Unit 9: Personal Finance Lesson 1: Personal Finance

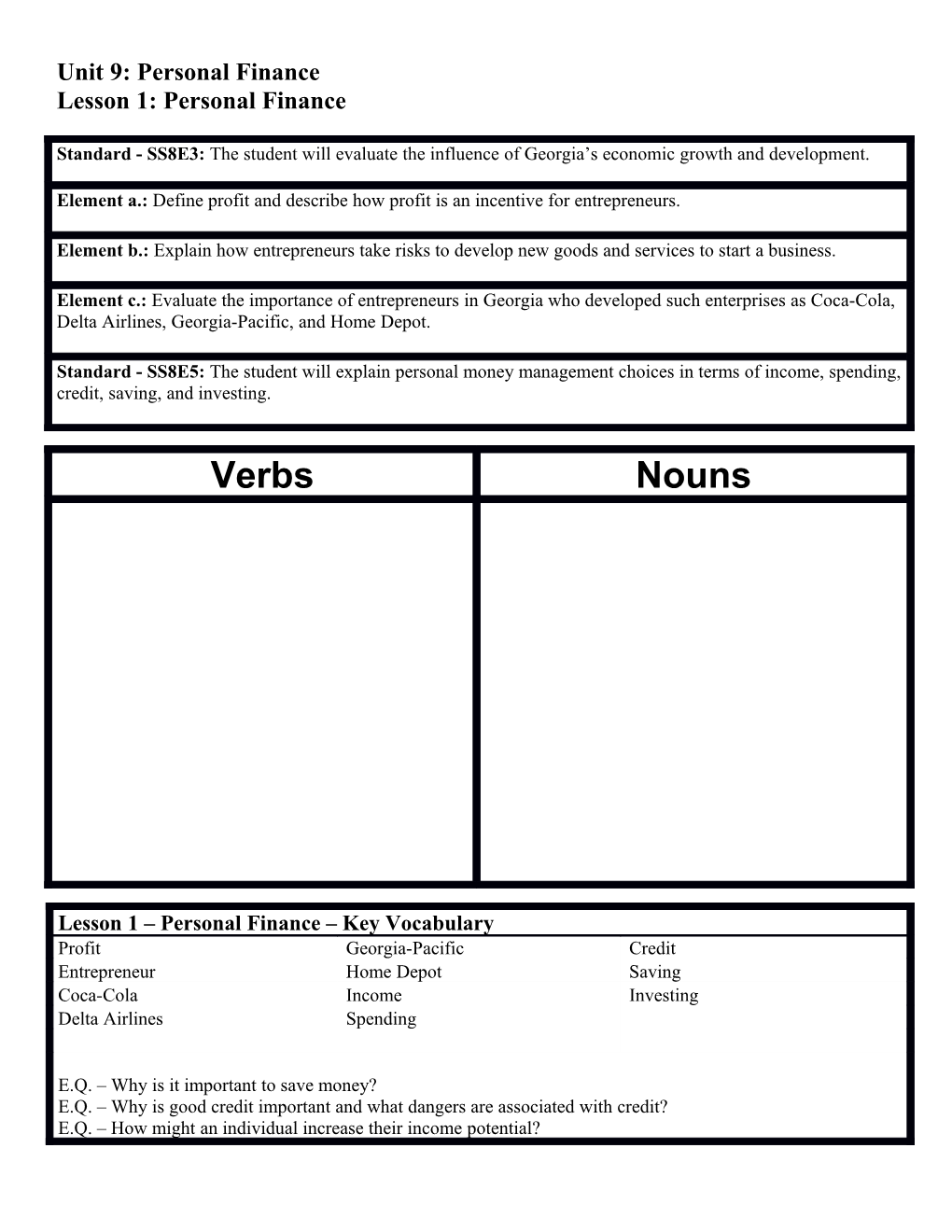

Standard - SS8E3: The student will evaluate the influence of Georgia’s economic growth and development.

Element a.: Define profit and describe how profit is an incentive for entrepreneurs.

Element b.: Explain how entrepreneurs take risks to develop new goods and services to start a business.

Element c.: Evaluate the importance of entrepreneurs in Georgia who developed such enterprises as Coca-Cola, Delta Airlines, Georgia-Pacific, and Home Depot.

Standard - SS8E5: The student will explain personal money management choices in terms of income, spending, credit, saving, and investing.

Verbs Nouns

Lesson 1 – Personal Finance – Key Vocabulary Profit Georgia-Pacific Credit Entrepreneur Home Depot Saving Coca-Cola Income Investing Delta Airlines Spending

E.Q. – Why is it important to save money? E.Q. – Why is good credit important and what dangers are associated with credit? E.Q. – How might an individual increase their income potential? Identification Context Connections Who? and/or What? When? and/or Where? Why and/or How? Explain its connection to the GPS, its impact on GA, and/or the “big picture”. Profit What are the differences between income and profit?

Entrepreneur What are the possible benefits and risks associated with being an entrepreneur?

Coca-Cola, Delta Airlines, Georgia- Why are entrepreneurs in GA (such as Pacific, and Home Depot those that created Coca-Cola, Delta Airlines, Georgia-Pacific, and Home Depot) so important to the state economy?

Income What are some possible ways you can increase your income potential?

Spending What are some possible benefits and risks associated with spending? Credit What are the positive and negative effects of credit?

Saving What are some ways people can save money and what are the benefits of each?

Investing What are some possible ways you can choose to invest your money?

Additional Notes: ______

Essential Question #1: Why is it important to save money?

Essential Question #2: Why is good credit important and what dangers are associated with credit?

Essential Questions #3: How might an individual increase their income potential? Additional Notes: ______