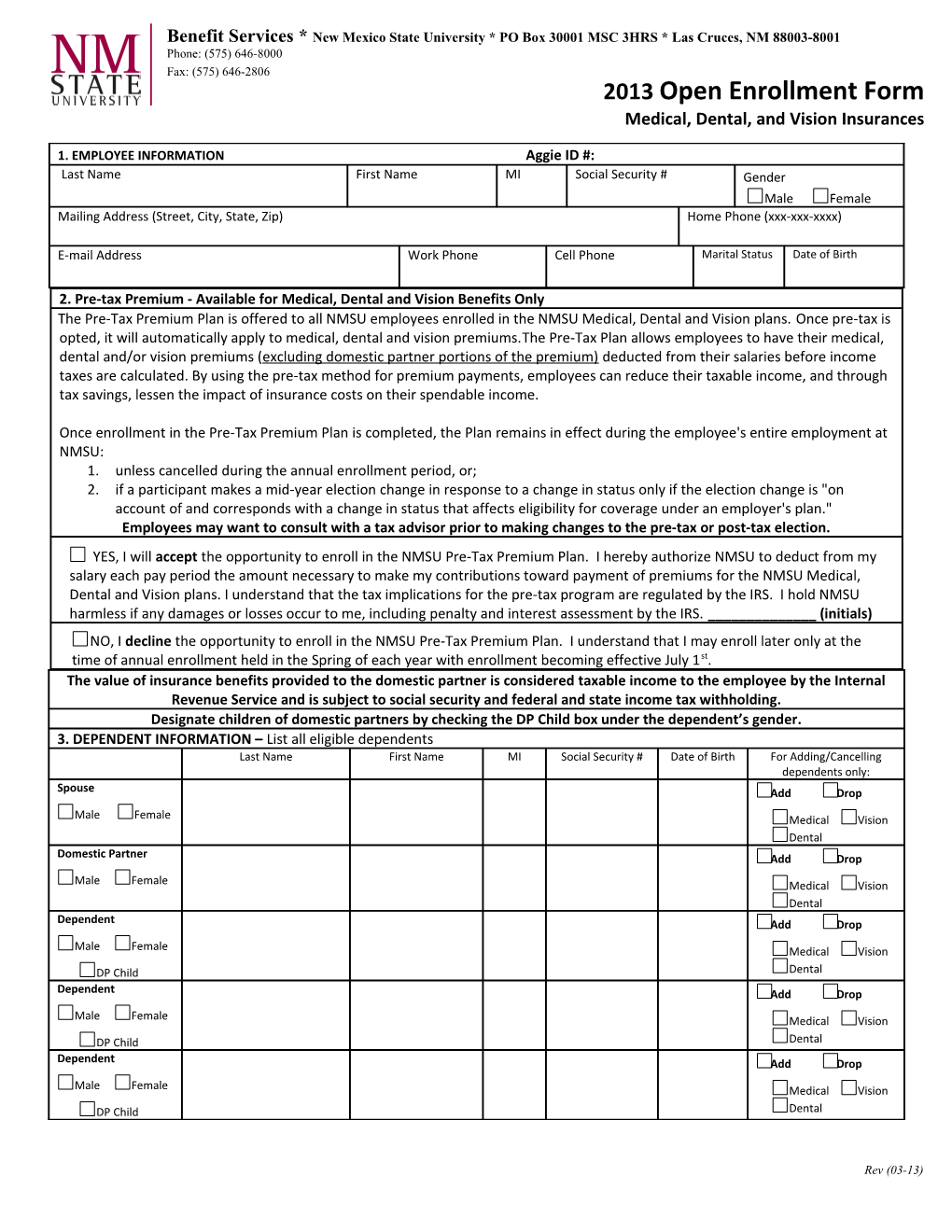

Benefit Services * New Mexico State University * PO Box 30001 MSC 3HRS * Las Cruces, NM 88003-8001 Phone: (575) 646-8000 Fax: (575) 646-2806 2013 Open Enrollment Form Medical, Dental, and Vision Insurances

1. EMPLOYEE INFORMATION Aggie ID #: Last Name First Name MI Social Security # Gender

Male Female Mailing Address (Street, City, State, Zip) Home Phone (xxx-xxx-xxxx)

E-mail Address Work Phone Cell Phone Marital Status Date of Birth

2. Pre-tax Premium - Available for Medical, Dental and Vision Benefits Only The Pre-Tax Premium Plan is offered to all NMSU employees enrolled in the NMSU Medical, Dental and Vision plans. Once pre-tax is opted, it will automatically apply to medical, dental and vision premiums.The Pre-Tax Plan allows employees to have their medical, dental and/or vision premiums (excluding domestic partner portions of the premium) deducted from their salaries before income taxes are calculated. By using the pre-tax method for premium payments, employees can reduce their taxable income, and through tax savings, lessen the impact of insurance costs on their spendable income.

Once enrollment in the Pre-Tax Premium Plan is completed, the Plan remains in effect during the employee's entire employment at NMSU: 1. unless cancelled during the annual enrollment period, or; 2. if a participant makes a mid-year election change in response to a change in status only if the election change is "on account of and corresponds with a change in status that affects eligibility for coverage under an employer's plan." Employees may want to consult with a tax advisor prior to making changes to the pre-tax or post-tax election. YES, I will accept the opportunity to enroll in the NMSU Pre-Tax Premium Plan. I hereby authorize NMSU to deduct from my salary each pay period the amount necessary to make my contributions toward payment of premiums for the NMSU Medical, Dental and Vision plans. I understand that the tax implications for the pre-tax program are regulated by the IRS. I hold NMSU harmless if any damages or losses occur to me, including penalty and interest assessment by the IRS. ______(initials) NO, I decline the opportunity to enroll in the NMSU Pre-Tax Premium Plan. I understand that I may enroll later only at the time of annual enrollment held in the Spring of each year with enrollment becoming effective July 1st. The value of insurance benefits provided to the domestic partner is considered taxable income to the employee by the Internal Revenue Service and is subject to social security and federal and state income tax withholding. Designate children of domestic partners by checking the DP Child box under the dependent’s gender. 3. DEPENDENT INFORMATION – List all eligible dependents Last Name First Name MI Social Security # Date of Birth For Adding/Cancelling dependents only: Spouse Add Drop

Male Female Medical Vision Dental Domestic Partner Add Drop

Male Female Medical Vision Dental Dependent Add Drop Male Female Medical Vision DP Child Dental Dependent Add Drop Male Female Medical Vision DP Child Dental Dependent Add Drop Male Female Medical Vision DP Child Dental

Rev (03-13) Dependent Add Drop Male Female Medical Vision DP Child Dental

4. MEDICAL PLAN New Enrollment Change to Existing Plan NO Change to Existing Plan Cancellation I DECLINE/WAIVE MEDICAL COVERAGE Required by Risk Management Division - If you waived coverage – Do you have coverage through another means? Yes No If Yes, with whom do you have coverage? If No, why did you waive coverage? *New Mexico Health Investment Plan – Acknowledgement of Service Charges Please initial next to each statement which indicates your understanding of the Health Savings Account (HSA) requirements associated with the NM HIP. Employees electing coverage under the NM HIP and setting up the HSA are required to discuss all aspects of the program with Health Equity at 866-346-5800. 1. ______I understand the NMHIP is not open to me if I am a Domestic Partner of an eligible employee. 2. ______I am not eligible to open an HSA if I am currently contributing to the Flexible Spending Account (FSA) for health care expenses. 3. ______I understand for calendar year 2013 the maximum contribution limit for individual coverage is $3,100. 4. ______I understand for calendar year 2013 the maximum contribution limit for family coverage is $6,250. 5. ______I understand that I may be charged the below fees by Health Equity for my HSA account. 6. ______I understand I am NOT ELIGIBLE for this plan if I am Medicare eligible or covered by another health plan. 7. ______I understand that I must complete the Health Equity HSA Authorization Form if I want to enroll in the HSA and send it to the Presbyterian Health Plan.

Eligibility and contribution limits to your health savings account (HSA) are determined by the effective date of the NM HIP. If you’re covered as of July 1, you’re considered an eligible individual for the entire year and you’re not required to pro-rate your contributions. If you cease to be an eligible individual during the next calendar year, any funding over the prorated amount is considered an excess contribution and subject to a penalty and income tax. For further information or to review eligibility, please contact HealthEquity Member Services at 866-346-5800.

Account Closing Fee $25.00 Check reimbursement Fee $2.00 for paper. No fee for electronic fund transfer Debit card replacement/additional card (3 free) $5.00 each additional if lost, stolen, or damaged Excessive contribution Refund Request $20.00 Monthly paper account statement mailed $1.00 per monthly statement. No fee for electronic statements Ongoing individual fee(if you keep account after leaving the state plan) $3.95 Overdraft or Insufficient Funds $20.00 per item Return deposited item $20.00 per item Stop check services $20.00 Stop payment request $20.00 per item Investments No fee 5. DENTAL PLAN New Enrollment Change to Existing Plan NO Change to Existing Plan Cancellation I DECLINE/WAIVE DENTAL COVERAGE Required by Risk Management Division - If you waived coverage – Do you have coverage through another means? Yes No If Yes, with whom do you have coverage? If No, why did you waive coverage?

Rev (03-13) 6. VISION PLAN New Enrollment Change to Existing Plan NO Change to Existing Plan Cancellation I DECLINE/WAIVE VISION COVERAGE I certify that all information supplied on this form is true to the best of my knowledge. I understand that if I knowingly and with intent to defraud any insurance company or if I file a statement containing materially false information, or conceal, for the purpose of misleading, information concerning any material of fact thereto commits a fraudulent insurance act which is a crime, I will be prosecuted to the fullest extent of the law and will be prohibitted access to RMD benefits in the future.

I understand that all benefits for myself and my eligible dependents will be provided in accordance with the terms of the plan(s) in which I have enrolled. I agree to abide by the terms and conditions provided in the plan(s). I authorize the carrier to cooridinate benefits and/or reimbursements with other health or dental plans or insurance companies.

I authorize my employer to reduce my salary in an amount necessary to pay for my benefit elections.

Employee Signature: ______Date: ______

Important Information: All fields must be completed. If adding a new dependent, documentation supporting the dependent’s eligibility for coverage must be attached. All documents must be received by Benefit Services no later than 5:00 MST on May 10, 2013 to be considered received by the deadline to enroll. All changes/elections requested will be effective July 1, 2013. Enrollment in the NM HIP allows enrollment in the Health Savings Account (HSA) if the employee is not currently contributing to the Health Flexible Spending Account. Additional forms will be required to enroll in the HSA.

Rev (03-13)