21 January 2008 IE 417 Prof. Parisay Hwk #4

Parisay’s comments are in red.

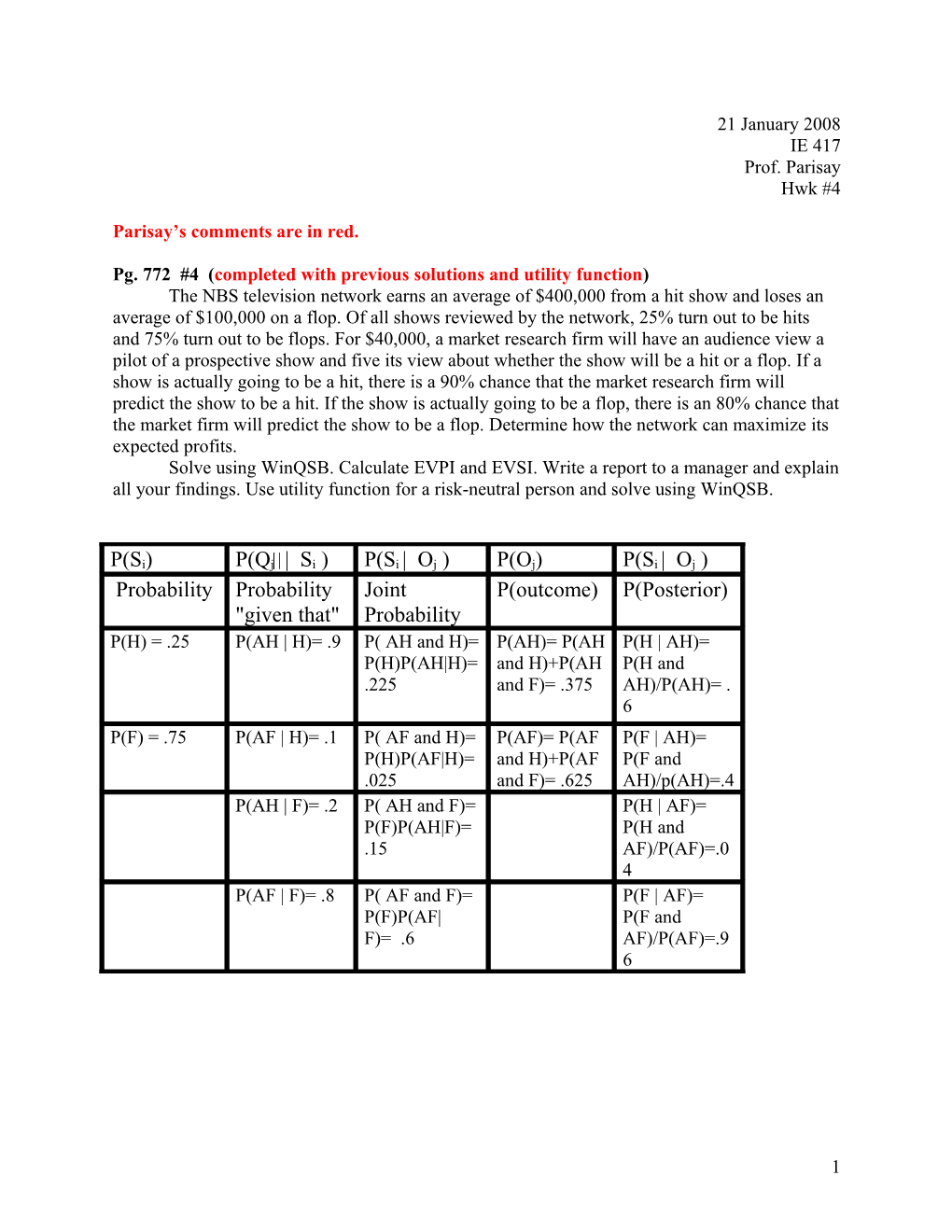

Pg. 772 #4 (completed with previous solutions and utility function) The NBS television network earns an average of $400,000 from a hit show and loses an average of $100,000 on a flop. Of all shows reviewed by the network, 25% turn out to be hits and 75% turn out to be flops. For $40,000, a market research firm will have an audience view a pilot of a prospective show and five its view about whether the show will be a hit or a flop. If a show is actually going to be a hit, there is a 90% chance that the market research firm will predict the show to be a hit. If the show is actually going to be a flop, there is an 80% chance that the market firm will predict the show to be a flop. Determine how the network can maximize its expected profits. Solve using WinQSB. Calculate EVPI and EVSI. Write a report to a manager and explain all your findings. Use utility function for a risk-neutral person and solve using WinQSB.

P(Si) P(Qj | Si ) P(Si | Oj ) P(Oj) P(Si | Oj ) Probability Probability Joint P(outcome) P(Posterior) "given that" Probability P(H) = .25 P(AH | H)= .9 P( AH and H)= P(AH)= P(AH P(H | AH)= P(H)P(AH|H)= and H)+P(AH P(H and .225 and F)= .375 AH)/P(AH)= . 6 P(F) = .75 P(AF | H)= .1 P( AF and H)= P(AF)= P(AF P(F | AH)= P(H)P(AF|H)= and H)+P(AF P(F and .025 and F)= .625 AH)/p(AH)=.4 P(AH | F)= .2 P( AH and F)= P(H | AF)= P(F)P(AH|F)= P(H and .15 AF)/P(AF)=.0 4 P(AF | F)= .8 P( AF and F)= P(F | AF)= P(F)P(AF| P(F and F)= .6 AF)/P(AF)=.9 6

1 Page 772 # 4 $400 Hit 0.25

Show -$100 Flop 0.75 h No Show $0 rc a o e P(hit I Pred. Hit) s N e R Hit, 0.6

Show Flop, 0.4 R $35 K e se ar ch No Show $0 - , $4 . Hit 0 Pred .375 0 P re 0 d. Hit, 0.04 .62 Flo 5 p, Show Flop, 0.96

P(pred. hit I hit) + 0.9 No Show $0

P(pred. flop I flop) = 0.8

Table 1: WinQSB-Decision Tree Analysis Input Data

2 Table 2: WinQSB-Decision Tree Analysis Output Data

Graph 1: WinQSB Decision Tree

3 EVSI (Expected Value of Sample Information) Calculation:

Market Research Value: $75,000 No Market Research Value: -$25,000 $50,000

Only invest in market research if it costs ≤ $50,000.

EVPI (Expected Value of Perfect Information) Calculation: Looking at No Market Research If the perfect info is there will be a hit the best decision will be to show with profit of 400000 and probability of 0.25. If the perfect info is there will be a flop the best decision will be not to show with profit of $0 and probability of 0.75.

Expected perfect info = ($400,000) * (0.25) + 0*(0.75) = $100,000

Your book’s approach is also below (by Mr. David Chavez)

4 Page 772 # 4 EVWPI Show $400,000

No Show

$400,000 $0 it H .25

Fl p o Show $-100,000 EVWPI = $100,00 .75 0 No Show

$0 $0

EVPI = (expected value with Perfect Info) – (expected value with No Market Research) $100,000 - $25,000 = $75,000

Only purchase perfect info if it costs ≤ $75,000

Report to Manager:

Considering the given information, the probabilities of the respective profits/costs, and the objective function to maximize the total profit, NBS Television Network will have an expected profit of $35,000. However, acquiring the $35,000 is not fixed, this is due to the probabilities that play under the circumstances. NBS Television Network can expect to profit $35,000 in the long run, however, the value can range from -$100,000 to $400,000. The best decision is to PERFORM Market Research at a cost of $40,000 and the expected profit will be $35,000. Two scenarios may happen after performing Market Research: If the research predicts that the show will be a hit the best decision will be to air the show for an expected profit of $200,000 not considering the cost of research. If the research predicts that the show will be a flop the best decision will be to not air the show for an expected profit of $0 not considering the cost of research.

However, the company can also select NO Market Research. In this case, the expected profit is only $25,000. The Estimated Value of Sample Information is $50,000, which is the maximum we are willing to pay for market research. In the problem, doing the market research will only cost the company $40,000. That is why the final decision is to Perform Market Research.

5 The Estimated Value of Perfect Information is $75,000, which is the maximum we are willing to pay for perfect information about the future.

Utility Function for a Risk-Neutral Person:

For utility function analysis you need to consider research cost at terminal values first. Therefore your maximum is 400,000 and minimum is -140000. The following graph is based on this note which is explain at the end as well.

Graph 2: Utility Function

6 Table 3: WinQSB-Decision Tree Analysis Input Data for Risk Neutral Person

Table 4: WinQSB-Decision Tree Analysis Output Data for Risk Neutral Person

7 Graph 3: WinQSB Decision Tree for Risk Neutral Person

Caluclations: P(LR) + (1 – P) * (SR) = rij (0.31)(400,000) + (1 - 0.31)(-140,000) = rij rij = $27,400

The expected return for utility should have been 0.324 if there was not any rounding up and down for terminal values. Then converting 0.324 to dollar amounts would have given us $35000, exactly as using return values. The reason it is not the same here is rounding up and down the numbers when entering to WinQSB.

Comments:

Before WinQSB can be attempted, we first need to subtract $40,000 (Market Research) to all the Terminal Values that proceeds after Market Research. For example, we need to subtract $400,000 (Terminal Value for Predicted Hit, Hit) - $40,000 (Cost for Market Reseatch) = $360,000 (New Terminal Value). Now, we can develop the Utility graph and insert the largest profit ($400,000 = 1) and the smallest profit (-$140,000 = 0). Finally, we can replace the original terminal values with the new utility values. Despite the changes, the outcome of the problem should remain the same, because the utility function for a Risk-Neutral person is proportional. Looking at the solution, and as

8 predicted, the Expected profit using WinQSB is 0.31, which translates into $27,400. This is agreeable to the $35,000 that we originally had.

9