Who are You and Who do you Want to be in 2017?

Implementing a business plan and establishing a few areas of focus doesn’t have to be an expensive, business-coached, multipage document. Simply establishing a few observations about who you are now, who you would like to become and things you would like to change, learn or develop can set up some meaningful strategies for the year to come.

In the following sections, we provide a framework for you to think about your business and make some plans for where you would like to be in 12 months’ time.

It is totally acceptable to plan to be the same as you are now in many facets of your profession, while there are some things that you should still contemplate developing. See the final section on technology developments and compliance processes—at the very least you will need to adjust your systems and services to embrace these coming changes. The Bookkeeping Business

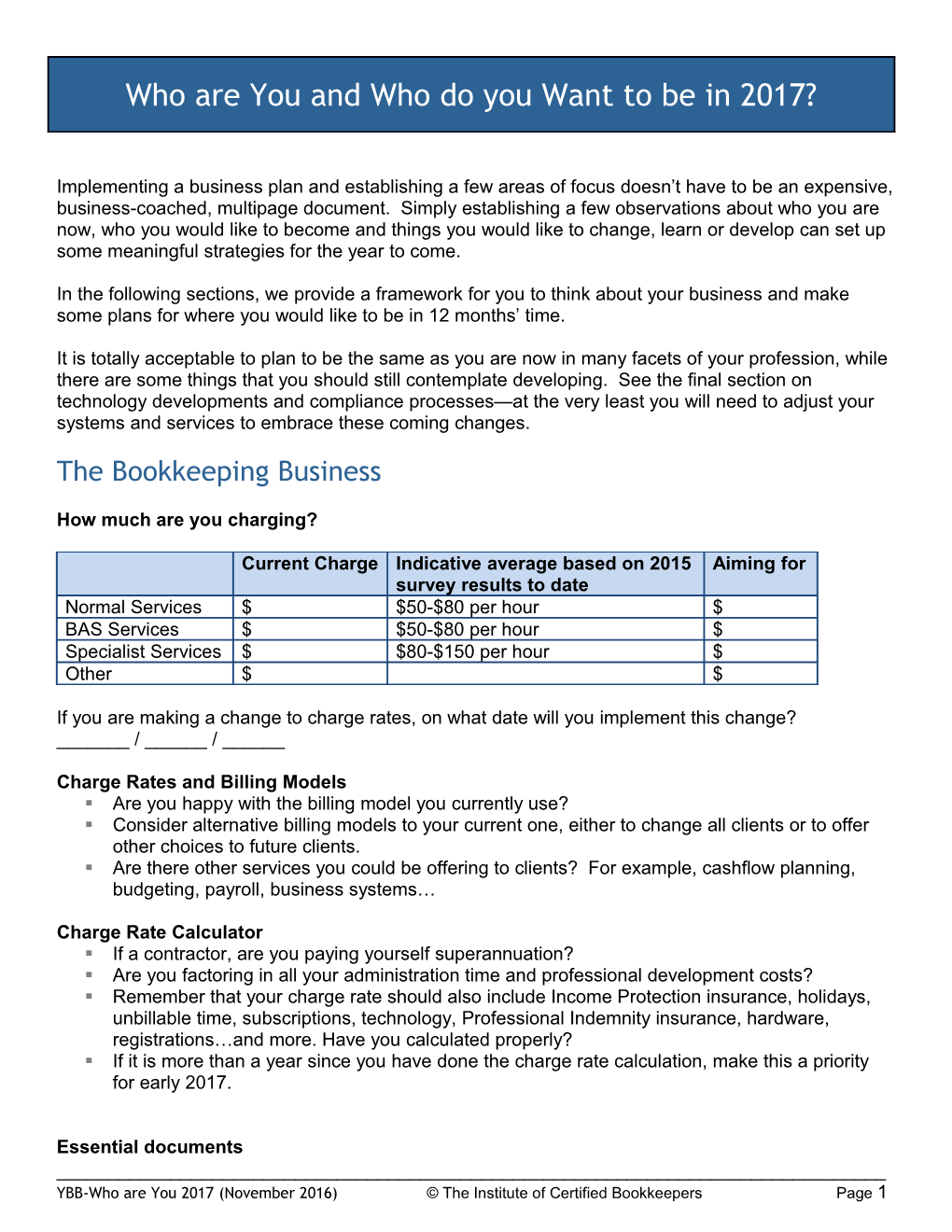

How much are you charging?

Current Charge Indicative average based on 2015 Aiming for survey results to date Normal Services $ $50-$80 per hour $ BAS Services $ $50-$80 per hour $ Specialist Services $ $80-$150 per hour $ Other $ $

If you are making a change to charge rates, on what date will you implement this change? ______/ ______/ ______

Charge Rates and Billing Models . Are you happy with the billing model you currently use? . Consider alternative billing models to your current one, either to change all clients or to offer other choices to future clients. . Are there other services you could be offering to clients? For example, cashflow planning, budgeting, payroll, business systems…

Charge Rate Calculator . If a contractor, are you paying yourself superannuation? . Are you factoring in all your administration time and professional development costs? . Remember that your charge rate should also include Income Protection insurance, holidays, unbillable time, subscriptions, technology, Professional Indemnity insurance, hardware, registrations…and more. Have you calculated properly? . If it is more than a year since you have done the charge rate calculation, make this a priority for early 2017.

Essential documents ______YBB-Who are You 2017 (November 2016) © The Institute of Certified Bookkeepers Page 1 Yes No Planning to Engagement letters Task reports Authority forms (e.g., lodge BAS, SC charge statement, supplier payments, etc.) Other

A task report is an email or communication to the business owner after each batch of work that provides information to the owner about what you have done. This should either be included in your invoice to the client, or provided in addition to the invoice.

If you are not currently using either of these documents with your clients, at the very least keep your own notes about what work you do for each client on each occasion.

How many clients?

Current Aiming for Weekly Monthly Quarterly Ad hoc consulting Regular payroll Verify and lodge BAS End of year payroll End of year accounts Supervision Mentoring Training of clients Other

Review and Update Your Business Information and Marketing

. Do you have a professional email address? . Does your email, website and all online activity display your professional associations, accreditations, logo and so on—are all of your communications to peers and potential clients consistent and congruent? . Do you have a website—if so, is it time to update the information on it? . Are you linked to software companies and industry associations? . Have you added your information to ICB Find a Bookkeeper? . Do you have a social media presence and/or blog? . Consider joining business networking groups in your area or industry specialisation.

What Type of Clients?

______YBB-Who are You 2017 (November 2016) © The Institute of Certified Bookkeepers Page 2 Who is your ideal client? Think about size of business, location if relevant, employees, software in use, industry and so on. Do you want to focus on a particular niche type of client? Or do you want to be able to look after anyone who rings you? If you are clear about who your ideal client is, then it is easier to make decisions about which clients are a good fit for you and which ones to say “No” to.

In reviewing your current mix of clients and what you are aiming for, review also your own invoicing cycle and process, average debtor days and KPIs relevant to your business. Planning Your Year

How much time are you working?

Current Indicative average based on Aiming for 2015 survey results to date BAS time 31-50 hours per week Non-BAS time 21-40 hours per week Holidays planned

Time Management

. Do you need to improve your time management to work more effectively and efficiently? . Do you need to change the structure of your working week? For example, you may need to put in place stronger boundaries around work time and personal time. . Consider structuring your work days for specific periods that are dedicated to specific tasks, e.g., returning phone calls, dealing with administration, reading and answering emails, billable work time. . Consider whether you can delegate some of your tasks to others and/or outsource to other providers so that you free up your available work and billable time. . Do you need to say “No” to some things? For example, not every client may be suitable for you, not every Facebook thread requires your attention and not every networking group is relevant for you. Be discerning about where you spend your professional development time. . Consider using an online project management solution for better client and task management.

Style of Operation

Currently Indicative average based on Aiming for 2015 survey results to date Just me 85% Casual or ad hoc 20% engage others Formally engage 30% others part time Formally engage 55% others full time Embrace a network or franchise Become part of another network Become an expert ______YBB-Who are You 2017 (November 2016) © The Institute of Certified Bookkeepers Page 3 advisor for related services Create a network of affiliated providers to refer business to each other Retire Sell business

Lifestyle Factors

. Do you want to continue working the same amount? . Do you want to reduce or expand? . Do you need to start planning for retirement of sale of business? . Are you happy doing what you are doing? . Do you take regular weekends, public holidays and holidays each year? . Consider whether being a contractor or employee is best for you—or perhaps a mixture of both? . Is working from home a good option? Or is it time you left the home office and found business premises?

Professional Development / CPE

Note ICB require 15 hours per year / TPB requires 45 hours every 3 years

Number Hours Total ICB network meetings 2 hrs each ICB monthly newsletter 2 hrs each ICB national conference 5.5 hrs ICB End of year workshop 6.5 hrs ICB Technical webinars 1.5 hrs Software roadshows Software annual conference Software training ATO webinars TPB forums FairWork information Other training to acquire specific skills Current technology solutions to assist business systems Become an accredited partner of accounting software and technology solutions Total Technology Developments - Automated (Artificial) Intelligence

______YBB-Who are You 2017 (November 2016) © The Institute of Certified Bookkeepers Page 4 2017 seems to be a year that everyone is going to talk about the development of artificial intelligence in the world of the bookkeeper.

Your reaction is to be the expert to bring this to fruition in a way that makes you more effective.

We are used to bank feeds and various forms of auto-coding and auto-processing. For many, this has been the first step into using automated intelligence to make us more efficient.

In 2017 set your plans for what automated intelligence you are going to embrace: . Bank feeds . Automatic payment gateways integrated with software . SuperStream (this should now be implemented for all employers) . Optical Character Recognition (OCR) invoice processing packages, (e.g., Smartbill, Receipt Bank, Shoeboxed, Entryless) . Employee portals; client portals; secure communication channels . Digital authenticated signature solutions . Enhanced electronic lodgement via Small Business Reporting solutions and gateways from within accounting software . Client management dashboards, (e.g., GovReports, Xero Practice Manager, MYOB dashboard, Reckon dashboard, Intuit QBO dashboard)

Keep watching the software and be on top of what solutions they are bringing to automate your world. Through effective use of their best features, you will become the automated intelligence expert, bringing the best software solutions into your own businesses systems and also for your clients. Changes to Compliance Processes

2017 is also going to be the year for changes to the way we do things, because the Government is introducing various developments. Your year will include being on top of these changes and implementing them for you and your businesses.

1. Simpler BAS This will apply for all small businesses with a turnover less than $10m. Starting officially on 1 July 2017, but new businesses may be able to adopt the system earlier. This will change the way we report GST on the BAS.

2. Single Touch Payroll This will apply to all “substantial” employers, (more than 20 employees), from 1 July 2018, with the option to enter the system for all from 1 July 2017. It’s here and it will need to be considered for every employer.

3. Fair Work Fair Work seems to be increasing its activities against employers. There is a great amount of work to assist employers in understanding their obligations and avoiding potential Fair Work prosecution.

4. ATO BAS Agent Portal The portal will be undergoing evolution during 2017. This will change your processes and approach.

Consider your strategies to stay informed and embrace these changes.

______YBB-Who are You 2017 (November 2016) © The Institute of Certified Bookkeepers Page 5 ICB Bookkeepers Helping Bookkeepers All of the above processes, developments and considerations about you and your professional bookkeeping services are informed and assisted by ICB news updates, resources, checklists templates, newsletters, network meetings and technical support. Related References ICB – Your Bookkeeping Business ICB – Charge Rates and Fixed Fees ICB – Building Your Bookkeeping Business ICB – CPE ICB – Engagement Letter ICB – Business Plan ICB – Bookkeepers Task Report ICB - How to go on a Holiday ICB – Bookkeepers Starting Out ICB – KPIs for Bookkeepers

______YBB-Who are You 2017 (November 2016) © The Institute of Certified Bookkeepers Page 6