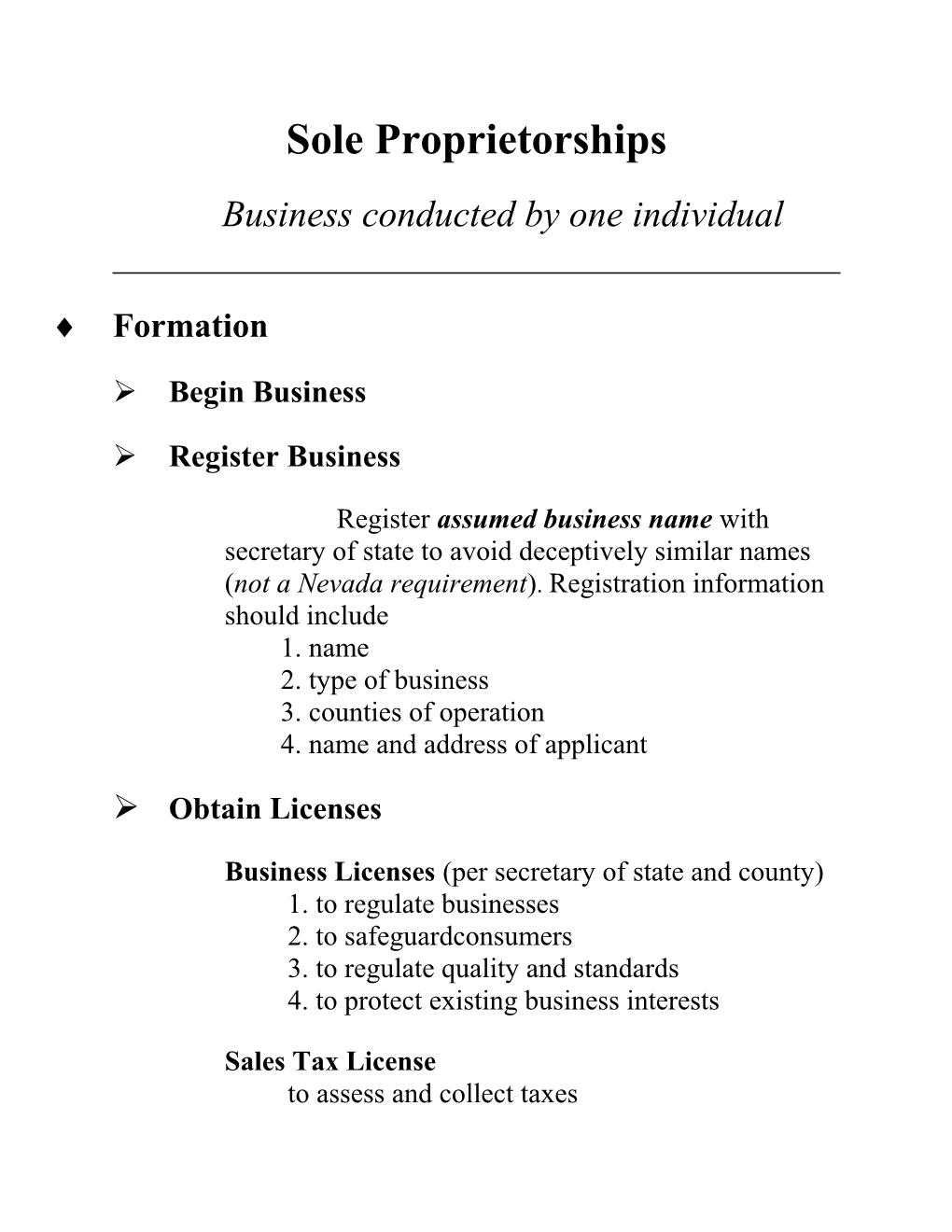

Sole Proprietorships Business conducted by one individual

Formation

Begin Business

Register Business

Register assumed business name with secretary of state to avoid deceptively similar names (not a Nevada requirement). Registration information should include 1. name 2. type of business 3. counties of operation 4. name and address of applicant

Obtain Licenses

Business Licenses (per secretary of state and county) 1. to regulate businesses 2. to safeguardconsumers 3. to regulate quality and standards 4. to protect existing business interests

Sales Tax License to assess and collect taxes Management

By proprietor

Liability

Business liability: business assets (home, savings accounts, cars)

Personal liability: personal assets (desks, chairs, bank accounts)

Contract Liability Limitations

Contracts can limit responsibility for business debts:

“Obligations due on or created by the contract, or a breach thereof, will be limited to and payable solely from the business’s assets.”

“Personal assets of proprietor shall not be liable for debts created by this contract, or a breach thereof.”

Bonding and Insurance

Bonding: performance of contract Insurance: liability (property damage, theft) Disadvantages: unavailable to high-risk and new businesses Taxation Considerations

Business profits = personal income

Advantages: Individual tax rates are generally lower than business rates. Owner offsets business income with other losses.

Report to IRS for informational purposes.

Tax identification number Identifies business for state and federal governments (functions as a business SSN) Required for hiring employees

Termination

Upon Death Termination is automatic upon death of proprietor.

Upon Sale Selling: business assets + goodwill (reputation)

Sale price: Look to other business sales or business income for specified time Sole Proprietorship Definition Business conducted by one individual Advantages Simplicity of formation Flexibility of management Disadvantages Involuntary termination upon proprietor’s death Unlimited liability of sole proprietor Formation Procedures 1. File assumed business name with secretary of state. 2. Publish notice of intent to operate under assumed business name. 3. Contact state and local licensing divisions to obtain required licenses and permits. 4. Apply for sales tax permit from state and local revenue agencies. 5. If the proprietor intends to hire employees a. Apply for a federal tax identification number (IRS Form SS-4) b. Apply for a state identification number, if different from the IRS. c. Contact the IRS to establish employee withholding procedures. d. Contact appropriate state agencies to make arrangements for unemployment and workers’ compensation premium payments.