Pennsylvania State System of Higher Education Fiscal Year 2012/13 Budget Information Request Instructions

Table of Contents

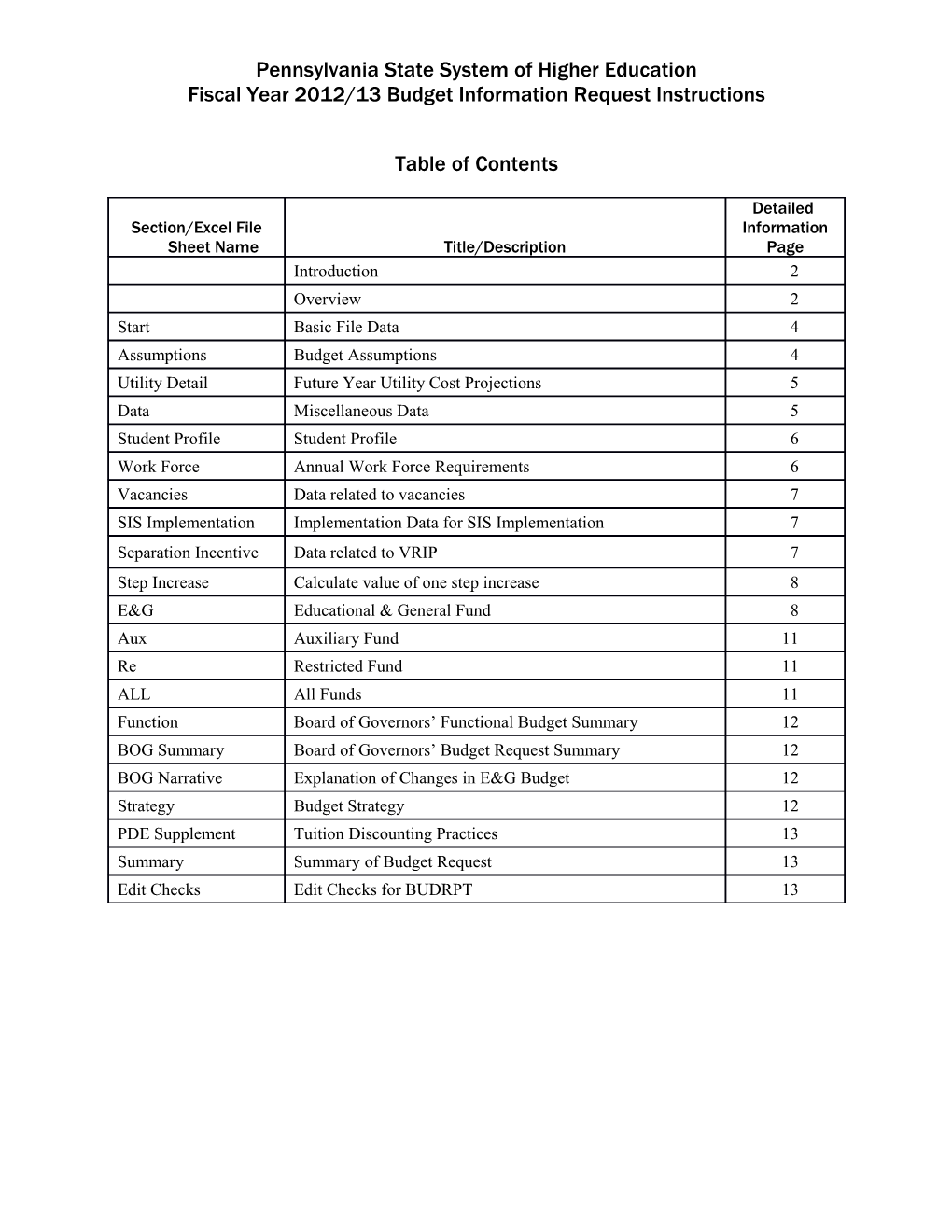

Detailed Section/Excel File Information Sheet Name Title/Description Page Introduction 2 Overview 2 Start Basic File Data 4 Assumptions Budget Assumptions 4 Utility Detail Future Year Utility Cost Projections 5 Data Miscellaneous Data 5 Student Profile Student Profile 6 Work Force Annual Work Force Requirements 6 Vacancies Data related to vacancies 7 SIS Implementation Implementation Data for SIS Implementation 7 Separation Incentive Data related to VRIP 7 Step Increase Calculate value of one step increase 8 E&G Educational & General Fund 8 Aux Auxiliary Fund 11 Re Restricted Fund 11 ALL All Funds 11 Function Board of Governors’ Functional Budget Summary 12 BOG Summary Board of Governors’ Budget Request Summary 12 BOG Narrative Explanation of Changes in E&G Budget 12 Strategy Budget Strategy 12 PDE Supplement Tuition Discounting Practices 13 Summary Summary of Budget Request 13 Edit Checks Edit Checks for BUDRPT 13 2

Pennsylvania State System of Higher Education 2012/13 Budget Information Request Instructions

Introduction This manual contains instructions to assist Pennsylvania State System of Higher Education (PASSHE) administrators in preparing the Budget Report, or BUDRPT. The BUDRPT is a series of spreadsheets contained in a Microsoft Excel computer file. The Universities must enter information specific to their institution. This information is primarily financial; however, enrollment, work force, and other data are requested as well. This information is then assembled by the Office of the Chancellor into a budget request for the entire System, which is presented to PASSHE’s Board of Governors and, with its approval, to the Governor’s Budget Office, Department of Education, and the Commonwealth General Assembly.

This year’s BUDRPT submission is due, via electronic transmission, to the Office of the Chancellor by Friday, September 2, 2011. It should be emailed to Ginger S. Coleman, Manager of Budget Planning and Analysis, at [email protected]. When transmitting your file, please name it with the first two letters of your institution, according to the chart in the Start sheet of the BUDRPT.

Although there are significant changes in the BUDRPT this year, the basic structure remains similar to what has been used in previous years. The file has a separate sheet for each fund: Educational & General (E&G), Auxiliary (Aux), and Restricted (Re). Each sheet has cells for entering revenue and expenditure information. The sheet labeled ALL pulls information from the three funds and provides a picture of the institution’s overall budget.

The same color-coding conventions have been used: green cells are for entering information, and blue cells indicate formulas that pull information from another sheet within the workbook. When entering data, please use whole dollars. Do not enter cents. If you are using a formula to calculate the new revenue or expenditure figure, please use the “@round” function at the beginning of your formula to remove the cents.

This year’s BUDRPT requests information for three fiscal years. The Prior Year is the fiscal year just ended June 30, 2011(FY2010/11). The Current Year is the fiscal year ending June 30, 2012(FY 2011/12). The Request Year is the fiscal year ending June 30, 2013(FY2012/13).

Overview As we begin the fiscal year 2012/13 budget process, it is clear that Pennsylvania’s economy continues to be challenged by the current national economic downturn. Fiscal year 2011/12 presented unprecedented times when the Commonwealth reduced the budget by four percent, partially through an eighteen percent reduction in PASSHE’s appropriations. The 2011/12 Commonwealth budget was the first step in fulfilling Governor Corbett’s promise to reduce the state budget by ten percent during his term in office. Although state revenues are currently exceeding projections, they have not rebounded enough to keep pace with anticipated expenditure requirements. There remains concern regarding the Commonwealth’s funding commitment to PASSHE in 2012/13 and beyond. As the Commonwealth will continue to implement budget-cutting strategies, PASSHE needs to be prepared to do so as well. PASSHE’s emphasis must continue to be on addressing the structural gap between revenues and expenses through strategic changes to our business models. Therefore, the following assumptions are to be used when creating the fiscal year 2012/13 budget request. These changes are highlighted below and are discussed in further detail in the explanations for each tab in the BUDRPT template.

2 Enrollment The new flexibility provided for tuition pricing in recent changes to Board of Governors’ Policy 1999/02-A, Tuition, may allow new opportunities for identifying and attracting new student markets. When projecting enrollment for 2012/13, consideration must be given to potential changes in enrollment management efforts and the cost/benefit of growth in certain market segments. At the same time, trends in Pennsylvania’s demographics and sluggish enrollment commitments for fall 2011 may indicate stress on some Universities’ demand. Some Universities may be approaching capacity for on-campus enrollment. For these institutions, it may cost more to take on additional students than is generated through student-based revenue. For 2012/13, if a change is anticipated, it should be not greater than the growth anticipated in 2011/12. If enrollment is projected to decrease in 2011/12, 2012/13 enrollment projections should show no growth, or a decrease in enrollment.

2012/13 Revenue Expectations

State Appropriations: Given Pennsylvania’s current fiscal landscape, PASSHE must be prepared for another reduction in state appropriations. This year’s BUDRPT is to be completed with an assumption of no change in state appropriations, but universities also should be preparing internal planning scenarios with reductions in 2012/13 appropriations. Tuition: At this time, no tuition rate increases are to be considered in the budget request. However, tuition and fee revenue adjustments should be made based on changes in enrollment. Other Revenue Sources: As Universities are becoming less dependent on state and federal funding, it is anticipated that other revenue sources will grow. Use of Carryforward: To the extent funds from previous years have been reserved for specific one-time purposes in the current and/or request years, they should be included as a revenue source. If Carryforward funds are needed to meet ongoing costs, this can only be done as a transitional step toward implementing lasting changes to the University’s cost structure. In addition, any university with unrestricted net assets in excess of 10% of their operating budget should reflect a planned Use of Carryforward in both the current and request years. An explanation should be provided in the BOG Narrative for the intent of all activities funded with this source.

Fiscal Year 2012/13 Expenditure Requirements Only essential cost increases are to be incorporated in 2012/13 expenditure estimates; assumptions for these cost increases are provided in other sections of the BUDRPT instructions.

Salary and Wage Rates: 2011/12 and 2012/13 compensation are to reflect only known pay adjustments. To date, this includes nonrepresented and AFSCME employee groups. If additional bargaining units ratify agreements prior to submission of the BUDPRT, guidance will be provided for Universities to include associated compensation increases in their submission. A separate section of the BUDRPT requires additional data on the impact of pay increases for informational purposes only. Positions: Universities must address staffing needs within existing funds. It is expected that, given the high level of retirements occurring, some vacant positions will be filled. However, there should be no increase in Educational and General expenditure

3 4

requirements due to new positions. Additional information is required this year for vacancy information in the Vacancies and Eliminated Positions spreadsheet.

Multiyear Budgeting As always, the BUDRPT requires data for the prior year (FY 2010/11), the current year (FY 2011/12), and the request year (FY 2012/13).This year, there is no requirement to submit budget projections beyond fiscal year 2012/13, since so much is unknown about both the expenditure requirements and revenue expectations. However, it is important for Universities to be prepared for multiple years of difficult budgets and to model various scenarios into the future.

These instructions provide the guidelines for ensuring the consistent development of minimum budget requirements for fiscal year 2012/13. More detailed information about changes to individual sheets can be found below under the headings that correspond to each sheet’s name.

Start This page contains general information regarding the BUDRPT file, including the fiscal years covered and the due date. There is also a chart that lists the two-letter code for each University and the name you should give your file when it is returned to the Office of the Chancellor. The only fields requiring input on this page are the placement of your University’s two-letter code, in capital letters, in the green cell and your contact information. This will automatically fill in the University’s name at the top of each sheet.

Assumptions The types of information provided on this sheet remain largely unchanged from previous years. As usual, rates on this sheet for the request year remain subject to change after the BUDRPTs are submitted and throughout the year. You will be notified as these changes occur.

Salary increases represent the fiscal impact of contract agreements and Board actions. These estimates take into consideration the impact of midyear increases in each fiscal year. Throughout the BUDRPT, the work force is divided into categories based on the type of employee. Faculty refers to those represented by the Association of Pennsylvania State College and University Faculties (APSCUF), except coaches, who fall within Other. AFSCME refers to those represented by the American Federation of State, County and Municipal Employees. Nonrepresented includes all managers and executive-level employees. SCUPA refers to employees in the State College and University Professional Association. The final category, Other, encompasses, as the name implies, employees not in one of the unions or categories mentioned earlier. This includes, but is not limited to, coaches, nurses, student employees, security, and police personnel.

The Social Security data represents the latest information available from the Social Security Administration.

Retirement rates are finalized for the prior and current years. SERS and PSERS rates for fiscal year 2012/13 are based upon language in Act 120-2010 that was signed into law in November 2010. The TIAA-CREF/alternative retirement program rate is set by statute and is not likely to change.

The Hospitalization Insurance section lists AFSCME and SCUPA first. This plan is administered by the Pennsylvania Employees Benefit Trust Fund, to which PASSHE makes per-employee payments. The rates are set in the collective bargaining agreements. In addition to AFSCME and SCUPA employees, this plan also covers the physicians’ union (PDA), and the social services union (PSSU). Faculty and Nonrepresented are listed next. These rates are determined by PASSHE’s benefits office, with the assistance of the healthcare provider, and are affected by the faculty collective bargaining agreement. Rates for fiscal year 2011/12 are final. Rates for fiscal year 2012/13 are unknown at this time; however,

4 estimates have been provided to aid in completion of the 2012/13 budget request and are subject to change before presentation to the Board of Governors. The rates shown on this page are composite rates of all tiers (single, two-person, family) and are the employer’s share only.

Annuitant hospitalization rates for the prior and current years are final. The rates for the request year are subject to change.

Life insurance rates are set for the prior and current years. The rate for the request year is still subject to change.

Two inflation factors are listed. The consumer price index for the prior year comes from the Federal Bureau of Labor Statistics. Estimates for the current and budget years come from the Congressional Budget Office. Utility rate increases are estimated based upon the mix of utilities used within PASSHE’s E&G facilities and correlating anticipated rate increases. Please note, due to the expiration of electric generation rate caps, some Universities saw a significant increase in electricity rates beginning in January 2010; others saw the increase in January 2011. The System-wide estimated rate increases have been factored into the utility rate increases for fiscal years 2011/12 and 2012/13 and on the benefits assumptions page. University experience may vary significantly.

Utility Detail Additional information for projecting utility costs is provided. Individual University utility costs will vary, depending on mix of utilities, local utility providers, expiration of electric generation rate caps, and usage. This spreadsheet provides cost projections for each energy source (electricity, gas, coal, and oil), as well as some insight into costs associated with regional energy providers. This information serves as a guide; your facilities directors may have better information. Also, this spreadsheet only addresses predictions in rate changes; changes in energy usage also may have a significant impact on each University’s utility costs.

Data This sheet contains University-specific information for use in preparing the BUDRPT. Of particular note are the columns for state appropriation. Both here and on the E&G spreadsheet, the state appropriation is divided into several categories of funding related to the E&G appropriation.The first is the portion of the base allocation produced through the allocation formula and transferred to the Universities on a monthly basis. The second is the portion of the base allocation dedicated to the Academic Facilities Renovation Program (AFRP). The next data component provides performance funding— 2010/11 includes both the portion funded from the E&G appropriation and the portion funded from the Program Initiatives line item. For 2011/12 and 2012/13, the only funding source is the “off-the-top” portion from the E&G appropriation. Please note, due to the change in funding method, total performance funding is now the equivalent of approximately 2.4% of the current year E&G budget. Actual performance funding amounts are listed for fiscal year 2010/11. Performance funding for fiscal years 2011/12 and2012/13 are prorated based upon the actual awards of E&G performance funding for fiscal year 2010/11. This distribution is for budget purposes only, and is meant to minimize fluctuations in the appropriation estimate due to changes in performance funding. The 2011/12 distribution will be provided when it becomes available; BUDRPTs will be adjusted accordingly. The final category is for the E&G allocation for other purposes, such as the McKeever Environmental Learning Center. Additional explanations for this data can be found in notes on the sheet.

Also, at the bottom of this spreadsheet is information on the new academic programs that have been approved by the Board of Governors and any programs that have been terminated or placed in moratorium. Revenue and expenditure requirements associated with the implementation of these program changes should be addressed in your budget development.

5 6

Student Profile The Student Profile sheet collects enrollment information by headcount and annualized full-time- equivalent (FTE) students. Prior year fall headcount totals by graduate and undergraduate should match headcount figures provided in the Data spreadsheet. Annualized FTE totals by graduate and undergraduate for all three years must match those provided concurrently to the System Research Office by your University’s Institutional Research Office for the Program Budget. Some Universities may be at or near student capacity. Enrollment estimates should be based upon University leadership’s planning goals and market demand. Annualized FTE is calculated as follows: 30 undergraduate credit hours = 1 FTE; 24 graduate credit hours = 1 FTE. All credit hours taken (summer 2, fall, spring, summer 1) should be used in annualized FTE calculations. Nonresident enrollment must be reported based on whether or not the students were part of a tuition plan target market. For 2011/12, a change was made to the way nonresident undergraduate tuition is charged. Previously, universities were required to charge undergraduate nonresidents a tuition rate set at 250% of the in-state rate, unless they had an approved plan to charge an alternative rate (between 150% and 250% of the in-state rate) to a certain nonresident population. Now, a minimum out-of-state tuition rate of 150% of the in-state rate has been established and plans are approved to charge anything above this. If your University charges an alternative rate to any or all nonresidents, they should be reflected as Alternate Rate. Please note unless your University has an alternative rate, the tuition rate for international students is 250% of the resident undergraduate tuition rate.

Some Universities are at or are approaching capacity for on-campus enrollment. For these institutions, it may cost more to take on additional students than is generated through student-based revenue. For 2012/13, if a change is anticipated, it should be not greater than the growth anticipated in 2010/11. If enrollment is projected to decrease in 2010/11, 2012/13 enrollment projections should show no growth, or a decrease in enrollment.

Work Force The University’s work force is counted in annualized full-time-equivalent (FTE) employees. Annualized Employee FTE should include all positions for which funds are budgeted. In general, your FTE should be adjusted downward for planned vacancies. If, for instance, you are holding a position vacant for a year, your FTE count should not include that position; if you are holding a position vacant for six months, that position should be reflected as .50 FTE. With the exception of faculty, 1.00 FTE should reflect 37.5 or 40 hours of work (or normal workweek) for 52 weeks. If an employee works half-time year-round, he/she should be reflected as .50 FTE. If an employee (including coaches) works full-time for three months, he/she should be reflected as .25 FTE. Employee FTE figures should include only salaried employees, not wage employees. This may differ from payroll FTE definitions, which are computed based upon the percentage of a normal workweek in a given pay period. Faculty FTE should be calculated based on the number of contract hours, where 24 contract hours in a fiscal year equals 1.0 FTE. In addition, faculty on full sabbatical should be reflected as 1.0 FTE, rather than 0.5, as reflected on payroll.

As introduced last year, the template includes a more detailed request for workload information. For each employee group, annualized FTE is requested for (1)positions permanently filled, and (2) permanent positions that are currently filled on a temporary or interim basis. For faculty, there is also a third category for temporary or adjunct faculty that may not be associated with a permanent position.

Do not adjust FTE downward for normal turnover in positions; however, cost projections should incorporate salary savings anticipated due to normal turnover. Turnover expectancy is required to be reported, as a percent of salaries and total E&G salary dollars, in this spreadsheet. For example, if historically your University experiences payroll costs that are 2.0% less than projected due to positions

6 being vacated midyear, then the turnover expectancy would be 2.0%, and total budgeted salaries would be reduced by 2.0%.

Instructional faculty FTE positions should be estimated for the current, request, and future years. In previous years, this was based upon the Common Cost figures for the actual year. PASSHE is currently transitioning away from Common Cost Accounting to the National Study of Instructional Costs and Productivity. The definition of instructional faculty is different in these two methodologies. Instructional faculty should now be defined similar to the National Study of Instructional Costs and Productivity, which includes all faculty whose primary purpose is instruction. The FTE count for those faculty is based upon the human resources definition (e.g., a full-time faculty member is hired as 1.0 FTE). Instructional faculty will no longer exclude portions of faculty time for noninstructional activities.

In the Current Year Retirement Program Participation: E&G Only section, provide the institution’s unrestricted headcount for each retirement program by bargaining unit. The Current Year Health Care Program Participation: E&G Only section requests unrestricted headcount for each healthcare program by full-time and part-time employees by bargaining unit.

Vacancies and Eliminated Positions As PASSHE continues to face financial challenges and Universities work within constrained budgets, many Universities are holding positions vacant, or eliminating vacant and/or filled positions. Frequently questions arise concerning changes in PASSHE’s complement. The purpose of this spreadsheet is to provide consistent information that can be reported externally on the number of positions that are vacant, frozen, or eliminated. In the spring of 2009, a report was completed that provided information on vacancies that occurred in 2009/10. Similar information is requested at this time for vacancies and eliminated positions for 2010/11, 2011/12, and 2012/13.

For the purposes of this report, vacancies are unfilled authorized positions, based upon the agreed upon definition for Position Budget Management as follows.

Authorized Position: A position which has been approved by executive staff for inclusion in the budget; the position may or may not have a direct funding source in the current budget year.

Please include in this spreadsheet information concerning all vacant positions that were/will be at least partially funded in the University budget during the prior, current or request year. Also include all authorized positions that were/will be eliminated in the prior, current, or request year, even if they are not currently vacant. Also, please indicate if the position was filled when eliminated.

7 8

SIS Implementation Seven Universities completed the implementation of a student information system (SIS) in fiscal year 2010/11. Estimated costs associated with the implementation and ongoing maintenance costs are included in this page. From those Universities who implemented a SIS, additional information is required for costs associated with ongoing maintenance. When providing this information, please ensure that all necessary costs are incorporated into the appropriate year for each fund.

Separation Incentives In spring 2010, the Separation Incentive Program was developed. This program had two components, a voluntary retirement incentive package (VRIP) and a severance package for abolished positions. Last year, a new tab was created in the BUDRPT template to capture actual costs and estimated savings related to these two packages. This year, information is requested concerning cost and savings estimates related only to VRIP, as activity may still be occurring regarding the filling of positions vacated by VRIP.

Voluntary Retirement Incentive Package The first section of this chart (rows 46–50) deals with the number of employees participating in the retirement package, and salary and benefits (social security, retirement, and healthcare) originally budgeted for those positions through fiscal year 2012/13. The second section (rows 51–63) deals with the salary, earned leave, and incentive payouts; and benefits associated with these amounts that were actually paid out to the retiring employees. The third section (rows 64–69) deals with the number of positions vacated by retirees that will be filled, and the new compensation costs (salary and all related benefits, including healthcare) of those replacements. The fourth section (rows 70–74) calculates the net cost or savings generated by the package. This section is set to a default that all employees who participated were paid from the E&G fund. If some employees were paid from the Auxiliary or Restricted funds, corresponding amounts need to be entered in the respective rows, and the E&G row will adjust accordingly.

Per guidelines provided in Governmental Accounting Standards Board (GASB) 47, below are instructions on how to record expenditures related to the Voluntary Retirement Incentive Package in the proper fiscal year. Please use these instructions as you build this information into the E&G, Auxiliary, or Restricted tabs of the BUDRPT.

Voluntary Retirement Incentive Package Universities should record the termination benefit expense as of the date the employee signs the release and settlement agreement. The termination benefit expense is the cash incentive plus associated benefits (taxes). For example, Jane Jackson announced a retirement date of August 28, 2010. She signed her release and settlement date on June 15, 2010. Because she signed her release and settlement in 2009/10, the cash incentive and associated benefits (taxes) should be recorded in that same year. Any leave payouts and associated benefits (taxes) should be recorded in the fiscal year the employee retires. (In the example above, it would be recorded in 2010/11.)

Step Increase Since the compensation provisions of all bargaining unit contracts expired June 30, 2011 and most union contracts are still being negotiated, contract increases for all unions except AFSCME for fiscal years 2011/12 and 2012/13 are not known at this time. As the fiscal year 2012/13 budget request is being built, other union contracts may be ratified and appropriate pay adjustments will need to be made. To aid in the building of the request, it will be helpful to know the value of one step increase, by fund, for each

8 bargaining unit at your University. Please report the value of one step increase and the associated benefits (social security and retirement), if one step increase was given on July 1, 2012. Note: These numbers are to be excluded from salary estimates provided on the E&G, Auxiliary and Restricted tabs of the BUDRPT. This information may be used as the System-wide budget strategy is developed.

E&G Below are specific instructions for certain data components in this spreadsheet.

Tuition and Fee Revenue—Increases in student revenues due to anticipated enrollment increases and/or anticipated changes in institutional fees should be reflected.

As in previous years, tuition should be reported based on whether it comes from the regular academic year or intersession (summer and winter) terms. It should also be categorized based on the type of student: undergraduate versus graduate, resident versus nonresident, and nonresidents paying the minimum nonresident price versus those paying an alternative rate. Please note that BOG Policy 1999-02-A, Tuition, was revised in January 2011, providing Universities more flexibility in tuition rates for summer/winter sessions, graduate tuition and nonresident undergraduates. If your University is planning to utilize these new pricing policies, be sure to incorporate the potential impact on revenue in your estimates. No changes in the technology tuition fee rates should be assumed for the request year. Any changes in the technology tuition fee revenue collected should be based solely on anticipated changes in enrollment.The current and request year revenue estimates for fees set by your University’s Council of Trustees should incorporate changes for both enrollment and projected rate changes.

State Appropriations—The state appropriations minor object (412) has been divided into four categories. E&G Base Appropriations are those E&G funds that Universities receive each month as a result of the allocation formula (excluding AFRP), and constitute the bulk of the state appropriations. AFRP refers to the portion of the base allocation that is set aside for debt service in support of the Academic Facilities Renovation Program. Since all AFRP projects have been fully funded at this point, the current funding level for AFRP is expected to remain unchanged for several years. The remaining categories are Performance Funding and Other E&G. For 2010/11, Performance Funding includes both the “off-the-top” portion from the E&G appropriation and the portion from Program Initiatives. For 2011/12 and 2012/13, the only funding source is the “off- the-top” portion from the E&G appropriation. The numbers in these cells for all fiscal years should correspond to those in the Data spreadsheet. For fiscal year 2010/11, all numbers are actual. For fiscal year 2011/12, the Base Appropriations, AFRP, and Other E&G data represent what has been allocated by the Board of Governors. Performance Funding for fiscal years 2011/12 and 2012/13 assume each University will receive performance funding proportionate to their fiscal year 2010/11 performance funding award. This may or may not be the case. However, use this estimate for performance funding in lieu of a final award at this time. If fiscal year 2011/12 Performance Funding awards are available prior to the October Board meeting, these amounts will be adjusted. Finally, total state appropriations for fiscal year 2012/13 should be held equivalent to 2011/12 total E&G appropriations.

Other Revenue—Please make your best effort to estimate changes in other sources of revenue (e.g., gifts, grants, interest income) in the current, request,and future years.

Minor object 411, Scholarship Discounts & Allow. (cell C41), should be entered in the revenue section of the sheet just as it is in the FINRPT, as a negative number. The formulas calculating total revenue will not include this negative number. Instead, it links

9 10

as a positive number to the same category under Services & Supplies Expenditures (cell C206). The current, request, and future year estimates should be entered as positive expenditures. The revenue category is not used for these years. This allows entries for the actual year to match the FINRPT, while the negative revenue is treated as an expense for all years, making the report easier to analyze from a budget standpoint. As a result, prior year revenues and expenditures in the BUDRPT will exceed those in the FINRPT by an amount equal to minor object 411 expressed as a positive number.

Corporate Sponsorships (minor object 475) should include revenue associated with System-wide Corporate Sponsorships: Pepsi and OfficeMax. Funding received from these contracts in 2011/12 should be estimated as the same amount received by each University in 2010/11, unless you have a better estimate for your University. The Office Max contract ends June 30, 2012, so 2012/13 revenue should be estimated in the same fashion solely based on the Pepsi sponsorship. For more information on these contracts, please see PASSHE’s website at: http://www.passhe.edu/executive/finance/Procurement/Contracts/Pages/collaborativecont racts.aspx.

Use of Carryforward Funds—To the extent funds from previous years have been reserved for specific one-time purposes in the current and/or request years, they should be included as a revenue source. If Carryforward funds are needed to meet ongoing costs, this can only be done as a transitional step toward implementing lasting changes to the University’s cost structure. In April 2011, the Board of Governors established a new policy: BOG Policy 2011- 01, University Financial Health. This policy establishes expectations for Unrestricted Net Assets and Operating Margins. In compliance with this new policy, any university with unrestricted net assets in excess of 10% of the operating budget should reflect efforts to reduce unrestricted net assets through planned Use of Carryforward. An explanation should be provided for the intent of all activities funded with this source in the BOG Narrative page.

Compensation Expenditures—Personnel expenditure data are requested by bargaining unit for each fund in its respective sheet. A projection of the impact of anticipated turnover of the work force at your University should be factored into the compensation costs.Your turnover expectancy is required to be reported, as a percent of salaries, in the Work Force spreadsheet.

The following should be taken into consideration when calculating salary projections for 2011/12 and2012/13.

o Salary Rates—2011/12 and 2012/13 compensation are to reflect only known pay adjustments. To date, this includes Nonrepresented and AFSCME employee groups. If additional bargaining units ratify agreements prior to submission of the BUDRPT, universities are to include associated compensation increase in their submission. If this is to occur, additional guidance will be provided. A separate section of the BUDRPT requires additional data on the potential impact of increment pay increases for informational purposes only.

o Separation Incentive Program—The fiscal impact (cost and projected savings) of the Retirement Incentive Package should be incorporated into the expenditure estimates by fiscal year (see Separation Incentive spreadsheet and page 8 of instructions).

10 o Benefit Liabilities—Annuitant health care should not include the unfunded postretirement liability, but only the pay-as-you-go portion. In the same fashion, the unfunded portion of your compensated absence liability should not be reflected, but only the pay-as-you-go portion. The unfunded portions of these liabilities are reported separately in the FINRPT. Your actual year budget figures should tie to the FINRPPT.

o Health Care—Rates for the Pennsylvania Employees Benefit Trust Fund are set in the collective bargaining agreements. Rates for the System’s health care plan are determined by PASSHE’s benefits office, with the assistance of the health care provider, and have been finalized for 2011/12. Fiscal year 2012/13 rates for PASSHE’s health care plans are unknown at this time; however, estimates have been provided in the benefits assumptions sheet to aid in completion of the 2012/13 budget report and are subject to change before presentation to the Board of Governors.

Noncompensation Expenditures and Transfers—Please note that only summary data is required for Services & Supplies, and Capital Expenditures. Travel expenditures are reflected as a separate category, rather than including them in Other Services and Supplies. Cost estimates should include anticipated savings from strategic sourcing and SIS implementation expenditures, if appropriate. (See the SIS Implementation sheet for additional information.)

For 2012/13, in general, there should be minimal increases in Services & Supplies and Capital Expenditures due to continued savings from the strategic sourcing initiatives and low inflation. Utilities increases should reflect estimates of anticipated rate (see Utility Detail spreadsheet) and usage changes. Even though System-wide utility costs are anticipated to increase 3.0% in fiscal year 2012/13, it is understood that some institutions may vary due to energy sources, utility providers, lengths of existing contracts, energy savings activities, and changes in space. If your University is involved in a guaranteed energy savings agreement, both the energy savings and contract costs should be reflected in the budget.

Mandatory transfers should consist solely of requirements from external sources, such as debt service. Debt service for the Academic Facilities Renovation Program should be reflected in each University’s E&G budget as a mandatory transfer. The proper amounts are in the Data spreadsheet.

Nonmandatory transfers and/or capital expenditures should include the anticipated amount transferred to the plant fund throughout the year. For those universities who tend to rely on budget savings from vacancies to fund plant activity, be sure to reduce personnel costs by a reasonable turnover expectancy and budget those savings as a transfer to plant. Combined capital expenditures and transfers for 2012/13 should be similar to 2011/12, unless explained in the BOG Narrative page.

The prior year (FY2010/11) entries must match the FINRPT minor object detail. Before submission of the BUDRPT, please review the fiscal year 2010/11 data with the University’s most recent FINRPT to ensure consistency. Provide the best estimates available for the current year (FY2011/12) and the request year (FY2012/13) as to what the FINRPT will reflect, within the given assumptions. Only the request year is permitted to show a deficit.

11 12

Aux This sheet lists all revenues and expenses from the Auxiliary Fund for the three years covered by this BUDRPT. The current and request year revenue estimates for fees set by the University’s Council of Trustees should incorporate changes for both enrollment and rates. Also, please make your best effort to estimate changes in other sources of revenue (e.g., gifts, grants, interest income) in the current and request years.

All instructions listed in the E&G section, except those dealing with Tuition and State Appropriations, also apply to the Auxiliary section. Since Auxiliary activities are self-supporting, all years should be balanced.

Re This sheet lists all revenues and expenses from the Restricted Fund for the years covered by this BUDRPT. In the revenue section, enter the actual year based on the FINRPT and make every effort to estimate increases in other sources of revenue (e.g., gifts, grants, interest income) in the current and request years.

All instructions listed in the E&G section, except those dealing with Tuition and State Appropriations, also apply to the Restricted section. Since Restricted activities are externally funded, all years should be balanced.

ALL This worksheet sums revenue and expenses from all three funds to provide a picture of the University’s total budget. There is no data entry required on this sheet.

Function This spreadsheet displays E&G expenditures by functional categories, rather than by minor object. Total E&G expenditures and transfers for the prior and current years on this sheet must match the totals from the E&G sheet. Similar information is provided in the FINRPT for the prior year, which may serve as the basis for completing this spreadsheet.

BOG Summary This summary sheet is one of the most important in the BUDRPT. At the October Board meeting, when the Board votes on the current year’s budget and approves the budget request for the next fiscal year, Board members are provided with the summary of each University’s budget. No data is entered on this sheet. It draws information from several other sheets in the file. When looking at this sheet, ask, “What picture does this summary paint of the University?” and “What kind of questions does it raise?” If the answers to these questions are unsatisfactory, reexamine the numbers driving this summary.

BOG Narrative This sheet provides space for an explanation of the changes taking place in your E&G budget, as reflected in the BOG Summary worksheet. Based on variances between the current and request years, please explain the variances in the ten fiscal line items indicated and the reasons for the forecast changes in student enrollment on this summary. Once all BUDRPTs have been submitted and reviewed, a consolidated report will be run to determine System-wide average increases in these fiscal line items. This report will be sent out in early September to assist in the completion of this narrative page. Explanations should highlight revenue and expenditure patterns unique to your University, which may make your data stand out from others. Work force changes should have already been explained on the Work Force and Vacancy sheets; provide summary comments here. This should give an overall assessment of what is happening in the E&G budget. The explanations can be in the form of numbered or bulleted points, or a short narrative. If you prefer, they can be placed in cells or in a separate Word file.

12 Strategy Certainly, there is no “one-size-fits-all” approach to meeting the current economic challenges. Throughout this decade, Universities have reduced expenditures through various means of across-the- board reductions, achieving purchasing and energy efficiencies, and postponing investments in equipment and physical plant. There is little, if any, more that can be done to squeeze savings from budgets in this fashion. To poise PASSHE Universities for a sustainable future, Universities must make strategic budget decisions to change the cost structure permanently and create new sustainable revenue sources.

o Actions to Balance Budget—Actions taken by the Board of Governors in June to raise the tuition and technology tuition fee were not enough to offset the eighteen percent reduction in state appropriations and balance PASSHE’s 2011/12 E&G budget. A gap of approximately $33 million remained. Provide a list of actions taken in fiscal year 2011/12 to balance the E&G budget. Please be specific about how you balanced the year and the effect it has had on your University. For example, what have you not been able to do because of fiscal constraints, reductions in student services, etc.? How many positions at what levels were eliminated (filled or vacant)? If you met your budgetary requirements by reducing your transfers to plant funds or increasing fees, that should be identified as well. If reallocations have been made, the University’s cost savings would have to increase accordingly. If you would like to provide a strategic planning document to supplement this information, please do so.

PDE Supplement The Pennsylvania Department of Education has requested supplemental budget information concerning tuition discounting practices. Although most of this information is available through student data records, this spreadsheet collects information on University-based undergraduate grants. Please use the definitions in the worksheet to complete this form.

Summary This sheet summarizes the University’s entire budget on the first page and lists expenditures as a percent of revenue on the second page. No data input is necessary.

Edit Checks A series of edit checks help ensure that information is filled in properly and test for reasonableness. Please use these edit checks when reviewing your BUDRPT, and correct anything that gives a message of “please correct.” Provide an explanation for anything that gives a message of “please explain” before submitting it to the System office.

D:\Docs\2018-04-14\0012a12b428539e4760aeb6dda3671fb.docx

13