Homework 5 Spring 2012

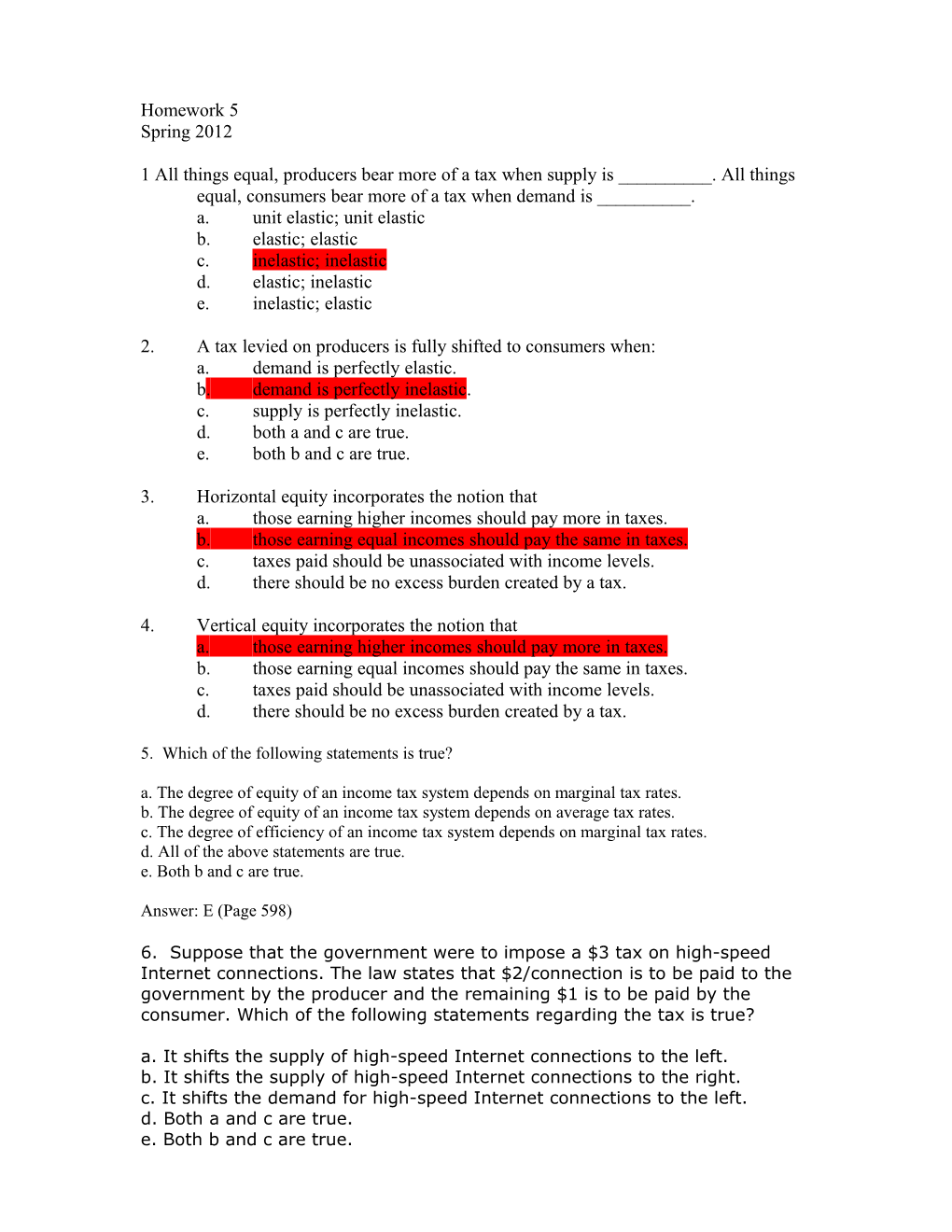

1 All things equal, producers bear more of a tax when supply is ______. All things equal, consumers bear more of a tax when demand is ______. a. unit elastic; unit elastic b. elastic; elastic c. inelastic; inelastic d. elastic; inelastic e. inelastic; elastic

2. A tax levied on producers is fully shifted to consumers when: a. demand is perfectly elastic. b. demand is perfectly inelastic. c. supply is perfectly inelastic. d. both a and c are true. e. both b and c are true.

3. Horizontal equity incorporates the notion that a. those earning higher incomes should pay more in taxes. b. those earning equal incomes should pay the same in taxes. c. taxes paid should be unassociated with income levels. d. there should be no excess burden created by a tax.

4. Vertical equity incorporates the notion that a. those earning higher incomes should pay more in taxes. b. those earning equal incomes should pay the same in taxes. c. taxes paid should be unassociated with income levels. d. there should be no excess burden created by a tax.

5. Which of the following statements is true? a. The degree of equity of an income tax system depends on marginal tax rates. b. The degree of equity of an income tax system depends on average tax rates. c. The degree of efficiency of an income tax system depends on marginal tax rates. d. All of the above statements are true. e. Both b and c are true.

Answer: E (Page 598)

6. Suppose that the government were to impose a $3 tax on high-speed Internet connections. The law states that $2/connection is to be paid to the government by the producer and the remaining $1 is to be paid by the consumer. Which of the following statements regarding the tax is true? a. It shifts the supply of high-speed Internet connections to the left. b. It shifts the supply of high-speed Internet connections to the right. c. It shifts the demand for high-speed Internet connections to the left. d. Both a and c are true. e. Both b and c are true. Answer: D (Pages 548, 550)

7. In a labor market in which demand is inelastic and supply is elastic, who bears a tax levied on the firms? a. only the workers b. only the firms c. both the workers and the firms, although the workers bear more of the tax d. both the workers and the firms, although the firms bear more of the tax e. more information needed to answer the question

Answer: D (Page 556-557)

8. Tax expenditures are revenues that A) are always recouped during tax season. B) only apply to large corporations. C) are needed to get full exemptions. D) are forgone due to preferential tax treatment. Ans: d

9. A tax credit A) is not the same as a tax deduction. B) is another phrase for a tax deduction. C) is never calculated on federal tax returns. D) only applies to the EITC. Ans: a

10. A tax system in which the average tax rates fall as income rises is a ______tax system; the way in which the average tax rate changes as income rises is a measure of ______equity. a. regressive; vertical b. regressive; horizontal c. progressive; vertical d. progressive; horizontal e. proportional; horizontal

Answer: A (Page 523)

11. There is a 20% tax on the first $15,000 of income, a 30% tax on income above $15,000 until $30,000, and a 40% tax on all income above $30,000. What is the marginal tax rate for someone making $35,000? a. 14.29% b. 20% c. 30% d. 31.7% e. 40%

Answer: E (Page 521) 12. Assume that the nominal rate of interest is 10% and that the inflation rate is 10%. The tax rate on interest from savings is 25%, and in the first period, Wes has $100 in savings. After taxes, what will Wes's nominal savings be one year from now? a. $10 b. $105 c. $107.50 d. $110 e. none of the above

Answer: C (Pages 642-643)

13. Which of the following is true regarding the Earned Income Tax Credit (EITC)? a. Single mothers who marry are always penalized by the EITC program. b. The EITC creates a marriage penalty because its formula is different for two-parent families than for single-parent families. c. Single mothers who marry sometimes receive an EITC "marriage bonus." d. Both a and b are true. e. Both b and c are true.

Answer: C (Page 626)

14. When government borrowing decreases private investment by raising the market interest rate, this is known as A) the Director’s Law. B) crowding out. C) positive economics. D) the Ramsey Rule. E) random error. Ans: b

15 Suppose that the government were to eliminate taxes on interest from savings. Which of the following statements is NOT consistent with economic theory?

a) people would save more as a result

b) people would save less as a result.

c) The substitution effect of the policy induces people to save less

d) Allof the above statements are not consistent with economic theory

e) Both a and b are not consistent with economic theory

C

16. A tax on consumption for those who are nonsavers A) is equivalent to a tax on income. B) causes income gains to increase dramatically. C) would be preferred to a tax on wealth. D) makes it difficult to tell what the result for the nonsavers would be. Ans: a

17. A wealth tax can be justified because it A) helps to correct certain (inevitable) problems that arise in the administration of an income tax B) the higher an individuals wealth, the greater his or her ability to pay, other things- including income – being the same C) reduces the concentration of wealth, which is desirable socially and politically D) are payments for benefits that wealth holders receive from government E) all of the above Ans: e

18.A capital gain is best defined as which of the following descriptions? a) The accumulation of assets that comes from increased savings

b) The difference between an asset’s purchase price and sale price

c) The portion of investment earnings that is not taxed

d) The portion of investment earnings that is taxed

e) Investment earnings on non-cash assets

B

19Which of the following statements would be true if government were to tax land instead of the assets on land?

a) Market values could no longer be used for taxation

b) Market values could now replace arbitrary assessments in determining the amount of the tax

c) Landowners no longer would face a disincentive to improve the buildings on their land

d) Both and c are true

e) Both b and c are true

D

20The substitution effect of child care expenditures induces parents to______. The income effect of child care expenditures induces parents to______.

a) Work more, work more

b) Work no more or less (there is no substitution effect); work more c) Work more, work less

d) Work less; work less

e) Work less, work more

E 21. If a tax is efficient, it will necessarily be equitable. a. True. b. False. c. Uncertain.

22. One advantage of a consumption tax is that there are fewer problems with inflation. A) True. B) False. C) Uncertain. Ans: a

23 Interest deductibility does not provide an incentive for debt finance. A) True. B) False. C) Uncertain. Ans: b

4. Tax ______is legal; tax ______is illegal. A) avoidance; compliance B) compliance; avoidance C) evasion; avoidance D) avoidance; evasion E) None of the answers is correct.

4. If the government were to give every student a voucher to redeem at any school, it would be intervening through ______. If the government were to mandate no tuition costs more than $6,000/year without intervening in any other way, it would be intervening through______. a. public provision; private provision b. the price mechanism; the price mechanism c. the quantity mechanism; the price mechanism d. the price mechanism; the quantity mechanism e. public provision; public provision

Answer: B Part 2

1. Which would a taxpayer in the 36% tax bracket prefer: a $2,000 tax exemption or a $700 tax credit? What if the taxpayer were in the 28% tax bracket? Ans: For 36% taxpayer: exemption $2,000(0.36) = $720; tax credit = $700. Choose exemption. For 28% taxpayer: exemption $2,000(0.28) = $560; tax credit = $700. Choose tax credit.

2. Your textbook (Ch. 24) highlights a debate that has been going on for some years. The issue is whether there should be a corporation tax, given that corporations are nothing more than groups of people. Should there be a corporation tax? Why or why not? Ans: The debate will be answered by investigation whether a switch in taxing systems will generate the same level of tax revenue without causing harm to the economy. Theoretical models have yielded mixed results as to the effectiveness of a switch. It will have to be tested empirically to know for sure. -reduces tax avoidance

3 Jennifer lives in two periods. In the first period, her income is fixed at $20,000; in the second, it is $28,000. She can borrow and save at the market interest rate of 8 percent. (A) Sketch her intertemporal budget constraint. (B) Suppose that Jennifer is unable to borrow at any rate of interest, although she can still save at 8 percent. Sketch her intertemporal budget constraint. Ans: (A)

(B)

4. Refer to Figure 16.1 in your textbook. Suppose that the total number of hours (T) is 720 and the wage rate is $10. Suppose further that all income is spent on consumption, so that the vertical axis is also total consumption. (A) Sketch this graph. (B) Sketch the graph if a 5% consumption tax is imposed. (C) Can you say conclusively that a consumption tax will lower hours worked? Ans: (A) and (B)

(C) We cannot say, because of different preferences.

5. . a. The price paid by consumers will not change at all. If the demand for apples is perfectly elastic, it means that consumers have perfect substitutes for apples and will buy another product (and be no worse off) if the price goes up at all. Consequently, apple producers bear the entire burden of the tax. In contrast, if the demand for apples were not perfectly elastic, the price paid by consumers would rise and consequently the consumers would bear some of the tax burden.

b. The quantity of apples will fall dramatically. If the demand for apples were neither perfectly elastic nor perfectly inelastic (and if supply were neither perfectly elastic or perfectly inelastic), then the quantity would fall but by less than it falls when the demand for apples is perfectly elastic.

c. Only price changes caused by the tax affects the welfare of the consumers in the market. Since in this case the price paid by consumers does not change, consumers are made no better or worse off because of the tax, even though they consume fewer apples. The reason for this is that the perfectly elastic demand curve for apples implies that consumers are indifferent between consuming apples at that price and consuming other goods at that price. Consequently, although people shift consumption to another good, they are no better or worse off for it.

6. (12 pts.) The market demand for stuffed rabbits is Q = 2,600-20P, and the government intends to place a $4 per bunny tax on stuffed rabbit purchases. Calculate the excess burden (deadweight loss) of this tax when:

a. Supply of stuffed rabbits is Q= 400.

b. supply of stuffed rabbits is Q = 12P

c. explain why the dead weight loss calculations differ between a and b

d. 7. (