Labour Market Research – Construction Trades Australian Capital Territory (ACT) 2016

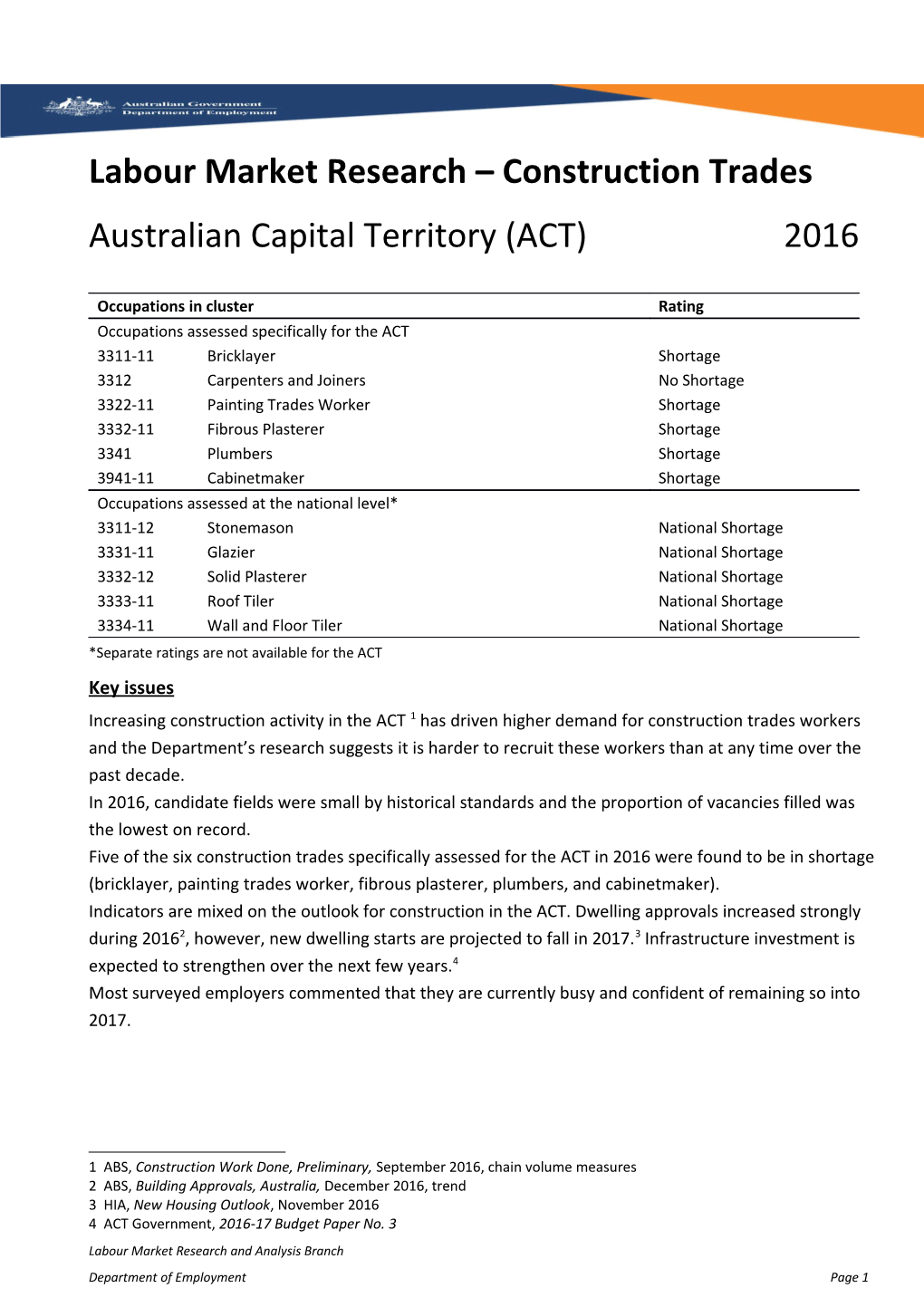

Occupations in cluster Rating Occupations assessed specifically for the ACT 3311-11 Bricklayer Shortage 3312 Carpenters and Joiners No Shortage 3322-11 Painting Trades Worker Shortage 3332-11 Fibrous Plasterer Shortage 3341 Plumbers Shortage 3941-11 Cabinetmaker Shortage Occupations assessed at the national level* 3311-12 Stonemason National Shortage 3331-11 Glazier National Shortage 3332-12 Solid Plasterer National Shortage 3333-11 Roof Tiler National Shortage 3334-11 Wall and Floor Tiler National Shortage *Separate ratings are not available for the ACT Key issues Increasing construction activity in the ACT 1 has driven higher demand for construction trades workers and the Department’s research suggests it is harder to recruit these workers than at any time over the past decade. In 2016, candidate fields were small by historical standards and the proportion of vacancies filled was the lowest on record. Five of the six construction trades specifically assessed for the ACT in 2016 were found to be in shortage (bricklayer, painting trades worker, fibrous plasterer, plumbers, and cabinetmaker). Indicators are mixed on the outlook for construction in the ACT. Dwelling approvals increased strongly during 20162, however, new dwelling starts are projected to fall in 2017.3 Infrastructure investment is expected to strengthen over the next few years.4 Most surveyed employers commented that they are currently busy and confident of remaining so into 2017.

1 ABS, Construction Work Done, Preliminary, September 2016, chain volume measures 2 ABS, Building Approvals, Australia, December 2016, trend 3 HIA, New Housing Outlook, November 2016 4 ACT Government, 2016-17 Budget Paper No. 3 Labour Market Research and Analysis Branch Department of Employment Page 1 Survey results 5 Employers in the ACT found it more difficult to recruit construction trade workers in 2016 compared with recent years (Figure 1). In 2016, a series low of 33 per cent of surveyed construction trade vacancies were filled. Employers attracted an average of 2.0 applicants per vacancy, of whom 0.6 were suitable. Almost one fifth of employers surveyed did not attract any applicants and a further one fifth did not attract any suitable applicants. Figure 1: Proportion of vacancies filled (%), average number of applicants and suitable applicants per vacancy (no.), Construction trades, ACT, 2007 to 2016

Source: Department of Employment, Survey of Employers who have Recently Advertised (occupational coverage varies over the time series)

Reasons applicants were unsuitable Around two-thirds of surveyed vacancies required applicants to have trade qualifications. Lack of qualifications was the main reason employers considered applicants unsuitable. Employers also considered around 45 per cent of qualified applicants to be unsuitable, mainly due to inadequate technical skills and concerns over their work ethic and motivation. A number of applicants were regarded as unsuitable because they lacked specific construction sector experience, or experience in a particular construction technique or skill. This was particularly evident in the plumbing trade, where a number of employers commented that they did not regard experience as transferrable across construction sectors. Demand and supply Demand trends Most construction trades workers are employed in the construction industry, either directly in the building construction sector or in organisations providing services to this sector.6 Supporting strong demand for these workers, the total value of construction work done in the ACT has

5 The methodology underpinning this research is outlined at Skill Shortage Research Methodology | Department of Employment - Document library, Australian Government and can also be accessed by the QR code 6 ABS, Census of Population and Housing, 2011 grown for four consecutive quarters, and at September 2016 was 20.8 per cent higher than at the same period a year earlier.7 Building construction increased by 16.2 per cent (largely driven by residential work8), while engineering construction grew by 36.5 per cent (Figure 2). Figure 2: Value of work done ($, millions), Construction sectors, ACT, 5 years to September 2016

Source: ABS, Construction Work Done, Preliminary, chain volume measures, trend Employment and vacancy numbers for construction trades workers in the ACT have both grown over the past year (Figures 3 and 4). Employment increased by 9.6 per cent to around 5500 (Figure 3).9 The number of advertised vacancies grew by 20.3 per cent to a record high (Figure 4).10 Figure 3: Employment (no.), Construction trades workers, ACT, 5 years to November 2016

Source: ABS, Labour Force, Department of Employment trend

7 ABS, Construction Work Done, Preliminary, September 2016, chain volume measures, trend 8 ABS, Construction Work Done, Preliminary, September 2016, chain volume measures, seasonally adjusted 9 ABS, Labour Force, November 2016, Department of Employment trend 10 Department of Employment, Internet Vacancy Index, November 2016, trend Labour Market Research and Analysis Branch Department of Employment Page 3 Figure 4: Vacancy levels (indexed), Construction trades workers, ACT, 5 years to November 2016

Source: Department of Employment, Internet Vacancy Index, trend (January 2006 = 100) Supply trends More than 60 per cent of construction trades workers in the ACT hold a certificate III or higher qualification.11 Apprenticeships provide the main pathway for entry to these trades (Figure 5). There were around 450 commencements over the year to March 2016, a historically high level. Completions fell slightly in the year to March 2016 to 270, but this remains a historically high level. Discussions with industry contacts suggest that there is some movement of construction trades labour between the ACT and Sydney depending on relative levels of activity. The strong Sydney market and high wages on offer there are likely to have attracted some construction trades workers from the ACT. Media reports suggest that bricklayers earn very high rates in Sydney.12 Figure 5: Apprentice and trainee commencements and completions (no.), Construction trades workers, ACT, 2006 to 2016 (year to March)

Source: NCVER, Apprentices and Trainees, estimates (certificate III or higher qualification)

11 ABS, Census of Population and Housing, 2011 12 AFR Weekend, Building prices through the roof, 5 March 2016 Outlook Indicators are mixed about the future demand for construction trades in the ACT. ABS data suggest there is a healthy pipeline of residential work, with the total number of dwelling approvals increasing strongly during 2016 to historically high levels.13 The Housing Industry Association (HIA), though, projects that new dwelling starts will fall by 17.8 per cent in 2017, before rising by 2.3 per cent in 2018, with large falls in multi-unit construction offsetting growth in house construction.14 Renovation activity is expected to rise slightly, up 0.9 per cent in 2016-17 and 3.7 per cent in 2017-18.15 In terms of non-residential building, there are limited opportunities. The ACT Government reports that the office vacancy rate in the ACT is “currently the third highest in Australia, at 14.9 per cent and has risen considerably over the past three years”.16 BIS Shrapnel estimates that the Canberra office market will remain oversupplied over the next five years.17 The ACT Government expects infrastructure investment to strengthen in 2016-17 and beyond. Projects planned over the next four years include the Light Rail, the ACT Law Courts Facilities, and the University of Canberra Public Hospital.18 The Department of Employment projects employment in the ACT construction industry will increase by 5.8 per cent over the five years to November 2020, compared with growth of 7.2 per cent for all industries in the ACT.19

13 ABS, Building Approvals, Australia, December 2016, trend 14 HIA, New Housing Outlook, November 2016 15 HIA, Media Release: Renovations set to boost ACT residential building, November 2016 16 ACT Government, 2016-17 Budget Paper No. 3 17 BIS Shrapnel, Canberra Office Market, 28 June 2016 18 ACT Government, 2016-17 Budget Paper No. 3 19 Department of Employment, Regional Projections to November 2020 Labour Market Research and Analysis Branch Department of Employment Page 5