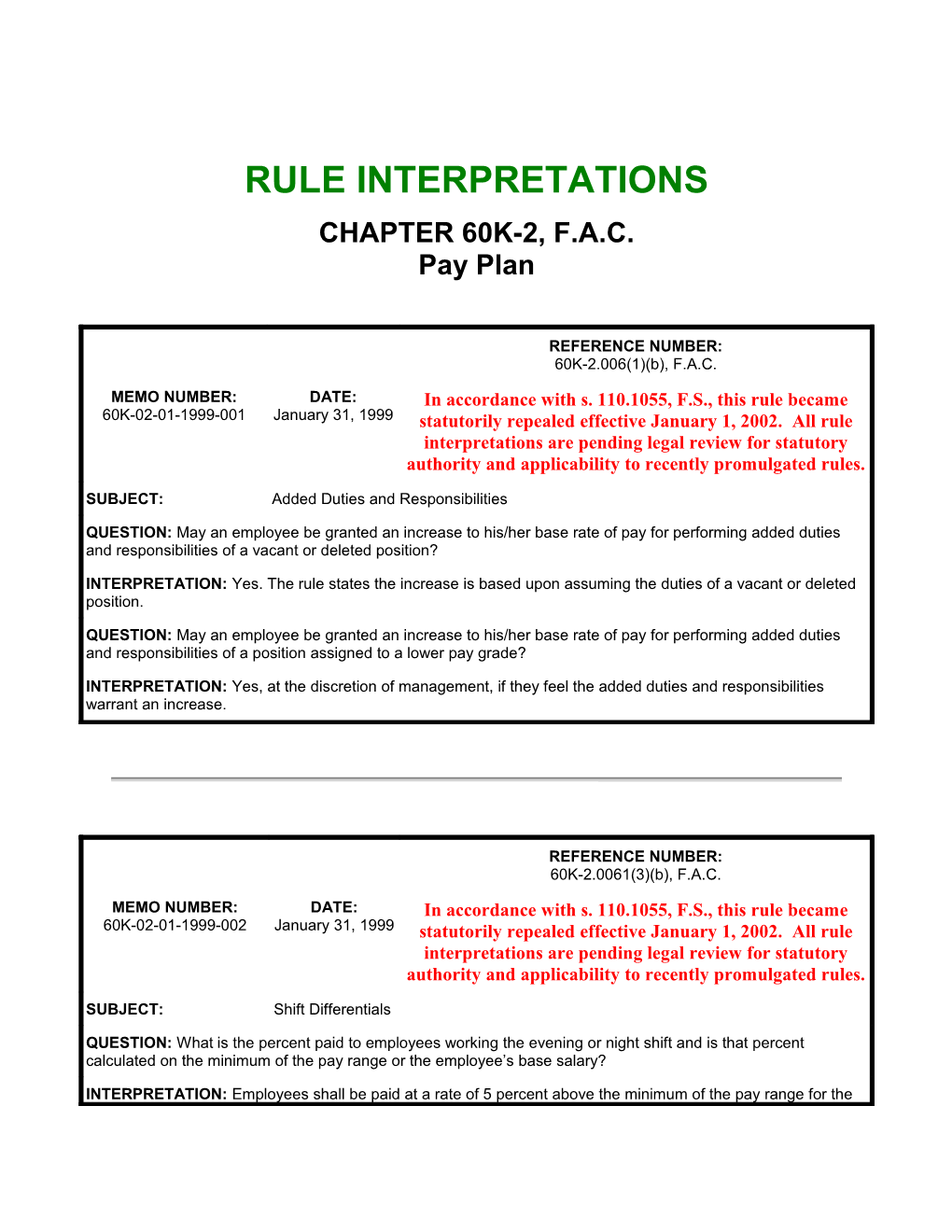

RULE INTERPRETATIONS CHAPTER 60K-2, F.A.C. Pay Plan

REFERENCE NUMBER: 60K-2.006(1)(b), F.A.C. MEMO NUMBER: DATE: In accordance with s. 110.1055, F.S., this rule became 60K-02-01-1999-001 January 31, 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Added Duties and Responsibilities

QUESTION: May an employee be granted an increase to his/her base rate of pay for performing added duties and responsibilities of a vacant or deleted position?

INTERPRETATION: Yes. The rule states the increase is based upon assuming the duties of a vacant or deleted position.

QUESTION: May an employee be granted an increase to his/her base rate of pay for performing added duties and responsibilities of a position assigned to a lower pay grade?

INTERPRETATION: Yes, at the discretion of management, if they feel the added duties and responsibilities warrant an increase.

REFERENCE NUMBER: 60K-2.0061(3)(b), F.A.C. MEMO NUMBER: DATE: In accordance with s. 110.1055, F.S., this rule became 60K-02-01-1999-002 January 31, 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Shift Differentials

QUESTION: What is the percent paid to employees working the evening or night shift and is that percent calculated on the minimum of the pay range or the employee’s base salary?

INTERPRETATION: Employees shall be paid at a rate of 5 percent above the minimum of the pay range for the class for working the evening shift and 10 percent above the minimum of the pay range for the class for working the night shift. If a current employee is receiving the differential calculated on their base rate of pay, when the position becomes vacant, the new employee shall have the differential calculated on the minimum of the pay range for the class.

REFERENCE NUMBER: 60K-2.0061(3)(b), F.A.C. MEMO NUMBER: DATE: In accordance with s. 110.1055, F.S., this rule became 60K-02-01-1999-003 January 31, 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Shift Differentials

QUESTION: What are the hours that determine the eligibility for payment of shift differential pay?

INTERPRETATION: In order to be eligible to receive a shift differential payment, if the time frame is not stated in the letter of approval for a particular class, the majority of hours worked shall be between 5 p.m. and 6 a.m.

REFERENCE NUMBER: 60K-2.0061(3)(c), and 60K-5.027(3), F.A.C. DATE: MEMO NUMBER: January 31, In accordance with s. 110.1055, F.S., these rules became 60K-02-01-1999-004 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: On-Call and Leave Status

QUESTION: May employees who are on approved annual or compensatory leave and who elect to make themselves available for on-call remain in on-call status?

INTERPRETATION: Yes. If employees make themselves available and management approves, such employees may remain in on-call status in accordance with the requirements of Section 60K-2.0061(3)(c), F.A.C.

QUESTION: May employees who are on approved sick leave and who elect to make themselves available for on- call remain in on-call status?

INTERPRETATION: No. An employee who qualifies for sick leave shall not remain in on-call status.

QUESTION: An employee has approval to use his personal holiday, but is also instructed to be on-call for that day. Is the employee entitled to receive on-call pay? If so, is it paid at the holiday rate?

INTERPRETATION: An employee who has received prior approval to use the personal holiday may not be placed on-call. If it becomes necessary, the supervisor may cancel the prior approval and require the employee to report to work and grant the personal holiday at a later date prior to June 30. If that action is not taken then the employee cannot be placed under the restrictions necessary to make the employee eligible to receive the on-call fee.

REFERENCE NUMBER: 60K-2.017(1) and 60L-1.004(1)(a), F.A.C. DATE: MEMO NUMBER: January 31, In accordance with s. 110.1055, F.S., these rules became 60K-02-01-1999-005 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Perquisites: Part-time Employees

QUESTION: Should part-time employees who receive a uniform allowance, laundry allowance, and a shoe allowance have their perquisite benefit prorated?

INTERPRETATION: No, not on the basis that they are employed as a part-time employee. Rather, the benefit should be granted based on what is reasonable and necessary, in the best interest of the state; and in accordance with Sections 60K-2.017, and 60L-1, F.A.C. Based on this criteria, it is possible that perquisite benefits granted to part-time employees will equal benefits granted to full-time employees for such items as uniforms, laundry allowance, and shoe allowance.

REFERENCE NUMBER: 60K-2.022(4) and 60K-2.006(1) & (2), F.A.C. MEMO NUMBER: DATE: In accordance with s. 110.1055, F.S., these rules became 60K-02-01-1999-006 January 31, 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Salary Increases

QUESTION: May salary increases of any type be made retroactive?

INTERPRETATION: No. Section 215.425, F.S., prohibits retroactive salary increases. Therefore, the Rules do not provide for retroactive salary increases. QUESTION: If an employee is promoted and adequate funds are not available due to budget limitations at the time of promotion to grant a promotional salary increase, can such increase be granted subsequently when funds become available?

INTERPRETATION: Yes, provided the promotional salary increase is granted within 12 months following the date of promotion. However, in accordance with Section 215.425, F.S., the salary increase can not be retroactive.

QUESTION: Can an agency, after establishing the initial appointment rate for an employee in accordance with the provisions of Section 60K-2.004, F.A.C., increase the employee’s rate of pay before he has completed six months of service?

INTERPRETATION: Yes, increases can be granted at any time provided the increase is in accordance with Section 60K-2.022, or 60K-2.006, F.A.C., or by a legislative mandate.

REFERENCE NUMBER: 60K-2.012(1), (2)(c), 60K-5.026(1), (6) and 60K-5.040(5), F.A.C. DATE: MEMO NUMBER: March 29, In accordance with s. 110.1055, F.S., these rules became 60K-02-03-1999-074 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Inter-agency Transfers: Holidays

QUESTION: When an employee moves directly from one agency to another and the holiday falls on the day after the termination date from the exit agency and prior to the beginning date with the receiving agency, which agency pays the employee for the holiday?

INTERPRETATION: Pursuant to Section 60K-5.026(6), F.A.C., as amended during Career Service Reform, if the holiday falls on the day after the employee’s date of termination, the exit agency should pay for the holiday. Therefore, the employee’s termination date must be the holiday. Section 60K-2.012(2)(c), F.A.C., and Section 60K-5.040(5), F.A.C., will be revised accordingly.

QUESTION: The employee terminates from state government but is employed by another State agency within 31 days, and a holiday falls between employment dates. Thus, the employee is in non-pay status the day before the holiday. Is either agency responsible for paying for the holiday?

INTERPRETATION: No. Even though there is no break in service as defined in Section 60K-5.022(1), F.A.C., the employee is not in pay status the day before the holiday as required by Section 60K-5.026(1), F.A.C. In addition, pursuant to Section 60K-2.012, F.A.C., and Section 60K-5.040, F.A.C., an employee cannot be paid if they are not employed by either agency.

MEMO NUMBER: DATE: REFERENCE NUMBER: 60K-2.0061(3)(c) and 60K-5.040(7), F.A.C.

March 29, In accordance with s. 110.1055, F.S., these rules became 60K-02-03-1999-075 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Salary Additives: On-Call/Call-Back

QUESTION: An employee who is on-call is required to return to work during the on-call period and returns to on- call status at the completion of the call-back. Is the on-call salary additive discontinued for the actual time the employee is called back to work?

INTERPRETATION: No. The employee will be paid "on-call" for the entire on-call period since the employee was on-call before and after the time he was called back to work.

QUESTION: An employee who is on-call is required to return to work during the on-call period and, for whatever reason, does not return to on-call status. Is the on-call salary additive discontinued for the actual time worked?

INTERPRETATION: Yes. When an employee is called back to work and does not return to on-call status at the completion of the call-back, the on-call salary additive shall be discontinued upon the employee’s return to work.

QUESTION: If an employee is scheduled to be on-call at the end of his normal workday and the employee is required to work beyond the end of his normal workday, when does the payment of on-call salary additive begin?

INTERPRETATION: The on-call salary additive will begin when the employee is released from work and actually goes on-call.

QUESTION: If an off-duty employee is contacted for assistance (whether on-call or not) and the employee is not required to return to the assigned work site is the employee entitled to the 2-hour minimum call-back?

INTERPRETATION: No. The 2-hour minimum call-back is only applicable if the employee is actually required to travel to the work site. If the employee is already present at the assigned work site or is able to render assistance without returning to the assigned work site, the employee is entitled only to the actual hours worked.

REFERENCE NUMBER: 60K-2.0021(13), 60K-2.010 and 60K-17.003(1), (6), F.A.C. DATE: MEMO NUMBER: August 20, In accordance with s. 110.1055, F.S., these rules became 60K-02-08-1999-119 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Reducing a Full-time Position to a Part-time Position

QUESTION: Due to budgetary constraints, a full-time position must be reduced to a part-time position. The incumbent in this position will have their salary reduced by half. Is that employee adversely affected and, therefore entitled to lay-off rights? If they are not adversely affected, is it a reduction in pay with appeal rights? INTERPRETATION: Yes, the employee is adversely affected. The language in Chapter 60K-17, F.A.C. referring to an abolishment of a "position" should be interpreted to include the abolishment of a part of a position. Therefore, an incumbent in a full-time position being changed to a part-time position is adversely affected and entitled to lay-off rights in accordance with Chapter 60K-17, F.A.C. If an employee with lower retention points elects to accept the part-time position, the employee would have re-call rights to a full-time position.

No, the employee is not considered to have received a reduction in pay. An employee’s salary is based on a set number of hours either worked or covered by leave per pay period on an hour-for-hour basis. Therefore, it would be considered a reduction in pay if the employee’s hourly rate of pay is reduced. In this circumstance, the hourly rate of pay is not reduced, only the number of hours to be paid each pay period is being reduced.

REFERENCE NUMBER: 60K-2.021(13) and 60K-5.022(11), F.A.C. DATE: MEMO NUMBER: August 20, In accordance with s. 110.1055, F.S., these rules became 60K-02-08-1999-120 1999 statutorily repealed effective January 1, 2002. All rule interpretations are pending legal review for statutory authority and applicability to recently promulgated rules.

SUBJECT: Criminal Justice Incentive Pay

QUESTION: Should Criminal Justice Incentive Pay (CJIP) be included when determining regular rate of pay for overtime and leave payments?

INTERPRETATION: Yes. CJIP is granted as a salary incentive for additional education to law enforcement officers in accordance with Section 943.22, F.S. According to Fair Labor Standards Act this type of payment shall be included in an employee’s regular rate of pay.

Updated: September, 1999