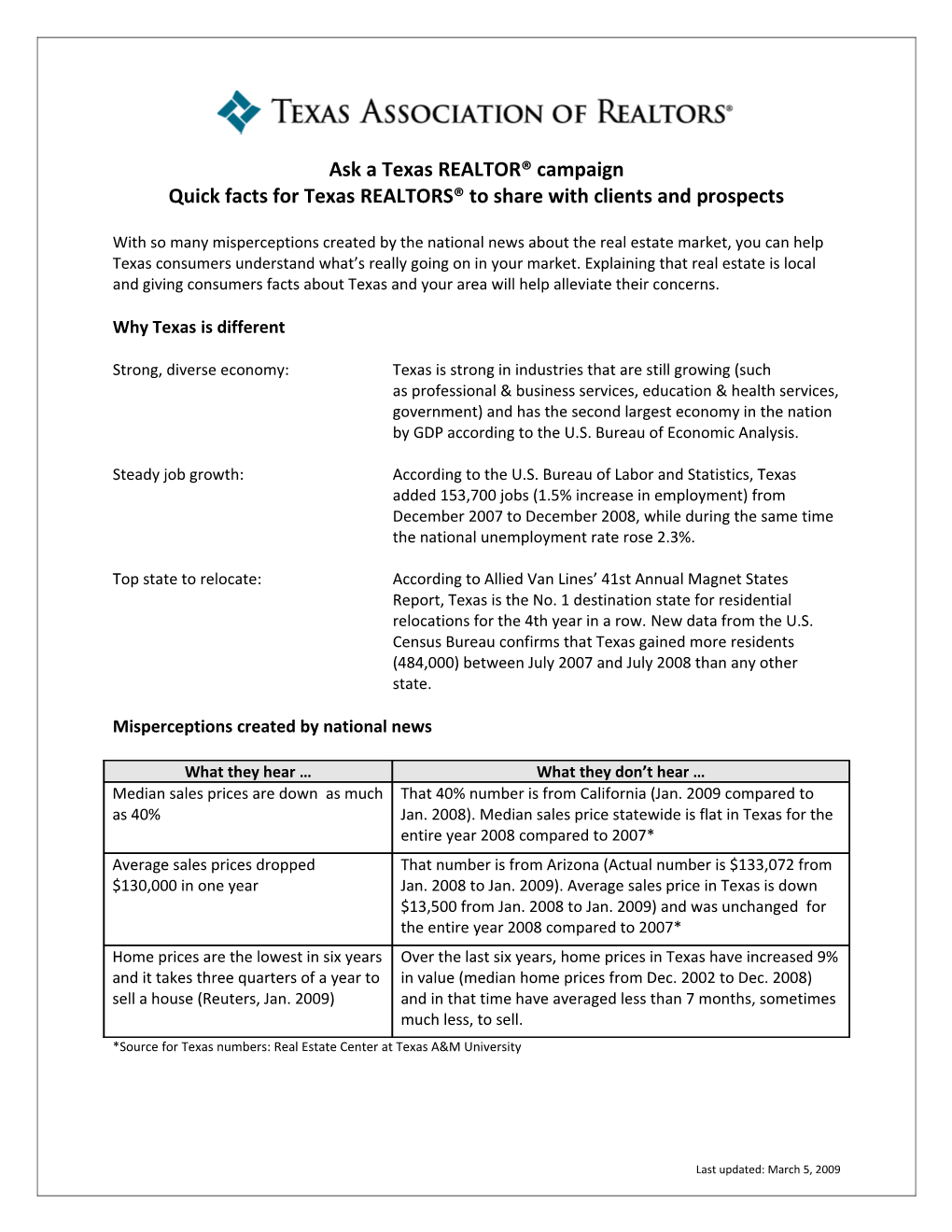

Ask a Texas REALTOR® campaign Quick facts for Texas REALTORS® to share with clients and prospects

With so many misperceptions created by the national news about the real estate market, you can help Texas consumers understand what’s really going on in your market. Explaining that real estate is local and giving consumers facts about Texas and your area will help alleviate their concerns.

Why Texas is different

Strong, diverse economy: Texas is strong in industries that are still growing (such as professional & business services, education & health services, government) and has the second largest economy in the nation by GDP according to the U.S. Bureau of Economic Analysis.

Steady job growth: According to the U.S. Bureau of Labor and Statistics, Texas added 153,700 jobs (1.5% increase in employment) from December 2007 to December 2008, while during the same time the national unemployment rate rose 2.3%.

Top state to relocate: According to Allied Van Lines’ 41st Annual Magnet States Report, Texas is the No. 1 destination state for residential relocations for the 4th year in a row. New data from the U.S. Census Bureau confirms that Texas gained more residents (484,000) between July 2007 and July 2008 than any other state.

Misperceptions created by national news

What they hear … What they don’t hear … Median sales prices are down as much That 40% number is from California (Jan. 2009 compared to as 40% Jan. 2008). Median sales price statewide is flat in Texas for the entire year 2008 compared to 2007* Average sales prices dropped That number is from Arizona (Actual number is $133,072 from $130,000 in one year Jan. 2008 to Jan. 2009). Average sales price in Texas is down $13,500 from Jan. 2008 to Jan. 2009) and was unchanged for the entire year 2008 compared to 2007* Home prices are the lowest in six years Over the last six years, home prices in Texas have increased 9% and it takes three quarters of a year to in value (median home prices from Dec. 2002 to Dec. 2008) sell a house (Reuters, Jan. 2009) and in that time have averaged less than 7 months, sometimes much less, to sell. *Source for Texas numbers: Real Estate Center at Texas A&M University

Last updated: March 5, 2009 Statewide facts

Texas real estate remains a strong long-term investment. The average home sales price in Texas has increased $15,600 from December 2004 to December 2008; over the same four years, median sales prices (half of all homes sold are priced higher and half are prices lower) increased $8,600.

Texas has a balanced market. Statewide, there was 6.4-month inventory of homes for sale at the end of 2008. Economists at the Real Estate Center at Texas A&M say that about 6 ½ months of inventory is a balanced market, where homes are being sold and prices continue to increase at a moderate pace.

Texas homes have appreciated steadily. Home-price appreciation in Texas has not fallen below zero in the last 16 years.

Texas has steady home value appreciation. Sales prices in places like California, Florida, Nevada, and Arizona have had rapid rises and drops in values, while Texas prices have remained relatively steady.

Texas homes are more affordable. Using a ratio of average family income compared to income required to qualify for a loan, the Housing Affordability Index indicates the proportion of the population that can afford to buy the average home sold during a certain time period. The higher the index, the more affordable the housing in that area. See the Housing Affordability Index Comparison chart below from the Real Estate Center at Texas A&M.

MLS Area 2008Q3 2007 2006 2005 2004 2003 2002

Texas 1.55 1.45 1.52 1.68 1.77 1.81 1.68

USA Total 1.27 1.11 1.09 1.23 1.34 1.61 1.43

Most borrowers are approved. According to a report by the National Association of REALTORS®, 91% of buyers in Texas were NOT rejected by lenders last year.

Great rates are available. See chart below from the Mortgage Bankers Association (MBA) and Freddie Mac from Feb. 27, 2009 on mortgage loan rates that are the lowest they have been in decades.

Type MBA Market Rates Freddie Mac Rates 30-Year Fixed Rate 5.14% 5.07% 15-Year Fixed Rate 4.73% 4.68% 1-Year ARM 6.13% 4.81%

First time buyer incentives. First time home buyers qualify for a $8,000 tax credit that does not have to be repaid if the buyer remains in the home for at lease three years.

Additional resources

Last updated: March 5, 2009 Your local association of REALTORS® and local MLS Real Estate Center at Texas A&M: www.recenter.tamu.edu TexasRealEstate.com (Inside the News): www.texasrealestate.com//web/3/31/

Last updated: March 5, 2009