.89 Note: All new or revised material since the last report is highlighted.

Reason for Report: Some Cover Discontinued (Previous: IBM to acquire ISSX for $1.3 billion, September 6)

Overview

Based in Atlanta, Georgia, Internet Security Systems Incorporated (ISSX) provides software, appliances, and services that protect information technology infrastructure against Internet threats in enterprises worldwide. The company’s software and appliance products provide pre-emptive security across various layers of information technology infrastructure, including network gateways, servers, and endpoint devices, such as PCs, laptops, and handhelds. Its products incorporate various security technologies, including intrusion prevention systems, intrusion detection systems, firewall and virtual private networking, content security, Web filtering, antispam, antivirus, vulnerability assessment, and security management. The company also provides professional and managed security services for organizations to secure their corporate networks and online resources. Its managed security services include monitoring and management, correlation, event prioritization, and incident response upon detection. In addition, the company offers technical support services, including telephone technical support; online support incident submission and tracking, product updates and enhancements, access to the True Blue Customer Portal, online incident submission and tracking, priority notification of new and emerging security threats, and, unlimited access to the ISS Knowledgebase, X-Force Threat, and vulnerability database. For more information on the company, please visit its website: www.iss.net

On July 31, 2006, the company reported 2Q06 results with revenue of $82.7 million, a Proforma EPS of $0.22, and GAAP diluted EPS of $0.14.

Key Positive Arguments Key Negative Arguments The ISSX balance sheet reflects a strong The sales of security appliances could liquidity position as cash flow from potentially cause conflict with software sales operations has increased. to hardware resellers that license ISSX’s The company believes it has a technology products. lead over its competitors and will invest in Competition from aggressive pricing tactics R&D, and, sales and marketing to maintain could affect ISSX’s operating results and and extend this advantage. financial condition. The company has a strong position in the There can be no assurance that ISSX’s large enterprise security market as it existing products will continue to be remains a valuable property within the positioned properly in the market or that the enterprise security landscape. company will be able to introduce new or According to analysts Launch of new enhanced products to the market on a timely products will fuel growth for the company. basis.

© Copyright 2006, Zacks Investment Research. All Rights Reserved. Note: ISSX’s Fiscal Year ends on December 31.

Recent Events

On August 23, 2006, IBM and ISSX announced they have entered into a definitive agreement for IBM to acquire ISSX, in an all-cash transaction at a price of approximately $1.3 billion or $28 per share. The acquisition is subject to Internet Security Systems, Inc. shareholder and regulatory approvals and other customary closing conditions. The transaction is expected to close in the fourth quarter of 2006.

On May 4, 2006, ISSX held its annual analyst day in Las Vegas. The event included presentations from Thomas Noonan, Chairman, President and Chief Executive Officer; Peter Evans, Vice President of marketing; Greg Adams, Vice President of product management; Chris Rouland, Chief Technology Officer; Raghavan (Raj) Rajaji, Chief Financial Officer; and Larry Costanza, Senior Vice President of Americas sales.

Revenue

Revenue- FYE Dec 31 q/q y/y ($MM) 2Q06A %change %change 2005A 2006E 2007E 2008E Products $33.4 2.2% -0.6% $146.3 $153.0 $171.6 $189.3 Subscription $43.4 1.6% 8.9% $161.1 $177.5 $194.8 $212.2 Professional Services $5.9 9.3% 4.8% $22.3 $23.5 $24.5 $23.1 TOTAL REVENUE $82.7 2.4% 4.6% $329.8 $354.0 $390.0 $424.5

Zacks Digest average total revenue in 2Q06 was $82.7 million, up 4.6% y/y and 2.4% q/q. Product License revenue was $33.4 million, down 0.6% y/y but up 2.2% q/q. Subscription revenue was $43.4 million, up 8.9% y/y and 1.6% q/q. Professional Services revenue was $5.9 million, up 4.8% y/y and 9.3% q/q. The company reported the same figures.

Product License: As far as the drivers of ISSX's product revenue shortfall are concerned, management put a major portion of the blame on an order fulfillment disruption driven by certain issues in its recent implementation of Oracle's distribution and logistics software. Management indicated that the high volume of orders at the end of the quarter along with various issues with its internal systems led to some orders being filled as split or partial orders for which revenue could not be recognized. The company indicated that the negative impact was approximately $2.0 million, which would have put it towards the lower end of its revenue guidance range. As a result of this issue, the company is expanding its shipping lanes at its contract manufacturer by 133.0% and opening up a new shipping location on the West coast for higher capacity. Taking a closer look at product revenues, Proventia revenue at $26.0 million increased an impressive 16.0% y/y and 13.0% sequentially. Proventia comprised of 78.0% of 2Q06 Product revenue.

On a regional basis, the Americas revenue was $49.6 million down 0.4% y/y and was the only region affected by the deal slippage. Europe generated $19.0 million, up 9.3% y/y, while the Asia Pacific region increased 18.5% y/y to $14.1 million. FX translations had a negative impact of $1.0 million compared to the last quarter.

In an effort to drive improved growth, ISSX has been heavily focused on launching new products or what would classify as new versions of existing products. In 3Q06, the company plans to launch its Proventia Mail and Messaging Protection solution and in 4Q06 the company plans to launch its 10GB Proventia IPS appliance and a desktop protection system that includes antivirus.

Zacks Investment Research Page 2 www.zackspro.com According to one analyst (Prudential) it is too early to get overly excited about a new product cycle driving a significant improvement in ISSX's growth. This is for several reasons. First, they note that some of its "new products" are really new versions of prior solutions. For example, according to them Enterprise Scanner appliance is a next generation of ISSX's existing vulnerability management solutions in an appliance form factor. They view its Proventia Server solution in a similar fashion as ISSX has historically offered server protection capabilities. It is not clear to them whether ISSX vulnerability management and server-based solutions have been major drivers of growth for the company, particularly relative to its network-based solutions.

Probable Date of New Product Introduction Mail Security 3Q06 AV Integrated Proventia Desktop 4Q06 10 Gigabit Intrusion Prevention 4Q06

Please refer to Zacks Research Digest spreadsheet for detailed revenue breakdown and future estimates.

Margins

q/q y/y MARGINS - FYE Dec 31 2Q06A %change %change 2005A 2006E 2007E 2008E Gross 73.3% -1.9% -2.3% 75.2% 74.4% 74.7% 74.4% Operating 16.2% -1.8% -1.4% 19.4% 17.6% 18.2% 18.1% Pre tax 18.2% -2.0% -0.4% 20.7% 19.2% 20.2% 20.9% Net 11.7% -1.0% -0.2% 13.1% 12.4% 13.0% 13.2%

Zacks Digest average gross profit was $60.6 million representing 73.3% of revenue. It was up 1.4% y/y but down 0.3% q/q. The Company press release reported gross profit of $60.7 million representing a margin of 73.4%. It was up 1.6% y/y but down 0.1% q/q. An increase in gross margin was due to the higher mix of appliance revenue inked in the quarter. Product gross margin decreased to 76.2% from 79.2% in the prior quarter, while subscriptions and services margins decreased to 71.6% from 72.6% in the prior quarter.

Management noted that the gross margin decline was caused by a higher mix of appliances to software license revenues. Management expects to bring gross margins back to the 75.0% range with the introduction of higher-priced appliance products (10G Intrusion Prevention System) and growth in Proventia server protection software and Proventia desktop prevention by 4Q06.

Pro-forma operating margin was 16.2%, down slightly from 18.1% in 1Q06 and down from 17.6% in 2Q05. With continued sales/marketing, promotional, and other demand-generation programs surrounding new product launches, a significant margin expansion is not anticipated going forward.

Please refer to Zacks Research Digest spreadsheet for more details on margin estimates.

Earnings per share

PRO FORMA EPS - FYE Dec 31 2Q06A 3Q06E 4Q06E 2005A 2006E 2007E 2008E Zacks Consensus $0.22 $0.16 $0.19 $1.01 $0.75 $0.94 $0.23- $0.95- Company Guidance $0.25 $1.00 Digest Average $0.22 $0.22 $0.24 $0.91 $0.97 $1.09 $1.26 High Estimate $0.22 $0.22 $0.25 $0.91 $0.99 $1.16 $1.26 Low Estimate $0.22 $0.22 $0.22 $0.91 $0.96 $1.03 $1.26

Zacks Investment Research Page 3 www.zackspro.com In 2Q06, GAAP diluted EPS was $0.14, down 17.6% y/y and 6.7% q/q. Pro forma diluted EPS in the quarter was $0.22, up 10.0% y/y but flat q/q. Pro forma EPS excludes the impact of amortization of intangibles, compensation expense (net of taxes) associated with the expensing of stock options in accordance with FAS 123, and, restricted stock of $0.08. Most of the analysts believe that the yearly upside in pro forma EPS was due to lower share count.

2006 forecasts (18 of them in total) range from $0.90 to $0.99; the average is $0.97. 2007 forecasts (18 of them in total) range from $1.03 to $1.16; the average is $1.09.

The reconciliation of GAAP and non-GAAP EPS is shown below: US GAAP Pro forma Net Income $6.2 $9.7

Reconciliation: (+) Stock based compensation, net of tax $2.0 (+) Amortization of intangibles, net of tax $1.5 Net Income after reconciliation $9.7 $9.7

EPS before reconciliation $0.14 $0.22 Reconciliation effect = $3.5/44.8* $0.08 *Diluted Shares Outstanding *Figures have been rounded off to the nearest decimal

Please refer to Zacks Research Digest spreadsheet for more extensive EPS figures.

Guidance

Management established 3Q06 guidance of $90.0-92.0 million in revenue and non-GAAP EPS of $0.23-0.25, roughly in line with consensus estimates of $90.7 million and $0.24, respectively. For FY06 however, management lowered guidance to $350.0-360.0 million in revenue (from $358.0- 368.0 million), and tightened EPS guidance to the range of $0.95-$1.00 (from $0.94-$1.00). Although the revenue guidance revision makes sense given the 2Q06 shortfall, the narrowed EPS range is dependent upon traction of the higher margin new product cycle in 4Q06, which continues to pose risk to the company’s EPS targets.

Target Price/Valuation

The Digest average target price is $26.50 ( from the previous report).

The target price for ISSX ranges from a low of $23.00 (Deutsche Bank) to a high of $28.00 (Prudential; Friedman, Billings; Jefferies; UnionBankSwitz.). Most of the analysts have used either multiples of P/E multiple or DCF analysis to calculate the target price. Analysts with lower target price did not quote the valuation metric. One analyst (Friedman, Billings) quoting the highest target price using 24x FY07 EPS as the valuation methodology, while another analyst (UnionBankSwitz.) has used sum-of-parts-analysis.

Of the 12 analysts covering the stock, 1 is bullish, 10 are neutral, and 1 is negative.

Zacks Investment Research Page 4 www.zackspro.com Rating Distribution Positive 8% Neutral 83% Negative 8% Avg. Target Price $26.50 Analysts w Target/Total # 6/12

One analyst (RBC Cap.) has strong assumptions about deferred revenue growth, and a powerful upgrade and cross-sell opportunity within the company's installed base. According to them if these fail to materialize, the price target could be at risk. Further risks include: potential weakening acceptance of the company's products, margin pressure, potential failure to meet expectations, and, back-end loaded quarter sales linearity.

Please refer to Zacks Research Digest spreadsheet for further details on valuation.

Capital Structure/Cash Flow/Solvency/Governance/Other

DSO’s dropped back within the target range of 75-85 days, at 85 days, down from the abnormally high 90 days in the prior quarter.

Deferred revenue grew 14.0% y/y and 1.0% q/q to $85.5 million (including $0.7 million from delayed deals due to the ERP issue).

Driven by the DSO improvement and healthy deferred revenue growth, cash flow from operations of $21.2 million was up from $7.4 million in the prior quarter and remained flat y/y. ISSX ended the quarter with $220 million in cash and equivalents, down $12 million q/q as the company spent $6.0 million on capital purchases, and $28.1 million to repurchase 1.36 million shares.

Acquisition: Upon the close of the deal under which IBM will acquire ISSX, ISSX will operate as a business unit within IBM Global Services' security division. IBM will also integrate ISSX's software technology with its Tivoli service management portfolio. IBM will market and sell ISSX's managed security services (MSS) business through both companies' sales channels. The fate of ISSX's Proventia hardware line is unknown.

Potentially Severe Problems

There are none other than those discussed in other sections of this report, if any.

Long Term Growth

The long-term growth rates for ISSX range between 13.0% (SIG) and 17.0% (Raymond James). The average long-term growth rate is 15.0%.

The long-term competitive position of the company remains challenging. The security market remains highly competitive and ISSX continues to compete against companies with a larger installed base and greater channel presence. However, as analysts do not see the situation worsening, they believe ISSX’s growth will accelerate in the near future.

Zacks Investment Research Page 5 www.zackspro.com One analyst (SIG) believes ISSX may significantly benefit from rising demand for intrusion detection and prevention software and have a great deal of success with its Proventia appliance strategy over the next couple of years.

Some of the analysts are optimistic about ISSX's future given the next generation product cycle it is entering.

According to one analyst (Stifel Nicolaus) the company generated a meaningful portion of its growth over the last two years by converting its installed base of RealSecure software users into using its Proventia appliances. To be fair, the company also generated some growth from new customer additions and expansion of existing customer deployments. However, they believe conversions of RealSecure to Proventia were likely an important driver of growth and it seems like the company may have worked the bulk of this opportunity.

Upcoming Event

October 24, 2006: 3Q06 Earnings Announcement (expected)

Individual Analyst Opinions

POSITIVE RATINGS

RBC Cap. – Outperform ($25 - target price): 08/01/2006. INVESTMENT SUMMARY: While they believe ISSX’s new products should drive a greater growth opportunity in 2H06 and 2007, the company is clearly in the midst of a transition away from declining legacy products sales and faces near-term execution challenges.

NEGATIVE RATINGS

J.P. Morgan – Under weight (no target price): 08/23/2006 – INVESTMENT SUMMARY: The analyst believes ISSX will bring marquis customers to the MSS business of IBM such as Ford.

NOT RATED

Merrill – Not Rated (no target price): 08/23/2006 – The analyst has withdrawn rating from ISSX (earlier it had rated the stock Neutral, based on the proposed acquisition of the company by ISSX. INVESTMENT SUMMARY: The analyst believes by acquiring ISSX, IBM will be able to enhance its position in the MSS market in future.

DROPPED COVERAGE

Wedbush – 08/11/2006 – The analyst has dropped coverage on the stock of ISSX due to analyst departure covering it.

Piper Jaffray - 08/30/2006 – Since IBM has acquired the company the analyst has dropped coverage on the stock.

Prudential – 10/03/2006 – Since IBM has acquired the company the analyst has dropped coverage on the stock.

Copy Editor: Joyoti D.

Zacks Investment Research Page 6 www.zackspro.com