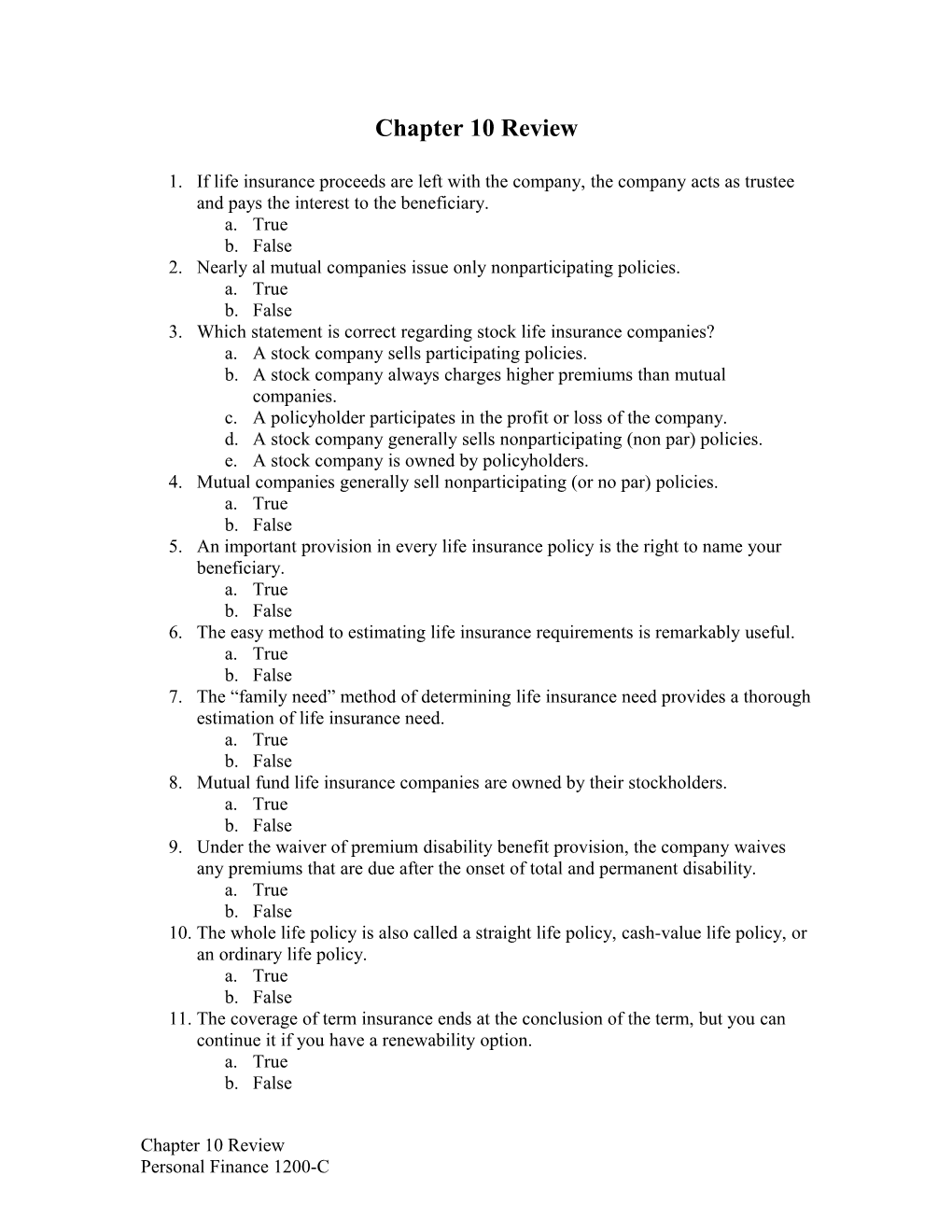

Chapter 10 Review

1. If life insurance proceeds are left with the company, the company acts as trustee and pays the interest to the beneficiary. a. True b. False 2. Nearly al mutual companies issue only nonparticipating policies. a. True b. False 3. Which statement is correct regarding stock life insurance companies? a. A stock company sells participating policies. b. A stock company always charges higher premiums than mutual companies. c. A policyholder participates in the profit or loss of the company. d. A stock company generally sells nonparticipating (non par) policies. e. A stock company is owned by policyholders. 4. Mutual companies generally sell nonparticipating (or no par) policies. a. True b. False 5. An important provision in every life insurance policy is the right to name your beneficiary. a. True b. False 6. The easy method to estimating life insurance requirements is remarkably useful. a. True b. False 7. The “family need” method of determining life insurance need provides a thorough estimation of life insurance need. a. True b. False 8. Mutual fund life insurance companies are owned by their stockholders. a. True b. False 9. Under the waiver of premium disability benefit provision, the company waives any premiums that are due after the onset of total and permanent disability. a. True b. False 10. The whole life policy is also called a straight life policy, cash-value life policy, or an ordinary life policy. a. True b. False 11. The coverage of term insurance ends at the conclusion of the term, but you can continue it if you have a renewability option. a. True b. False

Chapter 10 Review Personal Finance 1200-C 12. The most common settlement options in a life insurance policy are lump sum payments, limited installment payment, life income option, and proceeds left with the company. a. True b. False 13. Temporary insurance can be term, renewable term, convertible term, or deceasing term insurance. a. True b. False 14. With universal life, you control your outlay and can change your premium without changing your coverage. a. True b. False 15. In participating policy, a part of the premium is refunded to the policyholder annually. a. True b. False 16. Single persons living alone have little or no need for life insurance. a. True b. False 17. Choosing a good agent is among the most important steps in building your insurance program a. True b. False 18. The life expectancy of a female at the age of 30 is 50.6 years. It means that a. a 30-year-old female has the highest probability of dying. b. a 30-year-old female has the highest probability of living. c. 50.6 is the average number of years that all females alive at 30 years of age will still live. d. 50.6 is the average age at which all females, age 30, will die. 19. The cost of living protection rider is designed to help prevent inflation from eroding the purchasing power of the protection your policy provides. a. True b. False 20. Which statement is correct regarding mutual insurance companies? a. Mutual insurance companies have stockholders. b. Nearly al mutual companies issue only nonparticipating policies. c. Premiums are lower than those offered by stock companies. d. Mutual companies do not declare policy dividends. e. A mutual company refunds part of the premium to the policyholders.

Chapter 10 Review Personal Finance 1200-C