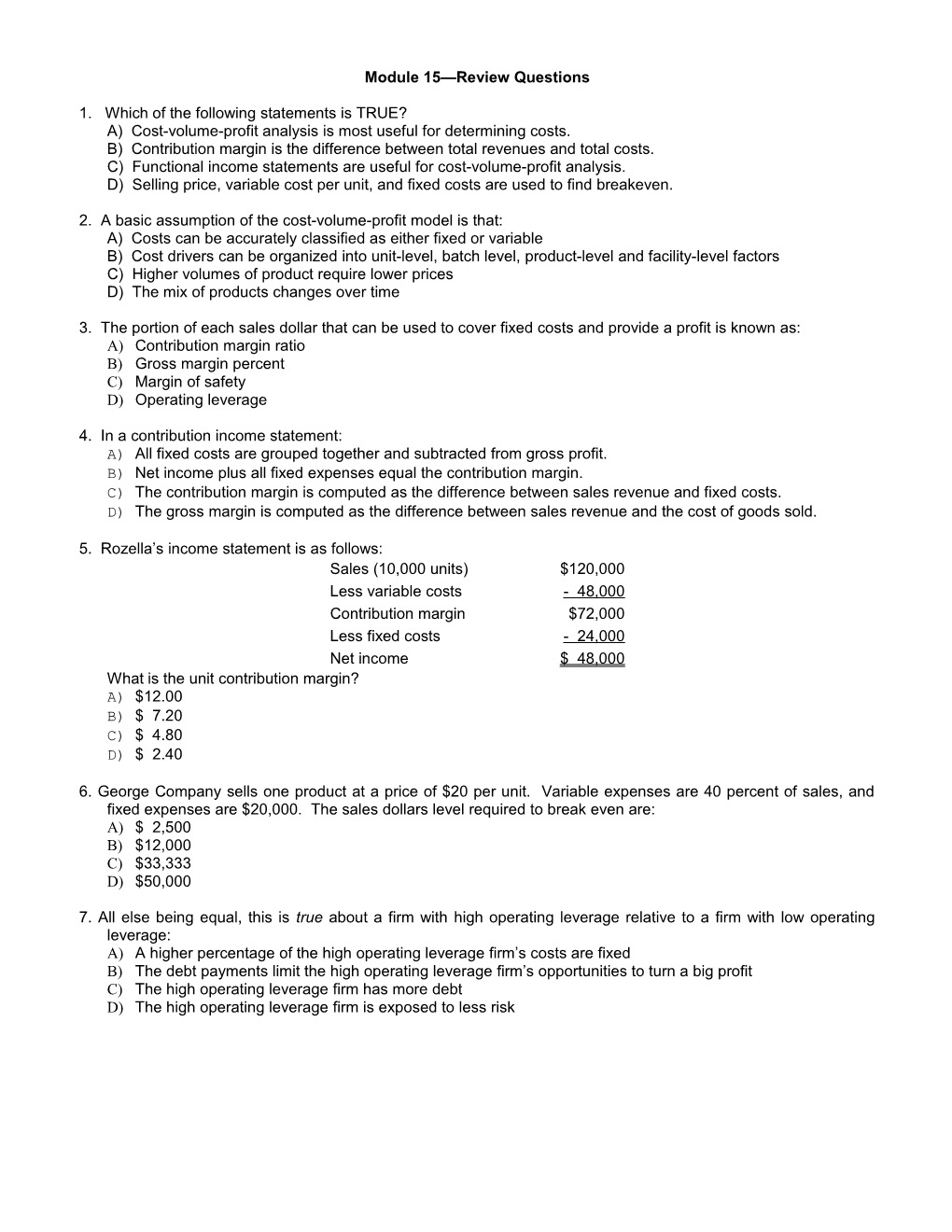

Module 15—Review Questions

1. Which of the following statements is TRUE? A) Cost-volume-profit analysis is most useful for determining costs. B) Contribution margin is the difference between total revenues and total costs. C) Functional income statements are useful for cost-volume-profit analysis. D) Selling price, variable cost per unit, and fixed costs are used to find breakeven.

2. A basic assumption of the cost-volume-profit model is that: A) Costs can be accurately classified as either fixed or variable B) Cost drivers can be organized into unit-level, batch level, product-level and facility-level factors C) Higher volumes of product require lower prices D) The mix of products changes over time

3. The portion of each sales dollar that can be used to cover fixed costs and provide a profit is known as: A) Contribution margin ratio B) Gross margin percent C) Margin of safety D) Operating leverage

4. In a contribution income statement: A) All fixed costs are grouped together and subtracted from gross profit. B) Net income plus all fixed expenses equal the contribution margin. C) The contribution margin is computed as the difference between sales revenue and fixed costs. D) The gross margin is computed as the difference between sales revenue and the cost of goods sold.

5. Rozella’s income statement is as follows: Sales (10,000 units) $120,000 Less variable costs - 48,000 Contribution margin $72,000 Less fixed costs - 24,000 Net income $ 48,000 What is the unit contribution margin? A) $12.00 B) $ 7.20 C) $ 4.80 D) $ 2.40

6. George Company sells one product at a price of $20 per unit. Variable expenses are 40 percent of sales, and fixed expenses are $20,000. The sales dollars level required to break even are: A) $ 2,500 B) $12,000 C) $33,333 D) $50,000

7. All else being equal, this is true about a firm with high operating leverage relative to a firm with low operating leverage: A) A higher percentage of the high operating leverage firm’s costs are fixed B) The debt payments limit the high operating leverage firm’s opportunities to turn a big profit C) The high operating leverage firm has more debt D) The high operating leverage firm is exposed to less risk 8. Assume the Mountain Furniture Company sells two kinds of picnic tables, pine and redwood. Mountain sells one pine table for every redwood table, the following revenue and cost information is available. Pine Table Redwood Table Unit selling price $400 $1,200 Unit variable costs $250 $ 600 Unit contribution margin $150 $ 600 Fixed costs per month: $18,000 Calculate Mountain Furniture’s current breakeven sales volume in total units. A) 120 B) 48 C) 30 D) 72

Exercise The Dorkville Co. sells its product for $100 per unit, has variable unit costs of $60, and has total fixed costs of $200,000.

REQUIRED: a. Breakeven volume in units.

b. Volume required to earn an income before taxes of $50,000.

Exercise The Perry Medical Laboratory income statement for the month of November 2012 is presented below. Sales $ 4,000,000 Less variable costs (2,800,000) Contribution margin $ 1,200,000 Less fixed costs (600,000) Income before taxes $ 600,000 Income taxes (40%) 240,000 Net income $ 360,000 REQUIRED: a. Breakeven volume in dollars.

b. Sales required to earn a monthly net income of $612,000.

c. Margin of safety ratio for November.

d. If sales increased by 10%, what would be the % impact on income? ______%

B. What are 4 reasonable ways to increase the margin of safety ratio?

1.

2.

3.

4.

C. 1. If variable costs are zero, then the contribution margin per unit must equal______.

2. If fixed costs are zero, then the operating leverage ratio must equal ______.