Budgeting

“For which of you, intending to build a tower, sitteth not down first, and counteth the cost, whether he have sufficient to finish it? Lest haply, after he hath laid the foundation, and is not able to finish it, all that behold it begin to mock him, Saying, This man began to build, and was not able to finish.” Luke 14:28-30

“If there is any one thing that will bring peace and contentment into the human heart, and into the family, it is to live within our means.” Heber J Grant May 1932

LESSON OBJECTIVES: 1. Help each family member to develop and implement a budget 2. Understand what the prophets have said about the process of budgeting

WHY TEACH ABOUT BUDGETING:

President Thomas S. Monson taught that “When performance is measured, performance improves. When performance is measured and reported, the rate of improvement accelerates.1” A budget is a tool that allows you to plan, measure, and review financial progress towards family goals. The First Presidency counseled “…establish a family budget. Plan what you will give as Church donations, how much you will save, and what you will spend for food, housing, utilities, transportation, clothing, insurance, and so on. Discipline yourself to live within your budget plan.2”

President N. Eldon Tanner taught “Many people think a budget robs them of their freedom. On the contrary, successful people have learned that a budget makes real economic freedom possible.3” A budget allows families to prepare for the future and get their houses in order. A budget is the instrument for aligning family finances with family goals. Implementing a budget will help families find greater peace and happiness.

LESSON:

Prophets have given inspired principles, listed below, that provide a way to obtain all the blessings that come from budgeting.

Creating a Budget

Elder L. Tom Perry of the Quorum of the Twelve Apostles outlines the inspired way to budget when he said:

1 Thomas S. Monson, Worldwide Leadership Training Broadcast, June 2004 2 “All Is Safely Gathered In: Family Finances,” All Is Safely Gathered In: Family Finances, (2007),1–4 3 N. Eldon Tanner, “Constancy Amid Change,” Ensign, Nov 1979, 80

1 “After paying your tithing of 10 percent to the Lord, you pay yourself a predetermined amount directly into savings. That leaves you a balance of your income to budget for taxes, food, clothing, shelter, transportation, etc. It is amazing to me that so many people work all of their lives for the grocer, the landlord, the power company, the automobile salesman, and the bank, and yet think so little of their own efforts that they pay themselves nothing.4”

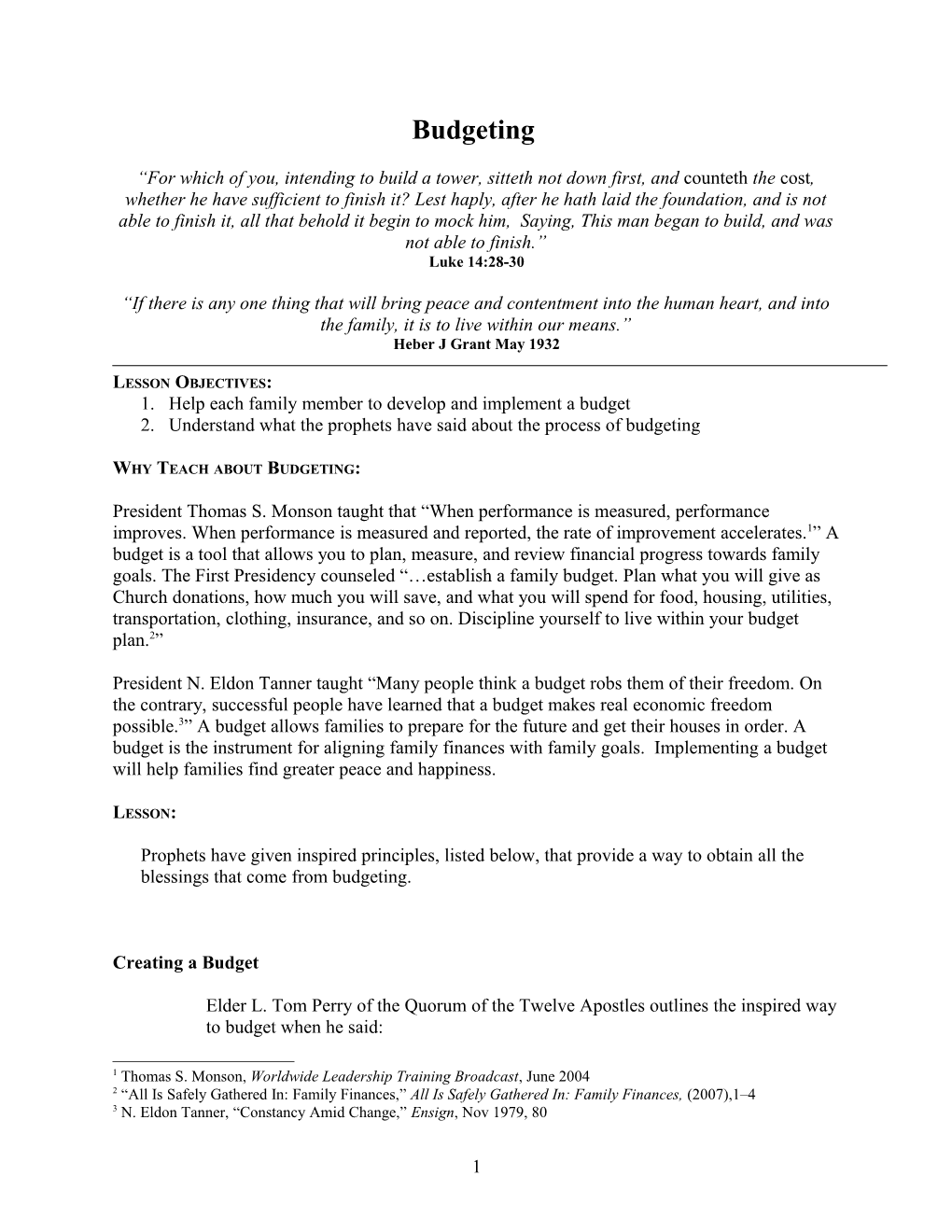

The diagram below shows the inspired counsel outlined by Elder Perry versus traditional budgeting practices.

Figure 3: Inspired vs. Traditional Budgets

Inspired vs. Traditional Budgets Inspired Traditional Total Income Total Income - Tithes and Offerings - Expenses - Savings - Savings - Expenses - Savings

a. Tithing: Discussed at length in another FHE lesson.

b. Savings: Marvin J. Ashton counseled to “Save and invest a specific percentage of your income.5” In the inspired counsel, savings is subtracted from our total income before we pay for expenses. The practice of prioritizing savings before taking into account expenses emphasizes a commitment to save.

c. Expenses: Elder Ashton said “Financial peace of mind is not determined by how much we make but is dependent upon how much we spend.6”

Elder Tanner taught “I have discovered that there is no way that you can ever earn more than you can spend. I am convinced that it is not the amount of money an individual earns that brings peace of mind as much as it is having control of his money… The key to spending less than we earn is simple—it is called discipline.7”

Church leaders have suggested ways we can reduce how much we spend. “If we are not able to save much money, we can practice being thrifty in our homes. We can rely on our own talents and abilities. This will help us save a great deal of money. We can garden and grow some of our own foods. We can recycle old clothes by cutting them up and 4 L. Tom Perry “Becoming Self-Reliant,” Ensign, Nov. 1991, 64. 5 Marvin J. Ashton, “Guide to Family Finance,” Liahona, Apr 2000, 42 6 Marvin J. Ashton, “Guide to Family Finance,” Liahona, Apr 2000, 42 7 N. Eldon Tanner, “Constancy amid Change,” Ensign, Jun 1982, 2

2 sewing them together in a new style. We can make new furniture from old and make new toys from crates, logs, lumber scraps, scraps of cloth, and buttons. By reusing clothing and rebuilding furniture, we can provide many things for ourselves.8”

The prophets emphasized the need for families to plan to save and plan expenses by creating an order that establishes financial priorities.

Not merely a record

A budget is a plan of future spending and a record of past spending. Too often a budget is thought of as a way to track expenses. Elder Tanner told the following story.

A friend of mine has a daughter who went overseas with a BYU study-abroad program for a semester. She was constantly writing home for more money. His concern was such that he called her long-distance and questioned her about the need for the additional funds. At one point in the conversation the daughter explained, “But dad, I can tell you where every penny you have sent me has been spent.” He replied, “You don’t seem to get the point. I’m interested in a budget—a plan for spending—not in a diary of where the money has gone.9

The following activities are provided to help you teach the principles listed above.

1. Hand out a small amount of money (e.g. 10 cents). Have a variety of items (e.g. cinnamon rolls, food/candy, small toys, etc) that each family member can “buy” for an incredibly reduced price, but only if they do it right now (if you give them 10 cent remind them to keep one cent for tithing). After each individual has had an opportunity to spend their money, have a family member read the quote by President Spencer W. Kimball

Every family should have a budget. Why, we would not think of going one day without a budget in this Church or our businesses. We have to know approximately what we may receive, and we certainly must know what we are going to spend. And one of the successes of the Church would have to be that the Brethren watch these things very carefully, and we do not spend that which we do not have.10

Discuss how family members used their money. Possible Questions: Which family members have a budget? Who set 10% aside for tithing? Why is that important? Which family members chose to save some of the money? Why?

8 The Latter-day Saint Woman: Basic Manual for Women, Lesson 21: Managing Family Finances, Part A, 152 9 N. Eldon Tanner, “Constancy Amid Change,” Ensign, Nov 1979, 80 10 Spence W. Kimball Conference Report, April 1975, pp. 166-167.

3 How should having a budget impact or change your behavior?

2. Set a family financial goal to start saving towards something like a vacation, a boat/trailer, or a TV. Have all family members create a budget in which they contribute an appropriate amount of money to the goal.

3. Discuss big events that are in the future for your family such as (education, missions, weddings, and home-purchasing) discuss how you can prepare financially for those events.

4. As a family fill out the budget sheet that is provide as Table 2.

ACTIVITY:

Consider playing a budgeting game. Give each group the same imaginary monthly salary. On a board, create a list of family “needs” in one column and family “wants” in another. Let the groups decide where to spend their money using the two lists. Discuss the results. Identify ways to save money. Before the lesson prepare a pie graph that shows what portion of income goes into the different expenses (mortgage, utilities, gas, insurance, food, savings, and tuition). Commit to reduces some of the expenses by turning off the lights, eating out less, or decreasing the cell phone bill. Consider making a family budget plan with all family members included in understanding how the money is spent and in deciding how to spend any extra income.

ASSIGNMENTS:

Before creating a budget have each family member review the goals that they set in the “Setting Goals” FHE. Create a budget following the Lord’s counsel to pay tithing, then set some aside in savings, and then pay expenses.

OPENING AND CLOSING SONGS:

Oh Say, What is Truth (Hymn 272) Today, While the Sun Shines (Hymn 229) Dare to do Right (Children’s Songbook 158)

OTHER RESOURCES AND IDEAS:

lds.org N. Eldon Tanner, “Constancy amid Change,” Ensign, Jun 1982, 2 Joseph B. Wirthlin, “Earthly Debts, Heavenly Debts,” Ensign, May 2004, 40 Marvin J. Ashton, “Guide to Family Finance,” Liahona, Apr 2000, 42 “All Is Safely Gathered In: Family Finances,” All Is Safely Gathered In: Family Finances, (2007),1–4

4 FIGURE 3: A budget template

Budget for______Planned Actual Wages/salaries (after taxes)

Other income

Total income

Church donations

Savings

Food

Mortgage or rent

Utilities

Transportation

Debt payments

Insurance

Medical

Clothing

Other

Total expenditures

Income less expenditures

This Family Home Evening lesson was developed by Dallin Anderson, December 2008.

5