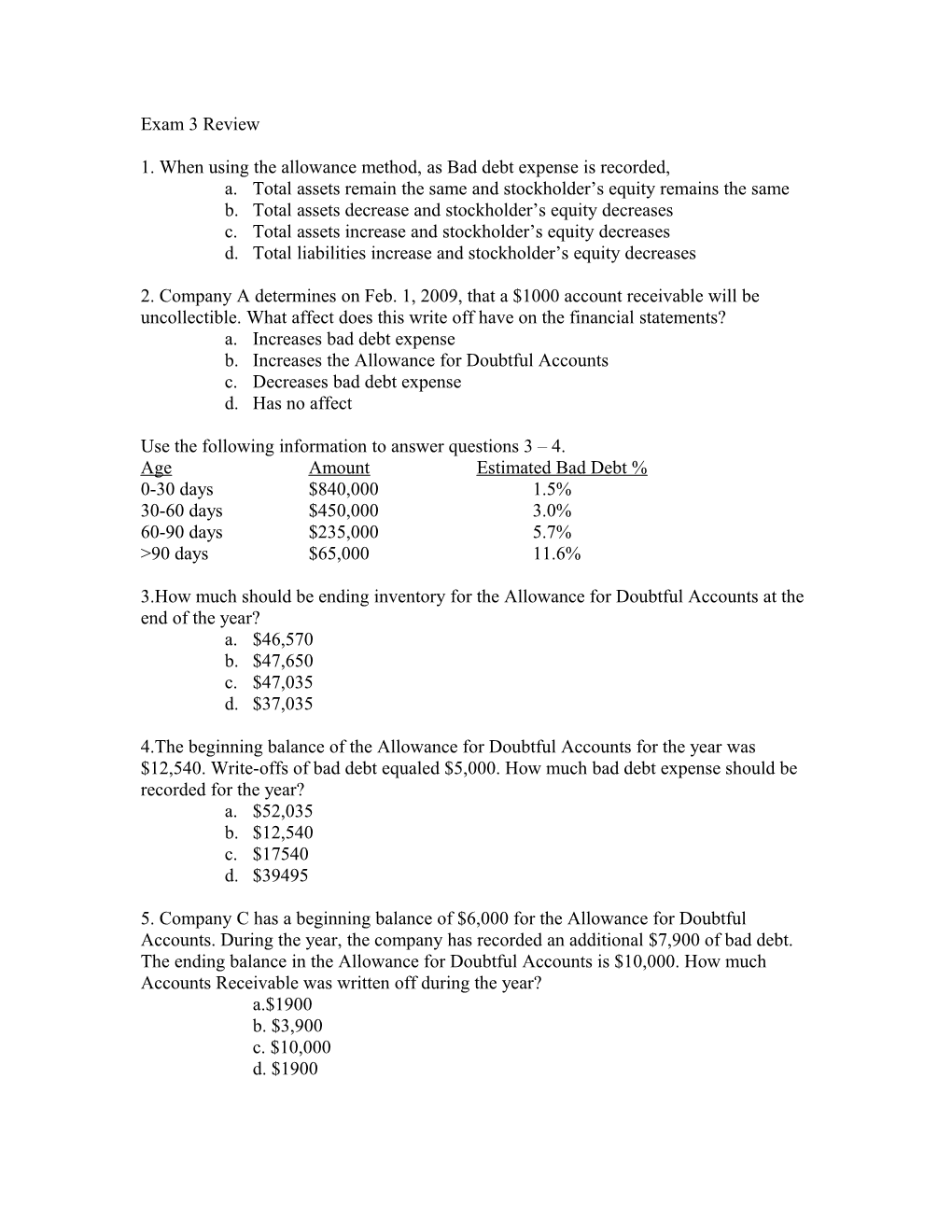

Exam 3 Review

1. When using the allowance method, as Bad debt expense is recorded, a. Total assets remain the same and stockholder’s equity remains the same b. Total assets decrease and stockholder’s equity decreases c. Total assets increase and stockholder’s equity decreases d. Total liabilities increase and stockholder’s equity decreases

2. Company A determines on Feb. 1, 2009, that a $1000 account receivable will be uncollectible. What affect does this write off have on the financial statements? a. Increases bad debt expense b. Increases the Allowance for Doubtful Accounts c. Decreases bad debt expense d. Has no affect

Use the following information to answer questions 3 – 4. Age Amount Estimated Bad Debt % 0-30 days $840,000 1.5% 30-60 days $450,000 3.0% 60-90 days $235,000 5.7% >90 days $65,000 11.6%

3.How much should be ending inventory for the Allowance for Doubtful Accounts at the end of the year? a. $46,570 b. $47,650 c. $47,035 d. $37,035

4.The beginning balance of the Allowance for Doubtful Accounts for the year was $12,540. Write-offs of bad debt equaled $5,000. How much bad debt expense should be recorded for the year? a. $52,035 b. $12,540 c. $17540 d. $39495

5. Company C has a beginning balance of $6,000 for the Allowance for Doubtful Accounts. During the year, the company has recorded an additional $7,900 of bad debt. The ending balance in the Allowance for Doubtful Accounts is $10,000. How much Accounts Receivable was written off during the year? a.$1900 b. $3,900 c. $10,000 d. $1900 6. Company F has sales of $600,000 and net income of $55,000 for 2008. Based on prior experience, the company estimates 2% to be bad debt. Using the percentage of credit sales method to estimate bad debt, how much bad debt should be recorded in 2008? a. $12,000 b. $1,100 c. $10,900 d. $13,100

7. Company D recorded an increase in estimated bad debts on December 31, 2007. a. Net Income increases and Total Assets increase b. Net Income and Total Assets are not affected c. Net Income decreases and Total Assets decrease d. Net Income decreases and Total Assets increase

8. A note receivable is a. a short-term contract for sale of goods on credit b. a formal written contract outlining the terms by which the company will repay, typically including interest c. an informal, verbal contract that outlines the terms by which the company will repay d. none of the above

9. If a 10 percent note receivable for $10,000 is created on January 1, 2006, and it has a maturity date of December 31, 2010, a. No interest revenue will be recorded in 2006 b. The note receivable will be classified as a current asset c. Interest Revenue of $1,000 will be recorded in 2006 d. None of the above

10. ABC Company lends $1,000,000 to Company AAA on July 1, 2008 to be collected on June 30, 2009, principal plus interest. The interest on the loan is 10%. How much interest revenue should be recognized on December 31, 2008? a. $100,000 b. $0 c. $50,000 d. $1,100,000

11. Which of the following assets are NOT depreciated? a. Land b. Equipment c. Vehicles d. Buildings 12. All of the following are intangible assets except: a. Licensing rights b. Equipment c. Trademarks d. Copyrights

13. Which of the following is not included in the acquisition of a piece of equipment? a. Purchase Price b. Transportation cost c. Routine maintenance d. Installation costs

14. When recording depreciation, which of the following statements is true? a. Total assets increase and stockholder’s equity increases b. Total assets decrease and total liabilities increase c. Total assets decrease and stockholder’s equity increases d. None of the above are true

15. On January 1, 2005, Company D purchases a piece of equipment for $60,000. The accumulated depreciation up to date is $15,000. The estimated salvage value is $10,000. What is the book (carrying) value of this piece of equipment? a. $60,000 b. $45,000 c. $35,000 d. $50,000

16. On January 1, 2008, Company ABC purchased equipment for $70,000. The estimated salvage value is $10,000. The estimated useful life is 12 years. Using straight line depreciation, how much is the depreciation expense per year? a. $10,000 b. $1,200 c. $5,000 d. $80,000

17. On January 1, 2009, Company C purchases equipment for $100,000. The estimated useful life in units is 200,000 units. The estimated salvage value is $20,000. During 2009, the equipment’s output is 15,000 unites. In the next year (2010), the output is $25,000 units. What is the accumulated depreciation at the end of 2010 (after 2 years)? a. $6,000 b. $10,000 c. $16,000 d. $12,000 18. Company C uses double declining balance depreciation method. On January 1, 201, they purchase a piece of equipment for $120,000. The estimated salvage value is $10,000. Useful life is estimated to be 10 years. What is the depreciation expense for 1011 (the second year)? a. $24,000 b. $43,200 c. 19,200 d. $11,000

19. A machine that cost $200,000 has an estimated residual value of $40,000, and has an estimated useful life of four years. The company uses straight-line depreciation. What is the book value after two years? a. $160,000 b. $120,000 c. $80,000 d. None of the above

20. A machine cost $200,000 has an estimated residual value of $40,000, and has an estimated useful life of four years. The company uses the double-declining balance method to depreciate. What is the accumulated depreciation after three years? a. $175,000 b. $100,000 c. $120,000 d. $50,000

21. Using the same information in question 20 what is the book value after two years? a. $100,000 b. $120,000 c. $50,000 d. $25,000

22. Company D uses straight-line depreciation for all of its depreciate assets. They sold a piece of machinery on December 31, 2007, that it purchased on January 1, 2006, for $10,000. The asset had a five-year life, zero residual value, and accumulated deprecation as of December 31, 2006, of $2,000. If the sales price of the used machine was $7,500, the resulting gain or loss on disposal was which of the following amounts? a. Loss of $3,500 b. Gain of $3,500 c. Loss of $1,500 d. Gain of $1,500 23. Company ABC sold a delivery truck for $16,000. They had originally purchased the truck for $28,000, and had recorded depreciation for three years. What is the gain or loss on disposal on the truck if the accumulated depreciation was $15,000? a. Loss of $1,000 b. Gain of $1,000 c. Loss of $3,000 d. Gain of $3,000

24. Which of the following is not an example of a current liability? a. Bonds Payable b. Deferred Revenue c. Accounts Payable d. Accrued Payables

25. Company G bought a delivery truck for $73,000 on January 1, 2004. They estimate the useful life of the truck to be 10 years and its residual value to be $8,000. If Company G uses the units-of-production method when they have estimated the truck will be driven 500,000 miles over its life, what is the depreciation expense in 2005 when the truck is driven 60,000 miles? a. $8760 b. $8820 c. 7800 d. 9108