DRAFTING LIMITED LIABILITY COMPANY OPERATING AGREEMENTS--THIRD EDITION

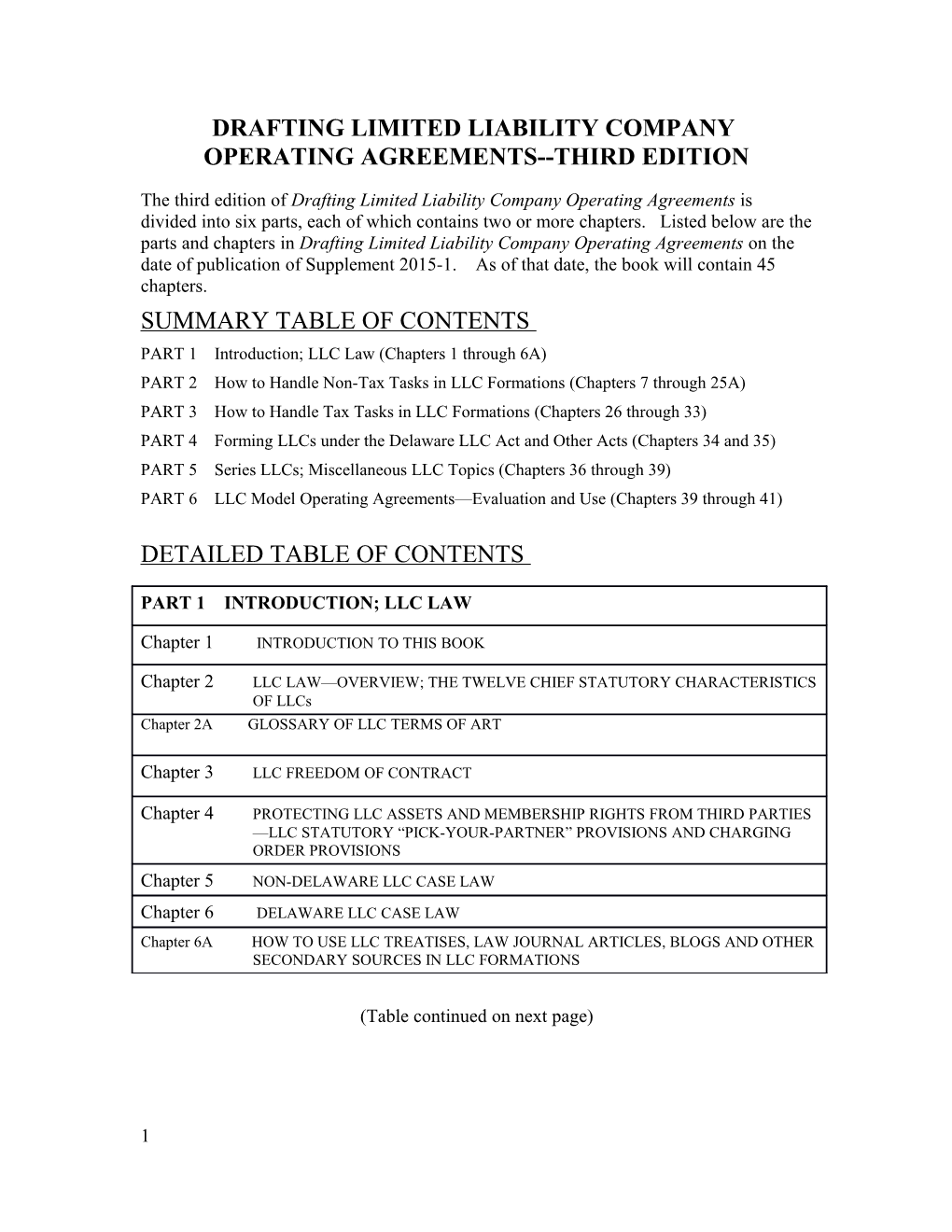

The third edition of Drafting Limited Liability Company Operating Agreements is divided into six parts, each of which contains two or more chapters. Listed below are the parts and chapters in Drafting Limited Liability Company Operating Agreements on the date of publication of Supplement 2015-1. As of that date, the book will contain 45 chapters. SUMMARY TABLE OF CONTENTS PART 1 Introduction; LLC Law (Chapters 1 through 6A) PART 2 How to Handle Non-Tax Tasks in LLC Formations (Chapters 7 through 25A) PART 3 How to Handle Tax Tasks in LLC Formations (Chapters 26 through 33) PART 4 Forming LLCs under the Delaware LLC Act and Other Acts (Chapters 34 and 35) PART 5 Series LLCs; Miscellaneous LLC Topics (Chapters 36 through 39) PART 6 LLC Model Operating Agreements—Evaluation and Use (Chapters 39 through 41)

DETAILED TABLE OF CONTENTS

PART 1 INTRODUCTION; LLC LAW

Chapter 1 INTRODUCTION TO THIS BOOK

Chapter 2 LLC LAW—OVERVIEW; THE TWELVE CHIEF STATUTORY CHARACTERISTICS OF LLCs Chapter 2A GLOSSARY OF LLC TERMS OF ART

Chapter 3 LLC FREEDOM OF CONTRACT

Chapter 4 PROTECTING LLC ASSETS AND MEMBERSHIP RIGHTS FROM THIRD PARTIES —LLC STATUTORY “PICK-YOUR-PARTNER” PROVISIONS AND CHARGING ORDER PROVISIONS Chapter 5 NON-DELAWARE LLC CASE LAW Chapter 6 DELAWARE LLC CASE LAW Chapter 6A HOW TO USE LLC TREATISES, LAW JOURNAL ARTICLES, BLOGS AND OTHER SECONDARY SOURCES IN LLC FORMATIONS

(Table continued on next page)

1 PART 2 HANDLING NON-TAX TASKS IN LLC FORMATIONS

Chapter 7 HOW TO HANDLE INITIAL CONTACTS WITH LLC FORMATION CLIENTS

Chapter 8 HOW TO HANDLE ISSUES OF PROFESSIONAL ETHICS IN LLC FORMATIONS

Chapter 9 HOW TO HANDLE NON-TAX CHOICE OF ENTITY IN LLC FORMATIONS

Chapter 10 HOW TO USE MULTI-LLC STRUCTURES TO MAXIMIZE BUSINESS ASSET PROTECTION

Chapter 11 HOW TO CHOOSE BETWEEN YOUR HOME-STATE LLC ACT AND THE DELAWARE ACT FOR LLC FORMATION CLIENTS

Chapter 12 HOW TO DRAFT LLC ARTICLES OF ORGANIZATION

Chapter 13 HOW TO CHOOSE THE RIGHT MODEL OPERATING AGREEMENT FOR AN LLC

Chapter 14 HOW TO DRAFT OPERATING AGREEMENTS—GENERAL GUIDELINES Chapter 15A HOW TO DRAFT OPERATING AGREEMENTS FOR SINGLE-MEMBER LLCs WHOSE MEMBERS ARE INDIVIDUALS Chapter 15B HOW TO DRAFT OPERATING AGREEMENTS FOR SINGLE-MEMBER LLCs WHOSE MEMBERS ARE ENTITIES

Chapter 16 HOW TO USE PLUG-IN PROVISIONS IN LLC FORMATIONS

Chapter 17 HOW TO UNDERSTAND AND APPLY LLC STATUTES IN LLC FORMATIONS

Chapter 18 HOW TO EXPLOIT LLC FLEXIBILITY AND AVOID LLC PITFALLS IN DRAFTING LLC OPERATING AGREEMENTS

Chapter 19 DRAFTING OPERATING AGREEMENTS FOR MULTI-MEMBER LLCs— UNDERSTANDING AND MASTERING THE DRAFTING PROCESS Chapter 19A SECTION-BY-SECTION AND PROVISION-BY-PROVISION COMMENTARY ON FORM 6.2

Chapter 20 LLC FIDUCIARY LAW FROM AN LLC FORMATION VIEWPOINT

Chapter 21 HOW TO IDENTIFY AND HANDLE “MISCELLANEOUS” ISSUES IN LLC FORMATIONS

Chapter 22 HOW TO ADVISE LLC FORMATION CLIENTS ABOUT VEIL-PIERCING

Chapter 23 HOW TO USE PLANNING MEMOS IN LLC FORMATIONS

Chapter 24 HOW TO COMPLETE THE LLC FORMATION PROCESS

Chapter 25 THE LAWYER’S ROLE AS TEACHER IN LLC FORMATIONS

Chapter 25A RECOGNIZING AND HANDLING INTELLECTUAL PROPERTY LAW ISSUES IN LLC FORMATIONS—AN INTRODUCTION FOR NON-SPECIALISTS

2 3 PART 3 HANDLING TAX TASKS IN LLC FORMATIONS

Chapter 26 HOW TO HANDLE FEDERAL AND STATE TAX ISSUES IN LLC FORMATIONS-- INTRODUCTION

Chapter 27 HOW TO CHOOSE THE RIGHT FEDERAL INCOME TAX REGIMEN FOR AN LLC ON FEDERAL INCOME TAX GROUNDS

Chapter 28 UNDERSTANDING AND APPLYING THE CHECK-THE-BOX REGULATIONS IN LLC FORMATIONS

Chapter 29 HOW TO DRAFT FEDERAL INCOME TAX PROVISIONS IN OPERATING AGREEMENTS FOR LLCs TAXABLE AS PARTNERSHIPS Chapter 29A HOW TO DRAFT “PLUG-IN” PARTNERSHIP TAX PROVISIONS IN THE OPERATING AGREEMENTS FO MULTI-MEMBER LLCS TAXABLE AS “STRAIGHT-UP PARTNERSHIPS” Chapter 29B HOW TO DRAFT “CONTRACTUAL SPECIAL ALLOCATION” PROVISIONS IN THE OPERATING AGREEMENTS OF MULTI-MEMBER LLCS TAXABLE AS PARTNERSHIPS PVNSCTLL

Chapter 30 HOW TO DRAFT FEDERAL INCOME TAX PROVISIONS IN OPERATING AGREEMENTS FOR LLCs TAXABLE AS S CORPORATIONS

Chapter 31 HOW TO PROTECT LLC MEMBERS FROM SOCIAL SECURITY TAXES-- INTRODUCTION

Chapter 32 HOW TO DRAFT OPERATING AGREEMENT PROVISIONS TO PROTECT LLC MEMBERS FROM SOCIAL SECURITY TAXES

Chapter 33 HOW TO HANDLE STATE AND MULTISTATE TAX ISSUES IN LLC FORMATIONS

PART 4 FORMING LLCs UNDER THE DELAWARE LLC ACT AND OTHER ACTS

Chapter 34 HOW TO FORM LLCs UNDER THE DELAWARE LLC ACT

Chapter 35 HOW TO FORM LLCs UNDER THE MASSACHUSETTS LLC ACT

(Tables continued on next page)

4 PART 5 SERIES LLCs AND OTHER MISCELLANEOUS LLC TOPICS

Chapter 36 SERIES LLCs—LAW, TAX, FORMS

Chapter 37 HOW TO RESTRUCTURE LLCs AND OTHER BUSINESS ORGANIZATIONS TO SAVE TAXES AND PROTECT ASSETS

Chapter 38 HOW TO CONVERT CORPORATIONS TO LLCs

PART 6 LLC MODEL OPERATING AGREEMENTS—EVALUATION AND USE

Chapter 39 HOW TO EVALUATE MODEL OPERATING AGREEMENTS

Chapter 40 HOW TO FORM HUSBAND-WIFE LLCs

Chapter 41 HOW TO USE SPECIAL-PURPOSE FORM 2 IN DRAFTING SHORT-FORM OPERATING AGREEMENTS

Copyright © 2013, 2012 CCH Incorporated. All Rights Reserved.

D:\Docs\2017-12-13\0c44b04aef445950c9bf71b6c91fca61.docx

5 6