REAL CLIENT MANAGED PORTFOLIOS MEMORANDUM

TO: Real Client Managed Portfolios Fall 2007 Class FROM: Linden Lu, Yanlei Xu, Gleb Zarkh, Mohamed Ibrahim SUBJECT: American Eagle Outfitters, Inc. Investment Recommendation DATE: November 13, 2007

Recommendation: SELL 450 SHARES @ Market Value

Company Overview American Eagles Outfitters is a leading retail company which designs, markets and sells its own brand of clothing, which include intimates, jeans, graphic T’s, accessories, footwear, outwear, basics etc. The target customers are 15 to 25 years old. American Eagles’ products are sold not only domestically but also internationally through e-commerce. It’s primarily a mall-based store with limited stand-alone stores and internet sales. In 2006, AE introduced 2 new brands: Martin+Osa operates as a separate brand targeting 20-40 year old men and women; Aerie runs as a sub-brand under American Eagles’ brand name selling intimates for women.

Current Position : American Eagles’ shares were bought several times in transaction history from 1999 to 2000, resulting to 1000 shares in total. AE underwent stock split 3 times in 2001, 2005 and 2006 respectively. We sold 600 and 700 shares in 2005 and sold 400 shares in Nov 06. Currently, AEO represents 11.2% of the total portfolio in terms of market value before selling 300 shares of CPRT. We have 1950 shares of AEO trading at $22.00 as of Nov 12th, 2007 with a weighted cost 0f $5.23 per share for an unrealized gain of $32,710 or 321.04%.

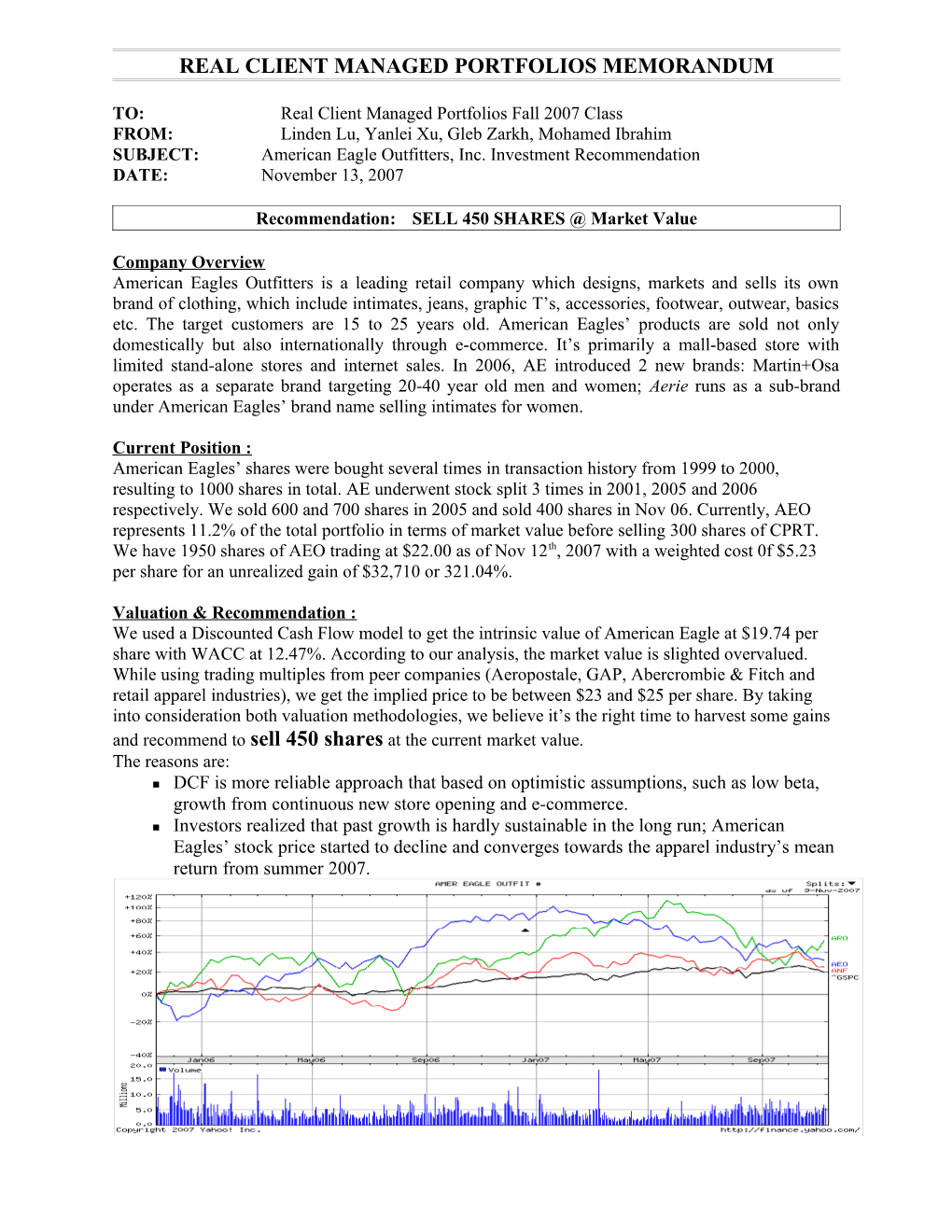

Valuation & Recommendation : We used a Discounted Cash Flow model to get the intrinsic value of American Eagle at $19.74 per share with WACC at 12.47%. According to our analysis, the market value is slighted overvalued. While using trading multiples from peer companies (Aeropostale, GAP, Abercrombie & Fitch and retail apparel industries), we get the implied price to be between $23 and $25 per share. By taking into consideration both valuation methodologies, we believe it’s the right time to harvest some gains and recommend to sell 450 shares at the current market value. The reasons are: DCF is more reliable approach that based on optimistic assumptions, such as low beta, growth from continuous new store opening and e-commerce. Investors realized that past growth is hardly sustainable in the long run; American Eagles’ stock price started to decline and converges towards the apparel industry’s mean return from summer 2007.