PUC DOCKET NO. 22348 SOAH DOCKET NO. 473-00-1013

APPLICATION OF SHARYLAND § PUBLIC UTILITY COMMISSION UTILITIES, LP FOR APPROVAL OF § UNBUNDLED COST OF SERVICE RATE § PURSUANT TO PURA § 39.201 AND § PUBLIC UTILITY COMMISSION § OF TEXAS SUBSTANTIVE RULE § 25.344 §

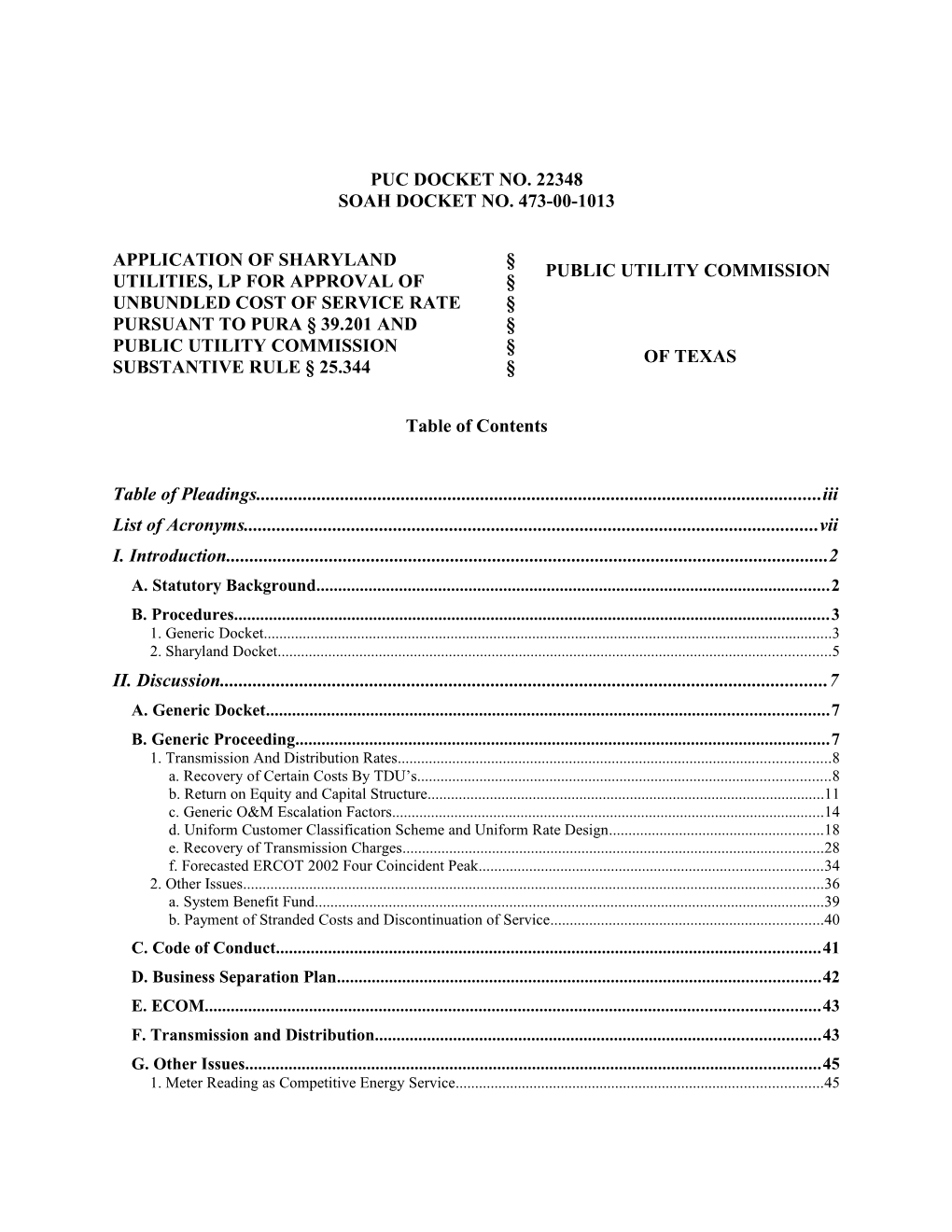

Table of Contents

Table of Pleadings...... iii List of Acronyms...... vii I. Introduction...... 2 A. Statutory Background...... 2 B. Procedures...... 3 1. Generic Docket...... 3 2. Sharyland Docket...... 5 II. Discussion...... 7 A. Generic Docket...... 7 B. Generic Proceeding...... 7 1. Transmission And Distribution Rates...... 8 a. Recovery of Certain Costs By TDU’s...... 8 b. Return on Equity and Capital Structure...... 11 c. Generic O&M Escalation Factors...... 14 d. Uniform Customer Classification Scheme and Uniform Rate Design...... 18 e. Recovery of Transmission Charges...... 28 f. Forecasted ERCOT 2002 Four Coincident Peak...... 34 2. Other Issues...... 36 a. System Benefit Fund...... 39 b. Payment of Stranded Costs and Discontinuation of Service...... 40 C. Code of Conduct...... 41 D. Business Separation Plan...... 42 E. ECOM...... 43 F. Transmission and Distribution...... 43 G. Other Issues...... 45 1. Meter Reading as Competitive Energy Service...... 45 PUC Docket No. 22348 Table of Contents Page ii SOAH Docket No. 473-00-1013

2. Commitment to File New Rate Case...... 46 3. Residential Rate Cap...... 46 III. Findings of fact...... 47 A. Generic Docket...... 47 1. Procedural History...... 47 a. Category “A” and “B” Issues...... 50 b. Payment of Stranded Costs...... 52 c. Generic Operation and Maintenance Escalators...... 53 d. Natural Gas Prices and Market Prices...... 53 e. Rate Design and Customer Classification...... 54 f. Incentive Plan, Return on Equity, and Capital Structure...... 55 g. Four Coincident Peak...... 57 h. Retail Transmission Charges...... 58 2. Transmission and Distribution (T&D) Rates...... 59 a. T&D Cost of Service...... 59 b. Uniform Customer Classification...... 63 c. Generic T&D Rate Design...... 64 d. Exceptions to Generic Rate Design and Customer Classification...... 73 e. Other Non-Bypassable Charges...... 74 f. Tariffs...... 74 3. Other Generic Issues...... 75 a. Targeted Incentive Plan (TIP)...... 75 b. Pilot Project...... 75 B. Code of Conduct, Business Separation Plan, Transmission and Distribution...... 76 1. Procedural History...... 76 2. Settlement...... 78 3. Informal Disposition...... 81 IV. Conclusions of Law...... 81 A. General...... 81 B. Generic Proceeding...... 82 1. Procedural History...... 82 2. Transmission and Distribution (T&D) Rates...... 83 a. T&D Cost of Service...... 83 b. Uniform Customer Classification...... 87 c. Generic T&D Rate Design...... 87 d. Exceptions to Generic Rate Design and Customer Classification...... 89 e. Other Non-Bypassable Charges...... 89 3. Other Generic Issues...... 90 a. Targeted Incentive Plan (TIP)...... 90 b. Pilot Project...... 90 C. Code of Conduct, Business Separation Plan, Transmission and Distribution...... 90 V. Ordering Paragraphs...... 92 A. Generic Ordering Paragraphs...... 92 B. Code of Conduct, Business Separation Plan, Transmission and Distribution...... 95 PUC Docket No. 22348 Table of Contents Page iii SOAH Docket No. 473-00-1013

APPENDIX A: Code of Conduct – Revised Paragraph F...... 97 ATTACHMENT: TRANSMISSION RATE DESIGN SCHEDULES, EXCERPT OF AUGUST 1, 2000 FILING...... 99 TABLE OF PLEADINGS

Docket No. 22344 – Generic UCOS Proceeding Date AIS No. Abbreviated Pleading Title Reference 04/06/00 4 Order Initiating Order Initiating Proceeding Proceeding 04/07/00 5 Notice of Notice of Proceeding to Address Issues Proceeding Generic to Applications for Approval of Unbundled Cost of Service Rate Dockets 05/09/00 50 Order No. 3 Order No. 3 – Granting Interventions, Identifying Issues, and Requesting Briefing 05/12/00 53 Order No. 4 Order No. 4 – Granting Interventions 05/23/00 62 Order No. 5 Order No. 5 – Granting Interventions

06/05/00 138 Order No. 7 Order No. 7 – Addressing Motions to Intervene 06/13/00 187 Order No. 11 Order No. 11 – Consolidating Docket No. 22633 with Docket No. 22344 06/13/00 188 Order No. 10 Order No. 10 – Granting Intervention, Designating a New Generic Issue, and Establishing Briefing Schedule 06/14/00 189 Order No. 12 Order No. 12 – Designating a New Generic Issue and Establishing Briefing Schedule 07/13/00 254 Order No. 15 Order No. 15 – Interim Order Ruling on Order No. 12 Issue 07/18/00 256 Order No. 14 Order No. 14 – Ruling on Category A Issues 07/18/00 257 Order No. 18 Order No. 18 – Memorializing Pre-Hearing Conference of July 17, 2000 07/24/00 261 Order No. 17 Order No. 17 – Ruling on Category B Issues 08/01/00 283 Order No. 20 Order No. 20 – Memorializing Pre-Hearing Conference on July 28, 2000 08/11/00 341 Order No. 21 Order No. 21 – Interim Order Expanding Scope of Generic Customer Classification and Rate Design Issues 08/11/00 342 Order No. 22 Order No. 22 – Interim Order Ruling Setting Natural Gas Prices and Market Prices for Use in ECOM Model 08/15/00 363 Target Incentive Target Incentive Program Program 08/16/00 366 Order No. 23 Order No. 23 – Memorializing Ruling On PUC Docket No. 22348 Table of Contents Page v SOAH Docket No. 473-00-1013

Date AIS No. Abbreviated Pleading Title Reference ORA’s Motion To Clarify Order No. 14 and Granting ORA’s Motion To Modify Procedural Schedule With Respect To Factual Hearing On Customer Classification and Rate Design 08/25/00 405 Order No. 25 Order No. 25: Interim Order Ruling On Escalator Issues 09/08/00 438 Customer Distribution Service Customer Classification Classification Non-Unanimous Stipulation And Agreement NUA 09/18/00 452 Targeted Incentive Targeted Incentive Program and Report On Program Settlement Conference 09/22/00 456 Order No. 28 Order No. 28 – Interim Order Ruling On Incentive Plan and Return On Equity Issues 10/19/00 533 ROE and Capital Return on Equity and Capital Structure Non- Structure NUA Unanimous Stipulation and Agreement 11/22/00 655 Order No. 40 Order No. 40 : Interim Order Establishing Generic Customer Classification and Rate Design 12/14/00 678 Order No. 43 Order No. 43 Expanding Scope of Generic Proceeding, Admitting Additional Parties, Identifying Issue For Resolution, and Scheduling Pre-Hearing Conference 12/21/00 685 Order No. 44 Order No. 44 Clarifying Scope of 4CP Issue 12/22/00 687 Order No. 42 Order No. 42: Interim Order Establishing Return on Equity and Capital Structure 01/12/01 696 Order No. 46 Order No. 46 – Memorializing Prehearing Conference Held on January 12, 2001 02/21/01 708 ERCOT 4CP NUA Forecast ERCOT 2002 Four Coincident Peak Stipulation and Agreement 03/21/01 717 Order No. 51 Order No. 51 Identifying Issue for Resolution, Providing Notice, and Establishing Procedural Schedule 03/22/01 719 Order No. 50 Order No. 50 – Interim Order Establishing Forecasted ERCOT 2002 Four Coincident Peak 04/06/01 731 ERCOT Retail ERCOT Retail Transmission Charge Transmission Calculation Stipulation and Agreement Charge NUA 04/26/01 735 Order No. 53 Order No. 53: Interim Order Addressing Issue Identified in Order No. 51: ERCOT Retail Transmission Charge Calculation PUC Docket No. 22348 Table of Contents Page vi SOAH Docket No. 473-00-1013

Docket No. 22348 – Sharyland Specific UCOS Proceeding

Date Filed AIS No. Abbreviated Reference Pleading Title 03/31/2000 2 Application of Sharyland Utilities, L.P. for Approval of Unbundled Transmission and Distribution Rates 05/01/2000 20 Supplement to Application of Sharyland Utilities, L.P. 06/07/2000 43 Preliminary Order 03/02/2001 93 Agreement Joint Motion for Approval of Stipulation and Agreement 06/04/2001 111 Interim Order-Rate Phase 07/20/2001 115 Revised Interim Order-Rate Phase LIST OF ACRONYMS

4CP – four-month coincident peak (June through September)

A&G – administrative and general

AEP – American Electric Power Company

ALJ – administrative law judge

CPL – Central Power and Light Company

CTC – competition transition charge

ECOM – excess cost over market

ERCOT – Electric Reliability Council of Texas

FERC – Federal Electric Regulatory Commission

IDR – interval data recorder

NCP – non-coincident peak

NUA – non-unanimous stipulation and agreement

O&M – operation and maintenance

PFD – proposal for decision

PTB – price-to-beat

PURA – Public Utility Regulatory Act

REP – retail electric provider

ROE – return on equity

SB7 – Senate Bill 7 (76th Legislature)

SBF – System Benefit Fund

SIHL – state institution of higher learning PUC Docket No. 22348 Consolidated Interim Order Page viii SOAH Docket Nos. 473-00-1013

SOAH – State Office of Administrative Hearings

SWEPCO – Southwestern Electric Power Company

T&D – transmission and distribution

TC – transition charge

TCOS – transmission cost of service

TCRF – transmission cost recovery factor

TDU – transmission and distribution utility

TIP – targeted incentive plan

TSP – transmission service provider UCOS – unbundled cost of service PUC DOCKET NO. 22348 SOAH DOCKET NO. 473-00-1013

APPLICATION OF SHARYLAND § PUBLIC UTILITY COMMISSION UTILITIES, LP FOR APPROVAL OF § UNBUNDLED COST OF SERVICE RATE § PURSUANT TO PURA § 39.201 AND § PUBLIC UTILITY COMMISSION § OF TEXAS SUBSTANTIVE RULE § 25.344 §

CONSOLIDATED INTERIM ORDER

This Order addresses Sharyland Utilities, L.P.’s (Sharyland) application for approval of unbundled cost of service (UCOS) rates. Primarily, this Order addresses Sharyland’s code of conduct, separation of business functions (business separation plan), and transmission and distribution rates; however, it addresses a number of other issues as well. It incorporates and supercedes the decisions and orders of the Commission in the Generic Proceeding1 as well as all interim orders in this docket. While this Order systematically addresses final restructuring issues, parties who are interested in a greater level of detail are encouraged to refer to the initial decisions of the Commission as reflected in the various interim orders entered in both the Generic Proceeding and this company-specific docket. The Table of Pleadings identifies these interim orders to aid in this process.

This Order contains a brief discussion of statutory and procedural background, addresses issues considered in the Generic Proceeding, and then addresses issues decided in the various phases of the company-specific docket.

Sharyland’s application for approval of UCOS rates, consistent with the settlement of the settling parties, is hereby approved.

1 Generic Issues Associated with Applications for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22344 (Generic Proceeding), Order No. 14 (July 18, 2000) and Order No. 17 (July 24, 2000). PUC Docket No. 22348 Consolidated Interim Order Page 2 SOAH Docket Nos. 473-00-1013

I. INTRODUCTION

A. Statutory Background

Having formulated a public policy shift from comprehensive regulation to increased competition and having determined that the production and retail sale of electricity should no longer be subject to extensive governmental regulation, on May 27, 1999, the Texas Legislature enacted, and on June 18, 1999 Governor George W. Bush signed, Senate Bill 7 (SB7)2 relating to electric utility restructuring and requiring electric utilities in most areas of Texas to prepare for retail electric competition to begin January 1, 2002.

Material portions of SB7 are codified amendments to Title II of the Texas Utilities Code. Specifically, amendments were made to the Public Utility Regulatory Act (PURA),3 Chapter 39. PURA, Chapter 39, was enacted to protect the public interest during the transition to and the establishment of a fully competitive electric market power industry in Texas.4 These modifications establish the perimeters within which deregulation restructuring is to take place in Texas and allow prices of electricity to be set in accordance with customer choice and competition. PURA Chapter 39, Restructuring of Electric Utility Industry, provides the framework for the restructuring of the electric utility industry by January 1, 2002. This Order specifically addresses the provisions of PURA § 39.201, requiring the initiation of the utilities’ tariff applications for the establishment of rates and charges following the initiation of competition in Texas.

2 Tex. S.B. 7, 76th Leg., R.S. (1999) codified at Tex. Utilities Code Ann. § § 11.001-64.158 (Vernon 1998 & Supp. 2001). 3 Public Utility Regulatory Act, Tex. Util. Code Ann. § § 11.001-64.158 (Vernon 1998 & Supp. 2000) (PURA). See also current Supp. 2001. 4 PURA § 39.001(a) (Vernon 1998 & Supp. 2001) PUC Docket No. 22348 Consolidated Interim Order Page 3 SOAH Docket Nos. 473-00-1013

B. Procedures

1. Generic Docket

To institute retail competition in the electric industry, SB7 requires electric utilities to unbundle their business functions and establish transmission and distribution (T&D) rates for various non-bypassable “wires” charges to reflect costs that are reasonable and necessary. 5 In compliance with SB7, Sharyland filed an application proposing rates based on costs it projects will exist in the future, using 2002 as its forecast test year.6 This application has been commonly referred to by the Commission and the parties as the Company’s unbundled cost of service, or UCOS, case.

The 1999 statute requires existing utilities to separate themselves into three distinct units: a power generation company, a T&D utility, and a retail company. Because all retail competitors will depend on the T&D utility’s power lines to deliver electricity to the retailer’s customers, the rates and services of the T&D utility remain regulated by the Commission.

The Commission determined that a generic proceeding was the most efficient and appropriate method for determining threshold issues relevant to those utilities involved in the deregulation and restructuring process.7 On April 6, 2000, the Commission’s ALJ issued Order

5 See generally, Public Utility Regulatory Act, TEX. UTIL. CODE ANN. Chapter 39 (Vernon 1998 & Supp. 2001) (PURA).

6 See P.U.C. SUBST. R. 25.344(d). 7 Application of Sharyland Utilities, L.P. for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22348 (pending); Application of Texas-New Mexico Power Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22349 (pending); Application of TXU Electric for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22350 (pending); Application of Southwestern Public Service Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22351 (pending); Application of Central Power and Light Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22352 (pending); Application of Southwestern Electric Power Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22353 (pending); Application of West Texas Utilities Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22354 (pending); Application of Reliant Energy HL&P for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22355 (pending); and Application of Entergy Gulf States, Inc. for Approval of Unbundled Cost of Service Rate PUC Docket No. 22348 Consolidated Interim Order Page 4 SOAH Docket Nos. 473-00-1013

No. 1, initiating Docket No. 22344, Generic Issues Associated with Applications for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 25.344 (Generic Proceeding).

The Commission directed all parties to file lists of issues to be addressed and to separately identify those issues generic to all unbundled cost of service filings. In addition, parties were encouraged to identify any issues that should not be addressed in the docket and to identify any threshold legal and/or policy issues or matters of precedent that necessitated briefing. The Commission made clear its intent that all matters decided in the Generic Proceeding would be applied to each individual, utility-specific proceeding.

On May 9, 2000, the Commission identified and requested briefing on thirteen issues for resolution to be made during the June open meetings. The breadth and complexity of the issues necessitated that the issues be heard over the course of two open meetings. Seven issues were slated for consideration at the June 14 open meeting and six were assigned to the June 29 open meeting. Briefs and reply briefs were scheduled accordingly. The Commission’s decisions at the June 14 open meeting (commonly referred to as “Category A” issues) were memorialized in Generic Proceeding Order No. 14; the June 29 (“Category B”) rulings were set out in Generic Proceeding Order No. 17. The Commission’s decisions regarding these generic issues are discussed in further detail in this Order. The Commission further addresses some of these generic issues, as well as additional generic issues, in subsequent Orders in the Generic Proceeding.

In separate company-specific proceedings, the Commission addressed related issues in multiple phases. The business separation phase reviewed the company’s plan for dividing itself into a power generation company, a T&D utility, and a retail company. In the stranded cost phase, an examination was made of those stranded costs reasonably projected to exist when retail competition begins January 1, 2001. Stranded costs are the anticipated difference between the book value of an existing utility’s generation assets and the market value of those same assets. The final phase was conducted to determine what level of rates the T&D utility would be authorized to charge retailers. In this portion of the proceeding, the utility’s costs for providing

Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule 25.344, Docket No. 22356 (pending). PUC Docket No. 22348 Consolidated Interim Order Page 5 SOAH Docket Nos. 473-00-1013

T&D service were examined. In addition to memorializing the Commission’s decisions on each of these matters, this Order provides details relevant to both the Generic Proceeding and this company-specific docket.

2. Sharyland Docket

Sharyland is a start-up retail electric utility, providing electric utility service to residential, commercial and industrial customers of Sharyland Plantation, a 6,000-acre planned community located between the Cities of McAllen and Mission in Hildalgo County. On July 9, 1999, the Commission granted to Sharyland a certificate of convenience and necessity to begin providing retail electric service in Hildalgo County,8 and on July 26, 2000, the Commission approved its initial rates.9 On May 31, 2000, Sharyland filed its application for approval of unbundled transmission and distribution rates,10 and on May 1, 2000, Sharyland filed a supplement to its application.11 Sharyland intends to provide only transmission and distribution (T & D) service after December 31, 2001.

Just prior to the instant Order, the Commission issued an Interim Order-Rate Phase in this docket in which it approved Sharyland’s application for approval of UCOS rates consistent with

8 Application of Sharyland Utilities, L.P. for a Certificate of Convenience and Necessity in Hildlago County, Texas, Docket No. 20292, Order (July 9, 1999). 9 Application of Sharyland Utilities, L.P. for Authority to Establish Initial Rates and Tariff, Docket No. 21591, Order (July 26, 2000). Pursuant to its initial rate order, Sharyland is to file a general rate proceeding no later than May 1, 2003, which is in addition to the instant UCOS rate case and which will only apply to Sharyland’s transmission and distribution (T&D) rates since the proceeding will occur after the onset of competition. See Docket No. 21591, Order at 4 (July 26, 2000). Further, Sharyland is to abide by a residential rate cap, subject to certain conditions, through May 1, 2005. See Docket No. 21591, Order at 5 (July 26, 2000). Generally, pursuant to this rate cap, Sharyland agreed that its average bundled residential rate will not exceed Central Power & Light Company’s (CPL) average bundled residential rate; and, Sharyland agreed to keep its average unbundled T&D rates at or below the average unbundled T&D (including non-bypassable charges) rates of CPL. See Docket No. 21591, Proposal for Decision at 3 (May 26, 2000). For a more detailed treatment of the terms of Sharyland’s residential rate cap, see Docket No. 21591, Stipulation and Agreement at 13 (March 6, 2000). 10 Application of Sharyland Utilities, L.P., for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and Public Utility Commission Substantive Rule § 25.344, Docket No. 22348, Application of Sharyland Utilities, L.P. for Approval of Unbundled Transmission and Distribution Rates (March 31, 2000) 11 Supplement to Application of Sharyland Utilities, L.P. (May 1, 2000). In its supplement, Sharyland noted that it was unable to include in its application a complete set of rate schedules due to a then pending settlement in Docket No. 21591 in which it agreed to a residential rate cap tied to the average residential rates of CPL. Because Sharyland filed its application on the same day that CPL filed its unbundled transmission and distribution application, Sharyland did not know what its rate cap was for purposes of the settlement. See Supplement to Application of Sharyland Utilities, L.P. at 2-3 (May 1, 2000). PUC Docket No. 22348 Consolidated Interim Order Page 6 SOAH Docket Nos. 473-00-1013 a settlement among the parties.12 In that interim order, the Commission noted that Sharyland and Commission Staff (Settling Parties) filed a stipulation and agreement of settlement (Settlement) that provided for approval of Sharyland’s application, and that the Settling Parties were authorized to state that the remaining parties to the proceeding, Office of Public Utility Counsel, TXU Electric Company, and the National Association of Energy Service Companies did not oppose the Settlement.13

Sharyland filed a motion for modification/reconsideration of the Commission’s Interim Order– Rate Phase, in which it requested that the time requirement for filing its compliance tariff for its transmission and distribution rates be changed from “no later than 30 days after the effective date of the Interim Order” to “no later than 20 days after Central Power and Light Company’s T & D tariff for January 1, 2002, is approved in Docket No. 22352.”14 In a supplement to its motion for modification, Sharyland noted that Commission Staff concurred in this requested change.15 Because Sharyland agreed in its initial rate case, Docket No. 21591, to a residential rate cap that was linked to CP&L’s average residential rates, the Commission approved Sharyland’s requested modification and issued a Revised Interim Order–Rate Phase to allow Sharyland to comply with its initial rate settlement.16 With the instant Order, the Commission approves Sharyland’s application for approval of UCOS rates consistent with the Settling Parties’ Settlement.

12 Interim Order-Rate Phase (June 4, 2001). 13 Interim Order-Rate Phase at 1 (June 4, 2001). 14 Motion of Sharyland Utilities, L.P. for Modification or, in the Alternative, Reconsideration of Interim Order-Rate Phase at 1 (June 14, 2001). 15 Supplement to the Motion of Sharyland Utilities, L.P. for Modification or, in the Alternative, Reconsideration of Interim Order-Rate Phase (June 19, 2001). 16 Revised Interim Order-Rate Phase (July 20, 2001). PUC Docket No. 22348 Consolidated Interim Order Page 7 SOAH Docket Nos. 473-00-1013

II. DISCUSSION

A. Generic Docket

This discussion section is divided into two parts: The Generic Proceeding issues are first discussed, followed by the utility-specific-docket issues. The discussion of the Generic Proceeding is broken into two general areas (T&D and Other) and incorporates the Commission’s decisions in the Generic Proceeding.17 Much of the Commission’s directive for application of procedural and policy matters is contained in Generic Proceeding Order Nos. 14 and 17; however, those two Orders must be read in conjunction with the other Generic Proceeding Orders and instruments to determine the full scope of the Commission’s final decisions. Application of the Commission’s Generic Proceeding decisions is reflected in many of the utility-specific docket Orders. Thus, the second portion of this Discussion Section expands on the Commission’s Orders in both dockets.

B. Generic Proceeding

In order to develop a list of issues to be considered in this proceeding, the Commission directed all parties, including TXU, to file by April 26, 2000, a list of issues to be addressed and separately to identify those issues generic to all unbundled-cost-of-service filings.18 In addition,

17 Generic Proceeding, Order Nos. 12, 14, 15, 17, 21, 22, 25, 28, 40, 42, 43, 44, 50, 51, and 53. 18 Application of Sharyland Utilities, L.P., for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22348 (pending); Application of Texas-New Mexico Power Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22349 (pending); Application of TXU Electric Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22350 (pending); Application of Southwestern Public Service Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22351 (pending); Application of Central Power & Light Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22352 (pending); Application of Southwestern Electric Power Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22353 (pending); Application of West Texas Utilities Company for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22354 (pending); Application of Reliant Energy HL&P for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22355 (pending); Application of Entergy Gulf States, Inc, for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22356 (pending); hereinafter, individual UCOS cases. PUC Docket No. 22348 Consolidated Interim Order Page 8 SOAH Docket Nos. 473-00-1013 parties were encouraged to identify any issues that should not be addressed in the docket and to identify any threshold legal and policy issues or matters of precedent that required briefing.19 The Commission informed all parties that the decisions made by the Commission in the Generic Proceeding would be applied to each utility-specific docket.20

The Commission’s Administrative Law Judge (ALJ) issued Order No. 3,21 identifying generic issues, dividing those issues into two groups, and requesting parties’ briefs on generic threshold issues in the Generic Proceeding. Because of the extensive number of issues, they were divided into two groups, Category A and Category B, based on the time sensitivity of each issue rather than by substantive alliance. The issues were extensively briefed. The Commission discussed the Category A and Category B issues during the June 14, 2001 and June 29, 2001 open meetings, respectively. The following discussion of issues addressed in the Generic Proceeding is organized by subject matter as follows: T&D and other miscellaneous issues.

1. Transmission And Distribution Rates a. Recovery of Certain Costs By TDU’s

(Generic Proceeding Order No. 17: Category B Issue No. 2)

Are the following costs recoverable as costs of the T&D utility: rate case expenses, restructuring costs, energy efficiency costs, and costs of the pilot project? Are special cost- recovery mechanisms for costs incurred prior to January 2002 permitted under PURA, and if so, are they appropriate? Do the rate freeze and rate path prescribed by SB7 limit the recovery of these costs?

The Commission notes that recovery of costs by an electric utility is addressed in both chapters 36 and 39 of PURA. The overall purpose of PURA Subtitle B, Electric Utilities, “is to establish a comprehensive and adequate regulatory system for electric utilities to assure rates,

19 Id., Order Initiating Proceeding at 2 (April 6, 2000). 20 See Preliminary Order at 2 and 5 (June 1, 2000); Generic Proceeding, Order No. 3 at 5 (May 9, 2000). 21 Generic Proceeding, Order No. 3, Granting Interventions, Identifying Issues, and Requesting Briefing at 2-5 (May 9, 2000). PUC Docket No. 22348 Consolidated Interim Order Page 9 SOAH Docket Nos. 473-00-1013 operations, and services that are just and reasonable to the consumers and the electric utilities.” 22 Chapter 39 was subsequently “enacted to protect the public interest during the transition to and in the establishment of a fully competitive electric power industry.”23 In the event that “there is a conflict between the specific provisions of [chapter 39] and any other provisions of [PURA], . . . the provisions of [chapter 39] control.”24 In light of these statutory provisions, the Commission agrees that PURA § 36.051 provides guidance for determining T&D rates. PURA § 39.201, which provides a general framework for establishing post-2002 cost-of-service tariffs and charges, must take precedence in the event of any conflict.

Accordingly, the Commission concludes that the recovery of expenses incurred prior to January 2002, is generally not appropriate because PURA § 39.201(b)(1) requires that the rates set in this proceeding are to be “based upon a forecasted 2002 test year” and because PURA § 39.052 freezes existing retail base-rate tariffs until January 1, 2002. As noted by some parties, the rate-freeze provision of PURA § 39.052 benefit both retail consumers and utilities prior to the onset of competition. Furthermore, the annual-report process provides an avenue for utilities to recover some costs during the transition period.25

In addition, the Commission determines that any expenses or costs recoverable through T&D rates in the 2002 forecasted test year must be demonstrably related to the T&D function. Costs related to generation or retail sales cannot be included in T&D rates. This determination is consistent with, if not mandated by, the provisions of Chapter 39 that require business separation and with the Commission’s mandate pursuant to PURA § 39.201 to establish rates for the transmission and distribution utility (TDU). Allocation of recoverable costs to the appropriate T&D functions should occur in the company-specific proceeding.

The Commission finds, however, that rate-case expenses related to the T&D function and determined reasonable and necessary, including those incurred prior to January 2002, are recoverable and may be amortized over an appropriate time period to mitigate rate impact. This

22 PURA § 31.001(a). 23 Id. § 39.001(a). 24 Id. § 39.002. 25 See Id. §§ 39.256 – 39.262. PUC Docket No. 22348 Consolidated Interim Order Page 10 SOAH Docket Nos. 473-00-1013 treatment is consistent with Commission precedent, as just and reasonable rate-case litigation expenses incurred outside of the test year have traditionally been allowed pursuant to PURA § 36.061(b)(2).26

The Commission also finds that T&D-related restructuring costs for capital expenditures and associated depreciation, as well as annual expenses, should generally be treated according to traditional rate-making principles and the provisions of PURA § 36.051. T&D restructuring expenses that are determined reasonable and necessary and are expected to be incurred in the 2002 forecasted test year may be included in the T&D rates. Where appropriate, extraordinary expenses may be amortized over a suitable time period to mitigate rate impact. Restructuring expenses incurred prior to the 2002 forecasted test year may not be included in T&D rates, but recovery may be requested in the annual-report process. The Commission acknowledges that debt restructuring expenses are unique, and the recovery of such expenses should be limited to the proportionate share of T&D assets expressed as a percentage of total assets prior to business separation on a net book value basis.

Further, the Commission finds that energy efficiency costs that are recurring, are incurred in the 2002-forecasted test year, and comply with the energy efficiency rule27 are recoverable in T&D rates. Recovery of energy-efficiency costs incurred prior to the 2002 forecasted test year may also be requested in the annual-report process.

Finally, the Commission concludes that costs of the pilot project are not recoverable in the T&D rates established in this proceeding pursuant to PURA § 39.201 because they are not related to the provision of T&D service after January 1, 2002, and will not be incurred during the 2002 forecasted test year. For pilot project expenses incurred prior to the 2002 forecasted test, recovery may be requested in the annual-report process.

26 See Application of Texas-New Mexico Power Company for Authority to Change Rates and Petition of Texas-New Mexico Power Company for Deferred Accounting Treatment for TNP One-Unit Two, Docket Nos. 10200 and 10034, Examiners’ Report, 19 P.U.C. Bull. 89, 269 (Mar. 18, 1993).

27 P.U.C. SUBST. R. 25.181. PUC Docket No. 22348 Consolidated Interim Order Page 11 SOAH Docket Nos. 473-00-1013 b. Return on Equity and Capital Structure

(Generic Proceeding, Order No. 28 - Incentive Plan and Return on Equity)

(Generic Proceeding, Order No. 42 – Establishing Return on Equity and Capital Structure)

TARGETED INCENTIVE PROGRAM Early in the Generic Proceeding, the Commission concluded that a standard targeted incentives program (TIP), that could be opted into by companies, would be beneficial and should be developed in this proceeding.28 The Commission directed parties to seek a consensus plan. Commission Staff filed several versions of TIP, but no agreement could be reached by all parties. The Commission, therefore, concluded that a generic TIP is not appropriate at this time, and that neither a TIP nor performance-based ratemaking plans proposed by some utilities in their original UCOS filings should be considered in setting an ROE in either the Generic Proceeding or in the individual UCOS cases.

Given the basic underlying similarities of unbundled TDUs, including the level of regulatory oversight and comparable levels of risk, the Commission concluded that it was appropriate to conduct a factual hearing in the Generic Proceeding to address generic ROE and capital structure. Sharyland Utilities was exempted from the consideration of the generic ROE and capital structure; instead those issues would be determined in Docket No. 22348.29 On November 6, 2000, the Commission heard evidence in connection with the establishment of ROE rates and capital structure ratios for use in the utilities’ individual UCOS cases. Initial and reply post-hearing briefs were filed by the parties on November 22, 2000, and December 4, 2000, respectively. The Commission considered this matter in the open meeting on December 13, 2000.

In approaching the issues of the appropriate ROE and capital structure, the Commission notes two underlying considerations that served as a starting point in the decision-making

28 See Generic Proceeding, Order No. 17 at 12-13; Order No. 17 at 1. 29 Sharyland Utilities’ UCOS case. PUC Docket No. 22348 Consolidated Interim Order Page 12 SOAH Docket Nos. 473-00-1013 process. First, these decisions are made for ratemaking purposes for the newly unbundled TDUs during the transition period; and, second, the decisions are based on the close correlation between the ROE and capital structure.

The factors the Commission considered when determining an appropriate and reasonable ROE for the unbundled TDUs in Texas include: (1) the levels of business and financial risk; (2) the Commission’s decisions in the rate design phase of this case; (3) the need to maintain reasonable rates; (4) the need for new transmission capacity; (5) the maintenance of adequate reliability standards; and (6) the companies’ ability to attract new capital.

The Commission reviewed analyses of various proxy groups, including generation- divested, integrated, and water utilities and local gas distribution companies, for indications of risk levels and market concerns. The Commission finds that, while the generation-divested utilities most closely resembled the functions of the unbundled TDUs, significant differences in market restructuring in Texas and the size of the sample group do not allow for generalizations. The Commission also finds that the other sample groups provided useful information and need to be considered.

Based on these reviews, the Commission concludes there is strong evidence to support the presumption that, relative to the existing market structure, unbundled TDUs in the Electric Reliability Council of Texas (ERCOT) will be exposed to less risk.30 The following observations support the assertion that the Texas market is significantly different from other jurisdictions and should result in lower risk for the TDUs: (1) complete separation of generation and T&D functions, thus virtual elimination of commodity risk; (2) a requirement on retail electric providers (REPs) to be the point of sales for retail customers; (3) Commission-approved substantive rules related to registration and financial requirements to minimize a possibility of a

REP default on payments for contracted services;31 and (4) P.U.C. SUBST. R. 25.193 to ensure speedy recovery of transmission expenditures related to expansion of the transmission network.

30 Direct Testimony of Martha Hinkle, pp. 8 -9, 17, and 19, and NUS Joint Reply Brief, pp. 3-10.

31 P.U.C. SUBST. R. 25.107, relating to Certification of Retail Electric Providers (REPs), and P.U.C. SUBST. R. 25.108, relating to Financial Standards for Retail Electric Providers Regarding the Billing and Collection of Transition Charges. PUC Docket No. 22348 Consolidated Interim Order Page 13 SOAH Docket Nos. 473-00-1013

Therefore, the Commission concludes these favorable market and regulatory conditions in Texas should result in a lower business risk to Texas TDUs.

Additionally, in its consideration of what is an appropriate and reasonable ROE, the Commission reviewed a range of methods and models, as proposed by the parties: discounted cash flow (DCF), multi-stage DCF, capital asset pricing model (CAPM), and risk premium method. The Commission finds that the multi-stage DCF analysis as proposed by the IOUs does not accurately capture the lower business risk for Texas TDUs.32

In its determination of an appropriate ROE, the Commission considered the NUS recommendation of 10.75% as a reasonable starting point.33 This number lies in the middle of the ranges of reasonable ROE admitted into evidence. Further review of OPUC/EGSI Cities CAPM analysis indicated that the NUS ROE is compatible with a 60% debt in the capital structure.34 The Commission, however, provides for an upward adjustment to the ROE of 0.5% to account for (1) the Commission decision in the rate design phase of this proceeding; 35 (2) potential rating uncertainty due to higher debt, based on the adoption of 60% debt and 40% equity for capital structure in this proceeding; and (3) a risk premium recalculation as indicated in a Commission Staff witness’ errata testimony.36 Accordingly, the Commission approves an ROE of 11.25% for the Texas unbundled TDUs, starting in 2002.

With regard to the issue of capital structure, the Commission recognizes that the ultimate determination of the appropriate relationship between the level of debt and equity and the corresponding ROE is not an exact science. As a general proposition, however, the Commission finds that an increase in debt should result in an increase in ROE unless offset by lower business risk.

32 Direct Testimony of D. Tietjen, pp. 8-10. 33 Direct Testimony of D. Tietjen and M. Hinkle; see also NUS Initial Brief, pp. 12-19. 34 IOU Reply Brief, Exhibit C; see also Direct Testimony of Hill, Schedule 7. 35 The Commission adopted a Transmission Cost Recovery Factor, which may increase risk for the distribution company. Also adopted was an 80% ratchet for the distribution company, which may result in more streamlined cash flow; however, the adopted ratchet was the lowest one proposed. 36 Staff Exhibit 1B, Errata to Martha Hinkle’s Direct Testimony; see also November 6, 2000 Hearing Transcript at 1309-11. PUC Docket No. 22348 Consolidated Interim Order Page 14 SOAH Docket Nos. 473-00-1013

Both the NUS and OPUC/EGSI Cities proposed debt to equity ratio of 60/40. These parties presented substantial evidence showing that the unbundled TDUs would not be adversely affected by higher levels of debt, either in terms of adequate cash flows or market perception. The Commission agrees with these parties that any increase in the financial risk due to the higher debt leverage would be offset by the lower business risk to the TDUs. The Commission is not persuaded by the IOUs’ arguments that greater debt leverage would have a detrimental impact on the TDUs. The Commission finds that the TDUs are able to carry a higher level of debt and still achieve a favorable credit rating, which will allow capital to be raised at acceptable rates.

Therefore, the Commission finds that a capital structure of 60/40 debt to equity ratio is reasonable and that it will allow TDUs to attract sufficient capital at reasonable rates, while minimizing costs to the ratepayers. The Commission also finds that any increase in the financial risk due to the higher debt leverage is offset by the lower business risk faced by the TDUs. The Commission, therefore, adopts a 60% debt and 40% equity ratio as the capital structure for ratemaking purposes for Texas TDUs.37 c. Generic O&M Escalation Factors

(Generic Proceeding Order No. 17: Category B Issue No. 3)

(Generic Proceeding, Order No. 25)

Are there criteria for determining whether operations and maintenance (O&M) expenses and capital investments for the forecasted 2002 test year are reasonable and necessary, such as use of generic escalation factor(s)?

CAPITAL INVESTMENT ESCALATORS The majority of parties argued each utility should prove that capital investment is reasonable and necessary in the company-specific proceedings. Commission Staff, however, asserted that a 5% generic escalation factor for distribution net plant-in-service after 2002 would

37 NUS Initial Brief, pp. 4-11. PUC Docket No. 22348 Consolidated Interim Order Page 15 SOAH Docket Nos. 473-00-1013 be appropriate,38 and that investment in the transmission function is best determined in the company-specific proceedings. The Commission finds that capital investment costs for the T&D functions in the 2002 forecasted test year are more appropriately addressed in the company- specific dockets. A company-specific analysis appears appropriate for two reasons: (1) some utilities would over-recover their costs if they are making no or limited capital investment, and (2) for some utilities, an escalator would not provide adequate recovery for needed capital investment.

O&M EXPENSE ESCALATORS The Commission finds that operations and maintenance (O&M) expenses for the 2002 forecasted test year are appropriately determined by the application of generic escalation factors. Those parties seeking a company-specific determination to account for unique service areas and demand characteristics of the utilities generally failed to acknowledge that the historic test-year baseline should satisfactorily compensate for these factors. While a company-specific analysis is certainly possible, there is no assurance that the result will be any better than that achieved by applying some generic escalation factor to the historic test-year baseline for O&M expenses. As noted by TNMP, the use of a generic escalator is practical and at the very heart of forecasting. The Commission found that a factual hearing to determine the appropriate type of escalation factors was in order.

The Commission identified the following matters upon which evidence would be considered at the hearing: (1) evidence in support of either a single generic escalation factor or a limited number of generic escalation factors that appropriately account for O&M expenses and (2) evidence relating to labor costs that are currently known and measurable for the 2002 forecasted test year or that relate to unusual labor costs that would not be properly encompassed in generic escalation factors. The Commission indicated that, should a utility’s labor costs justify an exception to the generic escalators, the Commission reserved the right to determine how those labor costs are to be treated in the company-specific UCOS dockets.

38 This factor was derived from data in Standard & Poor’s DRI “Power Planner-Cost Information for Power System Analysis,” First Quarter, 2000. PUC Docket No. 22348 Consolidated Interim Order Page 16 SOAH Docket Nos. 473-00-1013

The Commission heard evidence in connection with this issue on August 7, 2000. Briefs were filed on August 14, 2000, and reply briefs on August 18, 2000. After reading and hearing evidence, reviewing briefs and reply briefs, and discussion at the Open Meeting on August 24, 2000, the Commission determines the issues in connection with O&M escalators as follows.

The Commission finds that the generic escalation factors developed by the IOU-aligned group witness John Mothersole for the fourth quarter of 1999, and the years 2000, 2001, and 2002, as set forth in Table 1 below, appropriately account for growth in O&M expenses.

Table 1 (Mothersole Escalator Factors)

4th Qtr, Category 1999 2000 2001 2002 Materials and Services, T&D Expenses 0.4% 2.6% 1.7% 1.5% Materials and Services, A&G (excluding 0.8% 3.6% 3.6% 3.3% labor) Labor – Managerial, Professional & Technical, and Clerical 0.9% 3.9% 3.8% 3.6% Labor – Other 0.5% 3.0% 3.8% 3.7%

Additionally, the Commission finds that a productivity offset should be applied to each escalation factor and that the 1.2% factor developed by Steven Andersen properly accounts for productivity enhancements. This factor shall be applied to each of the Mothersole escalation factors for the fourth quarter of 1999, and the years 2000, 2001, and 2002.39 The escalation factors that result from the application of this offset are summarized in Table 2 and shall be used to escalate 1999 historic test year O&M expenses in the company-specific dockets.

Table 2 (Generic O&M Escalation Factors Adopted by the Commission after Productivity Offset)

4th Qtr, 2000 2001 2002 Category quarter Materials and Services, T&D Expenses 0.1% 1.4% 0.5% 0.3% Material and Services, A&G (excluding 0.5% 2.4% 2.4% 2.1% labor)

39 For the 4th quarter of 1999, a productivity offset of 0.3025% (i.e. 1.21% divided by 4) should be applied. PUC Docket No. 22348 Consolidated Interim Order Page 17 SOAH Docket Nos. 473-00-1013

Labor – Managerial, Professional & 0.6% 2.7% 2.6% 2.4% Technical, and Clerical Labor-Other 0.2% 1.8% 2.6% 2.5%

The Commission agrees with Commission Staff that demand-side management (energy efficiency) expenses and transmission-access charges are “new” O&M expenses of the T&D utility and may be included in the 2002 future test year. Consequently, the Commission finds that these expenses may be included in the 2002 future test year to the extent they are found to be reasonable and necessary40 in the company-specific dockets.

Additionally, the Commission finds that “new” SB7-mandated corporate restructuring expenses may be included in the 2002 future test year, subject to reasonable and necessary review in the company-specific dockets. Expenses that are properly functionalized in the 1999 historic test year and subsequently escalated, are not “new” SB7 expenses.

The Commission agrees with the majority of the parties that UCOS Rate Filing Package (RFP) methodology for determining O&M expenses in the 2002 future test year is appropriate. The Commission disagrees with AEP that “new” O&M expenses included in the 2002 future test should be reflected in terms of 1999 dollars and subject to escalation. Additionally, the Commission agrees that 1999 historic test year data is subject to review pursuant to PURA § 36.051. To avoid double recovery, expenses that are recovered as “new” may not be recovered in the 1999 historic test year.

TNMP YEAR-2000 LABOR COSTS TNMP argued that its 2000 labor costs are known and measurable. TNMP maintained that it has put in effect wage increases of approximately 5% for 2000. The Commission finds that the generic escalators adopted in this order should be applied to TNMP’s 1999 historic test year labor costs in the same manner as other IOUs. TNMP shall not make other adjustments in addition to the application of the escalation factor in this order.

40 See PURA § 36.051. PUC Docket No. 22348 Consolidated Interim Order Page 18 SOAH Docket Nos. 473-00-1013

SHARYLAND Sharyland took no position concerning whether the Commission should adopt a generic escalator or how such an escalator should be designed. Sharyland, a new utility lacking historical data, maintained that its O&M costs can only be determined in its individual UCOS proceeding.41 The Commission finds that Sharyland has few of the characteristics of the other IOUs in the Generic Proceeding. In short, Sharyland, which only recently began service, has no 1999 historic test year for application of a generic escalation factor. Consequently, Sharyland is exempt from the application of this ruling.

LCRA AND STEC The Commission finds that the application of generic O&M escalation factors should only be applied in the UCOS filing of the IOUs. Consequently, the Commission finds that LCRA and STEC are exempt from the application of this ruling. d. Uniform Customer Classification Scheme and Uniform Rate Design

(Generic Proceeding Order No. 17: Category B Issue No. 6(A)

(Generic Proceeding, Order No. 21 – Generic Customer Classification and Rate Design Issues)

(Generic Proceeding, Order No. 40 -- Establishing Generic Customer Classification and Rate Design)

Should the Commission adopt a uniform classification scheme and uniform rate design for T&D service?

The Commission strongly agrees with parties which argued that, with nearly all of the IOUs having a rate case pending before the Commission, this is a unique opportunity to make and implement standardized policy decisions regarding customer classification and rate design. These parties contended that uniformity would facilitate the development of a competitive market because it would allow REPs to standardize products, reducing REPs’ costs to enter the

41 Application of Sharyland Utilities, L.P., for Approval of Unbundled Cost of Service Rate Pursuant to PURA § 39.201 and P.U.C. SUBST. R. 25.344, Docket No. 22348 (pending). PUC Docket No. 22348 Consolidated Interim Order Page 19 SOAH Docket Nos. 473-00-1013 market. Furthermore, they maintained, T&D services are similar among all service areas, so customers are easily grouped by the type of T&D service they require. In support of deferring such standardization, some argued that both the proposed customer classes and rate design filed by the utilities in their respective UCOS cases go a long way toward achieving the goal of uniformity, with new classes that necessarily reflect similarities across all the utilities.

The Commission finds that a uniform rate design and customer classification scheme is appropriate for the purposes of standardizing T&D rates in Texas. A reasonable approach to this end is to establish a small number of classes, as compared to the approximately twenty or more served by the typical integrated utility today, for standardized use, with a goal of uniformity. The Commission also recognizes that certain exceptions to the standard classifications established in this proceeding will be required. The goal for rate design is also to develop a standardized model, such that, to the greatest possible extent, rates are cost driven.

Generic Proceeding, Order No. 21 –

Generic Customer Classification and Rate Design Issues

On August 8, 2000, during its open meeting factual hearing on generic escalator issues, the Commission took up the motion by Commission Staff to expand the scope of the customer classification and rate design issues. The Commission found the motion appropriate, and determined that the scope of the customer classification should include identification of uniform customer classes and determination of clear definitions for each class. Furthermore, determination of any utility-specific exceptions to uniform classes is also appropriate, such that a final identification of both uniform classes and exceptions and/or additional classes is completed for each company. The Commission also agreed to consider the need for a “stand-by” classification, and if such classification were to be adopted, a rate design for that class would be determined. By way of example, the Commission identified the types of criteria that might lead to a determination of what constitutes a customer class as voltage level, or the size of the customer’s load, or the type of business, or, perhaps, the relationship to the price-to-beat classifications. PUC Docket No. 22348 Consolidated Interim Order Page 20 SOAH Docket Nos. 473-00-1013

The Commission also decided that the rate design issue would result in the development of a cost driven, standardized rate design for transmission rates and distribution rates, by class, including stand-by, time-of-day, and seasonal rates, if those are determined to be appropriate or necessary. The Commission determined that the rate design would identify types and measurement units of billing determinates by class, and would determine the need and/or justification for a transmission cost recovery factor (TCRF), and, if necessary, a methodology for determining the TCRF. The actual application, however, should be conducted at SOAH. The Commission wanted to complete the rate design so that, at the “second phase” hearings at SOAH, it would be a matter of plugging in numbers and assuring accuracy. In other words, the Commission determined a method for a compliance process.

In addition, the Commission determined that the following issues would not be heard in the generic proceeding because they were to be addressed in the securitization cases, in rules, or during the utility-specific SOAH hearings: distributed generation (DG) tariffs, discretionary services, miscellaneous fees, nuclear decommissioning, wholesale rates, system benefit fund (SBF) fees, competitive transition charges (CTC), transition charges (TC), and tariff language.

Generic Proceeding, Order No. 40 -

Establishing Generic Customer Classification And Rate Design

After considering the parties’ briefs, the Commission concluded that a uniform rate design and customer classification scheme is appropriate for the purpose of standardizing T&D rates in Texas.42 The Commission concluded, however, that resolution of this issue should await an evidentiary hearing where the Commission could evaluate the proposed customer classifications and rate designs.43 The customer classification and rate design (CC/RD) phase of the Generic Proceeding satisfies this requirement.

NON-UNANIMOUS AGREEMENT ON CUSTOMER CLASSIFICATION On September 8, 2000, a Distribution Service Customer Classification Non-Unanimous Stipulation and Agreement (NUA) was filed in the Generic Proceeding by American Electric

42 Generic Proceeding, Order No. 17 at 10. 43 Id. PUC Docket No. 22348 Consolidated Interim Order Page 21 SOAH Docket Nos. 473-00-1013

Power Company, Inc. (AEP); Texas-New Mexico Power Company (TNMP); TXU Electric Company (TXU); Southwestern Public Service Company (SPS); the Commission Staff of the Public Utility Commission of Texas (Commission Staff); Texas Industrial Energy Consumers (TIEC); Enron Energy Services, Inc. (Enron); and Texas Industries, Inc (TXI).44 The following parties did not oppose the NUA: ALCOA and Floresville Electric Light and Power Systems.45 The NUA addressed customer classifications for all of the utilities participating in the proceeding, including the NUA-signatory utilities (AEP, TNMP, TXU, SPS), Reliant Energy HL&P (Reliant), and Entergy Gulf States, Inc. (EGSI).

Direct testimony in the CC/RD phase of this proceeding was filed by the parties on October 16, 2000, and rebuttal testimony was filed October 23, 2000. On November 2 and 3, 2000, the Commission heard evidence in connection with the establishment of generic customer classifications and rate design for use in the utilities’ individual UCOS cases currently pending at SOAH. Initial and reply post-hearing briefs were filed by the parties on November 8 and 10, 2000, respectively. The Commission considered this matter in open meeting on November 16, 2000.

As previously discussed, Generic Proceeding Order No. 17 provided the Commission’s decision that a uniform rate design and customer classification scheme is appropriate for the purpose of standardizing T&D rates in Texas.46 Having convened a factual hearing on this matter, the Commission maintains this decision. Therefore, based upon the evidence, briefs, and arguments of the parties, the Commission adopts a generic customer classification and rate design for T&D rates. The Commission finds that the six customer classes, as proposed in the NUA, shall be adopted by each of the utilities participating in this proceeding. The six customer classes are: (1) Residential, (2) Secondary less than 10 kW or kVA (less than 5 kW for TNMP and EGSI), (3) Secondary greater than 10 kW or kVA (greater than 5 kW for TNMP and EGSI), (4) Primary, (5) Transmission, and (6) Lighting.

44 Distribution Service Customer Classification Non-Unanimous Stipulation and Agreement at 2 (NUA). 45 NUA at 1. 46 Generic Proceeding, Order No. 17 at 10 (July 24, 2000). PUC Docket No. 22348 Consolidated Interim Order Page 22 SOAH Docket Nos. 473-00-1013

The Commission agrees with the proponents of the generic customer classifications who cited cost causation as a significant factor in developing a uniform customer class configuration47 and the need for flexibility in addressing reconciliation with the price to beat (PTB).48 The adopted generic class design will best achieve these goals. Accordingly, the Commission adopts the six customer classes proposed in the NUA.

To recognize its unique characteristics, the Commission grants Sharyland an exemption from some of the classifications. All of Sharyland’s customers are equipped with interval data recorder (IDR) meters, obviating the need for classes to accommodate non-demand-metered customers.49 Therefore, to the extent that such classes are unnecessary for Sharyland, a modified version of the NUA classes for Sharyland is appropriately addressed in its individual UCOS case.50 This exemption does not, however, excuse Sharyland from meeting the underlying principles cited above. Additionally, Sharyland’s classifications should mirror those in the NUA for demand-metered classes.

GENERIC DESIGN OF TRANSMISSION AND DISTRIBUTION RATES The Commission agrees with the proponents of a generic rate design that the primary principles to be considered in the design of T&D rates are cost causation, simplicity, and equity to customers within the given rate classes.51 Further, uniform T&D rates help to ensure a more vibrant competitive electric market because the uniformity will facilitate entry by new competitors. The Commission finds that such a generic rate design is appropriate, and shall therefore be adopted by T&D utilities. Additionally, the Commission agreed that adoption of a generic rate design for lighting is not realistic given the complexity of the topic. Accordingly, lighting rate design shall be addressed in the individual UCOS cases.

47 See Entergy Gulf States’ (EGSI) Initial Brief at 2-3; Nucor’s Initial Brief at 3; Texas Industrial Electric Customers’ (TIEC) Initial Brief at 5. 48 See Cleco ConnexUS et. al., Initial Brief at 1; Texas Retailers Association’s (TRA) Initial Brief at 5. 49 See Sharyland Statement of Position at 1. 50 Docket No. 22348. 51 See Southwestern Public Service Company’s (SPS) Reply Brief at 6; American Electric Power Company’s (AEP) Initial Brief at 4. PUC Docket No. 22348 Consolidated Interim Order Page 23 SOAH Docket Nos. 473-00-1013

CUSTOMER CHARGE The testimony in the Generic Proceeding revealed that the inclusion of a customer charge was generally favored by the parties. Specifically, these parties proposed that the customer charge be comprised of costs that are incurred regardless of system usage, such as billing, metering, and customer service.52 One party maintained that customer charges should not be applied to the residential class because a fixed charge would discriminate against low use/low income customers.53 With the exception of TXU, the parties were not opposed to having costs related to metering, which is expected to become a competitive service in the future, recovered through a separately stated charge.54

The Commission finds that the adoption of a uniform rate design that includes a customer charge is appropriate. Specifically, the customer charge shall be comprised of costs that vary by customer such as metering, billing, and customer service.55 A customer charge comprised of these elements appropriately tracks cost causation. Additionally, the metering portion of such charges, at a wholesale level, should be separately stated. This will facilitate the unbundling of metering charges when they become a competitive offering.

FACILITIES/DELIVERY CHARGE Also considered in the Generic Proceeding was whether the generic rate design should include a facilities/deliveries charge. The majority of the parties maintain that a facilities/delivery charge is appropriate and that the manner in which the charge is to be recovered will be contingent on the metering capabilities of each customer. Because the residential and small commercial56 classes typically do not have demand meters in place, the majority of the parties agree that a facilities/delivery charge should be recovered on a monthly per-kilowatt-hour (kWh) basis for these customers.57 Many of the parties propose that demand-

52 See Commission Staff’s Initial Brief at 4-5. 53 See Texas Legal Services Center’s (TLS) Initial Brief at 5-7. 54 See TXU Electric Company’s (TXU) Initial Brief at 4-5. 55 See Nucor’s Initial Brief at 5; TXU’s Initial Brief at 4. 56 More properly, the secondary less than 10 kW or kVA (less than 5 kW for TNMP and Reliant) class. 57 See Office of Public Utility Counsel’s (OPUC) Reply Brief at 2; EGSI’s Initial Brief at 4. PUC Docket No. 22348 Consolidated Interim Order Page 24 SOAH Docket Nos. 473-00-1013 metered classes should be billed based on non-coincident peak (NCP) demand. There was greater disparity among the parties as to the issue of whether IDR demand-metered locations should be given different billing treatment from non-IDR locations. Parties opposing the use of a 4CP-billing determinant cited cost shifting and intra-class subsidies as the primary concerns.58

With respect to a facilities/delivery charge, the Commission finds that the non-coincident peak (NCP) billing determinant should be used for non-IDR metered customers. For those possessing IDR meter capabilities, the transmission per-kilowatt (kW) rate shall be billed according to the Commission’s relevant transmission rule, which currently mandates a four coincident peak (4CP) method.59 In the event that “gaming” of the 4CP methodology becomes a problem, the advisability of broadening the relevant peak period may be examined at that point. The distribution facilities/delivery charge for IDR metered customers shall be billed on the NCP billing determinant. The interval for billing of demand charges shall be that interval, which conforms to the protocols of the reliability council, power pool, or independent organization to which each utility belongs. For the majority of utilities participating in this proceeding, in accordance with ERCOT protocols, a 15-minute demand interval shall be applied to demand charges. Finally, facilities/delivery charges shall be recovered on a per-kWh basis for residential and small commercial customers that do not have demand meters. The method established for the recovery of a facilities/delivery charge from each customer class, appropriately reflects the best available metering data from each class, is a reasonable proxy for cost causation, and maintains continuity with past rate design methodology.

RATCHETS The Commission agrees with the parties who, with little opposition, recommended adoption of a demand ratchet in the distribution rates because ratchets stabilize utility revenues and because ratchets are an effective method to recover fixed distribution infrastructure costs. The Commission finds arguments that ratchets are not cost-justified or place an excessive burden on low load factor customers to be unpersuasive. The Commission determines that an 80%

58 See TXU’s Initial Brief at 6.

59 See P.U.C. SUBST. R. 25.192(c). PUC Docket No. 22348 Consolidated Interim Order Page 25 SOAH Docket Nos. 473-00-1013 ratchet is appropriate for recovery of distribution costs from demand-metered customers.60 The Commission holds that although a 100% ratchet properly reflects the fixed nature of distribution costs, the 80% level more appropriately recognizes load diversity on the distribution system. In addition, parties generally agreed that an exception is appropriate for seasonal agriculture customers, based on testimony that applying a ratchet to these customers could result in charges higher than their current bundled rate on an annual basis. The Commission acknowledges these unique characteristics of seasonal agricultural customers, and therefore grants an exception to the establishment of generic ratcheted distribution demand charges for these customers. The design for each customer class that includes seasonal agricultural customers shall contain a provision for the recovery of distribution charges without the use of a demand ratchet for those customers.

KVA BILLING Interested parties agreed that the practice of billing on a per-kilovolt-ampere (kVA) basis should continue for a utility that has historically billed on a per-kVA basis. Proponents of this practice claimed that kVA billing sends customers the proper price signal to maintain a high power factor and obviates the need for power factor correction formula.61 The proposed NUA classes allow this practice to continue. The Commission agrees that kVA billing should continue as recognized by the NUA.

TRANSMISSION COST RECOVERY FACTOR (TCRF) Proponents of a transmission cost recovery factor (TCRF) argued that a TCRF would be needed if the distribution utility were to act as the billing agent for transmission service providers. There were two general approaches proposed for such a mechanism. The first approach, proposed by Commission Staff, would allow a distribution utility to pass through to retail customers only the changes in ERCOT transmission costs approved by the Commission or allowed by P.U.C. SUBST. R. 25.193(a)(4).62 The second approach would serve as a true-up

60 The parties’ proposals ranged from an 80% ratchet (See Dallas-Fort Worth Hospital Council and the Coalition of Independent Colleges and Universities Initial Brief at 4-5) to be applied to customers with demand charges to a 100% ratchet for all customer classes (See AEP’s Initial Brief at 9-10). Most parties supported or were willing to accept an 85% ratchet for distribution rate classes with demand charges. 61 See Reliant’s Direct Testimony of Purdue at 15; Reliant’s Initial Brief at 10. 62 See Commission Staff’s Direct Testimony of Pevoto at 26-29; Commission Staff’s Initial Brief at 14. PUC Docket No. 22348 Consolidated Interim Order Page 26 SOAH Docket Nos. 473-00-1013 mechanism to allow distribution utilities to adjust for under or over recovery of transmission costs. The latter approach would address the distribution utility’s risk as a billing agent for transmission service providers.63 Several parties argued there should be no TCRF, because such an automatic rate adjustment is prohibited by PURA.64

The Commission adopts the Commission Staff’s methodology for a TCRF. The Commission agrees with Commission Staff that the TCRF should only be used to pass through wholesale transmission cost changes approved or allowed by the Commission. While this approach does not address the risk to the distribution utility for under- and over-collection of the transmission service charges, the Commission may take such risk into account when setting the distribution utility’s rate of return.

DIRECT SUBSTATION SERVICE One party asserted that a separate rate for customers taking service directly out of the substation is warranted on the grounds that these customers are basically the same as transmission-level customers, with one additional transformation.65 Opponents argued that such a rate would create a discrete class that would have significant impacts on other primary class customers.66

The Commission concludes that a separate rate or adjustment for customers taking service directly out of the substation is not warranted. To establish a rate based on the location of a customer in relation to a substation represents a significant departure from longstanding ratemaking principles with respect to the shared costs of the distribution infrastructure. The Commission declines to institute a separate rate for customers who happen to be either closer to, or farther from, a particular substation.

INTERRUPTIBLE AND STANDBY TRANSMISSION RATES (Generic Proceeding Order No. 17: Category B Issue No. 6(B))

63 See AEP’s Initial Brief at 12-14; Reliant’s Initial Brief at 11-12. TXU’s Initial Brief at 11-12. 64 See City of Houston Direct Testimony of Daniel at 19. OPC’s Initial Brief at 8. 65 See TIEC Direct Testimony of Jeffry Pollock at 20-23. 66 See TRA’s Rebuttal Testimony of Saunders at 2-3; TXU’s Rebuttal Testimony of Sherburne at 11-12. PUC Docket No. 22348 Consolidated Interim Order Page 27 SOAH Docket Nos. 473-00-1013

(Generic Proceeding Order No. 40: Standby Transmission Rate)

Should transmission and distribution rates include intermittent or stand-by service?

Some parties argued that transmission and distribution rates should include intermittent and standby rates in order to reflect the willingness and ability of some customers to curtail usage during period of high demand and, therefore, reduce stress on T&D system. These parties argued that traditional cost-of-service principles require that there is recognition of cost causation, and therefore these types of rates are appropriate. Opponents of such rates argued that intermittent or standby services are largely generation-related services and costs. These parties argued that facilities are largely the same whether a retail customer takes intermittent or firm service because they must be sized to meet maximum demand. Furthermore, these parties suggested that the Commission already addressed this question in Project No. 2108367 and determined that intermittent transmission and distribution rates were inappropriate.

The Commission finds that it is important to distinguish between interruptible and standby services. The Commission agrees that interruptible T&D rates are inappropriate. As the Commission stated in the Second Order on Rehearing in Docket No. 16705,68 the bundled, interruptible rate design approved in that docket was meant to ensure that those rates recover T&D costs from interruptible customers. The Commission notes that interruptible customers will receive value in the generation market for their willingness to curtail at high-priced periods and, to the extent such interruptibility eases transmission congestion, may also receive value in the congestion market for the ability and willingness to curtail their load.

Upon initiation of the Generic Proceeding, the Commission acknowledged that standby service is different from interruptible service and agreed to consider argument on whether a standby T&D rate may be appropriate. Proponents of a standby T&D rate argued that this load is infrequently on the grid, and customers with on-site generation who need to take standby services for maintenance or planned outages typically only do so in off-peak hours because the

67 Cost Unbundling and Separation of Business Activities, including Separation of Competitive Energy Services and Distributed Generation, Project No. 21083. 68 Application of Entergy Texas for Approval of Its Transition to Competition Plan and the Tariffs Implementing the Plan, and for the Authority to Reconcile Fuel Costs, to Set Revised Fuel Factors, and to Recover a Surcharge for Under-Recovered Fuel Costs, Second Order on Rehearing, Docket No. 16705 (Oct. 148). PUC Docket No. 22348 Consolidated Interim Order Page 28 SOAH Docket Nos. 473-00-1013 corresponding generation prices are low. Furthermore, these parties stated, back-up services are taken when a forced outage occurs, and this occurs infrequently and randomly. Again, the Commission recognizes that these customers use the T&D system in significantly different ways from normal firm-requirements customers. However, the Commission declines to establish a standby rate for transmission service to be offered by the regulated transmission utility. Such a rate is more appropriately offered in the competitive market. Furthermore, assuming that standby customers do not take transmission service during peak periods, coincident peak billing for transmission service will recognize the intermittent usage of the transmission system by such customers.

POWER FACTOR CORRECTION FORMULA The standard-power-factor-correction formula is being addressed in Project No. 22187.69 Consequently, the Commission finds there is no need to consider this issue in this proceeding. e. Recovery of Transmission Charges

ERCOT (Generic Proceeding Order No. 14: Category A Issue No. 3)

(Order No. 40 affirms the Order No. 14 decision)

How should ERCOT transmission providers recover their transmission costs? Should they bill retail electric providers, either directly or through an ERCOT settlement, or bill a transmission and distribution utility, which would then bill REPs a combined transmission and distribution charge.

The Commission initially considered two different billing methods for cost-recovery by ERCOT transmission service providers (TSPs). In the direct-billing approach, TSPs would bill retail electric providers (REPs) directly for transmission service. This would result in REPs receiving over 30 bills for transmission service and a bill for distribution service for each distribution service area. Under the other method, TSPs would bill distribution utilities for

69 Terms and Conditions of Transmission and Distribution Utilities' Retail Distribution Service, Project No. 22187. PUC Docket No. 22348 Consolidated Interim Order Page 29 SOAH Docket Nos. 473-00-1013 transmission service, and the distribution utility in each area would bill REPs for all transmission charges and for distribution service. Several parties proposed modifications of the direct-billing approach, such as using the ERCOT settlement system, to make the direct-billing approach simpler to implement. Ultimately, the Commission was presented, through pre-filed and live testimony, a number of models for the recovery of transmission charges within ERCOT. The options presented by the parties included (1) the “Order No. 14 model”, (2) the “Staff Exhibit 3 model”, and (3) the “Direct Billing model,” as well as variations on each of these.

In Order No. 14, the Commission considered whether ERCOT transmission service providers (TSPs) should recover transmission costs by billing retail electric providers (REPs) for transmission service either directly or through an ERCOT settlement process, or by billing a distribution utility, which would in turn bill the REP.70 There, the Commission concluded that the ERCOT TSPs should bill distribution utilities, which would then bill REPs a combined T&D charge.71 Specifically, under the Order No. 14 model, each TSP would bill each distribution company based on its share of the ERCOT four coincident peaks (4CP). The distribution company would then bill each REP a combined T&D charge based on each REP’s customer composition and billing determinants.72

Alternatively, under the Staff Exhibit 3 model, transmission costs for ERCOT utilities would be allocated on a 4CP basis, then collected from the REP, based on statewide rates, either through a distribution utility or through an ERCOT settlement process.73 Finally, the Direct Billing model contemplates that TSPs bill REPs for transmission service directly, without going through a distribution company or settlement procedure.74

The Commission concludes that the ERCOT TSPs should bill T&D utilities, which would then bill REPs a combined T&D charge. The direct-billing method, in which TSPs bill REPs directly for transmission service would introduce a new billing relationship in addition to