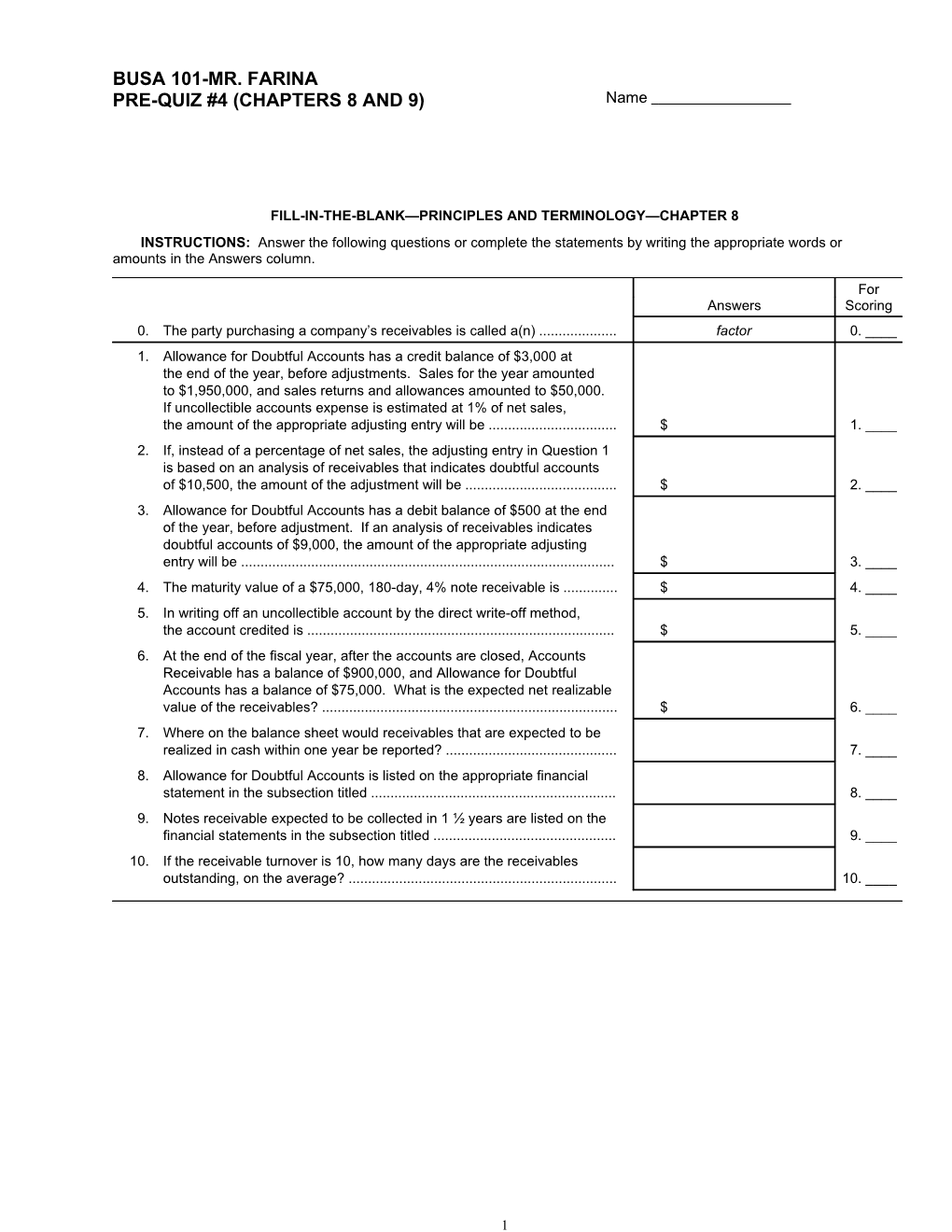

BUSA 101-MR. FARINA PRE-QUIZ #4 (CHAPTERS 8 AND 9) Name

FILL-IN-THE-BLANK—PRINCIPLES AND TERMINOLOGY—CHAPTER 8 INSTRUCTIONS: Answer the following questions or complete the statements by writing the appropriate words or amounts in the Answers column.

For Answers Scoring 0. The party purchasing a company’s receivables is called a(n) ...... factor 0. ____ 1. Allowance for Doubtful Accounts has a credit balance of $3,000 at the end of the year, before adjustments. Sales for the year amounted to $1,950,000, and sales returns and allowances amounted to $50,000. If uncollectible accounts expense is estimated at 1% of net sales, the amount of the appropriate adjusting entry will be ...... $ 1. ____ 2. If, instead of a percentage of net sales, the adjusting entry in Question 1 is based on an analysis of receivables that indicates doubtful accounts of $10,500, the amount of the adjustment will be ...... $ 2. ____ 3. Allowance for Doubtful Accounts has a debit balance of $500 at the end of the year, before adjustment. If an analysis of receivables indicates doubtful accounts of $9,000, the amount of the appropriate adjusting entry will be ...... $ 3. ____ 4. The maturity value of a $75,000, 180-day, 4% note receivable is ...... $ 4. ____ 5. In writing off an uncollectible account by the direct write-off method, the account credited is ...... $ 5. ____ 6. At the end of the fiscal year, after the accounts are closed, Accounts Receivable has a balance of $900,000, and Allowance for Doubtful Accounts has a balance of $75,000. What is the expected net realizable value of the receivables? ...... $ 6. ____ 7. Where on the balance sheet would receivables that are expected to be realized in cash within one year be reported? ...... 7. ____ 8. Allowance for Doubtful Accounts is listed on the appropriate financial statement in the subsection titled ...... 8. ____ 9. Notes receivable expected to be collected in 1 ½ years are listed on the financial statements in the subsection titled ...... 9. ____ 10. If the receivable turnover is 10, how many days are the receivables outstanding, on the average? ...... 10. ____

1 FILL-IN-THE-BLANK—PRINCIPLES AND TERMINOLOGY—CHAPTER 9 INSTRUCTIONS: Complete each of the following statements by writing the appropriate words in the Answers column.

For Answers Scoring 0. The depreciation method that varies the amount of depreciation with the asset’s usage is called ...... units-of-production 0. ____ 1-2. Three common depreciation methods are units-of-production, 1. ______, and ...... 1. ____ 2. ______...... 2. ____ 3. The periodic write-off of the cost of an intangible asset to expense is called 3. ____ 4. Costs that are chargeable to an asset account or its related accumulated depreciation account are termed ...... 4. ____ 5. Cost of an asset minus its accumulated depreciation is called ...... 5. ____ 6. Long-lived assets that are useful in the operations of a business, that are not held for sale, and that have no physical qualities are usually classified on the balance sheet as ...... 6. ____ 7-9. The following expenditures are related to land acquired for use by a busi- ness. Indicate the account that should be debited for each expenditure …. 7. ____ 7. Cost of paving parking areas ...... 8. Cost of razing unwanted building ...... 8. ____ 9. Realty broker’s commission paid in purchasing land ...... 9. ____ 10-13. The following expenditures are related to equipment acquired for use 10. ____ by a business. Indicate the account that should be debited for each expenditure. 10. Cost of vandalism on the equipment during installation ...... 11. Special foundation ...... 11. ____ 12. New parts to replace those damaged in installation ...... 12. ____ 13. Installation costs ...... 13. ____ 14. A patent is referred to as a (n) ...... 14. ____ 15. The expense account for using natural resources is ...... 15.____

PROBLEM 1—ANALYSIS OF TRANSACTIONS AND ADJUSTMENTS—CHAPTER 8

2 INSTRUCTIONS: In recording the selected transactions and adjustments, indicate the titles of the general ledger accounts to be debited and credited by inserting in the appropriate column the letters that correspond to the account titles listed. ACCOUNTS A. Accounts Payable E. Interest Expense I. Misc. Administrative Expense B. Accounts Receivable F. Interest Revenue J. Notes Payable C. Allowance for Doubtful Accounts G. Interest Payable K. Notes Receivable D. Cash H. Interest Receivable L. Bad Debt Expense

For For TRANSACTIONS Debit Scoring Credit Scoring 0. Received the final payment on a promissory note ...... D 0. ____ K,F 0. ____ 1-2. Recorded the adjusting entry for estimated uncollectible accounts at the end of the fiscal period, based upon the allowance method ...... 1. ____ 2. ____ 3-4. Wrote off the account of the bankrupt debtor (included in Allowance for Doubtful Accounts provision had been made in Question 1-2) ...... 3. ____ 4. ____ 5-8. Recovered the bad debt written off in Question 3-4 ...... 5. ____ 6. ____ 7. ____ 8. ____ 9-10. Replaced a customer’s account receivable with a note receivable ...... 9. ____ 10. ____

PROBLEM 2—ADJUSTMENTS TO THE ALLOWANCE FOR DOUBTFUL ACCOUNTS—CHAPTER 8

Accounts Receivable of the Foxen Canyon Co. on December 31, 2008, had a balance of $300,000. Allowance for Doubtful Accounts had a $2,400 debit balance. Sales in 2008 were $1,690,000. Sales discounts were $14,000 in 2008. Give the adjusting entry for the Allowance for Doubtful Accounts under each of the following independent assumptions:

1. Of 2008 net sales, 1.5% will probably never be collected.

2. An ageing schedule shows that $11,000 of the outstanding accounts receivable are doubtful.

Date Description DR CR

1.

2.

PROBLEM 3—CHAPTER 9 INSTRUCTIONS: Solve each of the following problems and record the answers in the Answers column. For Answers Scoring 0. If the cost of a fixed asset is $50,000 and its accumulated depreciation is $35,000, its book value is ...... $15,000 0. ____ 1-3. Equipment priced at $130,000 is acquired by trading in a similar asset and paying $115,000. 1. If the book value of the asset traded in was $23,000, the cost basis of the new asset is ...... $ 1. ____ 2. If the book value of the asset traded in had been $8,000, the cost basis of the new asset would be ...... $ 2. ____ 3. If the book value of the asset traded in had been $15,000, the cost basis of the new asset would be...... $ 3. ____ 4. A patent with a cost of $150,000 has an estimated useful life of 5 years and a legal life of 12 years. The annual amortization is ...... $ 4. ____ 5-7. Machinery acquired on the first day of the current fiscal year for $750,000 has an estimated useful life of 5 years or 50,000 hours and a residual value of $0. Determine the depreciation for the current year by each of the following methods: 5. Straight-line ...... $ 5. ____ 6. Double-declining-balance ...... $ 6. ____ 7. Units-of-production (the equipment was used for 5,000 hours during the year) ...... $ 7. ____

8-9. Based on the data in Question 5-7, and assuming that the machinery was used for 10,000 hours in the second year, determine the deprecia- tion for the second year by each of the following methods: 8. Double-declining-balance ...... $ 8. ____ 9. Units-of-production ...... $ 9. ____ 10-11. Based on the data in Question 5-7, and assuming that the machinery was used for 5,500 hours in the third year, determine the depreciation for the third year by each of the following methods: 10. Double-declining-balance ...... $ 10. ____ 11. Units-of-production ...... $ 11. ____

PROBLEM 4—ANALYSIS OF TRANSACTIONS—CHAPTER 9 INSTRUCTIONS: In the appropriate columns, insert the letters of the accounts to be debited and credited in recording the following transactions. (Do not record amounts.)

4 ACCOUNTS A. Accounts Receivable F. Depletion Expense K. Notes Payable B. Accumulated Depletion G. Equipment L. Notes Receivable C. Accumulated Depreciation—Equipment H. Gain on Disposal of Fixed Assets M. Research and Development D. Amortization Expense—Patents I. Goodwill Expense E. Cash J. Loss on Disposal of Fixed Assets N. Patents

For For TRANSACTIONS Debit Scoring Credit Scoring 0. Recorded amortization of patents, $12,500 ...... D 0. ____ N 0. ____ 1-2. Traded in old equipment for similar equipment priced at $75,000, receiving a trade-in allowance of $8,000 and paying the balance in cash. (Cost of the old equipment was $37,500; accumulated depreciation, $30,000) ...... 1. ____ 2. ____ 3-4. Traded in equipment costing $47,500, with accumulated depreciation of $30,000, for similar equipment priced at $60,000; received a trade-in allowance of $5,000 and issued a note for the balance ...... 3. ____ 4. ____ 5-6. Paid research and development expense, $40,000 ...... 5. ____ 6. ____ 7-8. Discarded equipment: cost, $83,750; accumulated depreciation, $82,750 7. ____ 8. ____ 9-10. Sold for $5,000 cash the following equipment: cost, $57,500; accumulated depreciation, $55,000 ...... 9. ____ 10. ____ 11-12. Sold on account for $8,000 the following equipment: cost, $32,000; accumulated depreciation, $15,000 ...... 11. ____ 12. ____ 13-14. Recorded depletion, $18,500 ...... 13. ____ 14. ____

PROBLEM 5—SHORT ESSAY—CHAPTER 8 Best Buy is a specialty retailer of consumer electronics, including personal computers, entertainment software, and appliances. Best Buy operates retail stores in addition to the Best Buy, Media Play, On Cue, and Magnolia Hi-Fi Web sites. For the years ending February 26, 2005, and February 28, 2004, Best Buy reported the following (in millions):

Feb. 26, 2005 Feb. 28, 2004 Net Sales $27,433 $24,548 Accounts Receivable at year end 375 343

Assume that the accounts receivable (in millions) were $312 at the beginning of the year ending February 28, 2004. Instructions: 1. Compute the accounts receivable turnover for 2005 and 2004. Round to one decimal place. 2. Compute the days’ sales in receivables at the end of 2005 and 2004. Use the following formula: Accounts receivable turnover divided into 360 days. 3. What conclusions can be drawn from (1) and (2) regarding Best Buy’s efficiency in collecting receivables? 4. For its years ending in 2005 and 2004, Circuit City Stores, Inc. has accounts receivable turnover of 61.0 and 56.3, respectively. Compare Best Buy’s efficiency in collecting receivables with that of Circuit City

6