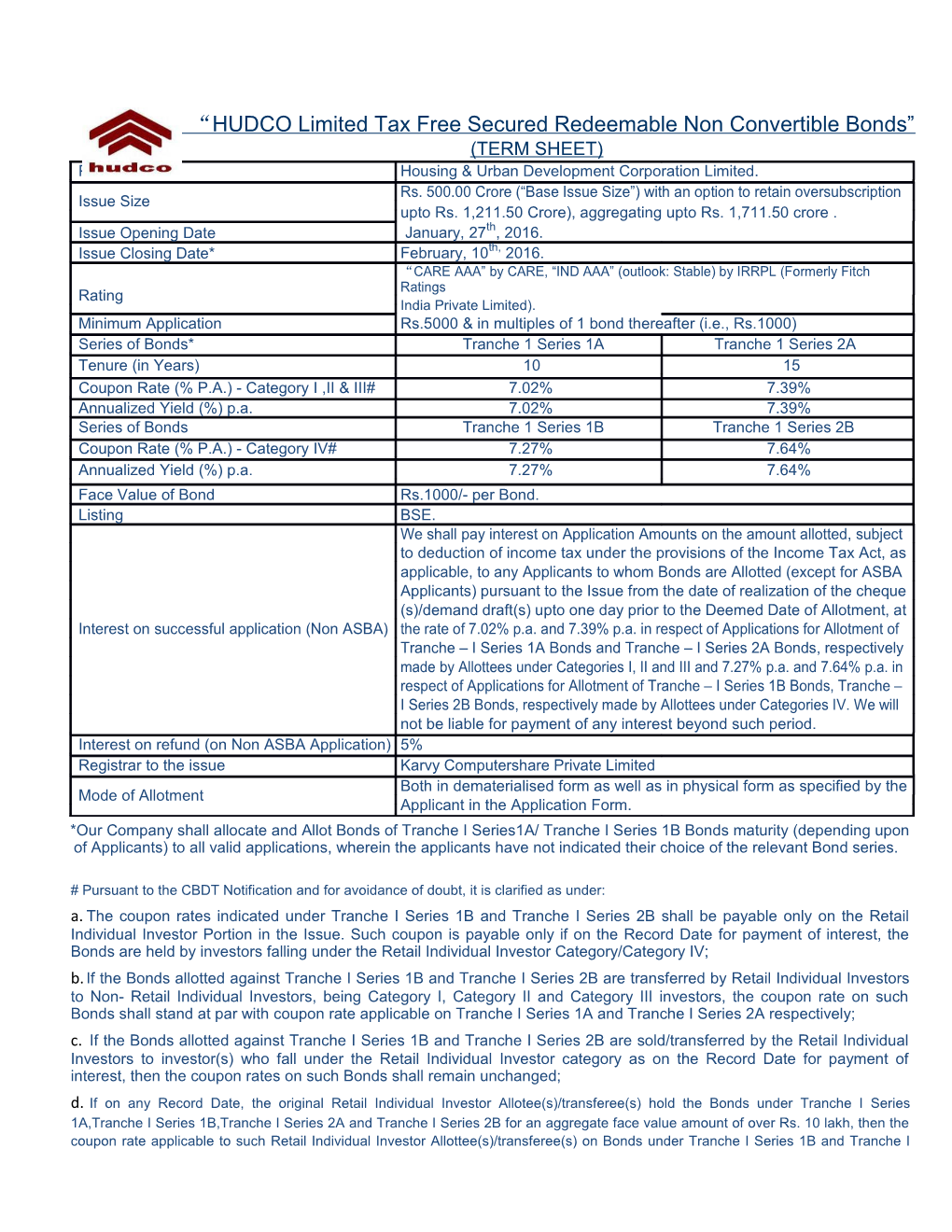

“ HUDCO Limited Tax Free Secured Redeemable Non Convertible Bonds” (TERM SHEET) Particulars Housing & Urban Development Corporation Limited. Rs. 500.00 Crore (“Base Issue Size”) with an option to retain oversubscription Issue Size upto Rs. 1,211.50 Crore), aggregating upto Rs. 1,711.50 crore . Issue Opening Date January, 27th, 2016. Issue Closing Date* February, 10th, 2016. “CARE AAA” by CARE, “IND AAA” (outlook: Stable) by IRRPL (Formerly Fitch Ratings Rating India Private Limited). Minimum Application Rs.5000 & in multiples of 1 bond thereafter (i.e., Rs.1000) Series of Bonds* Tranche 1 Series 1A Tranche 1 Series 2A Tenure (in Years) 10 15 Coupon Rate (% P.A.) - Category I ,II & III# 7.02% 7.39% Annualized Yield (%) p.a. 7.02% 7.39% Series of Bonds Tranche 1 Series 1B Tranche 1 Series 2B Coupon Rate (% P.A.) - Category IV# 7.27% 7.64% Annualized Yield (%) p.a. 7.27% 7.64% Face Value of Bond Rs.1000/- per Bond. Listing BSE. We shall pay interest on Application Amounts on the amount allotted, subject to deduction of income tax under the provisions of the Income Tax Act, as applicable, to any Applicants to whom Bonds are Allotted (except for ASBA Applicants) pursuant to the Issue from the date of realization of the cheque (s)/demand draft(s) upto one day prior to the Deemed Date of Allotment, at Interest on successful application (Non ASBA) the rate of 7.02% p.a. and 7.39% p.a. in respect of Applications for Allotment of Tranche – I Series 1A Bonds and Tranche – I Series 2A Bonds, respectively made by Allottees under Categories I, II and III and 7.27% p.a. and 7.64% p.a. in respect of Applications for Allotment of Tranche – I Series 1B Bonds, Tranche – I Series 2B Bonds, respectively made by Allottees under Categories IV. We will not be liable for payment of any interest beyond such period. Interest on refund (on Non ASBA Application) 5% Registrar to the issue Karvy Computershare Private Limited Both in dematerialised form as well as in physical form as specified by the Mode of Allotment Applicant in the Application Form. *Our Company shall allocate and Allot Bonds of Tranche I Series1A/ Tranche I Series 1B Bonds maturity (depending upon of Applicants) to all valid applications, wherein the applicants have not indicated their choice of the relevant Bond series.

# Pursuant to the CBDT Notification and for avoidance of doubt, it is clarified as under: a. The coupon rates indicated under Tranche I Series 1B and Tranche I Series 2B shall be payable only on the Retail Individual Investor Portion in the Issue. Such coupon is payable only if on the Record Date for payment of interest, the Bonds are held by investors falling under the Retail Individual Investor Category/Category IV; b. If the Bonds allotted against Tranche I Series 1B and Tranche I Series 2B are transferred by Retail Individual Investors to Non- Retail Individual Investors, being Category I, Category II and Category III investors, the coupon rate on such Bonds shall stand at par with coupon rate applicable on Tranche I Series 1A and Tranche I Series 2A respectively; c. If the Bonds allotted against Tranche I Series 1B and Tranche I Series 2B are sold/transferred by the Retail Individual Investors to investor(s) who fall under the Retail Individual Investor category as on the Record Date for payment of interest, then the coupon rates on such Bonds shall remain unchanged; d. If on any Record Date, the original Retail Individual Investor Allotee(s)/transferee(s) hold the Bonds under Tranche I Series 1A,Tranche I Series 1B,Tranche I Series 2A and Tranche I Series 2B for an aggregate face value amount of over Rs. 10 lakh, then the coupon rate applicable to such Retail Individual Investor Allottee(s)/transferee(s) on Bonds under Tranche I Series 1B and Tranche I Series 2B shall stand at par with coupon rate applicable on Tranche I Series 1A and Tranche I Series 2A,, respectively; e. Bonds Allotted under Tranche I Series 1A and Tranche I Series 2A shall carry coupon rates indicated above until the maturity of the respective Series of Bonds irrespective of category of holder(s) of such Bonds; and f. For the purpose of classification and verification of status of the eligibility of a Bondholder under the Retail Individual Investor category, the aggregate face value of Bonds held by the Bondholders in all the Series of Bonds Allotted under the Issue shall aggregated on the basis of PAN.

# NRI can’t apply in the Issue.

Category-wise Allocation

Category I Category II Category III Category IV QIB NII HNI RII 20% of the Issue Size 20% of the Issue Size 20% of the Issue Size 40% of the Issue Size Allotment will be on first come first serve basis

Who Can Apply

• Public Financial Institutions, scheduled commercial banks, state industrial development corporations, which are authorised to invest in the Bonds; • Provident funds and pension funds with minimum corpus of ` 25.00 crores, which are authorised to invest in the Bonds; • Insurance companies registered with the IRDA; • National Investment Fund set up by resolution no. F. No. 2/3/2005-DDII dated November 23, 2005 of the Government of India published in the Gazette of India; • Insurance funds set up and managed by the army, navy or air force of the Union of India or set up and managed by the Department of Posts, India; • Indian Mutual funds registered with SEBI; and Category I* Alternative Investment Funds, subject to investment conditions applicable to them under the Securities and Exchange Board of India (Alternative Investment Funds) Regulations, 2012,

*As per Section 186(7) of the Companies Act, 2013 a company shall not provide loan at a rate of interest lower than the prevailing yield of Government Security closest to the tenor of the loan. However, MCA through its General Circular No. 06/2015 dated April 9, 2015, has clarified that companies investing in tax-free bonds wherein the effective yield (effective rate of return) on the bonds is greater than the prevailing yield of one year, three year, five year and ten year Government Security closest to the tenor of the loan, there is no violation of sub-section (7) of section 186 of the Companies Act, 2013. Companies within the meaning of sub-section 20 of Section 2 of the Companies Act, 2013; Statutory bodies/corporations; Cooperative banks; Trusts including Public/ private/ charitable/religious trusts; Limited liability partnership; Category II* / Corporate Regional rural banks; Partnership firms in the name of partners;QFIs and FPIs not being individuals Association of Persons; Societies registered under the applicable law in India and authorized to invest in Bonds; and Any other domestic legal entities authorized to invest in the Bonds, subject to compliance with the relevant regulations applicable to such entities.

*As per Section 186(7) of the Companies Act, 2013 a company shall not provide loan at a rate of interest lower than the prevailing yield of Government Security closest to the tenor of the loan. However, MCA through its General Circular No. 06/2015 dated April 9, 2015, has clarified that companies investing in tax-free bonds wherein the effective yield (effective rate of return) on the bonds is greater than the prevailing yield of one year, three year, five year and ten year Government Security closest to the tenor of the loan, there is no violation of sub-section (7) of section 186 of the Companies Act, 2013. The following Investors applying for an amount aggregating to above Rs 10 lakhs across all Series of Bonds in each Tranche Issue: Category III / HNIs Resident Indian individuals; Hindu Undivided Families through the Karta;

The following Investors applying for an amount aggregating to up to and including Rs 10 lakhs across all Series of Bonds in each Tranche Issue: Category IV / RII Resident Indian individuals; Hindu Undivided Families through the Karta;

Note : “Applicants must use only CTS compliant instruments and refrain from using NON-CTS 2010 instruments for payment of the Application Amount”; Investors are cautioned that Application Forms accompanied by non-CTS cheques are liable to be rejected due to any delay in clearing beyond six Working Days from the Issue Closing Date.