Financials State of Kansas - FMS Page 1 of 5 AP Withholding Codes CAP048 Item Overview:

In order to process withholding in PeopleSoft, the environment which includes withholding codes must be configured for the system. A withholding code is used to define a set of withholding entity types, jurisdictions, and classes that are to be applied at the same time. The Withholding Codes page allows users to select the set of information that withholding is applied to.

Menu Path:

Set Up Financials/Supply Chain > Product Related > Procurement Options > Withholding > Withholding Codes

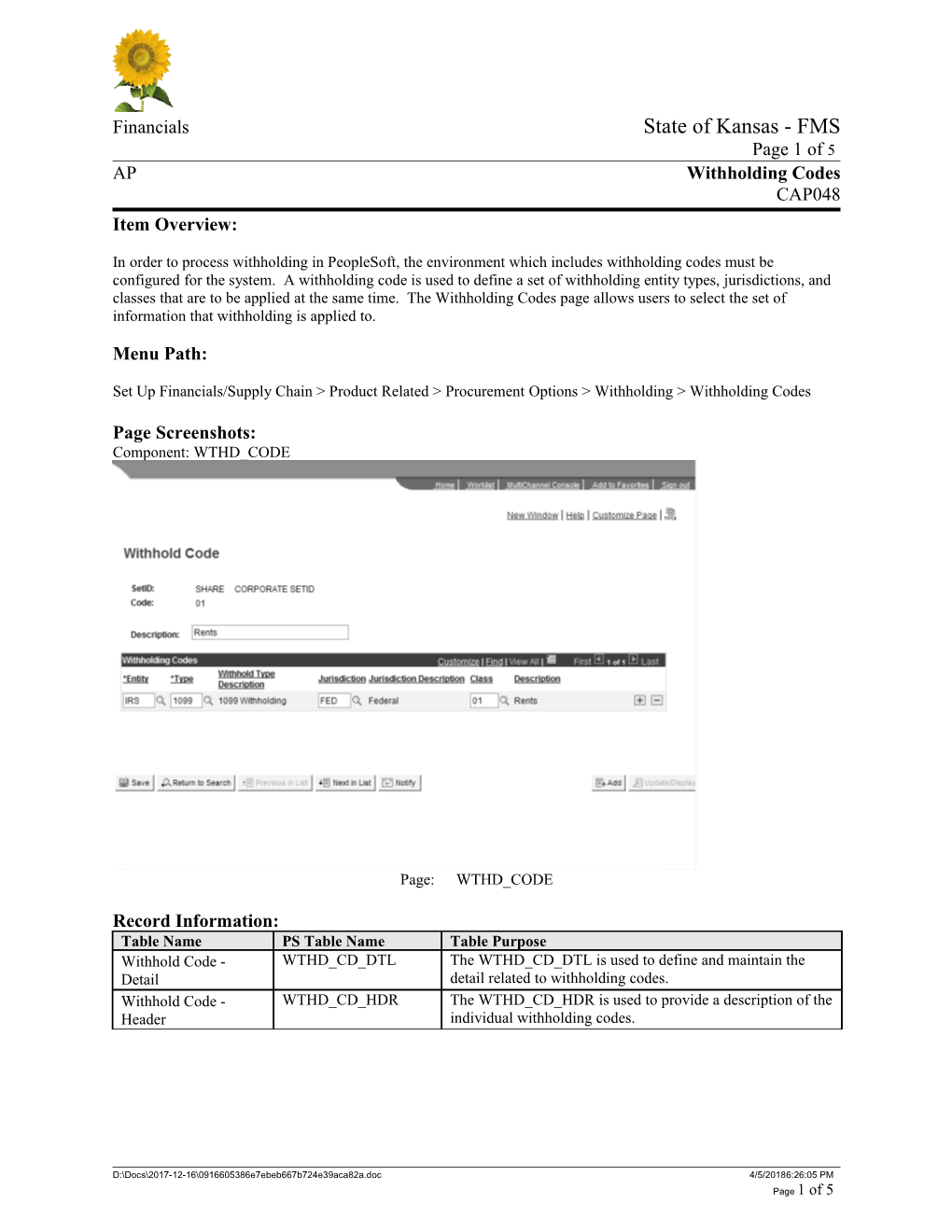

Page Screenshots: Component: WTHD_CODE

Page: WTHD_CODE

Record Information: Table Name PS Table Name Table Purpose Withhold Code - WTHD_CD_DTL The WTHD_CD_DTL is used to define and maintain the Detail detail related to withholding codes. Withhold Code - WTHD_CD_HDR The WTHD_CD_HDR is used to provide a description of the Header individual withholding codes.

D:\Docs\2017-12-16\0916605386e7ebeb667b724e39aca82a.doc 4/5/20186:26:05 PM Page 1 of 5 Financials State of Kansas - FMS Page 2 of 5 AP Withholding Codes CAP048

Approach:

The State will use the PeopleSoft delivered withholding codes. This approach will allow users to override the Vendor default withholding information on the Voucher Line by specifying a single Withholding Code value rather than specifying or overriding a value for one or more of the Withholding Entity, Type, Jurisdiction and Class fields. This will streamline the data entry of withholding information when users need to override the Vendor default information.

Information Source:

Accounts & Reports IRS

Data Entry Method:

_X___ On-Line Pages

_____ Excel Spreadsheet

_____ Conversion

Field Approach:

Record Name: WTHD_CD_DTL Field Name Approach WTHD_ENTITY The value will be “IRS”. WTHD_TYPE The value will be “1099”. WTHD_CLASS The values will be the IRS defined values. WTHD_JUR_CD The value will be “FED”.

Record Name: WTHD_CD_HDR Field Name Approach SETID There will be one centralized SETID for the State of Kansas. This SETID will be used for all withholding codes. WTHD_CD The value will be the IRS defined values. DESCR The field will be used to describe the withholding code.

RTM Cross-Reference:

AP 033.000 System provides the ability to automatically perform backup tax withholding for selected vendors AP 252.000 System provides for payments to multiple 1099 codes. AP 248.000 System provides the ability to track and report 1099 MISC, G and INT form types. AP 341.000 System provides the ability to capture 1099 information for P-Card transactions

D:\Docs\2017-12-16\0916605386e7ebeb667b724e39aca82a.doc 4/5/20186:26:05 PM Page 2 of 5 Financials State of Kansas - FMS Page 3 of 5 AP Withholding Codes CAP048

D:\Docs\2017-12-16\0916605386e7ebeb667b724e39aca82a.doc 4/5/20186:26:05 PM Page 3 of 5 Financials State of Kansas - FMS Page 4 of 5 AP Withholding Codes CAP048

Assumptions:

Updates to the Withholding Codes configuration values are maintained centrally. Vendors will be set up as withholding vendors at the time they are entered and approved. The vendor withholding status can be overridden at the voucher level. Agencies will be trained to enter 1099 applicable vouchers.

Issues:

None

Input Provided By: Name Title, Department

Change Log: Date Author Change Description

1/20/09 Kristie Herrick Initial Design Note: The Template Change Log should be maintained in reverse chronological order. Hence, the most recent changes are on the top of the list.

D:\Docs\2017-12-16\0916605386e7ebeb667b724e39aca82a.doc 4/5/20186:26:05 PM Page 4 of 5 Financials State of Kansas - FMS Page 5 of 5 AP Withholding Codes CAP048 SIGNOFFS

Configuration Team Leads

______Date: _____/_____/_____

Accenture Configuration Lead

______Date: _____/_____/_____

State of Kansas Configuration Lead

Module Team Leads

______Date: _____/_____/_____

______Date: _____/_____/_____

Team Leads

______Date: _____/_____/_____

______Date: _____/_____/_____

D:\Docs\2017-12-16\0916605386e7ebeb667b724e39aca82a.doc 4/5/20186:26:05 PM Page 5 of 5