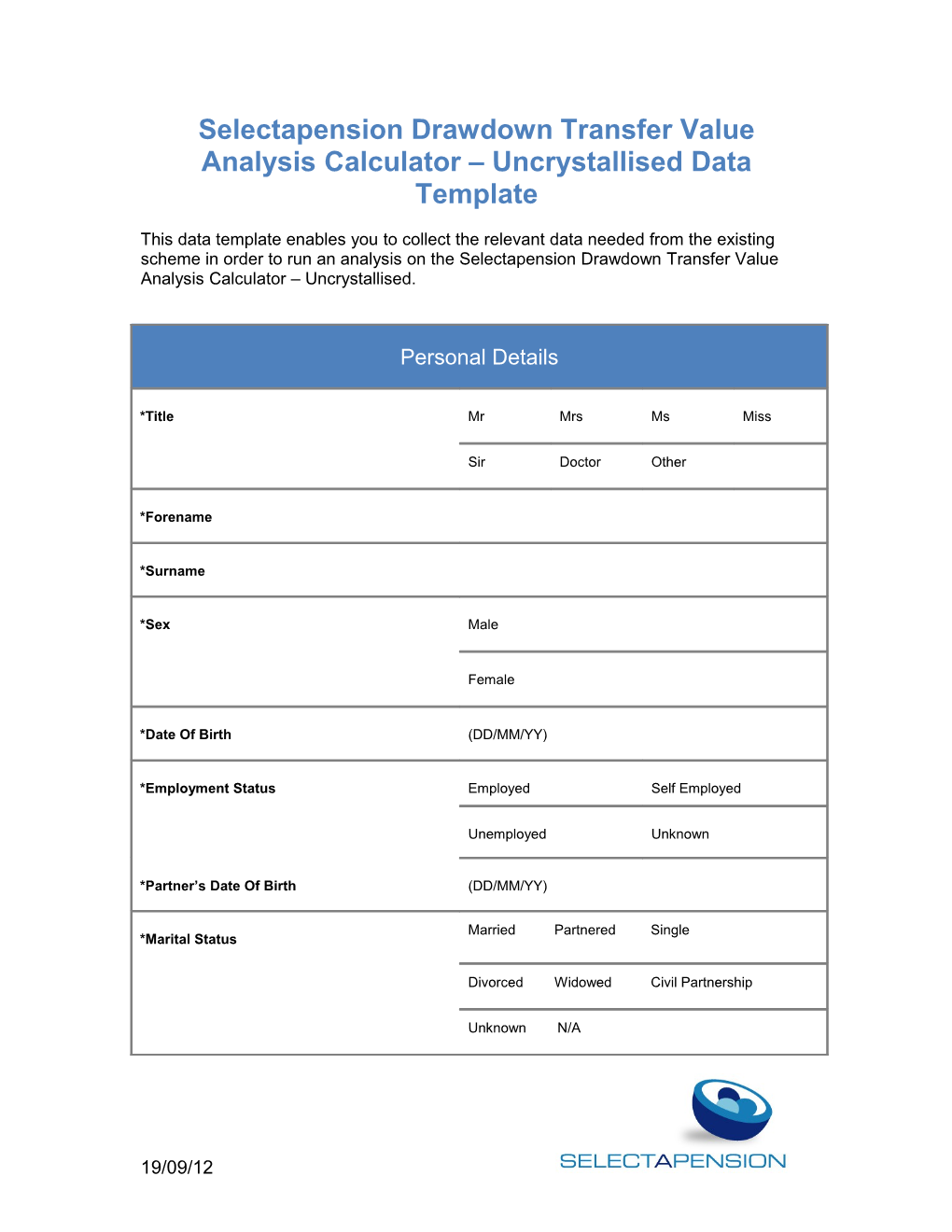

Selectapension Drawdown Transfer Value Analysis Calculator – Uncrystallised Data Template

This data template enables you to collect the relevant data needed from the existing scheme in order to run an analysis on the Selectapension Drawdown Transfer Value Analysis Calculator – Uncrystallised.

Personal Details

*Title Mr Mrs Ms Miss

Sir Doctor Other

*Forename

*Surname

*Sex Male

Female

*Date Of Birth (DD/MM/YY)

*Employment Status Employed Self Employed

Unemployed Unknown

*Partner’s Date Of Birth (DD/MM/YY)

Married Partnered Single *Marital Status

Divorced Widowed Civil Partnership

Unknown N/A

19/09/12 *Health Status Normal Poor Good Unknown

*Any Dependants Yes No Unknown

*Attitude To Risk Low Low to Medium Medium

Medium to High High Unknown

Other N/A

*Lifetime Limit Protection Unknown Enhanced Protection

Primary Protection Fixed Protection None

*Notes

19/09/12 Projection Basis/ Pension Status

*Age For Analysis Proposed age Desired age

Monetary e.g. 5% 7% 9%, *Projection Basis :

SMPI e.g. 7% Today’s Terms

1 & 3% (Real rates)

*Member of or eligible to join an Occupational Yes No Unknown Pension Scheme

*Member of or eligible to join a Group Personal Yes No Unknown Pension Yes, No Or Unknown

*Option to transfer to an Occupational Pension Yes No Unknown Scheme

*Existing GPP to be used in this analysis Yes No Unknown

19/09/12 Existing Scheme Details

*Provider Name

*Product Name

*Type Personal Pension FSAVC

Stakeholder Retirement Annuity

Section 32 Section 32 With GMP

Occupational GPP AVC

*Fund Valuation Date (DD/MM/YY)

*Fund Value £

*Transfer Value £

*Protected Rights included in Transfer Value Yes No

*(If yes to above) PRE 97 £ POST 97 £

*Associated Crystallised Fund Transfer Value £

*Are Regular Contributions Included Yes No

*If Yes to Regular Contributions Gross Amount:

Frequency: (Monthly, Quarterly, Half Yearly, Yearly)

Increase Rate: (RPI, AWE or Other)

*Current Death benefits Value

19/09/12 Existing Scheme Details - Projections

*Growth rate Basis (please tick) : Aggregate Rates

Varying Rates (%)

Varying Rates (£)

*If Varying Rates (%): Fund Name, Split % at Low, Medium and High % e.g. Name (Fund 1) Split (50%) Low, Medium and High (4%, 6%, 8%)

*If Varying Rates (£): Identify Fund Name, Split £ at Low, Medium and High % e.g. Name (Fund 1) Split (£50,000) Low, Medium and High (4%, 6%, 8%)

*If Aggregate Rates: The Low, Medium and High % are defaulted to 5% 7% 9%

*Fund Projection Rates (Aggregate) Low Medium High [ ] [ ] [ ]

*Fund Value £ £ £

Existing Scheme Details – Funds

You may select the funds in which this plan is currently invested. This will be used to provide comparison of past performance.

*Fund Name *% Split

19/09/12 Additional Plan Benefits

*Integrated Life Cover: Yes No

*Waiver of Premiums Yes No

*Annuity Guarantee Yes No

*Guaranteed Growth Yes No

*With Profits Fund, MVA Has Or May be Applied Yes No

*With Profits Fund MVA Not Applied Yes No

*General

19/09/12